Factors That Can Affect Commercial Real Estate Loan Rates

Just like business loan interest rates on other types of financing, commercial real estate loan rates fluctuate according to multiple factors.

In general, commercial real estate loan interest rates are lower than interest rates on unsecured business loans because the real estate serves as collateral for the loan. However, thereâs still a big variance in the rates that borrowers pay.

These are the main factors that affect commercial real estate loan rates:

Get Todays Best Mortgage Rate

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

RBC is one of Canada’s biggest banks and has a strong offering of mortgage products. While RBC certainly offers rates that are competitive among the big banks, we strongly recommend you compare mortgage rates from multiple lenders before deciding on a provider.

To see if an RBC mortgage is right for you, read on to learn about their products.

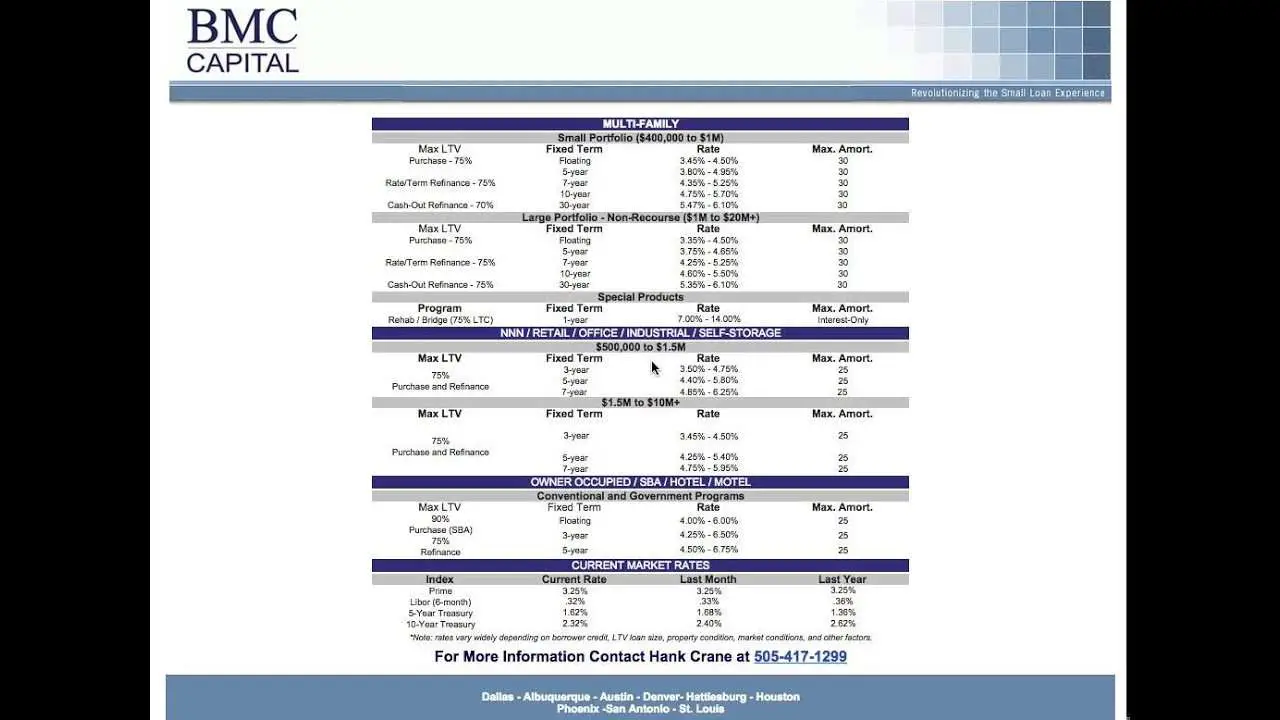

Common Sources Of Commercial Mortgage Financing

There are many sources of commercial financing in the market. Commercial loans are offered by banks, credit unions, insurance companies, and government-backed lenders. Private investors also lend commercial mortgages but at much higher rates.

The right kind of commercial loan for your business depends on the loan features you need. You must also factor in your business strategy, the type of commercial property, and your credit availability.

