How To Apply For An Sba Real Estate Loan

Several SBA programs offer real estate loans, most commonly through the 7 and 504 programs. While the application is similar to other 7 loan applications, your business needs to take some extra steps to get all of the documentation together like getting the property appraised and evaluated for potential environmental issues. On top of the other eligibility requirements, youll also need to:

- Make a minimum down payment of 10%

- Have plans to occupy at least 51% of the property

When it comes to documents, lenders typically ask for the following:

- Real estate purchase agreement

- Rent rolls for the new property

- Leases for tenants of the new property

- Remodeling or construction plans

- A report on the propertys condition

Sba 7a Loan Fees & The Sba Guarantee Fee

SBA 7a loans have high fees associated with them, although these fees might be waived on all new loans through September 2021 due to the second round of Stimulus due to COVID-19.; Please contact us at 1-800-414-5285 for more info on this.

The SBA Guaranty comes with a fee.; It is called the “SBA Loan Guaranty Fee” a.ka. “SBA Guarantee Fee.”; Without the fee paid to guarantee the loan the SBA programs would not exist.; The fee is actually very similar to a mortgage insurance premium on a HUD loan or even a home mortgage except there is no monthly premium amount paid by the borrower.

On average, the SBA loan fees for most loans end up between 2.3% and 2.75%, so yes, they are expensive, but there are typically NO points or origination fees for SBA 7a loans like you have with many conventional bank loans, so they cost 1 to 1.5 percent more on average than conventional loan fees, but the benefits outweigh the additional cost in many cases.

Also, if your project includes ground up construction then SBA loans can be slightly more affordable as SBA lenders do not charge higher fees for construction transactions, whereas many traditional banks will charge additional fees since construction loans require a lot more effort to get closed. .

Here is the finer detail regarding how SBA loan “guarantee” fees are calcuated:

Loan Amounts from$150,001 to $700,000:; 3% of guaranteed portion

If loan is $500,000 with a 75% guaranty then fee would be $11,250

3.5% of $750,000 PLUS 3.75% of $1,500,000

Find The Right Credit Institution

There are many credit institutions that are generating SBA loans. Nearly all of the big banks are SBA loan generators, with Wells Fargo being the biggest, followed by JP Morgan Chase.

All banks have to meet the SBA requirements, but credit unions are often easier to satisfy. Each institution will judge each case on its own merits weighing all of the factors. The size of the loan you get with a credit union will not be as big, but it will be easier to qualify for.

You May Like: How To Apply For Direct Loan

Sba Loan Requirements 2020: How To Apply Nav

Jul 2, 2019 Are SBA loans hard to get? Yes and no. Compared to some other business financing options, SBA loans usually have somewhat higher standards. They;

Are SBA Loans Hard to Get? First, dont let the requirements of SBA loans scare you off from considering one. Think of SBA financing as you would any other;

Buying A Business / Financing Goodwill

The 7a can be used to buy a business. Typically, the max loan is 10 years if just financing goodwill / blue sky / intangible assets. If there is some long life equipment included then longer term amortizations are possible, and if commercial property is included the loan term could be as long as 25 years as the rules for the SBA 7a allow for a 25 year amortization if the largest percentage of the use of proceeds for the loan is for commercial real estate.

Borrowing More than $5 million

Typically the maximum 7a loan will be $5 million whether the loan is for a business purchase, refinance, property purchase , but it is possible for very especially strong transactions to borrow more than $5 million as there are a few lenders who offer a second mortgage that they will put behind a first position SBA 7a loan.; This does not happen very often, but it is a possibility for the right type of transaction, although it could require that the borrower put up/have additional collateral.

Recommended Reading: Are There Student Loan Forgiveness Programs

Ways To Use Your Sba Loan

The funds you receive from a small business loan can be used for various purposes. Depending on the time of year and what your company needs to accomplish, your reasons for applying for an SBA loan may drastically differ from a business owner within another industry.

Here are six of the many ways you can use an SBA loan to quickly grow your business:

Additional Beneficial Business Qualities

In addition to the eligibility requirements, there are a few additional qualities which can increase your likelihood of SBA 7 loan approval.;

-

A good credit score – preferably above 680.

-

A history free from recent bankruptcies, foreclosures, or tax liens.

-

Having been in business for at least two years.

-

The ability to provide collateral for loan requests over $25,000.

-

The ability to make a down payment of 10% if your intended use of funds is to purchase a business, commercial real estate, or business-related equipment.

-

Sufficient cash flow to meet your debt obligations.

-

Sufficient working capital .

-

Good character according to the SBA .

Don’t Miss: What Are Assets For Home Loan

How To Build Personal Credit

There are many ways to build personal credit, even if your credit is tanked from previous debts or periods of financial hardship. Building credit is a long process, but one that you must undertake in order to receive government-backed loans. Here are a few ways you can build your credit:

-

Secured credit card. Some financial institutions offer secured credit cards that allow persons with bad or no credit to start building good credit. The primary differences between a standard credit or debit card is that you must provide a security deposit, which then typically becomes your line of credit amount, and that you must have a qualifying credit score lower than usual for a credit card.

