Ways To Buy A House With Bad Credit

While its not going to be as easy or affordable for a consumer with bad credit to purchase a house as a consumer with good credit, it is still possible to get a mortgage. Here are a few steps you can take toward securing a high-risk mortgage.

Be Patient

Although taking the time to rebuild your credit will always work in your favor when youre searching for a mortgage, being patient is especially important for those who have had a consumer proposal or gone bankrupt. Most conventional lenders are probably not going to even consider approving you for a minimum of two years after your case was discharged. So, its best to take that time to improve your finances and get your credit score back up.

Find Stable Employment

If you have good credit and a suitable income, even if youre self-employed or a commission based worker, prime lenders will still approve you for a mortgage. However, if you have bad credit, gone through a consumer proposal or bankruptcy, an unstable employment history will only add to a lenders opinion that youre a risky investment. For that reason, its best to find a stable source of confirmable income, especially if you one day hope to work with a prime lender.

Look Into Subprime and Private Lenders

Save For a Larger Down Payment

Improve Your Credit Score

For more information about Canadian interest rates, read this.

Have A Credit Score In The Mid

A favorable credit score is essential to meet most banks approval requirements. A credit score above 700 will most likely qualify you for a loan as long as you also meet equity requirements. Homeowners with credit scores of 621 to 699 might also be approved.

Some lenders also extend loans to those with scores below 620, but these lenders may require the borrower to have more equity in their home and carry less debt relative to their income. Bad-credit home equity loans and HELOCs will have high interest rates and lower loan amounts, and they may have shorter terms.

Before applying for a home equity product, take steps to improve your credit score. This could involve making timely payments on loans or credit cards, paying off as much debt as possible or avoiding new credit card applications.

Why its important: Having a good credit score will help you secure more favorable interest rates, saving you a substantial amount of money over the life of the loan. In addition, lenders use your credit score to predict how likely you are to repay the loan, so a better score will improve your odds of approval.

Home Equity Loans Approved In 24 Hours

When the unexpected happens what do you do? Sure, we should all have savings or access to available credit when life throws a curve ball easier said than done. If youre a homeowner and out of options, home equity loans can often solve the problem. If youve lost a job, become ill and unable to work, have accumulated too much high interest debt or for any other urgent reason we can help.

Youre not alone if you havent saved all of your money up at a bank. It isnt uncommon today to owe more than you own. Rising interest rates, low paying jobs, student debt there are a plethora of barriers to building a robust savings account in todays economy. As a result, borrowing against a home is a popular choice for many Canadians.

Recommended Reading: What Car Loan Can I Afford Calculator

Can I Qualify For A Home Equity Loan If I Have Bad Credit

Heres what a lender will look for when you apply for a home equity loan or a home equity line of credit.

like we talked about above, well review your credit history to help determine your ability to repay the loan. We want to make sure that the home equity loan you are borrowing wont be a significant burden on your financial life, and that youll be able to repay the loan with as few challenges as possible.

Equity You Have in Your Home this is a key difference between applying for a home equity loan with bad credit and applying for a personal loan. Because the equity youve built up in your house will be used as collateral for your loan, the amount of equity determines who much youll qualify to borrow. As a rule of thumb, a typical amount to borrow is 85% of the value of your home for a home equity line of credit and 80% for a home equity loan, after subtracting the amount you owe on your mortgage. For personal loans, your house will not be used as collateral on your loan.

Debt to Income Ratio this is another way that we make sure that you can repay your home equity loan, even if you struggle with bad credit. Your Debt to Income ratio is the total of all the debt you pay each month, including items like your mortgage and credit cards, divided by your gross monthly income.

How Do You Choose The Best Home Equity Loan

Choosing the best home equity loan will require you to do a bit of research. In order to get the best terms and interest rates, be sure to compare different lenders loan programs and fee structures.

Lenders can have different requirements for qualification and offer different terms for home equity loans. If you have a higher DTI or lower credit score, youll find that some lenders are more likely than others to offer you a loan. To ensure that you score the best deal, youll want to shop around to find out what your options are.

