What Is A Down Payment

When you get a mortgage to finance a house, the down payment is a percentage of the purchase price the borrower must come up with. FHA finances up to 96.5% of the purchase price. The remaining 3.5% will come from the borrower in the form of a down payment.

For example, if a buyer agrees to purchase a home for $200,000, the down payment is $7,000. The remaining $193,000 will be financed.

Requirements For Fha Loan

To qualify for an FHA loan, borrowers must meet a number of standards, including:

- The home youre thinking about buying has to be evaluated by an FHA-approved appraiser.

- You can only acquire a new FHA loan if the home you want to buy is going to be your primary residence, not an investment property or a second home.

- Within 60 days of closing, you must move into the property.

- An inspection must be performed, and the results must indicate whether the property fulfils minimal property requirements.

A down payment, mortgage insurance, credit score, loan limits, and income criteria are among the other requirements to qualify. For the most part, DACA recipients must meet the same FHA requirements to qualify for a mortgage. Well go over each of these points in further detail further down.

In Which Scenarios Is The Fha $100 Down Mortgage Useful

Though fairly limited in its scope, this program can create big opportunities for those looking to become homeowners but without a lot saved for a down payment. Even when funds are available home buyers may opt to put a small amount down and reserve those savings as an emergency fund, for long term retirement or education savings, for another investment, or some other purpose.

Depending on market conditions there may not be a wide selection of HUD homes available in a certain area at any given time. Current listings can be viewed online at hudhomestore.com. Consumers hoping to take advantage of buying a property at a reduced price and the $100 Down option may want to search for new listings frequently or work with a real estate agent who specializes in HUD homes and foreclosed homes.

Don’t Miss: Does Fha Loan On Manufactured Homes

Checking And Savings Accounts

This is one of the most common sources for down payment funds among home buyers who use FHA loans. Its also an acceptable source. These are funds that come from a borrower-held account in a financial institution that allows for withdrawals and deposits, according to the handbook.

The mortgage lender must verify and document the existence of the checking and/or savings accounts, and the amount they hold. They typically do this by obtaining bank statements and related documents from the borrower.

