Keeping Track Of Your Total Student Loan Balance While In School

Its always a good idea to keep track of your student loan balance as you go through school. After all, you dont want to end up with a surprise upon graduation.

As you borrow money, you should never borrow more than you need. If there are other ways to fund your education through scholarships or grants, or even savings from a summer job, it can save you considerably in the long run.

Its also a good idea to keep track of which loans are subsidized or unsubsidized. This is because unsubsidized loans gain interest, and after several years in school, that interest might be considerable.

When it is time to start repaying your loans, all unpaid interest becomes capitalized, meaning it is added to the total loan balance and will gain interest itself.

To avoid interest accrual and capitalization on your unsubsidized loans, you may want to pay off the interest as you go. Then, the balance will not grow while you are in school and be more manageable after graduation.

Who Is My Federal Student Loan Servicer

A loan servicer is a company that handles the billing and other services for your federal student loans. To find out who your loan servicer is, you may login to the Student Aid website. Here you may view information about all of the federal student loans that you have received and find contact information for the servicer of your loans. You will need your Federal Student Aid ID to access this information.

By: Sean LaPointe | 14th June 2021

Did you take out a student loan at university to help with tuition fees and living costs? Keeping track of how much you owe can help you budget and manage your money better. It can also help you keep your debt under control. Here is a useful guide to checking your student loan balance.

Finding Your Best Strategy For Managing Your Student Loans

Navigating the student loan system is complex and sometimes confusing. But now that you know where to find out your student loan balance, it should be a little easier.

Not only can you use the resources listed above to find out how much you owe on your student loans, but you can also learn details about your interest rate, monthly payment, repayment term and loan servicer.

After gathering all this important information, shift your focus to coming up with a strategy for repayment. A good place to start is with these student loan payment calculators. By crunching the numbers, you can come up with a plan for conquering your debt, and you might even find a way to pay it off ahead of schedule.

Kat Tretina and Paula Pant contributed to this article.

You May Like: How Long Does The Sba Loan Take

Unable To Repay Student Loans

If you cant pay the full amount due on time or have to miss a student loan payment, your loan may be considered delinquent and you may be charged late fees. Contact your loan servicer immediately for help, and ask them about your options.

Learn about COVID emergency relief for federal student loans that has been extended through January 31, 2022.

How To Check Your Student Loan Balance

By: Sean LaPointe | 14th June 2021

Did you take out a student loan at university to help with tuition fees and living costs? Keeping track of how much you owe can help you budget and manage your money better. It can also help you keep your debt under control. Here is a useful guide to checking your student loan balance.

Don’t Miss: Fafsa Entrance Counseling Quiz Answers

How Much Student Loan Debt Do I Have

When youre ready to focus on your finances and gather information about your debts, one question that may come up is, how much do I owe in student loans?

If youve received student loan funds, you may have an idea of what you owe, but that does not give a full picture of your total debt. In most cases, interest accrues on the loan from the date you received the funds. Therefore, the total student loan balance is often higher due to interest being added.

To find out how much you owe in student loans, its good to know whether you have federal or private student loans. If you are unsure which you have, or you have both types, determining your student loan total will take a little more effort.

Explore Different Student Loan Strategies

As you think through your loans, income and other financial factors, you can identify the plan of attack that best fits your situation.

The nice thing about the tools above is they take the focus off doing math and place it on creating a strategy that works for you.

With so much information out there and so many decisions to make, its easy to become overwhelmed. Dont let fear about your student loan situation paralyze you and prevent you from making decisions that will make your life easier in the long run.

With a little bit of ingenuity, hard work and help from Student Loan Hero, you can do more than manage your student loans you can conquer them.

Andrew Pentis and Honey Smith contributed to this report.

Also Check: Flex Modification Calculator

Resolve Student Loan Disputes

If you and your loan servicer disagree about the balance or status of your loan, follow these steps to resolve your disputes:

1. Talk with your loan servicer

You may be able to solve a dispute by simply contacting your loan servicer and discussing the issue. Get tips on working through an issue with your loan servicer to resolve the dispute.

2. Request help from the FSA Ombudsman Group

If you have followed the guide and still cannot resolve your issue, as a last resort, contact the Federal Student Aid Ombudsman Group. The FSA Ombudsman works with student loan borrowers to informally resolve loan disputes and problems. Use FSA’s checklist to gather information youll need to discuss the dispute with them.

What Is Your Student Loan Balance Heres How You Find Out

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

You May Like: Parent Plus Loan Interest Deduction

How Do I Check My Student Loan Balance

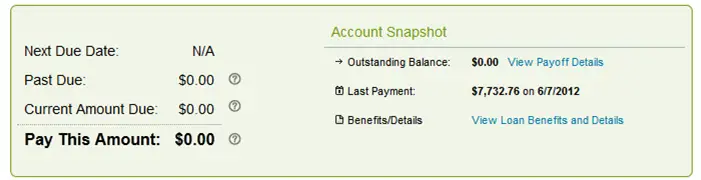

The easiest way to check your student loan balance is through the manage your student loan balance tool on the gov.uk website.