When determining which lender to choose, make sure you review the Loan Estimate forms provided by each lender. The Consumer Financial Protection Bureau requires all lenders to provide you with this standard three-page form to ensure that you understand the differences between what lenders are willing to offer you. Loan Estimates will give you a rundown of the terms of your home equity loan, including the interest rate, and itemize the closing costs and fees youll be charged.

Recommended Reading: How Do I Find Out My Auto Loan Account Number

How Much Do You Owe On Your Home Including Your Mortgage Balance And Any Other Secured Debt

As you pay down your mortgage balance, the amount of your home equity usually increases.

Your mortgage balance is the principal amount you still owe to your lender. It doesn’t include future interest payments. Secured debt is additional debt secured by your home that could include a second mortgage, a line of credit or a loan.

$0$1,700,000

You may qualify for a:

Personal loan or line of credit

$ increase on your mortgage*.

Personal loan or line of credit

$line of credit*.

Personal loan or line of credit

Based on your information, you may be able to access up to $ of your home equity*.

“Gauge chart illustrates your home’s appraised value, estimated equity and balance owing on your mortgage and any other secured debts.”

- Mortgage balance and other secured debt

- Estimated equity you may qualify to borrow

Lump sum

CIBC Home Power® Mortgage

Take advantage of your home equity. Borrow more money by refinancing your mortgage with the CIBC Home Power Mortgage:

- Consolidate expenses into one monthly payment

- Access up to 80% of your homes appraised value1

Take out a personal loan, starting at $3,000:

- Choose fixed or variable interest rates, payment frequency and term

- Pay off all or part of the loan at any time without penalty

- Apply online for faster approval

Ongoing access

CIBC Home Power Plan Line of Credit2

Enjoy convenient and constant access to your money with a CIBC Home Power Plan Line of Credit, secured against your home:

Ongoing access

CIBC Personal Line of Credit

What Is A Home Equity Loan For Bad Credit

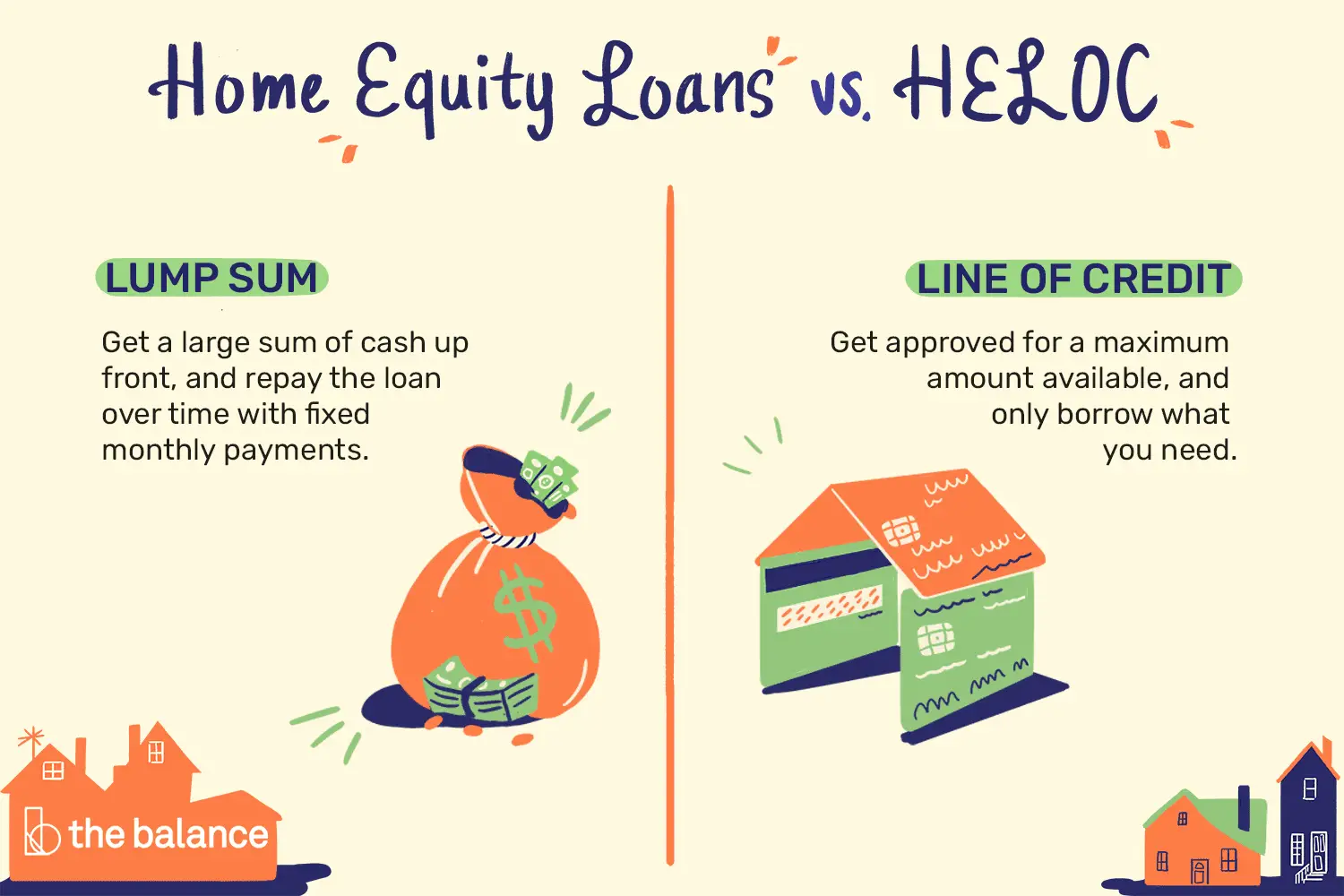

Using your home as collateral, a home equity loan lets you use the equity youve built up in your home as a lump-sum payment that you pay back at a fixed interest rate for a set amount of time. Equity is the difference between your homes value and what you owe on the home loan.

A home equity loan for bad credit is provided by a lender that specializes in helping borrowers with bad credit. However, having a bad credit score reduces your approval chances. If youre approved for a loan, bad credit can cause lenders to give you less favorable terms, such as a higher annual percentage rate.

The money you borrow can be used for anything, from paying for college to medical bills. Its most commonly used for home renovations.

A home equity loan is a second mortgage that doesnt affect the payment on your main mortgage. Your current mortgage wont change.

Payments during the loan term of the equity loan include principal and interest at a fixed rate, so you wont be surprised by a changing amount due each month and can budget for repaying the loan.

The loan is secured by your house, so missing a payment or paying late can lead to the lender foreclosing on your home. Also, if you sell your home before youve paid back the loan, the balance of the home equity loan is due.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

What Are My Heloc Interest Rate Options

- Competitive Variable RateEnjoy a competitive variable interest rate based on our TD Prime Rate on your Revolving Portion. At any time, you can put all or a portion of your outstanding balance into a Term Portion.

- Term PortionIf you opt for a Term Portion when setting up a TD Home Equity FlexLine or at any time after, you can choose a variable interest rate or a fixed interest rate, each with a set repayment schedule.

How To Find The Best Home Equity Lender

Finding the best home equity loan can save you thousands of dollars or more. Shop around to find the best deal. Different lenders have different loan programs, and fee structures can vary dramatically.

The best lender for you can depend on your goals and your needs. Some offer good deals for iffy debt-to-income ratios, while others are known for great customer service. Maybe you don’t want to pay a lot, so you’d look for a lender with low or no fees. The Consumer Financial Protection Bureau recommends choosing a lender on these kinds of factors as well as loan limits and interest rates.

Ask your network of friends and family for recommendations with your priorities in mind. Local real estate agents know the loan originators who do the best job for their clients.

Read Also: Does Va Loan Work For Manufactured Homes

How Borrowing On Home Equity Works

You may be able to borrow money secured against your home equity. Typically, interest rates on loans secured against home equity can be much lower than other types of loans.

Not all financial institutions offer home equity financing options. Ask your financial institution which financing options they offer.

You must go through an approval process before you can borrow against your home equity. If youre approved, your lender may deposit the full amount you borrow in your bank account at once.

You can borrow up to 80% of the appraised value of your home.

