Combine The Two Strategies

Consider refinancing to get a lower rate, but not a shorter-loan term. Then, apply what you save in interest payments and any extra payments you can afford to paying off your principal by making extra payments each month. Interest rates need to be lower when you refinance than they were when you got the loan, or refinancing is a bad option. It’s hard to predict when to refinance, since the market is constantly changing, but a financial planner and refinance calculators will be able to help you choose the right time to refinance.

When done right, this reduces your interest payments in several ways. First, your interest rate is lower to begin with. Then, you pay off your principal faster, which means you end up paying less in interest. Also, you aren’t strapped into a higher monthly payment, so if your finances change or if you got used to a certain monthly payment, you won’t be stuck paying hundreds of dollars more for a shorter loan period.

Take advantage of loan amortization and get your loan paid off sooner. You have several options for paying off your loan faster than scheduled, so consider which is right for you and start planning. Ultimately, the faster you pay off your loan, the less you’ll end up paying in interest, so accelerating repayment is a good financial strategy.

Calculating The Rate Per Period

When the number of compounding periods matches the number of payment periods, the rate per period is easy to calculate. Like the above example, it is just the nominal annual rate divided by the periods per year. However, what do you do if you have a Canadian mortage and the compounding period is semi-annual, but you are making monthly payments? In that case, you can use the following formula, derived from the compound interest formula.

- r = rate per payment period

- i = nominal annual interest rate

- n = number of compounding periods per year

- p = number of payment periods per year

Example: If the nominal annual interest rate is i = 7.5%, and the interest is compounded semi-annually , and payments are made monthly , then the rate per period will be r = 0.6155%.

Important: If the compound period is shorter than the payment period, using this formula results in negative amortization . See my article, “negative amortization” for more information.

If you are trying to solve for the annual interest rate, a little algebra gives:

Example: Using the RATE formula in Excel, the rate per period for a Canadian mortgage of $100,000 with a monthly payment of $584.45 amortized over 25 years is 0.41647% calculated using r=RATE. The annual rate is calculated to be 5.05% using the formula i=2*^-1).

