Are All Personal Loan Calculators The Same

There are a few key differences between RateCitys personal loan calculators and the personal loan calculators offered by lenders and some other comparison sites.

- Calculate repayments or your borrowing power: Get a more complete picture of how a personal loan could become part of your household budget.

- Experiment with variables: Some personal loan calculators only let you use pre-filled information for specific personal loan products. RateCitys personal loan calculator lets you select each variable for yourself, to help you better understand how each option may affect your personal loan.

- Find the total interest payable: Rather than simply showing you the interest rate or the regular repayment of a personal loan, our calculator can help you find the total amount of the personal loan, including interest, though youll also need to account for any other fees and charges that may apply.

- Compare home loans based on your calculations: Once youve made a personal loan calculation, our calculator can point you towards personal loans that are similar to the variables you entered. While these loans may not match your calculation exactly, this can serve as a benchmark for working out whether these loans may suit your needs.

- Find personal loans based on your credit score: By including your credit rating with your personal loan calculations, you can be more confident about applying for the loans based on your results, as youre more likely to fulfil the eligibility criteria.

How Do I Find The Right Personal Loan For Me

If you need a personal loan for debt consolidation, home improvements, or another purpose, you might not know where to start. To find the right loan for your needs, keep the following points in mind:

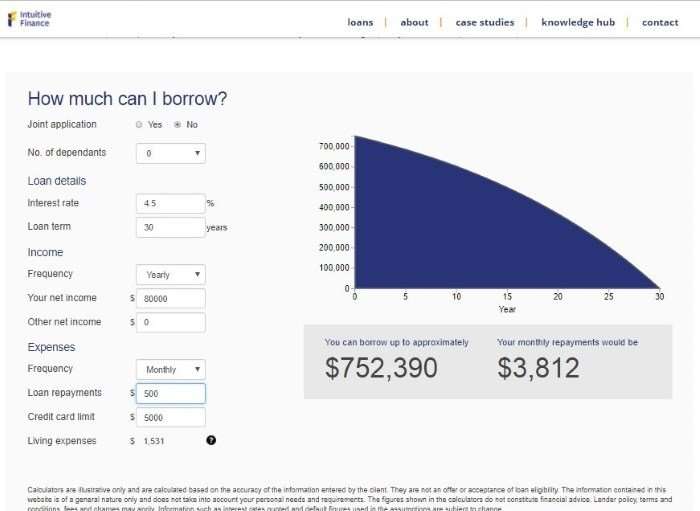

How To Calculate Your Borrowing Power

Follow these steps to fill out the fields in the calculator. If a field doesnt apply to you for example, youre not a landlord or dont have a car loan leave that section blank.

The results show how much you may be eligible to borrow, what your monthly repayments would be based on the term and interest rate you filled in and how much youd pay total in interest over the life of your loan.

You May Like: What Is My Monthly Loan Payment

How Does The Borrowing Power Calculator Work

Generally speaking, your borrowing power is calculated as your net income minus your expenses. Your expenses can be impacted by things like the number of dependents in your family, any current home or personal loan repayments and other financial commitments such as private health insurance. The more accurate the details you enter into the calculator, the more realistic your estimated borrowing capacity is likely to be so you may want to start by understanding your expenses.

The borrowing power calculator estimates how much you may be able to borrow based on the information you provide and the following assumptions:

- Loan term of 30 years

- Principal and interest repayments

- ANZ Standard Variable rate for home loans or an ANZ Standard Variable rate for residential investment property loans, depending on the type of property you select

Note the borrowing power calculator is designed to give you an idea of how much you might be able to borrow, but it shouldnt be taken as a guarantee that youll be able to borrow this amount. It doesnt take into account your complete financial position or whether you meet home loan eligibility criteria. For a more detailed conversation and to discuss next steps, speak with one of our home loan specialists.

Personal Loan Calculator 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Use the calculator below to see estimated interest rates and payments for a personal loan.

