Closing Costs For Buyers: Whats Negotiable

The buyer typically pays the majority of closing costs. Of course, theres always room to negotiate but choose your battles wisely. A seller will likely be much more open to negotiation when presented with an offer of the full asking price or when its a buyers market.

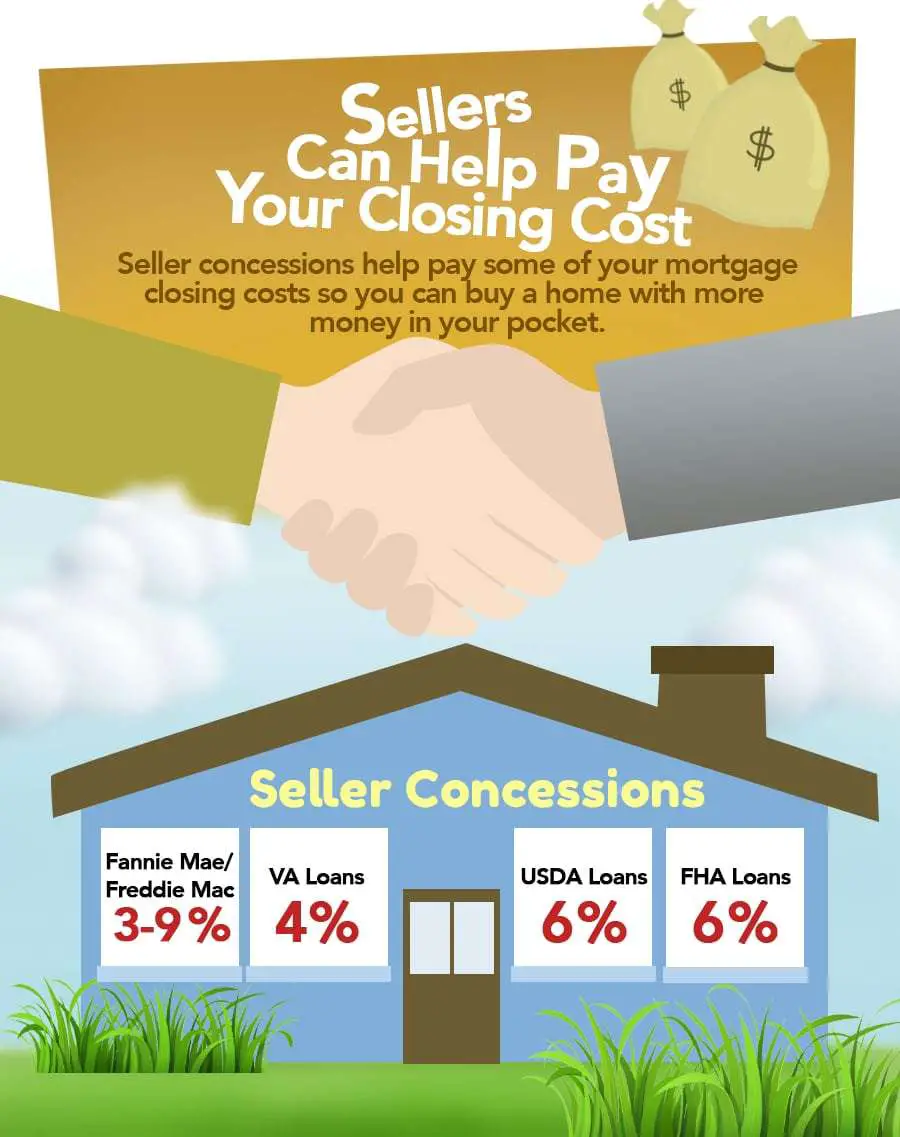

Another option for these costs is to meet the seller halfway, dividing expenses between both parties. Sellers traditionally pay for certain things, like the real estate agent commission. Other things, like the owners title policy, may be paid for by the seller depending on local custom. Alternatively, you could negotiate seller concessions.

Seller concessions are part of your closing costs that, instead of paying yourself, you negotiate to have the seller pay. Buyers might ask for concessions if they think theyll have trouble covering their closing costs or if a home inspector finds issues that are going to cost money to fix.

Its worth noting that concessions can help out the seller as well. If they are selling their home in a crowded market and arent having much luck, offering concessions can make the deal seem more attractive to potential buyers.

Also, watch for miscellaneous fees like funding and delivery fees. If the fees seem vague, you may be able to push back to have them lowered or eliminated.

