How Loan Forgiveness Is Calculated

To calculate how much of your loan can be forgiven, your lender will use the responses from your application to:

Determine the maximum amount of possible loan forgiveness.

This is based on how much you spent on payroll and other eligible expenses like rent and utilities during the 24-week period.

Calculate the amount by which the maximum loan forgiveness will be reduced.

If you reduced your number of employees or their wages during the 24-week period, your loan forgiveness amount will be reduced.2

Understand how much of your loan was used on eligible expenses.

Only 40% of your PPP loan can be used for expenses other than payroll for certain business structures. If you used more than 40% on non-payroll expenses, your forgiveness amount will be reduced by the percentage of the loan you used on ineligible expenses.

When Must Payroll Be Paid And/or Incurred To Be Eligible For Forgiveness

Payroll costs are considered paid on the day that paychecks are distributed or the borrower originates an ACH credit transaction. Payroll costs incurred during the borrowers last pay period of the covered period are eligible for forgiveness if paid on or before the next regular payroll date; otherwise, payroll costs must be paid during the covered period to be eligible for forgiveness. Payroll costs generally are incurred on the day the employees pay is earned . For employees who are not performing work but are still on the borrowers payroll, payroll costs are incurred based on the schedule established by the borrower .;

Are Health Care And Retirement Benefits Paid By The Employer Eligible Costs For Loan Forgiveness

For employees

Health care and retirement benefits paid or incurred during the covered period are eligible for forgiveness as payroll costs. Expenses paid by employees for such benefits are not eligible for forgiveness. Expenses for future periods that are accelerated into the covered period are also not eligible for forgiveness.

For self-employed individuals and general partners

Employer health insurance contributions and employer retirement contributions made on behalf of self-employed individuals or general partners are not eligible expenses.

For owner-employees of S-corps

Employer health insurance contributions are not included for owners having at least a 2% stake of an S-corp. Employer retirement contributions made on behalf of an owner-employee of an S-corp are eligible and do not count toward the cash compensation cap of $20,833 per individual, and are capped at the amount of 2.5x their monthly employer retirement contribution in the year that was used to calculate the loan amount .

For owner-employees of C-corps

Employer health insurance contributions and retirement contributions are eligible expenses. Retirement costs are capped at 2.5 x monthly employer retirement contribution in the year that was used to calculate the loan amount . These payments do not count toward the $20,833 cap per individual.

Read Also: How Do I Get My Student Loan Number

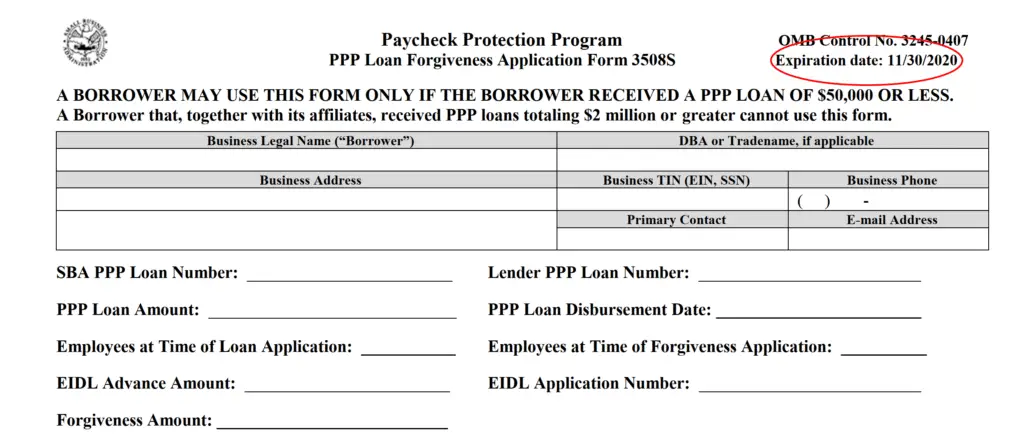

Preparing Your Forgiveness Application

The Economic Aid Act of 2020 provided an easier path to forgiveness for borrowers with PPP Loans of $150,000 or less and expanded the covered expenses eligible for forgiveness for PPP loans of any amount.