-

Find a co-signer. Most loans and credit cards allow for an additional party to be held responsible for the debt. In the case of default by the borrower, the co-signer is then held responsible for the balance. This reduces the risk of default for lenders, which makes them more apt to approve a loan to someone with bad credit. A co-signer must have a good credit score themselves, as well as stable income and long-term credit history.

-

. Most banks and credit card companies allow primary account holders with good credit to add an authorized user to their account. The authorized user becomes responsible for payments, and builds credit in their name. Opening a joint account is another way to share in the benefits of having a primary account holder with good credit.

Additional Sources Of Down Payment For An Sba 7a Loan

In addition to the above, the 7a is also fairly flexible with regard to equity contributions from the seller.

The SBA allows equity in the form of a second mortgage from the seller of the business. They allow the seller of the business to take back a second mortgage as equity IF the second mortgage is on what is called “Full Standby” for life of the loan. Full standy means that no payments can be made for as long as the borrower has the SBA loan – although interest can accrue during this period.

In some cases, a transaction will be structured with a seller held loan on full standby for equity/down payment requirements AND another seller held debt with “repayment terms” in order to reduce the lender’s exposure on a transaction.; We see this fairly frequently when a borower is buying a business that does not quite have strong enough cash flow, but the buyer has a plan and realistic projections to improve the cash flow.

These additional seller held debts serve to reduce the lenders risk and are sometimes the key to getting a loan approved.

Recent Creative Funding:

Please call us at;1-800-414-5285;for more info about;100% financing;with the 7a or leveraging equity in another property.

Read Also: What Is Fha And Conventional Loan

Why Use An Sba Loan

SBA loans are;designed;to;make it easier for small businesses;to;get;funding. If your business has exhausted all other financing options, you may be able to get an SBA loan. Whats more, the government caps interest rates on SBA loans, meaning youll never have to pay the high interest rates often associated with other types of business loans.

Max rates are pegged to a base rate, using the prime rate, LIBOR rate, or an optional peg ratebut usually the prime rate published by the;Wall Street Journal. In general, the prime rate is 300 points above the federal funds rate. At the end of 2020, the target federal funds rate was 0%-0.25%.

This table shows the maximum loan amounts:

| Loan Amount |

|---|

-

Purchase machinery, furniture,;supplies, or materials

Sba 7 Loan Requirements

To qualify for an SBA 7 loan, youâll have to meet requirements from the SBA and your lender. Although some requirements vary from lender to lender, there are general eligibility criteria that apply across the board:

- Your business needs to be officially registered as a for-profit business.

- Your business needs to meet the;SBAâs definition of a small business.

- Your business needs to be located in and operating in the U.S.

- You, as the business owner, need to have invested your own time and/or money into the business.

In addition to these standard SBA requirements, there are also common criteria that lenders use to evaluate your ability to repay a loan:

Use our guide to learn more about SBA loan requirements.

Don’t Miss: How Do I Get My Student Loan Number

Prepare Your Business Financial Statements

The SBA primarily wants to see your Profit & Loss Statement and Projected Financial Statement to make sure your small business will be able to repay the loan youre applying for.

If you need help creating these statements, you may want to consider writing out a business plan and using that information to form the foundation of your business financial statements. You can download our business plan template to help you get started:

How Long Does It Take To Get An Sba Loan Approved

Aug 16, 2021 Find out how long it takes for SBA 7, 504, microloans, and disaster loans to be approved. Learn about the SBA loan approval process in;How long does it take to get SBA loan funds after approval?How do I check the status of my SBA loan after approval?

6 answersThe SBA does not provide loans. The bank does. Huh?! Except for uncommon circumstances the SBA provides a guaranty to the bank to cover much of their;

Learn why its so hard for small businesses to get loans and how to improve business loans, including many Small Business Administration loans,;

Dec 21, 2020 The U.S. Small Business Administration has made disaster loans available for businesses in affected areas. Heres how the loan works, who;

Get prequalified online without a hard inquiry on your credit report You can apply for an SBA loan directly on Fundera with your loan funded through a;

Mar 16, 2020 However, long processing times and rigorous application standards make it difficult to get approved. Dont make an SBA loan your only option for;

May 5, 2021 How do SBA loans work? Businesses can apply for an SBA loan through lenderstypically banks or credit unions, but some loan programs are through;

Apr 22, 2020 Can I apply for both SBA loan programs? Yes. Businesses that receive a disaster loan can later refinance it into any Paycheck Protection Program;

Recommended Reading: When Do I Pay Back Student Loan

Do I Qualify For An Sba 7 Loan Sba7aloans

Learn about all of the credit and legal qualifications for getting an SBA 7 loan , and how you can increase your chances of getting the loan you need.

Sep 9, 2020 As such desirable products, however, SBA loans are also very competitive, and the process to actually get an SBA loan is lengthy and involved.