Shop Around For Lenders

As the buyer, you get to choose which mortgage company you want to work with. Dont be afraid to take some time to shop around for lenders.

Contact a few competing loan providers and ask what types of fees they charge. Choose a lender that offers low fees and competitive interest rates for lower overall closing costs.

Check Spelling Or Type A New Query

Maybe you would like to learn more about one of these? We did not find results for: Does a va home loan cover closing costs. Check spelling or type a new query.

Does a va home loan cover closing costs. Check spelling or type a new query. We did not find results for: Maybe you would like to learn more about one of these?

Don’t Miss: Va Loan For Modular Home And Land

Decide How Youll Pay Loan Costs

Like other mortgages, VA loans have closing costs, which are fees charged to cover services and expenses such as the appraisal, inspection, title and origination fees. Closing costs typically run from 2% to 5% of the loan amount and are detailed in the Loan Estimate.

Another cost is the VA funding fee, a one-time fee most borrowers will pay, based on the down payment amount and prior use of the VA loan benefit. The 2020 funding fee for a zero-down loan on a first VA loan is 2.3% of the loan amount.

Here are the options if you cant pay these costs upfront:

Roll the funding fee into the loan. Doing so will increase your loan amount and monthly payment, and it will mean you pay interest on the funding fee over the life of the loan.

Ask the seller to pitch in. The VA allows the seller to contribute up to 4% of the loan amount to cover some closing costs and the VA funding fee. Keep in mind, though, sellers are less likely to make concessions when the competition to buy homes is fierce.

Find out if your lender is willing to cover closing costs in exchange for you paying a higher interest rate. Understand that this will increase your monthly mortgage payment.

Seek closing cost assistance through a state home buying program for first-time buyers or veterans, as well.

Can Sellers Pay Va Closing Costs

This is a great example of how VA loans can help homebuyers save money. Because buyers using the VA loan are restricted in what they can and cannot pay when it comes to closing costs and other fees, it is common for sellers to cover some of these costs. Thats right: often, the seller pays!

Sellers arent required to pay a borrowers closing costs, but its commonly negotiated. Veterans Affairs allows property sellers to pay a percentage of the purchase price toward the buyers closing costs, often around 4%. But seller concessions can also go higher if they contribute to pre-paid fees, paying points, etc. Compare that to conventional mortgages, which can cap seller contributions toward closing costs at 3%.

Also Check: What Happens If You Default On Sba Loan

What You Need To Know About Closing Costs

You dont need a down payment to get a VA loan. However, you will be responsible for paying the closing costs. You can either pay them in cash or use seller/lender credits to cover them.

Its normal to be a little confused when it comes to closing costs. Here we answer some of the questions you might have about VA home loan closing costs to help you better understand how they work.

Reviewing Paperwork Is Crucial To Getting The Best Va Home Loan

Make sure that you review your loan estimate carefully and that you ask the lender any questions about the VA loan or its application process that you might have. Youll want to know exactly what you will owe in terms of closing costs. If you cant afford the costs listed on the loan estimate, ask about potential concessions. Dont forget that you can obtain a VA loan through numerous VA-approved lenders. Take your loan estimate and compare them to the loan estimates of other lenders. You may be able to find a better deal and you may be able to use one estimate to get a lender to reduce the costs on another.

Don’t Miss: What Should You Do If Lender Rejects Your Loan Application

Va Loan Fees The Borrower Cannot Pay

When you go to purchase a home with a VA guaranteed mortgage, youll typically encounter fees like closing costs and other expenses. How those get paid is often a matter of negotiation between you and the seller. But there are also fees the VA does not allow the buyer to pay.

Did you know the lender or seller can’t charge the borrower for attorney’s fees? If the buyer chooses to pay for his or her own attorney, that’s the buyer’s call, but the buyer can’t be charged for the bank’s legal representation.

The VA also prohibits a real estate agent from charging the buyer a commission. You’ll also find VA mortgage rules that close any loopholes that might allow an agent to charge fees appearing to be commissions even if not defined as such. Other costs that the VA prohibits buyers from paying include:

- Notary public fees

- Cost of termite inspection

It is legal for a house hunter to contact and use a “buyer broker” to find a suitable property, but buyers cannot pay brokerage fees and commissions. The VA adds that property availability and purchase price information is widely available. Forbidding a VA mortgage applicant from paying a commission or fee to a buyer broker doesn’t impair the buyer’s ability to find a suitable property.

