Book The Condition Inspection

- Make an appointment to have the car inspected at A-Katsastus at a time suitable for you and the seller. Book the inspection at a-katsastus.fi/varaa-aika. Select OP Autorahoitus from the list of options. You can have your car inspected and the sale completed during the same visit. This will take about two hours.

How To Qualify For A Private Party Auto Loan

To qualify as a borrower for a private party car loan, you typically need to meet a lenders credit score and income requirements. Many lenders prefer credit scores of 640+ and incomes of at least $1,500 to $1,800 a month.

Are there private party auto loans for bad credit?

You bet! Even if your credit score is below par, you can still shop around for the best private party auto loan. Take a look at car loans for bad credit.

As with all bad credit loans, youll face higher interest rates than those with the strongest credit. Provided you have a few months, it may be possible to get your score into good shape before you apply. You wont go from subprime to super-prime in that time, but you might move into the approvable range and shave off a bit of your interest rate.

Can You Get An Auto Loan For A Private Car Sale

Getting a new set of wheels is an exciting feeling. But like so many, you might be unable to pay cash for a car.

Purchasing a new car often involves an auto loan.

For your convenience, you can purchase a car and secure financing at many dealerships.

But what if youre not buying from a dealership?

Can you still get an auto loan?

Yes, you can get an auto loan to buy a car via a private sale.

Read Also: Caliber Home Loan Customer Service

Finance For A Private Sale

The finance company you apply to for lending will require a thorough check of the vehicle for which you are looking to borrow funds. This is to make certain the vehicle is being sold lawfully, there are no outstanding agreements for finance or outstanding debts attached to it, and that the stated history of the car checks out completely.

Servicemembers Civil Relief Act

The SCRA provides financial relief and protections to eligible servicemembers and their dependents. PNC is grateful for your service and we would like to help you understand your benefits and protections under SCRA as well as other similar benefits that PNC may be able to provide to you.

To find out more, please contact us at:

Recommended Reading: How To Take An Equity Loan

How To Apply For A Private

To formally apply for a private-party loan, youll need to fill out an application with the lender you choose. Youll be asked to provide some information about the car, which may include the vehicle identification number , make and model, model year and mileage. Youll also be asked for personal information, which could include your Social Security number, address, employment and income. The information you need to provide will vary by lender.

The lender will review this information, along with your credit, to determine whether you qualify and what the loan interest rate and terms will be.

Once youve chosen a loan, you may need to provide additional information and documents to your lender, like the vehicle registration, vehicle title, bill of sale and a payoff quote.

Depending on the lender, you may get a check for the agreed-upon sale amount thats made out to the seller or the lienholder , or the loan amount might be deposited into your bank account after the loan closing.

Auto Loan Ontario Is The One Stop Auto Loan Company With Solutions For All Credit Situations

Once you complete ouronline credit application, you’ll get personal attention from our Ontario financial experts so that they can understand your individual personal situation and work hard to get you the lowest interest rate available and ensure that you can have a comfortable and affordable monthly payment for the vehicle you want!Let Auto Loan Ontario, the automotive financing experts easily walk you through the vehicle loan process and all the options available to you for your next automobile purchase so that you make an informed educated decision. We know how to get you the most money and the best interest rates. We’ve helped people with:

| Ontario No Credit Car Loans |

| Bad Credit Vehicle Loans |

Also Check: Can I Lower My Car Loan Interest Rate

How Do I Finance A Car From A Private Seller

Buying a used car is a great way to save money while still getting a car you love. When you are on the hunt for a used car for sale that suits your needs and also suits your budget, you might find that used cars sold privately are slightly more affordable than those from a dealership. Though buying and selling privately can offer a financial benefit, it can be more challenging to navigate the car buying process for a private sale and also comes with some risks.

At Autorama, we want you to drive a car you love that suits your budget too. We understand that you may have questions about private sale used cars. We are here to answer your questions and help you navigate your options as you look for a new car. From used car financing options to safety, lets dig into private sales vs used car dealership purchases.

Capital One Auto Finance

Capital One Auto Finance is a leading US vehicle lender. You can prequalify for a loan without hurting your credit by filling out a short form on Capital Ones website. Its Auto Navigator shows you your financing terms before it directs you to a participating dealer. You can sign up for price alert emails to help you choose a vehicle.