Also Check: How To Get Loan Signing Jobs

Which Is The Best Lender For Personal Loans

Choosing your best personal loan will depend on your financial situation, loan requirements and credit history, so remember to factor these in when comparing products offered by different lenders.

Many lenders offer personal loans, including Australias big four banks and smaller banks like ING. You might also like to consider personal loans from credit unions, mutual banks and peer to peer lenders.

Its always worth comparing personal loans from a range of different banks and other lenders before you decide what’s right for you. When shopping around, consider the amount you wish to borrow and any features that are important to you. Some lenders might offer what you need, while others mightn’t.;

You should also make sure you meet your preferred banks lending criteria before submitting an application.

Alison Cheung

Finance Writer

Previously a financial writer for RateCity, Alison Cheung specialised in housing and real estate. Since 2015, she has written about commercial and residential property for Domain Group and NewsCorp in print and online, and has been published in both Domain and RealEstate.com.au. Alison is passionate about property investment and innovations in the real estate industry, and firmly believes in the most basic yet vital financial advice ever given: saving for a rainy day.

Mortgage Repayment Calculator Personal Banking

Use our mortgage calculator to calculate how much you can borrow or try our mortgage repayment First time buyer mortgage house with number one icon.

How much of a mortgage can I qualify for? Explore how much you may be able to borrow with our affordability calculator. Start now;

When you start looking for your first home youre bound to have lots of questions like how much can I borrow?, and how much will it cost? These mortgage;

Also Check: What Does Jumbo Loan Mean

First Time Buyer Mortgage Payments Calculator

Our mortgage calculator will show you your mortgage amount, monthly repayments and the cahsback you can recieve from our award winning 2% and 2% offer!

Our mortgage calculator can help you estimate your monthly mortgage payment. This is the amount you borrow from your lender to buy your home.

The first step in buying a house is determining your budget. Find out how much you can qualify to borrow, based on your annual income, savings and other;

Jun 16, 2021 Calculate your monthly mortgage repayments to work out how much you could afford to borrow when moving house, remortgaging, or buying your first;

How Do I Qualify For A Personal Loan

Eligibility criteria for a personal loan can vary by lender. However, there are a few common requirements youll likely come across, including:

- Good credit: Youll typically need good to excellent credit to qualify for a personal loan a good credit score is usually considered to be 700 or higher. There are also several lenders that offer personal loans for bad credit, but these loans tend to have higher interest rates compared to good credit loans.

- Verifiable income: Some lenders have a minimum income requirement while others dont but in either case, youll likely need to show proof of income.

- Low debt-to-income ratio: Your debt-to-income ratio refers to the amount you owe in monthly debt payments compared to your income. Lenders generally prefer a DTI ratio no higher than 40% for a personal loan though some lenders might require a lower ratio than this.

Tip:

A cosigner can be anyone with good credit such as a parent, other relative, or trusted friend who is willing to share responsibility for the loan. Keep in mind that this means theyll be on the hook if you cant make your payments.

Check Out: How to Get a Personal Loan With a 600 Credit Score

Also Check: What Credit Score Is Needed For Conventional Loan

Useful Guides And Tools

How this site works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySupermarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.

Simple Mortgage Calculator: How Much Can I Borrow Fifth

Our simple mortgage calculator will help you find the perfect loan amount. on how to buy your first home and see first time home buyer loan options.

Homeownership and mortgage calculators to help you assess and estimate your financial situation. How Much Can You Borrow? Learn how much money you might;

You May Like: What Is Fha And Conventional Loan

How Much Can I Borrow With A Personal Loan

The amount you can borrow from a lender, also known as your borrowing power, is based on your personal financial circumstances. For example, when considering your application for a personal loan, a lender will generally consider factors like:

- Your income

- Your expenses, such as mortgage repayments or rent and other living expenses

- Your existing debts, such as any credit cards or other loans

- Whether you have any dependants

- Whether you are making a single or joint application

How Much Mortgage Can I Afford

Modified date: Sep. 13, 2021

Editors note:

If youre in the market to buy a home in Canada, you may be trying to figure out what purchase price you can realistically afford. But the real question you should be asking is: How much mortgage can I afford?