Maybe You Would Like To Learn More About One Of These

Maybe you would like to learn more about one of these? Check spelling or type a new query. Does a va home loan cover closing costs. We did not find results for:

Maybe you would like to learn more about one of these? Does a va home loan cover closing costs. Check spelling or type a new query. We did not find results for:

Maybe you would like to learn more about one of these? Check spelling or type a new query. We did not find results for: Does a va home loan cover closing costs.

Check spelling or type a new query. We did not find results for: Maybe you would like to learn more about one of these? Does a va home loan cover closing costs.

We did not find results for: Maybe you would like to learn more about one of these? Does a va home loan cover closing costs. Check spelling or type a new query.

Maybe you would like to learn more about one of these? Check spelling or type a new query. We did not find results for: Does a va home loan cover closing costs.

You May Like: Va Loan Mobile Home Requirements

Common Va Loan Closing Costs And Who Pays Them

Though they largely function the same way other mortgages do, VA-backed mortgages feature many of the same closing costs. Still, there’s some variation between the costs linked to VA-backed mortgages and regular mortgages. It’s important to note that according to the VA, a seller cannot pay more than 4% of the total loan in fees, otherwise known as seller’s concessions. That rule only applies to some closing costs, such as the VA funding fee. The rule doesn’t cover loan discount points.

Below are some of the closing costs you can expect to see on a loan estimate for a VA-backed mortgage.

Common Misconception There Are No Va Closing Costs

Lets get the facts straight on VA closing costs. There are always closing costs associated with VA loans. Many Veterans will state, But, VA has no closing costs! That is assumed because it is common that another party covers the Veterans costs.

This misconception could cause issues later in the process. For instance, a purchase contract or lender not accounting for the closing costs would mean the buyer would pay the fees at closing. Not that there is anything wrong with the buyer paying closing costs, but many buyers choose not to bring or dont have those funds for the closing costs.

Also Check: How To Get Loan Officer License In California

Former Members Of The Armed Forces Must Still Pay Various Home Loan Fees

Andrew Martins is an award-winning journalist who has performed thousands of hours of research on small business products and services and technology. Over the last 12 years, he has also studied and covered taxes, politics, and the economic impacts policy decisions have on small business.

Whether they’re stationed abroad or serving stateside, the American armed forces get to enjoy a bevy of benefits when their tenure in the military ends, such as specially catered health benefits and free college through the Post-9/11 GI Bill. These benefits also extend to housing assistance through Veterans Affairs-backed home loans. And although those loans come with great terms and no need for a down payment, they still have some added costs attached.

What Are Va Loan Closing Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

For cash-strapped military borrowers, a VA mortgage can be the answer to a prayer. Eligible military borrowers can get into a new home with no down payment, only a funding fee an upfront charge that can be financed within your mortgage.

But borrowers without cash savings face a potential obstacle: closing costs, the big bill that includes lenders fees, taxes, insurance and other services needed to transfer a property. Payment is due when you sign your loan papers. Luckily, there are ways around this problem. VA borrowers are exempt from some closing costs and have options for managing others.

Don’t Miss: What Is An Rv Loan

Attorney Fees $400 Varies By Location

Lenders cant charge veterans for attorneys fees, but the VA does allow veterans to pay attorney fees for title work. The VA also allows veterans to seek independent legal counsel for such things as sales agreement and lending document reviews. Legal fees vary depending upon individual attorney or law firm rates.

Closing Costs Plan Of Action

Borrowers get an idea of closing costs expenses once they complete a full loan application. Within three business days of receiving the application, a VA lender will return a Loan Estimate to the borrower. The Loan Estimate is non-obligatory and does not commit the borrower to that lender or loan amount.

Using the Loan Estimate as a launching point, borrowers should talk with their VA loan specialist and real estate agent about the best closing cost approach. Some VA loan users have the capital to pay some closing costs, while others prefer to find sellers who are willing to pay more upfront to sell their property.

Also Check: Caliber Home Loans 1098 Form

Who Pays Closing Costs On A Va Loan

When using a VA loan, the buyer, seller, and lender each pay different parts of the closing costs. The seller cannot pay more than 4% of the total home loan in closing costs. But their portion of the closing costs includes the commissions for buyer and seller real estate agents.