Also Check: When Do I Apply For My Student Loan

Lease Buyout Explained: Should You Buy Your Leased Car

When the end of an auto lease period comes up, it’s not always a given that you need to trade your wheels in for something new. While there are advantages to trading in your car, there may be benefits to buying your leased car.

4 min read

Buying your first car can be intimidating. Our guide can help you understand what financing options are available and how apply for a loan.

9 min read

Find Out If You Are Eligible

Lenders often have certain requirements for both the borrowers and the cars that will secure the loan. The criteria may include minimums for your credit score, income and upfront payment. The lender may also set a limit on the age and mileage of the car or require a floor on the price. Usually, you can go online, call lenders or even walk into a financial center to get information about eligibility. Locate a Bank of America financial center near you

Don’t Miss: How To Get Approved For Ppp Loan

What You Need To Apply

You can apply online and can upload the documents listed below through a secure, paperless and electronic ID verification system.

We endeavour to get back to you without the inconvenience of leaving your work or home from your computer, tablet or mobile phone.

However you can apply in person at any of our branches nationwide and bring the documents below with you, we can usually give you an answer on the spot or simply call .

Valid NZ driver licence

Additional Insurance Products are also available to help protect you and your new asset.

Paying Off Your Car Loan Early: Things To Consider

Thinking of paying off your car loan? While theres the benefit of reducing your debt, take time to assess your personal financial position before making a decision. In this article, we highlight some of the important considerations to keep in mind.

3 min read

Timing can be an important factor in the car buying process. Learn when the best time to buy a car is and how timing can impact your decision making.

4 min read

There are many important factors to consider when deciding whether to buy a new or used car. Read more about the pros and cons of each car buying option.

4 min read

You May Like: How Do I Pay My Student Loans

Can I Get Car Finance For A Private Car Sale

If youâre looking to buy a car privately, the team here at Zuto can help. We work with a number of lenders who are able to offer private car finance. Some of our lenders may require additional information, including details from the seller, but this is something our team will discuss with you during the process.

Further Answers About Loans For Private Sale Cars

Perhaps most importantly, used cars and cars bought privately are both factors that reduce the cost of your loan, as theyre generally cheaper to buy with more room for negotiation than new cars bought from a dealership.

There are also measures in place to help you avoid buying the car completely blind without knowing about a potential history of accidents and/or repairs.

This report is conducted by an independent source, such as Equifax, and tells you about various important details you should know about the car youre looking at buying. This includes aspects such as vehicle valuation, whether its been written off or stolen and information on its odometer readings.

Its important to be aware of your cars history to ensure that youre not buying a vehicle with a track record of issues that could end up costing you more in the long run.

Yes we can arrange for cars up to 20 to 25 years of age to be financed by one of our flexible lenders. Alternatively, if you want a car even older than this, we can help you arrange an unsecured personal loan to finance the vehicle instead.

Yes generally, used cars come at slightly higher interest rates than new ones from a dealership. The fact that theyre being sold privately also means that greater scrutiny is required on the part of your lender to ensure that the car meets their requirements.

ABN 78 660 493 194. ACR Number 541 339.

You May Like: Is Fha Or Conventional Loan Better For Seller

Private Party Auto Loans Vs Alternatives

Alternatives to private party auto loans include HELOCs, home equity loans and borrowing from friends/family. But the go-to alternative is a personal loan. In an unsecured personal loan, the lender doesnt take what youre buying into consideration, only your income and credit. This can help you if the private party car loan didnt work out for reasons such as the following:

- The vehicle has more miles or is older than the lender allows.

- Youre purchasing a vehicle with a salvage title.

- You want to borrow less than the lenders required minimum loan amount.

The biggest downside is personal loans usually have higher interest rates because they are not backed by anything other than the borrowers promise to repay. Borrowers with high credit scores may still find competitive rates, though. Here are the current personal loan rates.

Making A Purchase Through Private Sale

Often, car buyers seeking to purchase a vehicle in a private sale would need to find the funding to acquire their chosen car. Here at Car.co.uk, we can give you access to lenders who specialise in offering car finance agreements in a variety of different circumstances, including private car sales as well as those bought via dealers.

Read Also: Student Loan Forgiveness Non Profit Work

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

What Are Your Options For Private Party Financing

The most common ways to finance a private party auto purchase are by using a personal loan or a private party auto loan. Both types of loans are available from banks, credit unions, online lenders and other financial institutions. Which is the most cost-effective option?