For PPP Loans of $150,000 or less, borrowers are now eligible for forgiveness if they sign and submit a certification to the lender. The SBAs new certification form only requires borrowers to:

- Provide a description of the number of employees the eligible recipient was able to retain because of the covered loan; and

- Provide an estimated amount of the covered loan amount spent on payroll costs

Borrowers with PPP Loans of $150,000 or less wont be required to submit any application or documentation beyond the certification. However, they will be required to retain employment records related to the certification for 4 years and all other documents related to the certification for 3 years.

The Economic Aid Act also changed the definition of the Covered Period for forgiveness. Under the new definition, borrowers can choose a Covered Period that is any date that occurs during the period:

- Beginning on the date that is 8 weeks after the date of disbursement; and

- Ending on the date that is 24 weeks after the date of disbursement

Finally, the Economic Aid Act added new categories of eligible expenses, including certain operations expenditures, property damage costs, supplier costs, and worker protection expenditures.

You can submit Form 3508EZ if you:

Wait For Your Lenders Decision

Within 60 days, your lender will decide on the forgiveness amount. You might get full, partial, or no forgiveness. Whatever the decision, it goes directly to the SBA, requiring no action on your part.

Youll be notified of the loan forgiveness amount as your case moves to the SBA. If you dont like the answer maybe you only got partial forgiveness when you expected 100% you have 30 days from receiving your lenders decision to request the SBA review your case again.

The SBA will render its own final decision within 90 days. They might reach out and ask for additional information.

The SBAs final decision is, well, final. If you want to appeal your lenders PPP forgiveness decision, talk to a CPA for guidance.

Also Check: How Does Pre Approval For Auto Loan Work

How To Apply For Ppp Loan Forgiveness As A Self

Youll work with your lender on your PPP loan forgiveness application. They should have sent you follow-up information on how to submit your forms and paperwork. Youll need to submit this application within 10 months of the end of your covered periodif not, your loan payment deferment will end, and youll have to start making monthly payments on your PPP loan.

After you submit your application, your lender will review your documentation and get back to you within 60 days. Once approved, the SBA will refund the portion of your loan that was deemed forgivable.

FAQs

How Does A Change In Ownership Affect My Ppp Loan Or Loan Forgiveness

If you are considering a change of ownership for your business, which could include a merger, asset sale, stock sale or transfer due to the death of a business owner, please notify Wells Fargo as far in advance of the change of ownership transaction as possible. You will need to request prior approval from Wells Fargo before you initiate the change of ownership and provide a copy of the proposed change of ownership agreement and other relevant documents. If you do not obtain prior approval of any change of ownership, it will be considered a default event and may affect your ability to apply for PPP loan forgiveness.

To contact us about a change in ownership if you are a Wells Fargo Business Online® user or a Wealth & Investment Management customer, please call 1-844-304-8911. If you are a Commercial Electronic Office® user, please contact your relationship manager for assistance. We will work with you to complete the process as quickly as possible, but we cannot make any assurances regarding the exact timing for completion of your request, due to the many variables involved.

Providing the requested documentation and responding to questions quickly ensures the best outcome. We anticipate that it will likely take a minimum of 30 days to fully complete the request. The timeframe will depend on our evaluation, your responsiveness during each step of the process, and applicable SBA requirements.

Don’t Miss: What Kind Of Loan Do I Need To Buy Land

What Expenses Are Eligible For Forgiveness

In summary, your loan funds can be used for the following business-related expenses:

- Payroll, including benefits, to retain employees, excluding amounts above a prorated annual salary of $100,000 for employees who make more than that amount.

- Mortgage interest payments for mortgages originated prior to February 15, 2020.

- Rent payments on leases in force before February 15, 2020.

- Utility payments, as long as the services began before February 15, 2020.

- Refinancing an SBA Economic Injury Disaster Loan made between January 31, 2020 and April 3, 2020 .

- Payments for any business software or cloud computing service that facilitates certain business operations.

- Costs related to property damage and vandalism or looting due to public disturbances that occurred during 2020 that were not covered by insurance or other compensation.

- Payments made to suppliers of goods essential to the operations of the business under contracts in effect before the origination of the loan.