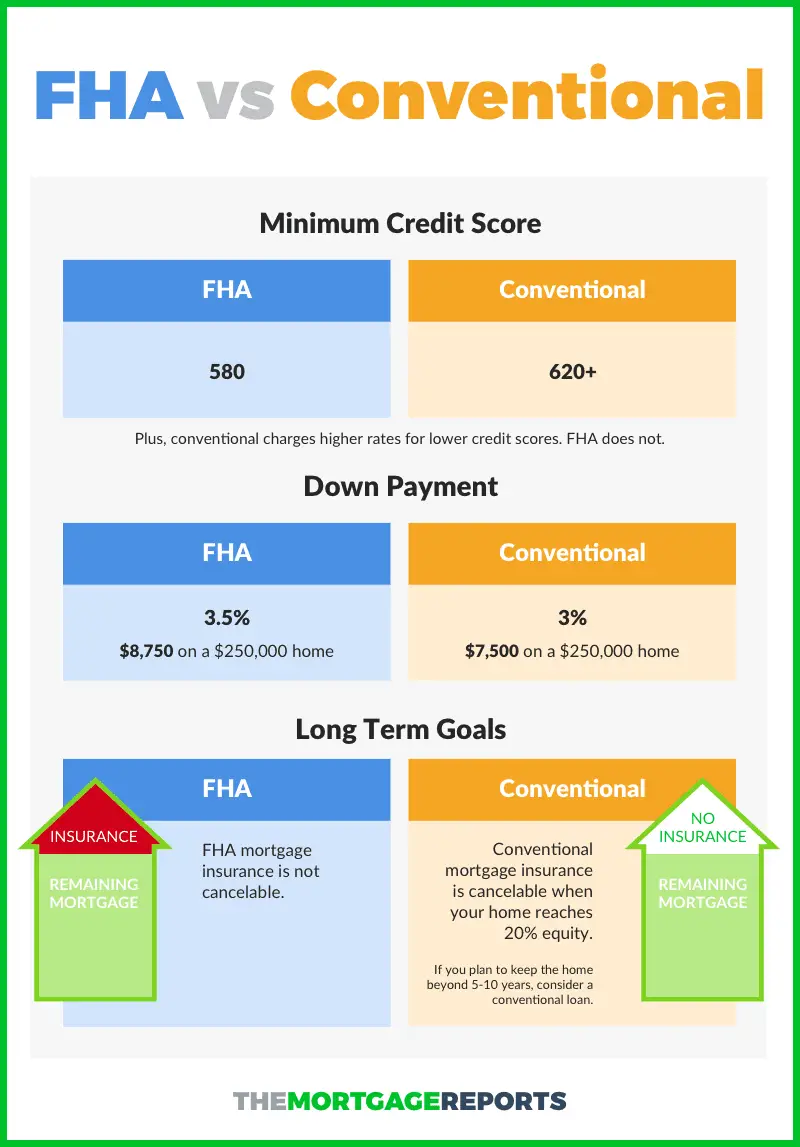

When A Conventional Loan Makes Sense

Each situation is flexible, but your qualifications or preferences should be close to these if you want to try for a conventional loan:

- Your credit score is at least 620.

- You have a down payment equal to at least 3%, or 20% if you want to avoid PMI.

- You have a low debt-to-income ratio, or DTI, which compares your monthly debt payments to your monthly gross income.

- You want flexible repayment terms.

Also Check: Can You Buy A Mobile Home With A Va Loan

What Is The Fha

The Federal Housing Administration better known as the FHA has been part of the U.S. Department of Housing and Urban Development since 1965. But the FHA actually began more than 30 years before that, as a component of the New Deal.

In addition to a stock market crash and the Dust Bowl drought, the Great Depression saw a housing market bubble burst. By early 1933, roughly half of American homeowners had defaulted on their mortgages.

The FHA was created as part of the National Housing Act of 1934 to stem the tide of foreclosures and help make homeownership more affordable. It established the 20% down payment as a new norm by insuring mortgages for up to 80% of a home’s value previously, homeowners had been limited to borrowing 50%-60%.

Today, the FHA insures loans for about 8 million single-family homes.

» MORE: Facts about FHA home loans

How Much Home Can I Afford

The answer to the question of How much home can I afford? is a personal one, and should not be left solely to your mortgage lender.

The best way to answer the question of how much can you afford for a home is to start with your monthly budget and determine what you can comfortably pay for a home each month.

Then, using your desired payment as the starting point, use a mortgage calculator and work backward to find your maximum home purchase price.

Note that todays mortgage rates will affect your mortgage calculations, so be sure to use current mortgage rates in your estimate. When mortgage rates change, so does home affordability.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

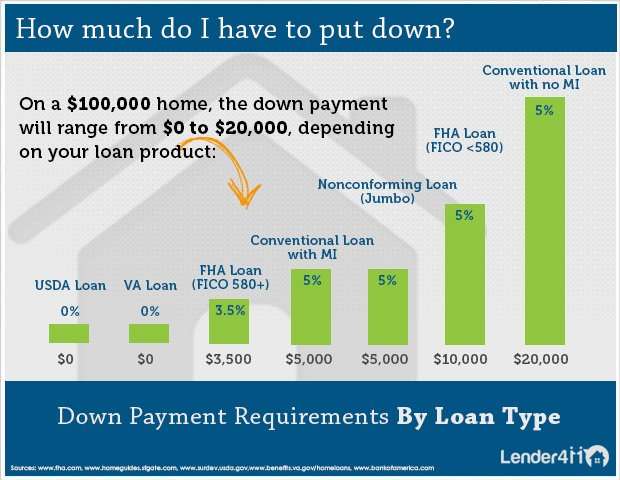

Fico Scores And Down Payment Requirements

First-time buyers want to know how much they’re expected to save for their FHA loan down payments. For those who qualify financially as new borrowers or return borrowers, the minimum FHA mortgage down payment is 3.5%. However, that low down payment option is not available for everyone.