A private party auto loan uses the car itself as collateral to secure the loan, so the lender can repossess the car if you don’t pay. As a result, private party auto loans generally have lower interest rates than personal loans and may be easier to get if your credit is less than stellar.

Personal loans are typically unsecured loans, which don’t require collateral. Unsecured loans are riskier for lenders, so they typically have higher interest rates than secured loans. Interest rates on personal loans have a wide range but can reach 35% or more. Experian’s personal loan calculator can estimate your loan payments for various amounts and interest rates.

Although a private party auto loan usually costs less than a personal loan, the interest rate for a private party auto loan can vary widely depending on your credit score. The average interest rate for a used car loan was 8.66% in the second quarter of 2021, according to Experian’s State of the Automotive Finance Market. Lenders with excellent credit paid an average interest rate of just 3.66%, while those with poor credit paid an average of 20.58%.

Read Also: What Is Difference Between Secured Loan And Unsecured Loan

Can You Get A Car Loan For A Private Sale

Is there any way for me to get a car loan for a private sale? I found this beautiful classic Corvette from a private seller, but I canât afford to buy it without taking out a loan. Do I have options?

Yesprivate-party auto loan

- Large banks: You wonât be able to find private-party loans at all large banks, but some will offer this type of loan. Banks that have private-party loan options include PNC, Bank of America, and Regions Bank.

- : Many credit unions offer private-party loan options with more flexible rates.

- Online: Online lenders like LightStream sometimes offer private-party loans.

personal loanhigh interest rate

Good For Bank Of America Loyalists: Bank Of America

Preferred Rewards members may qualify for a rate discount of up to 0.5%. Additionally, you can apply online for a Bank of America auto loan before youve chosen a car and lock in your rate for 30 days while youre shopping around. If youre still figuring out your budget, this can help you decide how much you can afford.

Read our review of Bank of America auto loans.

