How Federal Student Loan Repayment Works

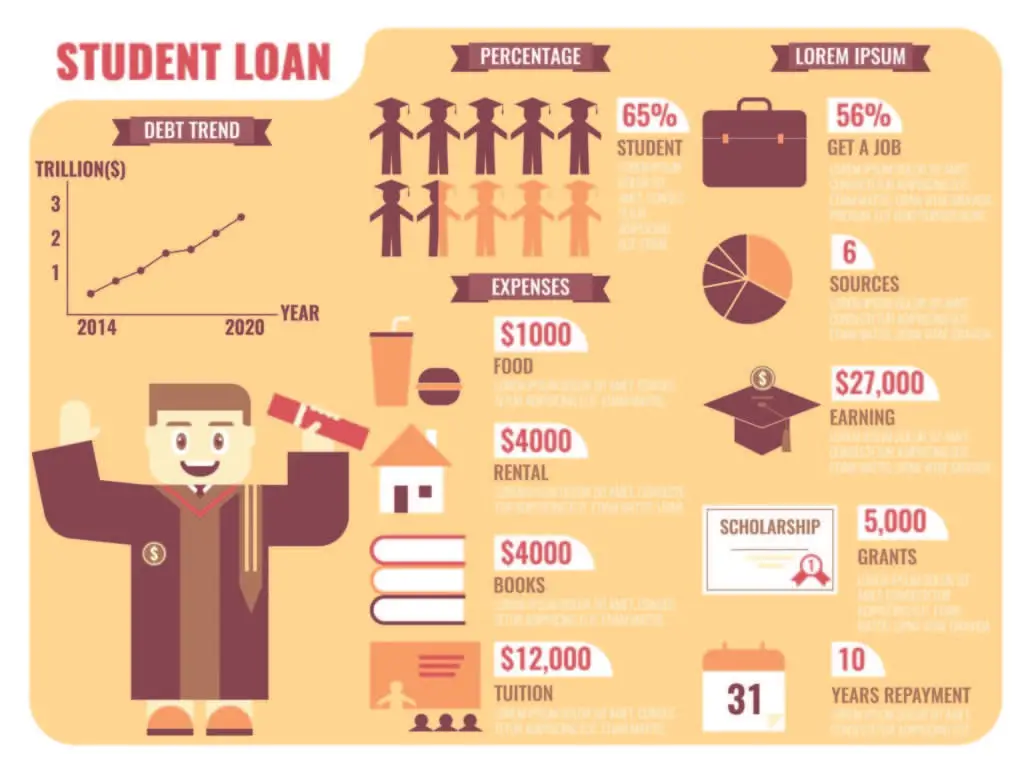

The standard repayment plan for federal student loans breaks up your balance into 10 years worth of payments. But only about 30% of borrowers paid off their federal or private loans within 10 years, according to a 2019 Student Loan Hero analysis.

Other federal repayment plan options include:

- Graduated repayment plan: Starts off with lower monthly payments that increase every 2 years payments are still made for 10 years

- Extended repayment plan: Draws out your repayment timeline to up to 25 years, with the option of fixed or graduated monthly payments

Deferment and forbearance could allow you to take a break from loan payments for a certain period if youre experiencing financial difficulty. But since interest will continue to accrue unless you have subsidized loans and youre in deferment these programs can leave you with a heftier balance when they end.

If youre looking for a way to lower payments or take more time to pay off your loans, one of the four income-driven repayment plans could be your best bet. Your options are:

These plans typically reduce your monthly bill to a percentage of your income, offering forgiveness after 20 or 25 years of payments though, youll likely have to pay income tax on the forgiven balance.

Its important to note that your student loan servicer will generally provide an interest rate discount of 0.25 percentage points if you choose to use autopay each month for your loan payments.

How To Calculate Interest

To calculate the amount of interest that accrues, or accumulates, on your loan, divide the loans interest rate by 365.25 the number of days in the year, including Leap Year. This number is the interest rate factor, or the daily rate on your loan.

For instance, a loan with a 5% interest rate would have a daily rate of 0.00013689253.

You can use the interest rate factor to calculate how much interest accrues on your loan from month to month.

Use the daily interest formula:

Outstanding principal balance x the number of days since your last payment x the interest rate factor you figured out above = interest amount.

You can also use MU30s loan calculator to determine how much interest a given loan will accrue.

Bank Student Loans Or Personal Loans

You can apply for a personal loan through a bank or online lender. A personal loan will advance you a lump sum amount, and youll need to start making payments right away, so its important that you factor your monthly payments into your budget.