Below are several common types of commercial loans and where you can obtain them:

Don’t Miss: Can You Pay Off Your Car Loan Early

Navs Verdict: Commercial Real Estate Loan Rates

Keep in mind that loan rates are based on market rates, and therefore they can change frequently, though commercial real estate rates typically dont fluctuate dramatically. In addition, the loan rate you receive will also depend on your business finances, personal creditworthiness, and the property for which they will be used.

If you are an investor looking for a commercial mortgage for a residential property or a commercial construction loan, or you are a business owner looking to purchase property to build equity, spend time finding the best loan option to ensure you save as much as possible in interest.

This article was originally written on June 19, 2019 and updated on March 11, 2021.

What Is The Average Down Payment On Commercial Property

The majority of commercial property loans will require a down payment, but how much that down payment amounts to will vary. Generally, conventional commercial loans and SBA 7 loans will require borrowers to make a down payment of 15% to 25%. In this case, a $200,000 commercial real estate loan will require a down payment between $30,000 and $50,000.

However, in some lending options, specifically SBA 504 loans, borrowers can take advantage of a 10% down payment requirement. In this case, that same $200,000 loan would only require a down payment of $20,000.

Read Also: Where To Refinance Auto Loan

Commercial Loans And Lines Of Credit In Pennsylvania

As a locally-based community bank, were committed to funding projects of all scopes and sizes within Pennsylvania through our commercial loans and lines of credit.

Mid Penn Bank offers commercial loans for a variety of purposes, including business expansion or acquisition, working capital, equipment and more. And since we are a local, independent community bank, decisions are made locally and quickly to better serve you and your business.

- Commercial loan If you are opening the doors to a new business or considering the expansion of a current business, a commercial loan from Mid Penn Bank will help you pay for inventory, leasing, property, and more. Contact us to find out what financing options you have.

- Commercial Line of Credit A pre-approved commercial line of credit offers you a flexible, revolving type of credit. You can borrow money up to your credit limit as often as you like and for a variety of purposes. Lines of credit are approved for a 12-month period and are reviewed for renewal each subsequent 12 months. Find out more about our commercial lines of credit today.

- Letters of credit In the course of business, a customer may be required to give an assurance to a supplier or other party for a particular transaction. Mid Penn Bank can issue a letter of credit, which on behalf of the customer, authorizes the entity receiving the letter to draw on a specified sum within a certain period of time. Learn more about letters of credit by contacting us today.

Sba Cdc/504 Loan Rates

The SBA CDC/504 loan program is for loans that are used to finance fixed assets such as land, real estate, and machinery. To offer these loans, the SBA works with Community Development Companies and other financial partners. The project is typically funded 40% by the CDC, 50% by a financial partner , and 10% by your business. If your business is new or youre funding a special property, you might have to pay a larger percentage of the cost.

While borrowers can use a general 7 loan to finance fixed assets, CDC/504 borrowers benefit from low, fixed, interest rates and larger possible borrowing amounts.

Don’t Miss: What Is An Sba 504 Loan

Determine Your Commercial Mortgage Payments

Not sure how much money youd be paying out every month on a commercial real estate loan? Forecast your payments quickly and easily with this commercial mortgage calculator.

Browse hundreds of loan options, custom-tailored to your business and budget needs, from a single, simple platform.

We Understand Different Businesses Have Differing Financial Needs

CMLS provides lending solutions to real estate owners, developers and related real estate services for some of Canadas most prominent financial institutions, insurance companies, investment managers and others. Whether youre developing property or investing in commercial space, our Canadian commercial real estate mortgage market experts will help you determine the best financing solution for your needs based on recent market updates. We are also Canadas only dedicated provider of commercial mortgage market intelligence, and publish our Commercial Mortgage Commentary on a quarterly basis.

Also Check: What Is Refinance Home Loan

Getting Some Of The Best Commercial Loan Interest Rates

Choosing a lender dedicated to helping businesses grow and succeed is an effective method to receive some of the best commercial loan interest rates. First Bank* has a history helping business owners manage their funds and grow their businesses. That is why we offer a variety of commercial loan** products with highly competitive interest rates.

- Mastercard Business Card with Rewards with low rates, no annual fee, and rewards.

- Loans that provide business owners with lump sums for long-term financing.

