Stretch Out Your Car Loan Term

There are pros and cons when you decide to stretch out your car loan term. The main pro is that it can reduce the size of each of your car loan repayments. However, it will increase the total amount of interest you have to pay on your car loan.

If you think you cant support your current car loan repayment, you can ask your financial institution if its possible to extend your car loan term.

You can also explore our car loan calculator to get an estimate of your car loan repayments. To use this calculator, you just need to indicate the value of the car, interest rate, loan term, initial deposit, and the balloon payment.

The Thought Of Paying Off Your Car Loan Early And Doing Away With Your Monthly Payment Is Appealing But Should You Do It

Maybe you have a little extra cash each month, or you recently came into a large amount of money. Should you use those funds to pay off your car loan early? There are potential benefits, but also some possible drawbacks, to consider when deciding whether to pay off your auto loan ahead of schedule.

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term | 14 years and 4 months |

| Total Payments |

| 24 years and 4 months |

| Total Payments |

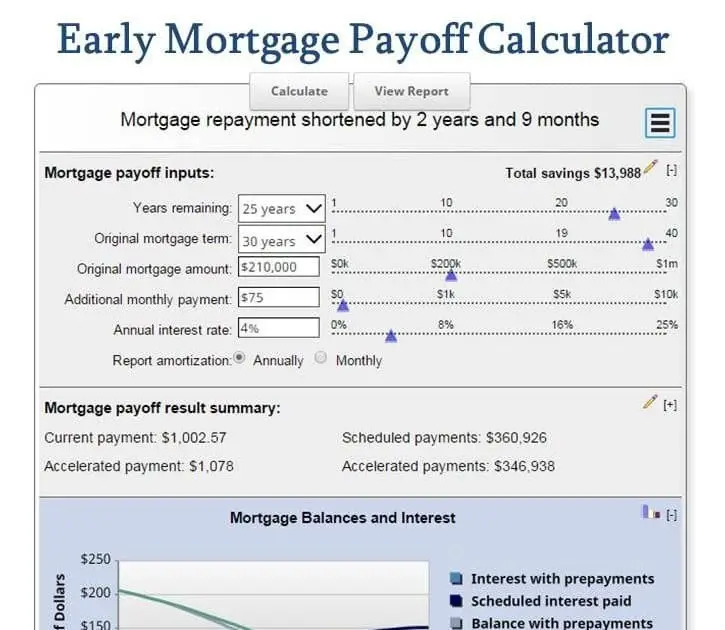

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.

Recommended Reading: How To Apply For Home Equity Loan With Bad Credit

Should I Consider Paying My Car Loan Off Early

As you can see, there are potential benefits to paying off a car loan early but before you make any changes, consult your lender. Things may not be as straightforward as sending your bank a big check to call it a day. Some loan agreements have early payment penalties which would derail the whole purpose of paying off your loan early.

How To Use The Early Mortgage Payoff Calculator

To fill in the calculator’s boxes accurately, consult a recent monthly statement or the first page of the Closing Disclosure that you received when you closed on your mortgage.

-

Under Loan term , enter the number of years for which your home is financed.

-

Under What was your mortgage amount?, fill in the loan amount. In the Closing Disclosure, you can find this on the first line of the Loan Terms section.

-

Under Interest rate, enter the percentage.

-

Under How many years are left on your mortgage?, you’ll need to enter a whole number, so round up or down.

-

Likewise, under In how many years do you want to pay off your mortgage?, you’ll have to enter a whole number, rounding up or down.

-

Under How much do you still owe ?, look for this figure in a recent monthly statement, or contact the mortgage servicer. Or you can use NerdWallet’s mortgage amortization calculator and drag the slider to find out how much you still owe.

Read Also: What Is The Best Private Loan For College

Other Mortgage And Financial Calculators

In addition to the standard mortgage calculator, this page lets you access more than 100 other financial calculators covering a broad variety of situations. Choose from calculators covering various aspects of mortgages, auto loans, investments, student loans, taxes, retirement planning and more.

All rights reserved. Mortgageloan.com® is a registered service mark of ICB Solutions, a division of Neighbors Bank, Equal Housing Lender Member FDIC, NMLS # 491986 ICB Solutions or Mortgageloan.com does not offer loans or mortgages. Mortgageloan.com is not a lender or a mortgage broker. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. We do not engage in direct marketing by phone or email towards consumers. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers.

Should You Pay Off Your Car Loan Early

Whether you should pay off your car loan early depends on the contract you signed. Since lenders make their money on the amount of interest you pay, its possible there will be a repayment fee if you decide to pay it off early. What youll need to do before deciding to pay it off is calculate the amount of interest youd pay if you were to continue making monthly payments. Once youve done that, compare it to how much youd pay for the repayment fee then ask yourself if its worth the cost difference. If you do decide to pay it off early, remember that your could also drop for multiple reasons. These reasons include a decrease in the age of accountsthe number of months/years youve had the loan foror the number of installment loans also known as a loan where you borrow a certain amount of money at once and pay it off on a month-to-month basis.