Personal loans interest rates can vary widely depending on your financial situation, so its important to carefully evaluate whether youll be able to afford your monthly payments while in school. Make sure to shop around for a lender and compare interest rates! A good place to start is an online search platform like Loans Canada the largest lender network in Canada. With a single search, youll be able to compare rates offered by the countrys top lenders.

Don’t Miss: Refinance Usaa Car Loan

How Student Loan Interest Works

When you take out a student loan, you agree to pay back the loan, plus interest. Your interest rate is the cost of borrowing the money. There are 2 types of rates:

- Fixed interest rates stay the same over the life of the loan.

- Variable interest rates change with the financial markets . Variable rates may seem great at first but can end up costing a lot more over the life of a loan.

How To Lower Your Student Loan Interest Rates

There are ways to lower your student loan rates, but these methods may not be in your best interest.

One option is consolidating your federal student loans with the Department of Education. The interest rate on consolidated loans is figured out by averaging the interest rates of your current loans.

If you had one loan with an interest rate of 6.8% and another at 4.53%, the new interest rate on your Direct Consolidated Loan would be 5.67%.

If you dont think consolidation makes sense, you may look to refinancing on the private market. If you have good credit and a high income, youre likely to qualify for some of the best rates on the market, which beat out current federal rates.

However, youll also be giving up advantaged repayment programs extended to you through the government. You are also likely to have to repay your student loans while youre still working on your education.

Recommended Reading: What Are Typical Loan Origination Fees

How To Choose A College Student Loan

Theres no hiding the truth. Going to college in America can be incredibly expensive.

We created Scholly to address this very problem, and were proud of the more than $100 million dollars in scholarships students have won over the years. But we know scholarships are just one of the ways students pay for college, and that for many students, loans are essential for making the college dream a reality.

Since youre here, were gonna guess youre thinking about taking out one or more student loans to help cover the costs. Right?

Okay. Now, were gonna take one more guess. You dont want to end up like the 69% of millennials who recently reported feeling moderately to extremely regretful over taking out student loans, right?

You surely said yes to that one. Didnt you? At least, we hope you did! If so, we made this guide just for you!

Feel free to click on the question that interests you most to skip ahead to that section of the guide! Or, you can follow along as we start with general questions you may have about student loans and then gradually work our way down to the stuff that tends to cause the most confusion.

Ready? Lets go!