- Expenditures made to facilitate compliance with federal, state or local guidance pertaining to sanitation, social distancing or any other worker or customer safety requirement related to COVID-19 during the period between March 1, 2020 and the end of the national emergency declaration.

A Guide To Ppp Loan Forgiveness For The Self Employed

Congress rolled out the Paycheck Protection Program to help small businesses retain jobs and avoid closures. And it workedfor the most part. However, the program initially kinda-sorta forgot about Americas 10 million self-employed workers. Whoops.

Originally, the SBA made PPP loans only available to business owners with employees. Later, they corrected themselves and made it available to sole proprietors and self-employed workers, too, but the processes and guidelines have been poorly explained and disseminated.

If you dont know how PPP loan forgiveness works as a self-employed worker, dont beat yourself upits not your fault. The process is confusing at best and downright frustrating at worst. Fortunately, we can help you out a bit.

Weve compiled everything you need to know about loan forgiveness for the self-employed in this quick-and-easy guide. Well walk you through PPP loan basics, terms for self-employed workers, and how to apply for loan forgiveness.

Read Also: Is My Home Loan Secured

Filling Out The Ppp Forgiveness Application

Filling out your PPP forgiveness application will be very different depending on whether you have employees or not.;

NOTE: If you are self employed and do not have W-2 employees read our article: Self Employed: How to Fill Out the PPP Loan Forgiveness Application Form

The most complicated part of filling out the forgiveness application is filling out the payroll sections. Well provide general information here but you may have questions; unique to your situation. You may find answers in the SBA guidance, so be sure to review it. Also keep in mind this information does not replace professional accounting or legal advice. In fact, we strongly encourage you to; work with your accountant before you submit your application for forgiveness.

Is There A Cap On Annual Salary When Considering Payroll Costs

For each individual employee, the total amount of cash compensation eligible for forgiveness may not exceed a gross annual salary of $100,000, as prorated for the covered period. For an 8-week covered period, thatâs a maximum of $15,385 per employee; $46,154 per employee for borrowers using a 24-week covered period. Note: the cap does not include eligible non-cash benefits.

Don’t Miss: What Is The Lowest Car Loan Rate

Are There Caps Or Exclusions From The Definition Of Payroll Costs Or Owner Compensation

You must exclude the following:

- Compensation to an employee whose principal place of residence is outside of the United States

- Compensation to an independent contractor . Independent contractors do not count as employees within PPP.

- Qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act

Also, the compensation of any individual employee is capped at an annual salary of $100,000, which translates to $46,154 per employee during a 24-week covered period – the maximums are lower for periods of less than 24 weeks.;

For a 24-week covered period, the maximum amount of loan forgiveness you can claim as compensation for owner-employees, self-employed individuals and general partners is the lower of 2.5 months of compensation earned in the year that was used to calculate the loan amount or $20,833, which is the 2.5-month equivalent of $100,000 per year – the maximums are lower for periods of less than 24 weeks.;

What Is Included As Covered Worker Protection Expenditure

An operating or capital expenditure to facilitate the adaptation of the business activities of an entity to comply with requirements or guidance issued by HHS, CDC, or OSHA, or any equivalent requirements issued by state or local government from March 1, 2020 until the President declares and end to the national emergency for COVID-19. Expenses may include the purchase, maintenance, or renovation of assets that create or expand:

- A drive-through window facility

- An indoor, outdoor, or combined air or air pressure ventilation or filtration system

- A physical barrier such as a sneeze guard

- Expansion of additional indoor, outdoor, or combined business space

- On- or offsite health screening capability

- Other assets relating to the compliance with requirements or guidance from HHS, CDC, or OSHA, including personal protective equipment

Read Also: Is Student Loan Refinancing Worth It

Sole Proprietors Without Payroll Expenses

In the event that you arent operating payroll, your PPP loan quantity will likely be determined making use of your revenues as reported on the web 7 of the 2019 or 2020 Schedule C.

To locate your normal month-to-month payroll cost, just take your gross income and divide it by 12. bring your typical monthly payroll cost and grow it by 2.5. This is your PPP loan quantity.