To use this tool, you will need your customer reference number or the email address that you signed up with. You will also need to log in with a password and secret answer, such as your mothers maiden name.

If you have changed your email address since signing up for your loan, you should contact the Student Loans Company .

If you applied for student finance through the Student Awards Agency for Scotland and you are signing in to this service for the first time, you will also need to contact the SLC so that they can set up your account.

Once youve successfully logged in you will be able to see your balance. You will also be able to:

- See how much youve repaid towards your loan

- See the amount of interest on your loan so far

- Make a one-off repayment

- Set up and amend direct debits

- tell the SLC about a change of contact details

How To Repay Your Student Loan

Your student loan is taken out of your salary once you earn over £26,575 a year, £2,214 a month or £511 a week before tax.

You repay 9 percent of anything you earn over this amount.

How much you repay isnt based on the total amount you owe, it is based on how much you earn.

For example, someone who earns £2,600 a month will repay £34 every month but someone who earns £3,200 will repay £88 a month. It doesnt matter how much these people owe.

Plan 2 loans, which are for those who started their course in the UK after September 1, 2012, are wiped 30 years after the April you were first due to repay.

When Plan 1 loans get written off depends on where you are from and when you took out the loan it could be when you are 65 years old, or 25 or 30 years after you were first due to repay.

This means you dont need to pay the full amount back if you dont manage to by them, and your student loan does not affect your credit rating.

If someone with a student loan dies, the loan will be cancelled.

If you claim certain disability benefits and can no longer work because of illness or disability, you may also be able to cancel your loan.

Read Also: Usaa Used Car Loan Rate

Who Needs To Start Repaying

You may need to start paying back your OSAP loan six months after your study period ends.

You dont need to start paying back your OSAP loan if your school confirms your enrolment for the next study period and we approve your application for one of the following programs:

- OSAP for Full-Time Students

If you received loans through the OSAP micro-credentials program, learn about repayment for micro-credentials programs.

How Do I Consolidate Student Loans

The process for consolidating your student loans depends on whether you have private or federal student loans. If you have private loans or want to combine private and federal loans into one, youll need to refinance them with another private loan. You can consolidate multiple federal loans into one new federal loan through a Direct Consolidation Loan, which you can set up through the Federal Student Aid website.

Recommended Reading: Can You Refinance Fha Loan

Select A Repayment Plan For Your Federal Student Loans

Within the grace period you may receive information about repayment from your lender. Youll have a choice of several repayment plans. Find the right one for you.

Most federal student loans are eligible for at least one income-driven or income-based repayment plan . These repayment plans are based on a percentage of your discretionary income. Theyre designed to make your student loan debt more manageable by reducing your monthly payment amount.

Finding Your Loan Information

If you are unsure which agency is servicing your defaulted student loan, you may retrieve your loan information from the National Student Loan Data System . This system contains financial aid information collected from schools, agencies, and other educational institutions. You will need your Federal Student Aid ID information to access your account. Or, you may contact the Federal Student Aid Information Center .

Also Check: Nslds Ed Gov Legit

National Student Loans Service Centre

You can find tools on the NSLSC website to help simplify and improve your repayment process. These include:

Pre-authorized debit: activate this option online to automatically make student loan payments every month.

Repayment notice: important information about your repayment terms, such as amount owing, repayment start date and repayment amount can be found by accessing the repayment notice feature online.

Virtual repayment counsellor: a virtual repayment counsellor can help you identify the best repayment path and ensure regular, timely loan repayments.

One-time payment: make lump-sum payments through the NSLSC website to accelerate repaying your loan.

Contact The Financial Aid Office

Before you leave college, reach out to your financial aid office. It can give you a report of the federal student loans you borrowed there since it is in charge of disbursing those loans to students.

However, keep in mind that if you attended multiple schools and transferred, your financial aid office might not have records of loans you borrowed at other colleges.

You should also make sure the financial aid office has the most up-to-date contact information for you .

Don’t Miss: Used Car Loan Calculator Usaa

How To Find The Balance On Your Private Student Loans

Retrieving balances on private loans is a little trickier than finding information on federal loans. Theres no national website for private student loans like there is for federal loans. Also, the financial institution that originally issued the loan might outsource the loan servicing elsewhere or sell your loans to a different entity.

However, there are other ways to find your private loan balances:

- Ask your original lender : Your original lender is always the best place to begin this search. Hopefully, youve kept your original loan documents with the lenders contact information. One phone call should help you find your student loan balance and current servicer.