How Compound Interest Works In Your Favor

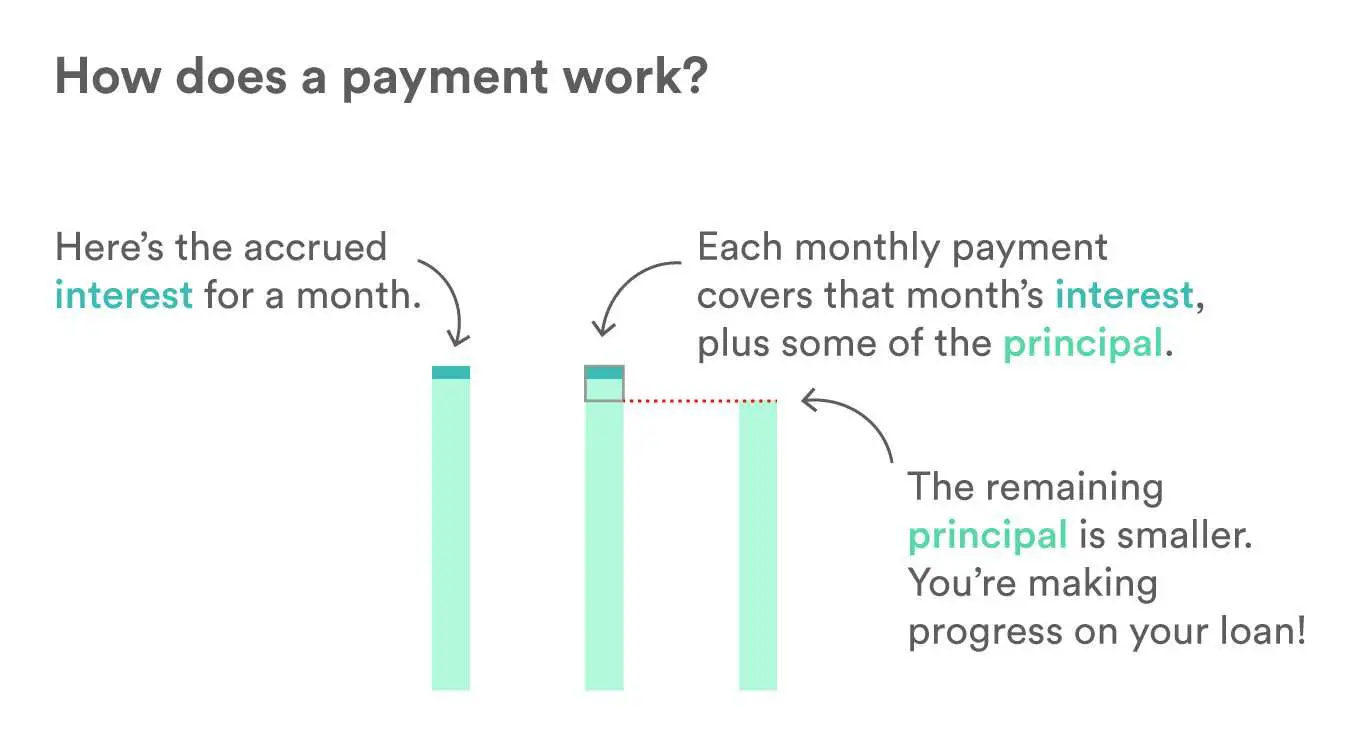

Looking at the examples above, its easy to see how this effect works over time. You naturally make a little more headway on your principal every month, even though your payment amount remains the same. This is known as amortization.

If you use amortization to your advantage, you can save yourself a lot of money over the life of your loan.

If your loan doesnt have prepayment penalties, you can pay it off faster by making higher payments every month. Because youve already paid the interest for that payment period, any additional money will go right toward the principal.

That will have a lasting benefit, because a lower principal amount means that those daily compounding calculations will be applied to increasingly smaller numbers.

Paying as little $10 extra per month can yield significant savings over the life of your loan. Paying $100 extra or more can save you thousands.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Federal Unsubsidized Loans And Private Student Loans

Undergraduate, graduate, and professional students may be offered Direct Stafford Unsubsidized Loans. Unsubsidized loans may also come in the form of Direct PLUS Loans which can be offered to parents of dependent undergraduate students, as well as graduate or professional students . And when it comes to private student loans, these can be borrowed by students and parents. Federal unsubsidized loans and private student loans do not include an interest subsidy, which means you are responsible for the interest as soon as the loan is disbursed.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Also Check: How Can I Refinance My Car Loan With Bad Credit

Pay Off Your Loans Faster

Take extra income you might have and make additional payments toward your student loans. This will pay off your loans quicker, which lowers the total interest you pay over time.

No, this technically wont lower your interest rate, but if the goal is to save money, this is an effective approach. The longer you allow interest to accrue, the more interest you will end up paying. Its a strategy you can use for both federal and private student loans if you have the extra money to attack student debt.

The average borrower would save nearly $2,000 and pay their debt two years earlier with an additional $70 payment each month.

Prioritize high-interest debt if you have multiple student loans with different rates. Use the extra money to pay off the loan with the highest interest rate first. Then move on to the loan with the next highest rate.

How Does Student Loan Interest Work

When new student loans are issued, the borrower signs a promissory note that explains the terms of the loan. Every part of this document is important to read and understand, as it determines how much you owe and when your payments are due. This applies to parent PLUS loans and their interest as well.

The most important terms to look out for are:

- Disbursement date: The date the funds arrive and interest starts accruing

- Amount borrowed: The total amount borrowed in each loan

- Interest rate: How much you have to pay to borrow the funds

- How interest accrues: Whether interest is charged daily or monthly

- How interest capitalizes: When accrued interest is capitalized to your principal balance

- First payment date: When you have to make your first loan payment

- Payment schedule: How many payments you have to make

Lenders understand that most full-time students do not have an income, and if they do, it is not enough to cover payments while in school. As a result, its often possible to avoid making payments while youre in school.

Don’t Miss: Average Loan Officer Income

Are Student Loans Worth It

Is it worth it to get a student loan? Itâs worth it to get a student loan if youâre borrowing an amount you can easily afford to pay off on a starting salary at a reasonable interest rate.

Before taking out a student loan, itâs essential to think critically about your future employment prospects and how much youâll pay to get your degree. You may be better off getting a degree from a less expensive school or starting at a community college and finishing at a state school.

For example, letâs say you take out the federal average of $35,000 in student loans at the current undergraduate rate of 3.73% . You agree to pay back your loans over the standard length of 10 years.

Youâll be paying $349.88 every month for those 10 years. At the end of your loan term, you will have paid $6,986.10 in interest for a total cost of $41,986.10. Youâll wind up paying even more with private loans at higher interest rates or federal loans for grad students.

Important note: In almost all cases, itâs better to get a student loan than to put your tuition on credit cards. The best decision comes down to your financial situation and the interest rates youâll get for the loan vs. your credit card interest rate.

If you want to hear about experiences of other borrowers, Reddit can be a great resource.