Q&a: Appealing An Sba Decision On A Ppp Loan Or Ppp Loan Forgiveness

Update: On July 28, 2021, SBA released updated guidance on how appeals affect the PPP loan deferment period. For details, continue to the section titled, How would an appeal affect loan payment timelines?

On Aug. 11, 2020, the Small Business Administration released an interim final rule titled Appeals of SBA Loan Review Decisions under the PPP, establishing guidelines for appealing SBA decisions both on Paycheck Protection Program loans and on forgiveness for those loans.;

The new guidance is intended to supplement the guidance in the May 22 interim final rule Loan Review Procedures and Related Borrower and Lender Responsibilities, as amended June 22.

Read on for an overview of the interim final rule and what to know about the outlined PPP loan review appeal process.

What types of appeals are covered by this interim final rule?

The interim final rule establishes a process under 13 CFR part 134 for appealing to the SBA Office of Hearings and Appeals when SBA has reviewed a PPP loan and made an official written decision that the borrower either:

1.Was ineligible for a PPP loan;

2.Was ineligible for the loan amount received, or used the proceeds for unauthorized uses;

3.Is ineligible for PPP loan forgiveness in the amount determined by the lender in its full or partial approval decision issued to SBA advance; or;

4.Is ineligible for PPP loan forgiveness in any amount when the lender has issued a full denial decision to SBA.

Who can appeal?

Recommended Reading: What Is The Role Of Co Applicant In Home Loan

How Do You Maximize Ppp Loan Forgiveness

In order to maximize PPP loan forgiveness you need to use at least 60% of your PPP loan for payroll costs. The higher the percentage used for payroll, the larger proportion of funds eligible for forgiveness. When your PPP funds are disbursed, focus first on payroll costssalary, wages, hazard pay, bonuses, pay for sick/family/vacation leave, benefits, and related payroll taxes.;

It is not recommended that you change payroll or check dates, or falsify any information in order to receive a more favorable loan forgiveness resolution. Instead, use careful documentation and save all information. Work carefully with your SBA-approved lender to identify any issues with your loan forgiveness and work toward fixing the issues. You have until June 30, 2021 to resolve any issues with your headcount, payment totals, or other roadblocks to your loan forgiveness.

What Is The Latest Date That I Can Apply For Forgiveness Before I Am Required To Start Making Payments On My Loan

The date that is 24 weeks plus 10 months after disbursement. If you do not apply for forgiveness before this date, you will have a payment due the 15th day of the following month. If you do apply for forgiveness before this date, you will have a payment due on the 15th day of the month following the month in which we receive a decision from the SBA.

Read Also: How Much Can I Borrow Personal Loan Calculator

What If I Plan To Sell My Business Can I Still Apply For Loan Forgiveness

You should consult your attorney to understand the potential ramifications and additional requirements of completing the sale of your business while you have an open PPP loan. If you sell your business before completing the loan forgiveness process, you may jeopardize your forgiveness claim.

You can request to have your planned ownership change approved by U.S. Bank.

Sole Proprietors With Payroll Costs

If you should be operating payroll expenses, your PPP loan calculation requires some more steps.

Start with using your income that is gross as on the web 7 of a 2019 or 2020 Schedule C. You shall then have to subtract any payroll expenses as reported on lines 14, 19, and 26. The worthiness you see after subtracting the payroll expenses is capped at $100,000. Keep this true quantity handy, it is utilized to determine your owner payment share or proprietor expenses later on.

Include your yearly payroll charges for 2019 or 2020 . This is discovered throughout your payroll provider or on IRS types 941, 944, or 940. Keep in mind that you can easily just add workers whose main residence is in the usa and their profits must certanly be capped at $100,000 annualized.

As soon as youve included your yearly payroll costs towards the quantity extracted from your Schedule C, divide by 12 to get your normal payroll expense that is monthly. Multiplying this true quantity by 2.5 provides you with your PPP loan quantity.

You May Like: Who Can Loan Me Money

What Is A Covered Operations Expenditure

Payment for any business software or cloud computing services that facilitates business operations, product or service delivery, the processing, payment, or tracking of payroll expenses, human resources, sales and billing functions, or accounting or tracking of supplies, inventory, records and expenses.