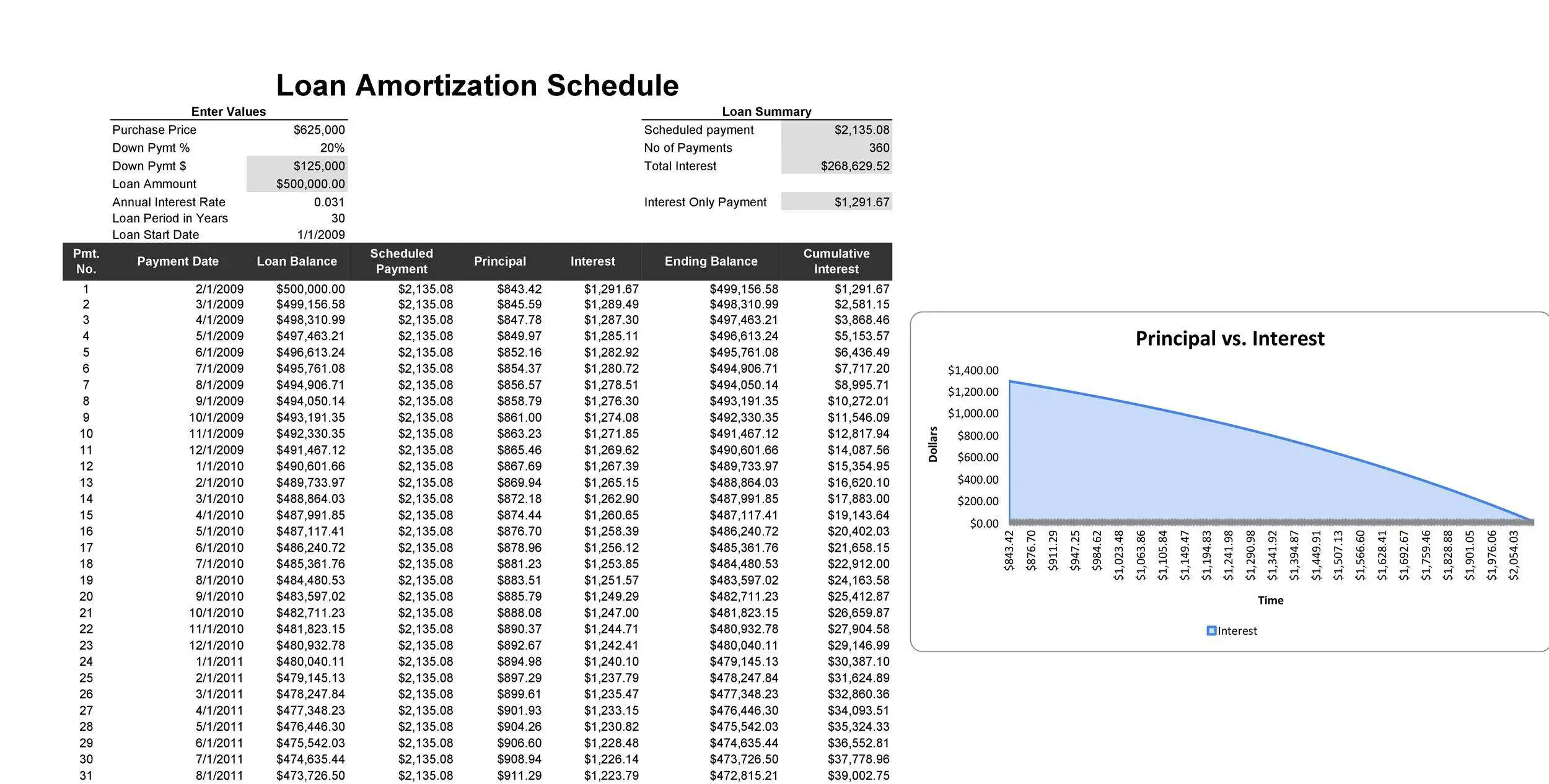

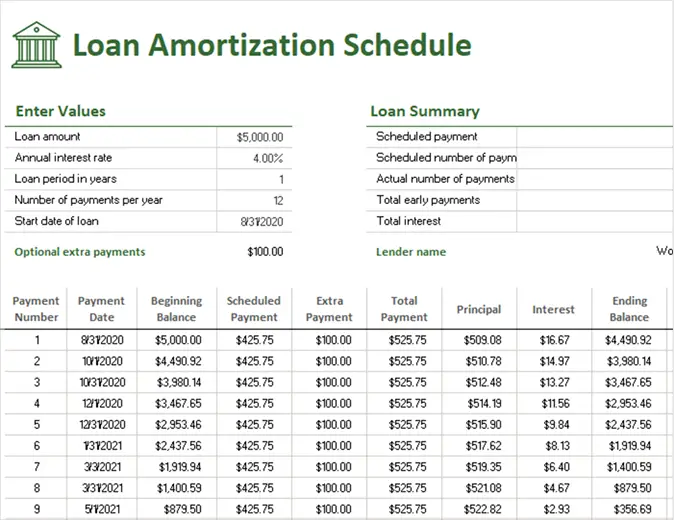

Understanding An Amortization Schedule

In an amortization schedule, the percentage of each payment that goes toward interest diminishes a bit with each payment and the percentage that goes toward principal increases. Take, for example, an amortization schedule for a $250,000, 30-year fixed-rate mortgage with a 4.5% interest rate. The first few lines look like this:

| Month | |

| $249,340.34 | $249,008.65 |

If you are looking to take out a loan, besides using an amortization schedule, you also can use a mortgage calculator to estimate your total mortgage costs based on your specific loan.

You May Like: How Much House Can I Afford Physician Loan

Calculate A Scheduled Payment

Apart from the input cells, one more predefined cell is required for our further calculations – the scheduled payment amount, i.e. the amount to be paid on a loan if no extra payments are made. This amount is calculated with the following formula:

=IFERROR, “”)

Please pay attention that we put a minus sign before the PMT function to have the result as a positive number. To prevent errors in case some of the input cells are empty, we enclose the PMT formula within the IFERROR function.