How Is Student Loan Interest Calculated

Your required loan payment will be the same each month. However, when you make a payment, interest is paid before any money goes toward reducing your principal. The remainder of your payment is applied to your principal balance.

Your interest rate is divided by the number of days in the year to get your interest rate factor. The interest rate factor is then multiplied by your loan balance and then multiplied by the number of days since your last payment. The result is how much interest youre charged for that period.

| What about fixed and variable interest rates? |

|---|

| Federal loans: The Department of Education only applies fixed interest rates, and the rates are set by Congress annually. Fixed rates remain the same over time, unless you refinance your federal loans to an, ideally, lower rate. Private loans: Lenders typically offer fixed or variable interest rates, and variable rates are fluid over time, making them a riskier proposition for borrowers. Some online lenders even offer hybrid rates, which offer both fixed and variable rates. |

Read Also: Usaa Auto Refinance Calculator

Get Answers To More Questions About Your Student Loans

Student loan interest works like a normal loan if youre making payments according to the normal schedule. However, there are important differences that dont exist with other kinds of debt.

You could be dealing with simple interest, compound interest, or subsidized interest depending on what kind of repayment plan youre using and what your income is.

If you look at traditional debt repayment advice, you need to understand the unique student loan rules or you could make a mistake.

Were the student loan experts. Talk to our professionals for advice on how to minimize your interest cost. Book a consultation today.

How Simple Interest Works

When you have a simple interest loan, also known as the simple daily interest formula, interest is calculated based on your outstanding principal balance. All federal student loans charge interest using this formula. Some private student loans will also use the simple daily interest formula, and you can confirm this in the terms and conditions of your loan.

Don’t Miss: How Much Do Mortgage Officers Make

Best Student Loan Refinance Lenders

$125,000 for borrowers with an undergraduate degree.

$175,000 for borrowers with a graduate, MBA, or law degree.

$500,000 for borrowers with a graduate health professional degree.

Nelnet Bank, and any associated logos or design marks, are trademarks or service marks of Nelnet, Inc. All loan programs and terms are subject to change or may be discontinued at any time without notice. Certain restrictions and limitations may apply.

How Student Loan Interest Actually Works

Student loan interest generally compounds on a daily basis. But, before you panic, that doesnt mean your balance will be growing each month .

If you pay your federal loans according to the 10-Year Standard Repayment Loan or your private loans according to your loan terms, your loan balance will only go down over time and you wont accrue unpaid interest.

But what about times that youre not paying toward your student loans, like during school, during a grace period, or during a period of forbearance? In many cases, interest will continue to accrue during these periods.

When you begin repayment, that accrued interest may capitalize, which means it would get added to your principal balance. So, from that point forward, you will be paying interest on your interest.

Also Check: Sofi Vs Drb

Paying Back Federal Loans

If you have federal loans, you wont need to pay them back while youre in school at least half-time. You can start paying back early if you choose. There are no prepayment penalties.

After graduation, youll usually have a six-month grace period before your repayment schedule begins. Then your lender will ask you to choose a repayment option.

Each option requires you to pay a different amount per month. The more you can pay per month, the less youll pay overall.

Remember the daily interest formula above if you make larger payments, youre chipping away faster at the unpaid principal, which results in less accrued interest. By the same token, if you make smaller payments, youre likely to pay more money overall, since the interest will add up.

The repayment plans below apply to every federal loan except Perkins Loans. If you have a Perkins Loan, the school should inform you about repayment options, which will vary.

Standard repayment plan

You pay a fixed monthly amount with the goal of paying your loan off in 10 years . This option saves the most money overall, but costs more at a time.

Graduated Repayment Plan

You start out with smaller payments which increase every two years again, with the goal of paying off the loan in 10 years .

Extended Repayment Plan

You pay monthly on a fixed or graduated plan with the goal of paying the loan in 25 years. This option is only available to loan holders with $30,000 or more in debt.

Revised As You Earn Repayment Plan

Student Loan Apr Vs Interest Rate: 5 Essential Faqs

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right. Read less

This article contains breaking news and events related to the current state of politics and the economy. While we try our best to keep our articles as up-to-date as possible, the ongoing effects of COVID-19 are happening in real time and information is subject to change.

Pop quiz: Whats the difference between student loan APR and student loan interest rate?

Both terms are related to how much money youll spend on total interest, so they should factor into your decision when comparing loans and lenders. It can be hard to weigh your options when some student loans display an interest rate, while others state an APR. The main difference is that APR includes any upfront charges and fees the lender may add to the loan principal and the interest rate does not. But there are complexities to each, which well break down here.

Recommended Reading: What Car Loan Can I Afford Calculator