Indeed, since most of us dont have enough cash on hand to buy a property outright, knowing your mortgage affordability is a critical first step in determining how much you can spend on a home.

But what exactly is mortgage affordability, and how is it calculated? We cover it all belowand provide a mortgage affordability calculator that can give you a ballpark maximum loan amount to consider before you consult a lender.

In This Article:

Don’t Miss: What’s Better Refinance Or Home Equity Loan

How Can I Spot A Personal Loan Scam

Unfortunately, there are plenty of scam artists willing to take advantage of borrowers desperate for a personal loan. Here are a few warning signs of personal loan scams to watch out for:

- Demanding money upfront: You should never have to pay money before getting your loan funds. A scammer might demand that you pay strange fees or require unusual payment methods that cant be tracked, such as a prepaid credit card.

- Using high-pressure sales tactics: Scammers will often pressure borrowers to make an instant decision for example, they might use language like limited-time offer or act now.

- Not requiring a credit check: Personal loan lenders usually perform a credit check to determine your creditworthiness. While there are some no-credit-check personal loans , other companies promising not to check your credit are likely a scam.

- Approaching you about the loan: Some lenders advertise through the mail with preapproved loan offers. But if a loan company approaches you out of the blue with an offer, it could be a scam.

- Not having a physical address: A legitimate loan company should have a physical address that you can verify. If you cant find location information for the lender, it could be a front for a scam.

- Not feeling comfortable with the company: Trust your instincts if something feels off, it probably is.

Learn More: Auto Loans for All Credit Types

Working Out Your Rate

Your interest rate is based on several factors including information you provide in your application, your credit history and information we already have about you if youre an existing customer.

After you submit your application, if youre conditionally approved, well give you an indicative interest rate. This is subject to verification of the information you give us in your application. Well provide your final interest rate in the loan documentation, at which point you can decide to accept the loan offer.

Don’t Miss: How To Get 150k Business Loan

Personal Loan Borrowing Power Calculator

The amount you may be able to borrow is determined by your financial situation. This is largely made up of your income, your financial commitments, current savings and your credit history. You’ll also need to consider your spending habits and any existing commitments such as personal or car loans, credit card debt, even travel expenses. Work out how much you may be able to borrow with ING Personal Loan by using our borrowing power calculator.

Oops, 6 and 7 year repayment terms are only available for loansover $30,000.

Other loan limit to consolidate:

Estimated borrowing power

Sorry, we’re unable to consider a loan application based onthe details entered.

Estimated monthly repayments

Fixed interest rate: 0% p.a.

Comparison rate: 0% p.a.

Sorry, we’re unable to consider a loan application based onthe details entered.

Important: This result is an estimate only and is based on the information you have entered, and is not an offer of credit. Your actual rate and repayment amount may be different. Any application for credit is subject to ING’s credit approval criteria, as well as minimum and maximum loan amounts.

Important Information

Comparison rate

Calculator

Results from the ING Personal Loan Borrowing Power calculator do not constitute anapplication or offer of credit . You can apply for an INGPersonal Loan on our website.

Can I Save By Switching Loans

If you already have a loan, itâs always worth checking to see if you can save by using a new, cheaper loan to pay it off, effectively switching loans. Plug the old and new loan details into our calculator and it will tell you if youâd be better off, after factoring in any charges to pay it off early .

Don’t Miss: What Is Auto Loan Interest Rate

How Does The Repayment Calculator Work

Which Factors Affect My Personal Loan Amount

Each lender has its own set of criteria for determining loan amounts. But in general, here are some of the primary factors:

Because every lender is different in how it considers each of these factors, it’s a good idea to shop around and compare multiple loan offers to improve your chances of scoring a better one. Experian CreditMatch allows you to get prequalified and compare loan offers from multiple lenders through one place based on your credit profile.

Don’t Miss: How Do I Get My Student Loan Number