Those who have marginal FICO scores are required to make a 10% down payment. According to FHA home loan minimum standards, those with FICO scores between 500 and 579 are required to come up with this higher down payment. Those with FICO scores at 580 or higher technically qualify for the lowest down payment offered.

It’s best to start saving early for your down payment and to anticipate how much that payment might be. You’ll need to estimate the price range for the home you want to buy and calculate either the 3.5% or 10% down payment using that potential sales price as your guide.

Gifts From An Approved Donor

Within the context of FHA down payments, a gift is when an approved donor contributes cash or equity with no expectation of repayment. This is an acceptable source of down payment funds for borrowers using an FHA loan.

Its also fairly common. According to the government-sponsored mortgage buyer Freddie Mac, about 25% of home buyers use a gift or loan from family and friends.

While gift money can be an acceptable down payment source for FHA loans, HUD has some specific rules and requirements for them. Weve covered gift money in a separate article. Heres the short version:

The person or organization that provides the gift money must also provide a letter stating that they do not expect repayment. In other words, the money must truly be a gift not a personal loan.

Disclaimers: This article provides an overview of some of the most commonly used down payment sources for FHA-insured mortgages. This information was adapted from HUD Handbook 4000.1 in June 2019. The funding sources listed above are acceptable in most borrowing scenarios, as long as all verification and documentation requirements have been met. In addition to those listed above, there may be other down payment sources that are acceptable within this program. Borrowers who wish to learn more can refer to the aforementioned handbook or speak to an FHA-approved lender.

You May Like: How Long For Sba Loan Approval

What Is An Fha Loan Down Payment

What is an FHA loan down payment? Most people in the house-hunting process are familiar or will become familiar with down payments-the money required from the borrower upfront which is paid against the principal of the loan.

Theres a long-standing notion about the nature of down payments if a borrower invests a large amount of money upfront, they have a bigger stake in making on-time payments and remaining in good standing on the mortgage loan. But that idea isnt addressed in the FHA loan rulebook. What is discussed is the nature of the minimum required cash investment or the down payment on an FHA mortgage.

All FHA loans for new purchases will require a minimum FHA loan down payment of 3.5% of the adjusted value of the home. Naturally, the actual amount you pay upfront can vary but one thing thats important to remember is that the borrower is free to make a larger down payment.

In some cases where credit score issues are present, a larger FHA loan down payment may be required as a condition of loan approval. FHA loan standards require a 10% down payment when the borrowers FICO scores are between 500 and 579. Lender standards may also apply above and beyond this minimum.

Down payment money cant come from anyone who has a financial stake in the outcome of the transaction. So there can be no assistance from the seller, lender, etc. FHA loan rules state that the down payment money you provide must be verified by the lender regardless of the source.

Kate: A Conventional Loan Is The Easy Choice

Kate has a very high credit score. She wants to buy a home and has saved enough to make a down payment of 20%. Kate has decided to settle in Beverly Hills, her dream home is a bit pricey so she will need a large loan. A Conventional loan is likely the right choice for Kate.