Enter this formula in some cell and name that cell ScheduledPayment.

Monthly Payment Loan Calculator

Enter the three known fields,then press the button next to the field to calculate. Loan Amount View schedule with year-end annual totals only.You’ll pay a total of $ over the life of this loan. To view the schedule, all input fields must contain a value. ©1995-

- Most loans in the United States compound interest monthly.

- Mortgage loans in Canada compound interest semi-annually.

FYI

- ; 3 years=; 36 months

EXAMPLES:

Recommended Reading: What To Do If Lender Rejects Your Loan Application

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

What Is An Amortized Loan

Your car loan is made up of two parts: the loans principal and its interest. The principal is the total amount you borrowed and promised to pay back. Interest is the amount you pay in exchange for borrowing the money. Together, the principal and interest make up your total loan balance.

As a responsible borrower, your monthly loan payments go toward paying down the loans total balance in a process called amortization. Amortization dictates how much of each payment goes toward either the principal or interest of your loan and how long itll take you to pay off your loan in full.

The result is an amortized loan, which means your loan will be paid off through a series of monthly installments over a specified length of time.

Read Also: What Are The Qualifications For Rural Development Loan

How Do I Refinance My Car Loan

Refinancing a car loan is essentially just taking out a new car loan so the steps for applying are mostly the same. You’ll need your driver’s license, Social Security number and proof of income, as well as details about your car. If approved, you’ll use the funds from your new loan to pay off your old car loan, then begin making monthly payments with your new interest rate and terms.

Whats The Difference Between New And Used Car Interest Rates

Loans for newer cars tend to have lower interest rates than those for used cars. Lenders see newer cars as less of a risk theyre less likely to break down, and lenders can identify exactly how much theyll depreciate over time. Newer cars have more predictable resale value down the line than newer cars, and that predictability results in a lower interest rate.

Recommended Reading: When Do Student Loan Payments Start After Graduation

How To Pay Off A Car Loan Early Using A Lump Sum Calculator

Dropping a huge sum on the principal balance is an excellent way to shorten the life of a car loan and cut spending on loan interest. You can use our auto loan early payment calculator to do this effectively. Crunching the numbers with this calculator will tell you exactly how much you’re saving in terms of time and money.

How fast can I pay off my car loan?

This is up to you. There is no limit to how fast you can clear your car loan. The quicker you pay it off, the less you will pay in the long run. This is because you will accrue less cost in terms of interest. However, to create a realistic budget and financial plan, you need to use an auto loan early payment calculator to guide you.

When will my car be paid off?

Judging by your current monthly payment and extra monthly payment, the time it will take to pay off the loan can be accurately computed using the auto loan early payment calculator.

How to determine the payoff amount on my car loan?

You can use the auto loan early payment calculator backward to find out how much you’ll be spending to pay off the car loan within a specific period. In doing so, you will arrive at the payoff you will need to pay every month over the life of the loan. You can pay extra payments to save on the loan interest.

What about car loan amortization calculators with extra payments?

What Is A Loan Amortization Schedule

A loan amortization schedule gives you the most basic information about your loan and how you’ll repay it. It typically includes a full list of all the payments that you’ll be required to make over the lifetime of the loan. Each payment on the schedule gets broken down according to the portion of the payment that goes toward interest and principal. You’ll typically also be given the remaining loan balance owed after making each monthly payment, so you’ll be able to see the way that your total debt will go down over the course of repaying the loan.

You’ll also typically get a summary of your loan repayment, either at the bottom of the amortization schedule or in a separate section. The summary will total up all the interest payments that you’ve paid over the course of the loan, while also verifying that the total of the principal payments adds up to the total outstanding amount of the loan.