May 18, 2021 Although the guarantee incentives lenders to work with small businesses, it can still be hard to qualify for SBA 7 loans. Lenders generally;

May 20, 2021 Generally speaking, for the lenders to look your way, youll want to have a minimum credit score of 640. Having said that, youll increase your;

1. Poor credit history. Credit reports are one of the tools lenders use to determine a borrowers credibility. · 2. Limited cash flow · 3. Lack of a solid;

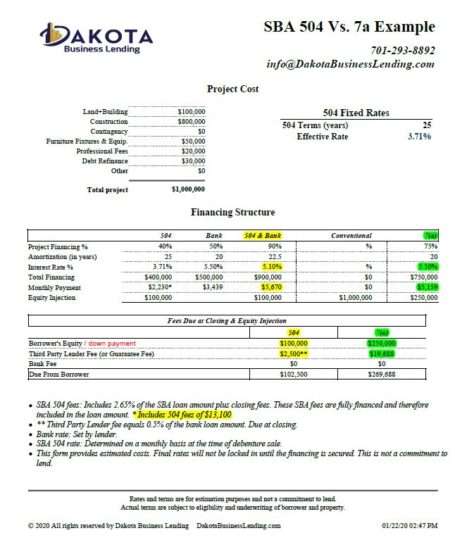

What Are The Differences Between An Sba 504 And 7a Loans

An SBA 504 loan is commercial real estate financing for owner-occupied properties. These loans require only a 10 percent down payment by the small business owner and funding amounts range from $125,000 to $20 million.

On the other hand, SBA 7a loans can be used to buy a business or obtain working capital. The maximum loan for an SBA 7a loan amount is $5 million.

A 504 loans interest rate is fixed, and no outside collateral is required. Also, fees are lower compared to a 7a loan.

Currently, 504 loans are amortized over 20 years, and as of April 2018 they began accepting applications for 25-year term SBA 504 loans.

The interest rate on a 7a loan, however, can be adjustable and tied to the prime interest rate. Collateral is required, at 90 percent. These loans are amortized over 25 years.

Heres some history and more specifics on each program: The SBA 504 loan program was designed for small businesses to finance commercial real estate or large equipment for use in business operations.

The 7a loan program was originally designed for higher-risk loans for things like the acquisition or starting of a business, working capital, or furniture and fixtures and leasehold improvements.

You May Like: Who Can Qualify For An Fha Loan

Sba Business Expansion Loans

The disaster-related loans referenced above are made with funds appropriated or guaranteed by Congress. SBA business expansion loans are commercial loans, structured according to SBA requirements, with an SBA guarantee. Small business owners and borrowers who have access to other financing with reasonable terms are not eligible for this type of SBA-guaranteed loan. Guaranteed loan programs from the SBA include the following:

Get The Documentation Together

There is an incredible amount of documentation involved in the SBA loan process. A full list can be found here. Typical documentation will include things like:

- A solid business plan

- Articles of incorporation and bylaws

- A business certificate or license

- A business credit report

- A current business profit and loss statement

- Projected financial statements

- Personal financial statements for those who own 20 percent or more of the business

- A written valuation for any asset used as collateral to secure the loan

Recommended Reading: How To Get 150k Business Loan

Get Sba 7 Loan Faster

SBA is a terminology of business loans that are often granted by the SBA and the lender to business owners for their existing business and startups. 7a loans one of the most advanced and fast ways to get finance for your enterprise.

All SBA 7 loans are approved by the federal government as they guarantee 80% of the loan and the lenders hold the difference. This characteristic allows traditional lenders to provide different kinds of small business loans on easy installments and flexible terms. These loans are one of the best ways for giving a head start to your business.

In 2020 SBA loans term 7 has become one of the most popular types of small business financing in SBA business line of credits. There are some strict criteria and lots of paperwork involved in the proceedings of these SBA 7 loans but still, they are one of the smartest choices for your business loan.

If you want your business to get that initial financial boom SBA programs are perfect because of their low-interest rates and flexible conditions. So, if you have the opportunity then go for SBA 7 loans. Unfortunately, if you are not qualified for SBA loans then there are many other fast ways to borrow money for your business like online small business loans.

How To Apply For An Sba 7a Loan

SBA 7a loans are available through banks and lenders throughout the U.S.

There are lenders who specialize in smaller loans for working capital, equipment and startup and there are lenders who specialize in real estate and other larger business transactions.; If you need a small loan for a startup , your best bet is usually a small local bank that offers SBA financing as it is probably better to sit down face to face with a lender for that type of transaction.; Also, many SBA lenders are not interested in smaller loans as lenders are more interested in financing established businesses with historical cash flow as there is less risk of default and a higher level of profit for the lender.

You will find the most variety of lenders and the best possible terms for loans between $350K and $5 million as that is the typical range of loan size for the most experienced SBA lenders.; Most loans in this size range are provided by banks who truly specialize in SBA lending.

For smaller loans there are some streamlined programs that are generally very credit score driven and quicker to process.

Read Also: What Is The Role Of Co Applicant In Home Loan