From that amount, you must deduct the following:

- the balance on your mortgage

- your total HELOC amount, if you have one

- any other loans secured against your home

Your lender may agree to refinance your home with the following options:

- a second mortgage

- a loan or line of credit secured with your home

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

You May Like: Can You Use A Va Loan To Buy Land And A Manufactured Home

Write Letters Of Explanation For Your Bad Credit In Advance

If youve had some tough financial times, write a letter to explain what happened and how youll be able to repay the home equity loan. Be prepared to provide documentation, such as bankruptcy papers, divorce decrees or anything else related to your financial situation to accompany the explanation letter.

Understand The Credit Score Youll Need

In 2021, Americans were reported to have an average credit score of 711. If you find your own credit score falls below this national average, there is still hope. Most lenders only require home equity loan seekers to have a FICO score of 620 or higher.

If you fall below the 620 figure, you dont have to count a home equity loan out completely. Your lender might be willing to work with youbut prepare yourself for a higher interest rate.

In the meantime, there are also ways to raise your credit score. Here are some tips:

- Prioritize making payments on time

- Dont apply for any new lines of credit

- Consolidate your debt

If youre having trouble managing payments, call your lenders to ask about your options. Some will be able to move payment due dates slightly or extend the length of your loan to allow you to make smaller payments.

Read Also: How Much Do Loan Officers Make Per Loan

Is A Home Equity Line Of Credit Good Or Bad It Depends On Your Financial Situation

Heres what Consolidated Credits Financial Education Director April Lewis-Parks has to say about using HELOCs.

Ask the Expert: When is it ok to take out a Home Equity Line of Credit?

- What do you need the home equity line of credit for?

- Whats your credit score?

- What is your interest rate going to be?

- Is that so much better than what you would get on a personal loan?

- And, what if something happens with the economy or your personal financial situation?

What you really need to think about is will you be able to afford the payments down the line? Is something happens, are you going to put your house at risk because you cant afford the payments?

So, before you explore this option, just be smart about it. Check the rates and the fees, and most importantly your own personal financial situation.

Consolidated Credit: When debt is the problem, we are the solution. Call now: 1-800-

Can I Get A Heloc With Bad Credit

It depends. Good credit can generally make it easier to qualify for loans and get favorable loan terms, including home equity financing. But depending on the lender and other considerations, it might be possible to get approved for a HELOC even with bad credit.

Lenders may consider other factors other than your credit scores when determining whether to approve you for a loan, so there may be a chance a lender would approve you for a HELOC even if you have bad credit.

For example, as of November 2020, heres how Wells Fargo says your FICO® scores can affect your chances of being approved for a HELOC.

- 760 and above: Depending a number of factors, these applicants may be able to qualify for the best rates they offer.

- 700 to 759: Depending a number of factors, applicants will likely be able to qualify for credit, but likely not at the best rates they offer.

- 621 to 699: Applicants may find it difficult to qualify for credit and are more likely to pay higher rates for it.

- 620 and below: Applicants are more likely to have trouble qualifying for credit.

Each lender sets its own standards for minimum credit scores required to qualify for a HELOC.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Home Equity Loans And Bad Credit

A home equity loan allows you to leverage the equity youve built up in your home to use as collateral in a loan. Unlike a home equity line of credit, with a home equity loan youll get the entire amount up front with a fixed rate term and payment. But what are your home equity loan options if you think you have bad credit? Lets start by breaking down how credit is built to help you understand why you may have been told that you have bad credit.

An Example Of When A Home Equity Line Of Credit Is A Good Idea

The economy is in a good place and home prices in your area are steadily increasing. You have good credit and steady income working for a stable company youve been with them for five years. You want to use a home equity line of credit to fund a series of home improvement projects.

This is an example of when a HELOC could be a good choice. Youre borrowing against your home to improve your home that increases your homes value. So, the financing is really an investment on an existing asset.

There is also a benefit here to using a HELOC instead of taking out an unsecured loan. Home improvement budgets can vary widely, and what you think you will spend doesnt always match reality. If you take out a loan and go overbudget, you could be stuck funding the rest of the project on high interest rate credit cards. Conversely, if you take out a big loan and dont use the funds, you get stuck paying off debt you didnt really need.

Important Note: HELOCs and home equity loans are not exactly the same thing, although they are similar. A home equity loan gives you a one-time lump-sum disbursement. We had a similar question about home equity loans that we answered previously.

Read Also: How To Get Loan Originator License