Recommended Reading: How To Get Out Of Loan Debt

Disadvantages Of Paying Off A Car Loan Early

- Debt with higher interest – if you have debt like a credit card, which has a much higher interest rate, you may not want to pay off your car loan before you pay off your credit card balance. Instead, pay off your credit card first because it would save you more money on interest than paying off the auto loan.

- Other opportunities – if you have other business or investment opportunities that can potentially make you more money than the interest payments that you are making on the car loan, you may want to delay paying off the auto loan.

- Overall budget – if paying off early means that you need to make lifestyle changes, and would prevent you from doing the things that you enjoy, then it might not be a good idea to pay off the car loan. However, if you can cut spending and save more money each month without too much struggle, then paying off the auto loan makes sense.

- Prepayment penalties – if there are prepayment penalties for paying off early, you should calculate the actual interest savings minus the prepayment penalties to see if it is still worthwhile for early payoff.

- Low interest – if your car loan has low interest, and you are trying to build your credit history, then having an open loan balance can help with your credit score. However, if the interest rate is high and you can afford to pay it off, then it is much better to just pay it off and be debt-free.

Early Mortgage Payoff Calculator

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Recommended Reading: What Type Of Mortgage Loan Do I Have

Calculating Your Mortgage Overpayment Savings

Start Paying More Early & Save Big

Want to build your home equity quicker? Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. The earlier you begin paying extra the more money you’ll save.

Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage. Put in any amount that you want, from $10 to $1,000, to find out what you can save over the life of your loan. The results can help you weigh your financial options to see if paying down your mortgage will have the most benefits or if you should focus your efforts on other investment options. As you nearly complete your mortgage payments early be sure to check if your loan has a prepayment penalty. If it does, you may want to leave a small balance until the prepayment penalty period expires.

Auto Loan Payoff Calculator

Auto Loan Payoff Calculator to calculate early payoff for your auto loan. Car Loan Early Payoff Calculator with amortization schedule will calculate how much interest you can save by paying off early. You can choose to make extra payments per month or the desired payoff time to calculate the payoff and see a new amortization schedule for your car loan.

| $0.00 |

Don’t Miss: Where To See Student Loan Balance

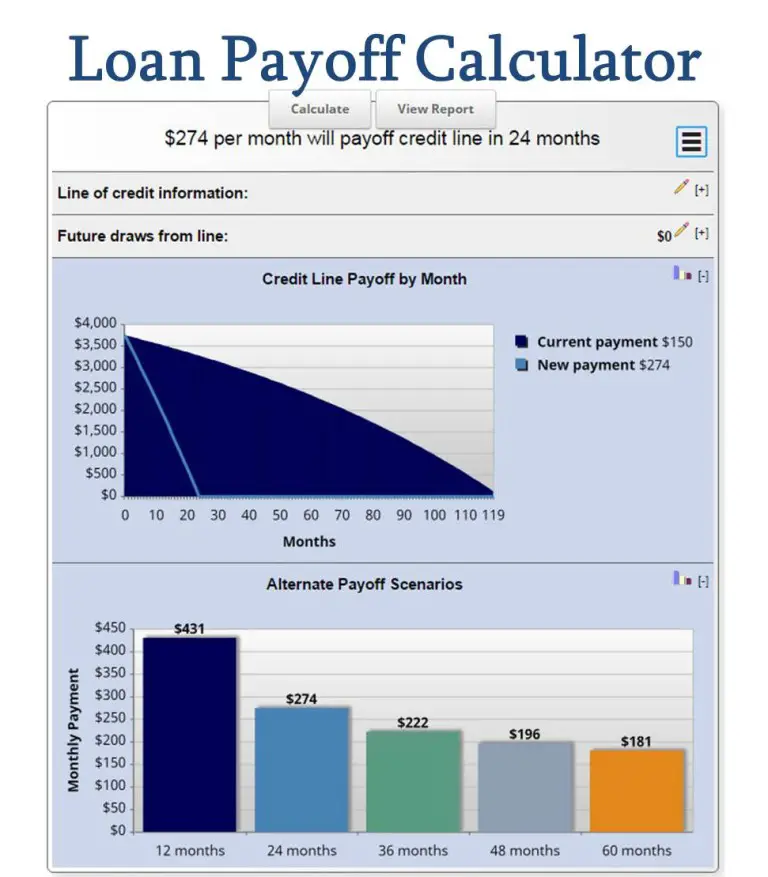

Debt Repayment Calculator Terms & Definitions

- Balance Owed The outstanding amount of debt owed to your creditor.

- Annual Interest Rate The annual percentage interest paid for borrowing money.

- Regular Monthly Payment The amount you regularly repay on your debts.

- One-Time Lump Sum Addition To Next Payment Your planned one-time additional payment toward principal owed on your loan during your next payment.