- Ask your school for help: If youre having trouble tracking down your loans, talk to your universitys financial aid office. They can help you identify who currently manages your debt.

- Check your credit report: Credit reports list all of your current and past credit obligations, including student loans. It will list the amount you borrowed and the loan servicer, which you can then contact to find the status of your account or to make payments. You can get a free credit report from the three main credit reporting agencies Experian, TransUnion and Equifax by visiting AnnualCreditReport.com.

Recommended Reading: How Much Car Can I Afford Based On Income Calculator

How Can I Find Track And Manage My Student Loans

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

* * *

Also Check: Upstart Prequalify

Contact Your Schools Financial Aid Office

If you have federal loans that dont show up on the NSLDS, another option is to contact your schools financial aid office. The staff there can look up your past loan information, including what you originally borrowed and who the loan servicer was. With that information, you can contact the servicer to get your current loan balance.

How To Find Your Private Student Loan Balance

Because the NSLDS is only for federal loans, your private student loans wont show up in the database. If you refinanced any federal loans, those wont show up either because once you refinance your student loans, they become private loans.

To find any private student loan balances :

Check Out: The Best Student Loan Refinancing Companies

You May Like: Capital One Pre Approved Car Loan

Do You Know The Total You Owe On Your Student Loans Here’s How You Can Figure Out Your Total Student Loan Balance

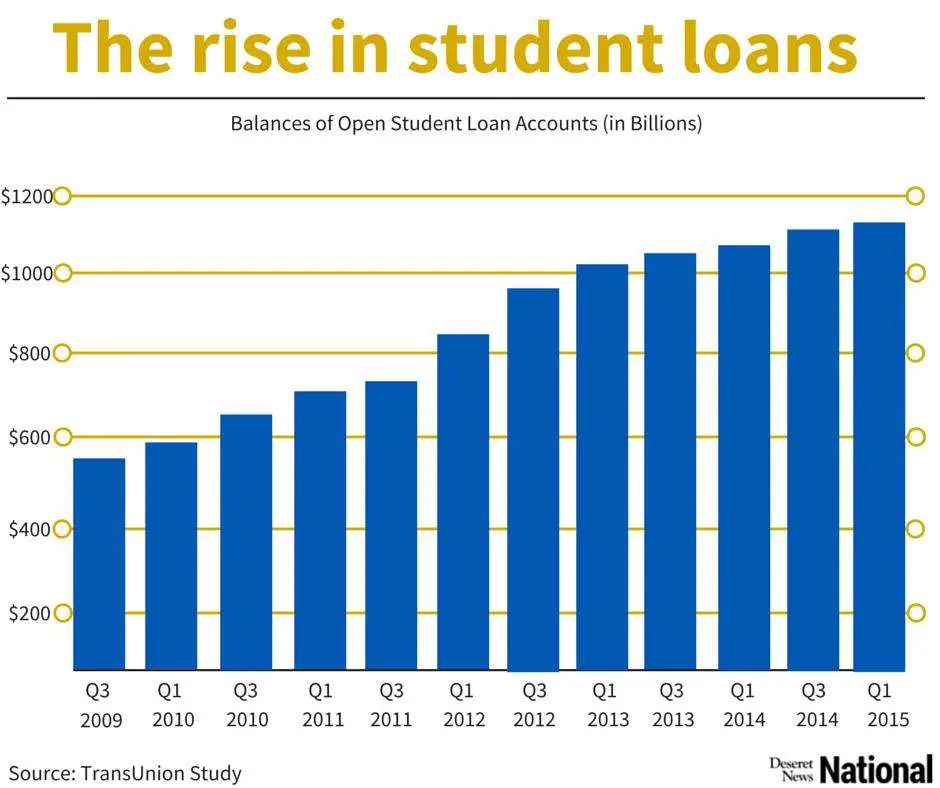

Paying for college with student loans has become the norm, but unfortunately things can get confusing quickly when you take on student debt. That’s because most students don’t get just one student loan — they get new student loans for each semester or school year and have a mix of different kinds of federal and private student loans. Those balances add up fast, so much so that the average student loan balance after graduation was $28,650 in 2017.

When you have multiple student loans to pay, and multiple different loan servicers to deal with, it’s easy to lose track of the total loan balance you owe. The problem is, unless you know what your loan balance is, it’s really hard to make a payoff plan or even estimate what your monthly payments will be. In a worst-case scenario, paying some of your loans could slip through the cracks and you could end up late in making loan payments.

You’ll want to make sure you know your total student loan balance so you don’t end up making costly mistakes — but how exactly can you figure out the total you owe? There are a few different steps you may need to take depending on what kinds of debt you’ve taken on.