Read Also: When Do I Pay Back Student Loan

How To Prepare Amortization Schedule In Excel

This article was written by Nicole Levine, MFA. Nicole Levine is a Technology Writer and Editor for wikiHow. She has more than 20 years of experience creating technical documentation and leading support teams at major web hosting and software companies. Nicole also holds an MFA in Creative Writing from Portland State University and teaches composition, fiction-writing, and zine-making at various institutions.The wikiHow Tech Team also followed the article’s instructions and verified that they work. This article has been viewed 1,109,785 times.

An amortization schedule shows the interest applied to a fixed interest loan and how the principal is reduced by payments. It also shows the detailed schedule of all payments so you can see how much is going toward principal and how much is being paid toward interest charges. This wikiHow teaches you how to create your own amortization schedule in Microsoft Excel.

Auto Loan Payment Calculator Results Explained

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results,;including the dollar amounts for the:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

You May Like: Can You Use Fha Loan If You Already Own House

Paying Off A Loan Over Time

When a borrower takes out a mortgage, car loan, or personal loan, they usually make monthly payments to the lender; these are some of the most common uses of amortization. A part of the payment covers the interest due on the loan, and the remainder of the payment goes toward reducing the principal amount owed. Interest is computed on the current amount owed and thus will become progressively smaller as the principal decreases. It is possible to see this in action on the amortization table.

Credit cards, on the other hand, are generally not amortized. They are an example of revolving debt, where the outstanding balance can be carried month-to-month, and the amount repaid each month can be varied. Please use our for more information or to do calculations involving credit cards, or our to schedule a financially feasible way to pay off multiple credit cards. Examples of other loans that aren’t amortized include interest-only loans and balloon loans. The former includes an interest-only period of payment, and the latter has a large principal payment at loan maturity.

Amortization Schedule

Basic amortization schedules do not account for extra payments, but this doesn’t mean that borrowers can’t pay extra towards their loans. Also, amortization schedules generally do not consider fees. Generally, amortization schedules only work for fixed-rate loans and not adjustable-rate mortgages, variable rate loans, or lines of credit.

How Is Interest Calculated On A Car Loan

An auto loan calculator shows the total amount of interest you’ll pay over the life of a loan. If the calculator offers an amortization schedule, you can see how much interest you’ll pay each month. With most car loans, part of each payment goes toward the principal , and part goes toward interest.

The interest you pay each month is based on the loan’s then-current balance. So, in the early days of the loan, when the balance is higher, you pay more interest. As you pay down the balance over time, the interest portion of the monthly payments gets smaller.

You can use the car loan calculator to determine how much interest you owe, or you can do it yourself if you’re up for a little math. Here’s the standard formula to calculate your monthly car loan interest by hand:

Also Check: How To Eliminate Student Loan Debt

Paying Off A Car Loan With Precomputed Interest

When you take out a loan with precomputed interest also called a precomputed loan interest is calculated at the time you take it out and must be paid in full.

This is all well and good if you never plan on making extra payments. In that situation, precomputed interest is treated more-or-less the same as simple interest, and will follow along the path reflected by your amortization schedule.

If you do plan or hope to make an extra payment on a loan with precomputed interest, your loans lender may apply the additional payment to the remaining interest of your loan and not the principal amount.

Even lenders who dont use precomputed interest may first apply portions of an extra payment to interest accrued since the last installment. If any money is left over, only then will it go toward the principal.

This gives you the opportunity to stay ahead of payments and make a slight dent in your loan balance, but youre still not getting as much bang for your buck.

Auto Loan Calculator Calculatestuffcom

How to Calculate Car Loan Payments · PMT = loan payment · PV = present value · i = period interest rate expressed as a decimal · n = number of;

Use this auto loan calculator to help you determine what your monthly car payment will be based on the net purchase price of the vehicle, the loan term,;

Use this calculator to help you determine your monthly car loan payment or your car purchase price. After you have entered your current information,;

You May Like: What Are Assets For Home Loan

What Are Other Important Car Ownership Costs To Consider

Beyond the cost of monthly car loan payments, car insurance can be a significant expense. Make sure you understand car insurance rates and the best car insurance companies available in order to select the best car insurance coverage for your needs.

Estimate your monthly payments with our handy Auto Loan Calculator.