- Commercial mortgage products that can be customized to meet your needs.

- Lines of credit that provide business owners with the flexibility to access cash quickly.

- Construction loans for new construction, remodeling, expansion, and other building projects.

Interest rates on each of our commercial loan products vary, but we will work with you to find a loan that meets the needs of your business and provide you with great interest rates. Getting the help you need is simple. Visit a First Bank branch near you to discuss your options for business loans.

If you need a commercial loan but arent sure where to begin, our online Financial Education Center offers tips, tricks, and resources for business owners on staring, managing, and growing a business.

*Member FDIC. Equal Housing Lender. NMLS #474504.**Loans subject to credit approval.

Loan Amount And Term Length

The loan amount and term will also have an effect on your commercial real estate loan rates. In most cases, short-term hard money loans will have higher interest rates because these lenders work with riskier borrowers. However, youâll pay more in total interest on a long-term loan, even if your interest rate is lower.

Don’t Miss: Where To Apply For Student Loan Forgiveness

Commercial Mortgage Rates In Canada

Compare commercial mortgage rates below provided by over 30 commercial mortgage banks and lenders across Canada. Commercial mortgage rates can vary greatly depending on the risk assessment of each individual property, the borrower and the business plan and financials.

- Lowest Commercial Mortgage Rates in Canada

- Access to over 30 Commercial Banks and Lenders

- Purchasing, Refinancing, Bridge, Private Funds and Renewals

- Multi-Family, Retail, Office, Industrial, Development and Construction

- Fixed Rate, Variable Rate and Interest Only Commercial Mortgages

What Types Of Properties Qualify For A Commercial Loan

Most property types that can be used to generate income can qualify for a commercial mortgage loan. That includes hotels, motels, apartments, office buildings, industrial spaces, warehouses, self-storage facilities, retail centers, condo complexes, and other multifamily real estate acquisitions. If you have questions about your specific property qualifies for a commercial real estate loan, contact Clopton Capital today and well be happy to help.

Also Check: How Are Student Loan Rates Determined

Borrowing For Commercial Real Estate Is Different From A Home Loan

Commercial real estate is income-producing property used solely for business purposes. Examples include retail malls, shopping centers, office buildings and complexes, and hotels. Financingincluding the acquisition, development and construction of these propertiesis typically accomplished through commercial real estate loans: mortgages secured by liens on the commercial property.

Commercial Loan Repayment Example

To understand how commercial payments work, lets review this example. Lets presume your commercial real estate loan is $2.5 million with 9 percent APR, with a loan term of 10 years. Lets use the calculator on top of this page to estimate your monthly payment, interest-only payment, and total balloon payment.

- Commercial loan amount: $2,500,000

| Balloon payment | $2,240,215.07 |

According to the results, your monthly commercial mortgage payment will be $20,155.80 for 10 years. If you choose to make interest-only payments, it will only be $18,787.00 per month. Once the 10 years is up, you must make a balloon payment of $2,240,215.07 to pay off your remaining balance.

What If You Cant Make the Balloon Payment?

Sometimes, you might not be able to make a balloon payment on your commercial mortgage. If youre worried about lack of funds, refinance before the end of the term. Start asking about refinancing at least a year before the term ends. This will save you from foreclosure and losing your lenders trust. If you default on your loan, it spells bad news for your credit history, making it difficult to get approved for future commercial loans.

Don’t Miss: What Do You Need For Va Loan

Sba Loans For Commercial Real Estate

Maximum Rates: 504 loans: 3.67% to 3.98% and 7A loans: 7.50% to 10.00%

With maximum rates in the range of 3.67% to 10.00%, SBA loans are often the least expensive way to fund the purchase of commercial real estate. The Small Business Administration guarantees repayment of a portion of the loan, which lowers the risk of making the loan for the lender and increases the favorability of the terms for the borrower.