- Current Payoff Term The remaining loan term if you make the regular monthly payment only.

- New Payoff Term The new loan term after paying an additional amount to principal.

- Time Saved How much time you’ll save by making the additional, one-time, lump sum payment.

- Original Interest Cost How much interest you’ll pay if you only make the regular monthly payment.

- Reduced Interest Cost How much interest you’ll pay if you make the additional one-time lump sum payment.

- Total Interest Savings How much interest you’ll save over the entire loan life if you make the additional one-time lump sum payment.

- Return On Investment For One-Time Repayment The percentage return you’ll make on your one-time lump sum payment.

Vehicles Last Longer As Well As Auto Loans

- Cars, SUVs, Trucks last a lot longer than they used to. 100,000 miles used to be considered a pretty good indication your vehicle was nearing the end of its useful life. These days it is not uncommon for a vehicle to go 200,000 miles or more.

Better engines and transmissions, improved corrosion protection, more durable components all add up to vehicles that hold up a lot longer than their predecessors.

- Consumers are also doing a better job of keeping up on auto maintenance schedules.

With cars lasting longer, lenders are willing to make longer auto loans as well. Auto loans of five, six, even seven years are increasingly common because the lender is confident the vehicle will keep running that long.

Longer loans mean lower monthly car payments, which is important when you’re looking at $25,000 or more for even a basic new vehicle. A good used car can easily run $10,000 or more.

- FAQ: Longer loans mean a lower monthly payment and a more affordable vehicle.

Unfortunately, those affordable monthly payments cost you money over the long run. Interest charges pile up over time and with the way loan amortization works, each additional year you add means disproportionately higher interest costs over the life of the loan.

- FAQ: In fact, you may be surprised by how small the difference in monthly payments can be between a six-year and a seven-year auto loan, due to the additional interest costs over the life of the loan.

Also Check: How Do Student Loan Interest Rates Work

Exercising Additional Payment Options

When you sign on for a 30-year mortgage, you know you’re in it for the long haul. You might not even think about trying to pay off your mortgage early. After all, what’s the point? Unless you’re doubling up on your payments every month, you aren’t going to make a significant impact on your bottom line right? You’ll still be paying off your loan for decades right?

Not necessarily. Even making small extra payments over time can shave years off your loan and save you thousands of dollars in interest, depending on the terms of your loan.

How Much Faster Will I Get Out Of Debt By Making Extra Payments

This debt repayment calculator figures how much faster you will get out of debt and how how much interest you will save by adding an additional principal repayment to your next regularly scheduled payment.

If you have multiple debts to repay then try this Debt Snowball Calculator to repay faster using the rollover method. In addition, there are 10 other to choose from. One will certainly fit your debt repayment needs perfectly.

Don’t Miss: Can You Loan Audible Books

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

Auto Loan Early Payoff Calculator

The American Institute of Certified Public Accountants

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

Read Also: When Do I Pay Back Student Loan

Extra And Lump Sum Payment Calculator

A home loan is likely to be the biggest expense you will ever have. While the home itself will cost several hundred thousand dollars at least, the interest component of that loan could easily add another couple of hundred thousand dollars. The average home loan can last 25-30 years, which is a long time to pay something off. The longer you have the loan for, the more youll have to pay.

But what if there was a way to reduce the length of your home loan, and save on interest? By making an extra lump sum payment off your loan, you can.

Any extra repayment you make – be it lump sum repayments or recurring repayments above the minimum – can save you money simply because it reduces the principal on the loan, aka the borrowed amount left to repay. Interest is charged on this principle amount, so the smaller the principal, the less there is to charge interest on.

Also the more you repay, the quicker youll pay off the loan. Our home loan extra repayment & lump sum payment calculator can show you just how much difference extra repayments can make to your overall loan.

All you have to do with our extra repayment/lump sum calculator is:

- Enter the loan amount and the loan term

- Enter your loans interest rate

- Enter your repayment frequency

- Enter how much your extra lump sum payment will be, or how much extra youll be paying per month

- Specify how far into the loan schedule youll make these extra repayments

The Pros And Cons Of Paying Off A Car Loan Early

Paying off a car loan early can be a great idea. Sometimes it might make sense, and other times there are better ways to spend or save any extra money. Like all major financial decisions, you may want to discuss with a financial professional and weigh the pros and cons of paying off a car loan early before jumping in.

You May Like: Bad Credit Refinancing Auto Loans

How To Calculate Auto Loan Payoff

The price of your vehicle, down payment you make, length of the loan, and interest rate are all factors that determine how much you’ll pay for your car. Adding a bit more to your payments each month can help you pay off your car loan sooner and, ultimately, save you money. Use this calculator to see the impact of putting a bit more money toward your loan each month.

Enter the price of your vehicle as the Vehicle Price and adjust the sliders to match the details of your loan. Move the Added Monthly Amt slider to see the impact of paying more toward the loan.