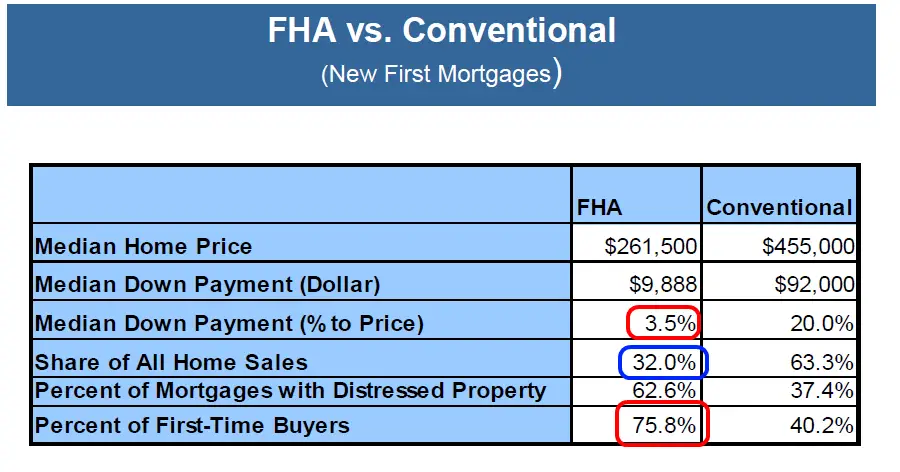

A conventional loan, or conventional mortgage, is not backed by any government body like the FHA, the US Department of Veterans Affairs , or the USDA Rural Housing Service.

Roughly two-thirds of US homeowners loans are conventional mortgages, while nearly three in four new home sales were secured by conventional loans in the first quarter of 2018, according to Investopedia.

Sometimes conventional loans are mistakenly referred to as conforming mortgages, which is a separate type of loan which meets the same criteria for funding from Fannie Mae and Freddie Mac, but although conforming loans are technically conventional loans, the reverse is not always true. For example, an $800,000 jumbo mortgage is a conventional mortgage, since it does not qualify as a conforming mortgage because it exceeds the maximum loan amount Fannie Mae and Freddie Mac guidelines will permit.

You May Like: Can You Use A Va Loan To Buy Land And A Manufactured Home

What Is The Minimum Down Payment For A House

A down payment is the amount of money you contribute towards the purchase of a home upfront. Think of it as the amount you initially put up as your share of ownership. The higher your down payment, the less youre asking to borrow and the lower your monthly payments will be.

Lenders require a down payment for most types of home loans, but there are exceptions. Here are the minimum down payment requirements for various types of mortgages:

| Loan type | |

| USDA loan | None required |

Conventional loans follow guidelines set by Fannie Mae and Freddie Mac, but lenders can have their own requirements above those standards, as well. There are conventional loan options that require a down payment of as little as 3 percent, but many lenders impose a 5 percent minimum. If the loan is for a vacation home or a multifamily property, you could be required to put down more, generally 10 percent and 15 percent, respectively.

Jumbo loans, which exceed the loan limits set by Fannie Mae and Freddie Mac, tend to require a higher down payment than other kinds of mortgages. The minimum is usually determined by the individual lender, but it can be 20 percent, 25 percent, 30 percent or more.

FHA loans, backed by the Federal Housing Administration, are available for as little as 3.5 percent down if the borrower has a credit score of at least 580. If the borrower has a lower score , the minimum down payment is 10 percent.

Flat Branch Processes And Underwrites Your Fha Loan

Flat Branch Home Loans is a Full Eagle FHA lender. Our status with the U.S. Department of Housing and Urban Development allows Flat Branch to underwrite FHA mortgages on behalf of HUD. This means your FHA loan will be processed and underwritten by the friendly Flat Branch Home Loans staff.

Flat Branch makes FHA mortgages easy while saving you money!

The Mortgage App ThatPuts You In Control

Recommended Reading: What Is An Rv Loan

Is Conventional Better Than Fha

FHA loans allow lower credit scores than conventional mortgages do, and are easier to qualify for. Conventional loans allow slightly lower down payments. FHA loans are insured by the Federal Housing Administration, and conventional mortgages arent insured by a federal agency.

Was this information helpful?

Summary Zero Down Fha Loan

These are proven methods to get a zero down FHA loan, or purchase a home with an FHA loan without using any of your own funds. You will likely still need a few months reserves to cover your first mortgage payments. Even those can be covered by the gift funds that you receive from a relative.

If you would like to discuss your options or even get an FHA rate quote, then for a free consultation.

Also Check: Mortgage Loan Officer Salary Plus Commission

Fha Energy Efficient Mortgage

This program is a similar concept to the FHA 203 Improvement Loan program, but its aimed at upgrades that can lower your utility bills, such as new insulation or the installation of new solar or wind energy systems. The idea is that energy-efficient homes have lower operating costs, which lower bills and make more income available for mortgage payments.