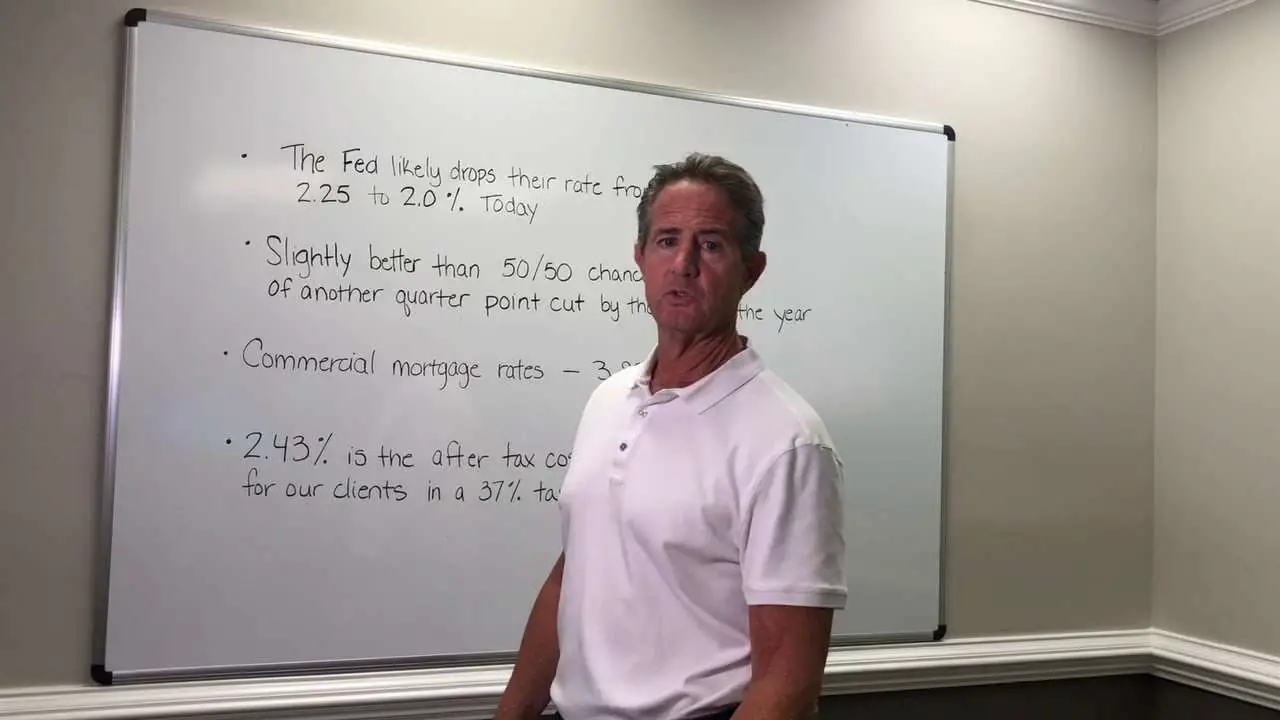

In general, its easier to get an SBA 7a loan for commercial real estate. The 7a loan program is the SBAs most popular loan program, and its quicker and easier to obtain a 7a loan, especially for smaller loan sizes. That being said, 7a loans have slightly higher rates than 504 loans. Rates start at a variable 7.50% and are tied to the Prime Rate.

SBA 504 loans are a better option for loan sizes over $1,000,000. These loans come in three parts: 50% of the loan is from a bank, 40 % is from an SBA-approved Certified Development Company, and 10 % is the borrowers down payment. The rates on the CDC portion of the loan are in the 3-4 % range and are fixed rate. The rates on the bank portion are in the 5-6 % range and may be fixed or variable. Our recommended SBA 504 lender it Liberty SBF. If youve been in business 4+ years, are profitable, and looking to borrow $1,000,000+, set up a time to speak to a Liberty SBF loan officer today.

Small Business Loans & Lines Of Credit

Every business has different financing needs. A line of credit is a flexible and convenient borrowing option that offers the financing you need, up to an approved limit, when you need it without having to reapply.

Our lines of credit are perfect for covering day-to-day operating costs or pursuing a unique and time-sensitive business opportunity. A loan, on the other hand, is best suited for one-time, larger expenses. Our small business and commercial loans come with a range of terms and payment options that give you the flexibility to successfully manage your business, and your money.

Also Check: How Much Does My Loan Cost

Important Disclosures And Information

Small Business Administration collateral and documentation requirements are subject to SBA guidelines.