Also Check: Best Used Car Auto Loan Rates

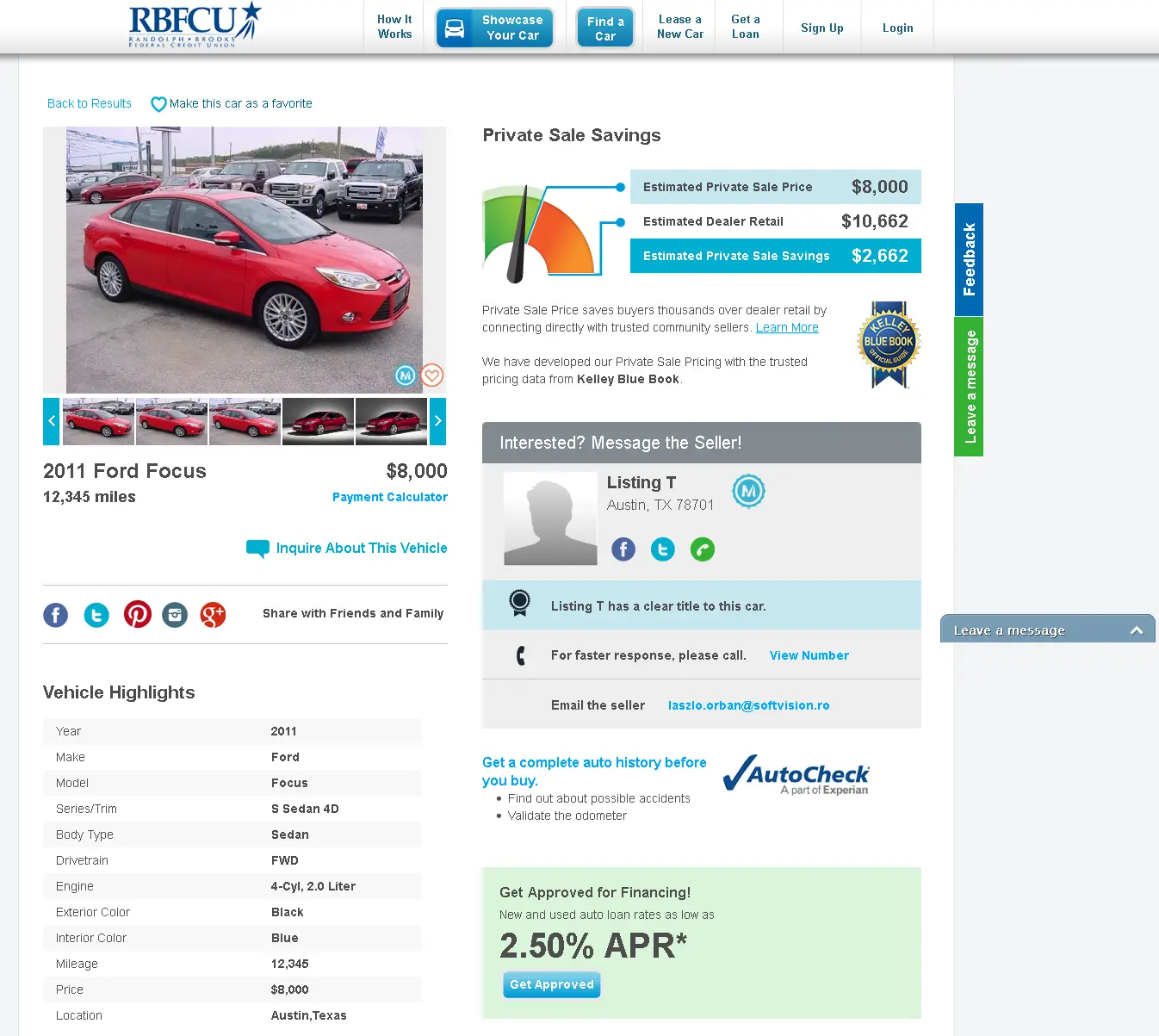

Sell Your Car To A Private Buyer

Each year over 5 million people sell cars to private buyers and make thousands of dollars more than selling to car dealers.

However, many private sellers give up as few buyers have enough cash to buy your car and you dont have a good way to guarantee the mechanical condition of your car.

Kar Loans Corp can give you get the higher price by providing the mechanical confidence and financing options offered at most dealerships. We can even handle paying off exiting loan balances if you cant pay it off before the sale.

No Check Engine light

While the check engine light may be on for a minor issue that is known in the mechanic inspection, the cause must be fixed before we can buy the vehicle. Most lenders do not want to finance a car with the check engine light on. In some cases, we can help get repairs completed before a sale is completed if you dont have the money to fix it.

No Airbag warning light

We will not be involved in selling unsafe cars. The typical concerns are brakes, tires and airbags. In some cases, we can help get repairs completed before a sale is completed if you dont have the money to fix it.

Legal brakes and tires

We will not be involved in selling unsafe cars. The typical concerns are brakes, tires and airbags. In some cases, we can help get repairs completed before a sale is completed if you dont have the money to fix it.

No known Powertrain issues

No undisclosed defects

Located in Illinois

Worth at least $2,500 to $5,000

Best Overall Private Party Auto Loan

This online lender network offers private party auto loans to consumers with all types of credit. It fills an essential niche for folks who want to buy a used car from the current owner rather than a dealership.

| 2 minutes | 7.5/10 |

You can fill out a short online application at myAutoloan.com for a private party car loan and compare up to four offers in minutes. You then can complete the loan application and receive a check or online certificate within 24 hours.

myAutoloan.com provides calculators and estimators on its website to help you work out the loan amount, interest rate, and monthly payments that fit your budget.

Read Also: What Is Fha Max Loan Amount

How Do I Recognize A Crooked Private Party Car Seller

Lets face it: You may encounter shady individuals when buying a vehicle privately. Be on the lookout for telltale signs of dishonest dealings, including:

- Lack of access to the vehicle: You dont want to buy from anybody who wont let you inspect or test drive the car.

- No guarantee: Its not unusual for sellers to insist on an as is deal, but thats riskier if the car is old or has high mileage. Demand the right to inspect the car before paying.

- High price: Know how much you should pay for a vehicle before making an offer. Some sellers try to charge too much, hoping car buyers dont know the actual value.

- Dirty or damaged vehicle: A filthy car is often a sign of owner neglect. Even if partially fixed, damage may be more extensive than what the owner claims. Always get a CARFAX or similar report detailing the cars service history.

- Cash only: A seller who will only take cash may not want to deal with a legitimate lending institution, perhaps for nefarious reasons.

Use your common sense when dealing with individual sellers. Check them out on social media and run a background check if you dont like their vibes.