Can You Get A No Down Payment Fha Loan

You might see information about “no down payment” FHA loans on websites. What these websites generally mean is that it is possible to get help finding the money for your down payment. For example, the Federal Housing Administration allows you to use a gift from a family member to make your FHA loan down payment.

Many states also have FHA loan down payment assistance programs. Visit theU.S. Department of Housing and Urban Development website to see what assistance may be available in your state. Youll find links to various programs such as housing counselor agencies who can provide advice on topics such as buying, foreclosures, credit issues and more.

In addition, there are state-specific homeownership assistance programs such as Habitat for Humanity, educational programs to learn about buying and maintaining your home, community resources, and homeownership voucher programs that provides down payment assistance if you qualify.

Also Check: Mysofi

Downsides Of Fha Loans

- Mortgage insurance can be costly. You may pay a price for making a small down payment. Youll have to pay a one-time upfront mortgage insurance premium, as well as an annual premium thats collected in monthly installments. The one-time premium is generally equal to 1.75% of the home purchase price and can be financed in the mortgage or paid for in cash but not a combination. The annual premium depends on your loan amount and loan-to-value ratio.

- Theres a limit to how much you can borrow. The FHA establishes loan limits based on median home prices in metro areas and counties. As of July 2020, the FHA maximum for a single-family home in a low-cost area is $331,760 while its $765,600 in a high-cost area. Alaska, Hawaii, Guam and the Virgin Islands are exceptions with a maximum of $1,148,400 for a single-family unit. These loan limits change periodically, so be sure to check for updated information. The Department of Housing and Urban Development has a search tool on its website to identify mortgage limits by county and state, so you can find out how much youre able to borrow where you live.

- Good credit? Consider other options. If you have strong credit and dont have enough money for a large down payment, you still might want to consider other options because of FHA loans mortgage premiums. Just keep in mind that if you dont put at least 20% down, youll likely have to pay private mortgage insurance, or PMI.

Conventional Loan Mortgage Insurance

If you dont put at least 20% down for a down payment, youre required to pay for private mortgage insurance , which can come in several forms:

- The most common is that you pay a monthly premium, which is an annual rate divided by 12.

- A single premium policy is another option, which involves an upfront payment.

- A split premium is an upfront payment as well as a monthly premium, and ideally, a seller will pay the upfront premium.

- Lender-paid PMI is also another option, in which the lender purchases the insurance and you pay it back at a higher interest rate. You cannot cancel lender-paid PMI.

Read Also: Drb Refinance Review

Why You Should Choose An Fha Loan With No Money Down

If youre a first-time homebuyer who doesnt want to wait to save, this loan may be a great option for you. There are many benefits to owning a home like building equity, having the freedom to make creative changes in your house and backyard and providing a place for your family to make memories for years to come. Without the obstacle of saving up for a down payment, start your journey to homeownership now. Were here to help you make the right decision on a loan that fits your life. Lets talk!

All loans subject to underwriter approval terms and conditions may apply. Subject to change without notice. Always consult an accountant or tax advisor for full eligibility requirements on tax deduction.

| Interested in learning more? Take the first steps with our pre-qualification calculator. |

Seller Assist And Other Sources To Help Cover Closing Costs

You have several sources of assistance with covering the closing costs. You may get seller assist, which has the seller pay your closing costs in return for you paying an equivalent amount on the homes price.

If you have friends or family members who will gift you the down payment, you can use that to help with the FHA closing costs. You must have documentation showing the money was a gift without you intending to repay it. Account information from you and the giver also will prove the money came from the giver.

Some lenders also help you cover closing costs by offering higher home loan rates. Depending on how quickly you can pay off the home loan, you may benefit from these. Talk to your lender about your personal situation to see if this option will work for you.

resources

Read Also: What Credit Score Is Needed For Usaa Auto Loan