You must be 18 years old or otherwise have the ability to legally contract for automotive financing in your state of residence, and either a U.S. citizen or resident alien .

Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation.

Commercial Real Estate products are subject to product availability and subject to change. Actual loan terms, loan to value requirements, and documentation requirements are subject to product criteria and credit approval. For Owner-Occupied Commercial Real Estate loans , a loan term of up to 15 years and owner occupancy of 51% or more are required. Small Business Administration financing is subject to approval through the SBA 504 and SBA 7 programs. Subject to credit approval. Some restrictions may apply.

Small Business Administration financing is subject to approval through the SBA 504 and SBA 7 programs. Loan terms, collateral and documentation requirements apply. Actual amortization, rate and extension of credit are subject to necessary credit approval. Bank of America credit standards and documentation requirements apply. Some restrictions may apply.

Choosing The Right Commercial Real Estate Loan

If youre thinking about purchasing or renovating an income-earning property or one to run your business from, one of the first steps youll need to take is to determine which lending option is best suited for your needs.

For many, this decision comes down to traditional small business loans from financial institutions such as a bank or credit union vs. SBA-specific loans. There are, however, other commercial real estate loan options that you may want to consider, including commercial bridge loans, hard money loans, and construction loans.

Today, well take a quick look at some of the most popular commercial lending options, starting with one of the most popular and often most affordable commercial real estate loans the SBA 504 loan.

Don’t Miss: How To Get Personal Loan With Low Interest

How Sba 7 Rates & Fees Are Determined

The lender sets your interest rate, but the SBA ensures that there is a maximum interest rate they can charge. The rate is determined by a base rate plus a small markup. Usually, the base rate is the Wall Street Journal prime rate, but lenders could use any of these base rates:

- Prime Rate: The lowest rate banks set for lending. The most commonly used prime rate is published by the Wall Street Journal.

- One Month LIBOR + 3% Rate Adjustment: The London Inter-bank Offered Rate, a rate used for inter-bank lending in London.

- SBA Optional Peg Rate: A metric which the SBA defines as a weighted average of rates the federal government pays for loans with maturities similar to the average SBA loan.

The base rate is added to a small markup to determine the maximum interest rate. Here are the markups for most 7 loans:

| Loan Amount |

|---|

| Source: The Small Business Administration |

For SBA Express and SBA Export Express loans, the markups are base rate + 6.5% for loans of $50,000 or below, and base rate + 4.5% for loans above $50,000.

General 7 loans rates can be fixed, but usually they have a variable interest rate. If you have a variable rate, your interest rate will rise or fall when the base rate changes.

In addition to the interest rate, the SBA might charge a one-time guarantee fee or a portion of your loan. The fee is based on the loan amount:

The SBA also charges a small prepayment penalty if you repay in the first three years of a loan with a term length of 15 years or longer.

What Determines Commercial Leveraging Finality

The posted mortgage loan rates are very important guidelines. However, one should not interpret these rates as an offer to loan.

Why? The simple answer to this question is that fixed rates and variable rates are hugely deviating items. In other words: they depend on several factors.

Here are some of the several factors that determine the commercial mortgage rates:

- Bank or credit union

- repayment option

- loan term option.

Further, an underlying assumption of all rates as provided is application to a commercial mortgage at 75% LTV. Naturally, lower LTV generally demands lower commercial mortgage rates.

Bottom line: The index rates are dynamic and rely on several factors. You need a professional broker to guide you for commercial real estate loans.

Once again: Our tables reflecting current index rates and spreads apply for today as we see them and they should be regarded strictly as a guideline. We will cover more about why you need a professional broker as a guide for commercial real estate loans in the rest of this article.

You May Like: How To Calculate Vehicle Loan Payment

Debt Service Coverage Ratio

DSCR estimates your companys available cash flow. This is essentially the money that pays for your companys current debt obligations. DSCR is calculated by dividing the annual total debt service with your annual net operating income . The total annual debt service is the amount borrowers use to pay the principal and interest of a commercial mortgage.

Preferred DSCR for Commercial Loans

A good DSCR range for companies is between 1.15-1.35. Most commercial lenders require a DSCR of 1.25 for approval.