As the buyer, youll have to pay the VA funding fee, loan origination fee, loan discount points, the VA appraisal fee, title insurance, and more. Finally, the lender will cover some of the typical closing costs such as the attorneys fees.

The VA sets particular limits on the costs facing the home buyer. For example, the limited origination fee can help to keep your costs low.

Who Qualifies For The Closing Cost Assistance Program

The Closing Cost Assistance program is not only for veterans and military personnel qualifying for VA loans. First time home buyers or First Responders may qualify for the program and use it for closing costs or even down payments. It can also be used for conventional, FHA and even USDA loans. This is especially beneficial for veterans that for one reason or another, dont qualify for a VA loan or dont meet the VA eligibility requirements.

Recommended Reading: How Do I Refinance My Car With Bad Credit

What Are The Va Loan Closing Costs

Closing costs on VA loans are practically the same as other mortgage loans with a few exceptions. Similar costs on a purchase include appraisal, title search, title insurance, closing attorney, recording fee, and any lender fees. Our lender fee is lower than our other loan types. In addition to closing costs, there are pre-paid items. Pre-paids include the first year of insurance premiums , set up for tax and insurance escrows, and interim interest due to cover a partial month after closing.

Doesrolling Closing Costs Into Your Mortgage Reduce The Amount Of Interest You Candeduct

Typically, no. The amount of interest you can deduct on your taxes isnt impacted by rolling the closing costs into your mortgage.

Choosing a slightly higher interest rate in lieu of closingcosts, however, can give you a bigger interest deduction. This is becauseyoull be paying a slighter higher rate, which means paying more interest.

Be sure to consult a tax professional for your specificsituation on what you can or cant deduct.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

How Much Closing Cost Assistance Can I Get

The program allows from $5,000 for first time home buyers up to $10,000 for qualified veterans. Again, this can be used for closing cost assistance or as mentioned before, down payment assistance.

$7,500 VA Closing Cost Assistance: If you currently serve or have served in any branch of the U.S. military but not called to action in an overseas conflict, you may qualify for up to $7,500 in VA closing costs assistance.

$10,000 VA Closing Cost Assistance: If you currently serve or have served in the U.S. Military and called to duty in an overseas conflict, you can qualify for up to $10,000 in VA closing costs assistance.

Can You Roll In Closing Costs On A Va Loan

The VA funding fee is the only fee or charge that can be rolled into a purchase loan amount. Think carefully about whether it makes financial sense over the long run to take advantage of this option.

The drawback is that you are financing and paying interest on your closing costs, so while it helps with lowering out-of-pocket costs, you end up paying interest on those costs during the life of the loan, Sanders says.

You May Like: Drb Student Loan Refi

Who Pays Closing Costs For A Va Loan

While many borrowers pay closing cost themselves, VA borrowers have a few options to get those expenses covered:

- Request that the seller pays them. The VA seller concession maximum cannot exceed 4% of your loan amount. The seller can even pay the VA funding fee, which helps you avoid financing the fee over the term of your loan. For example, a second-time VA borrower putting zero down on a $300,000 house could ask the seller to pay some or all of the $10,800 funding fee.

- Ask for a donor gift. You can get a gift for your closing costs, as long as the donor completes a gift letter and shows proof of funds.

- Apply for military closing cost assistance. Depending on where you live, you may be eligible for closing cost assistance. Income and family-size limits apply, so read the fine print before applying.

- Roll closing costs into the loan amount. The VA funding fee can be added to your loan amount for any type of VA loan. However, unless youre refinancing, closing costs cannot be added to the loan amount.

Choose A Real Estate Agent With Experience Serving Military Clients

Because the VA loan process has special requirements, its important to work with a real estate agent who understands VA financing. A good agent will guide you through the process and can advocate on your behalf to sellers.

For example, an experienced agent will understand the VA appraisal process and can steer you to homes that are likely to meet VA minimum property requirements.

An agent who has experience working with military buyers will also understand your unique housing needs. Rodgers, who was wounded in action when serving in the U.S. Army Special Forces in Afghanistan, helps each of his buyers create an exit plan for selling or renting out the property if they have to relocate later.

Interview a few agents and ask about their experience serving buyers using VA loans and any extra training theyve completed, such as the National Association of Realtors military relocation professional certification.

Dont assume agents have VA loan expertise just because they served in the military, Rodgers says.

Related

Recommended Reading: How To Refinance An Avant Loan