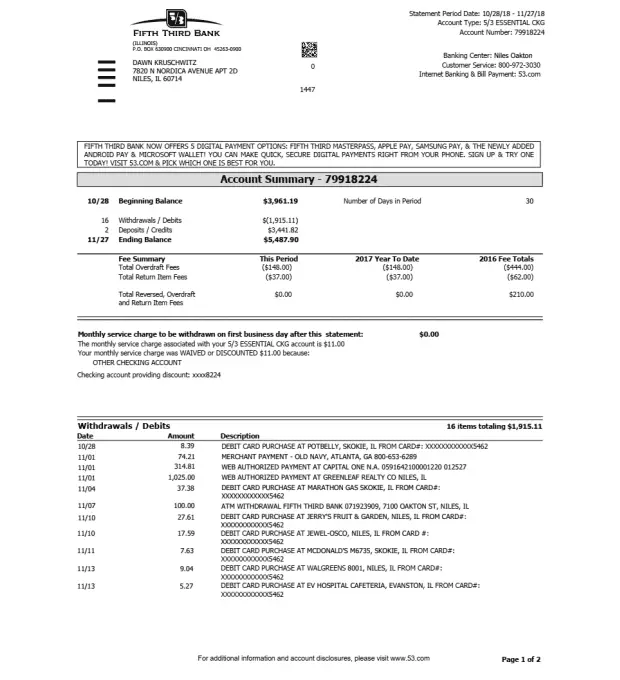

How To Contact Fifth Third Bank Customer Service

Fifth Third Bank provides a wide range of financial services and products. On almost every page of the banks website, there is a customer support phone number if you have questions or issues with any of your Fifth Third Bank accounts:

- Customer Service Call Center: 1-800-972-3030.

- Toll-free international fraud support: 1-513-900-3080.

- For individuals who are deaf or hard of hearing: 1-800-546-7068.

Mon. Fri, 8 a.m. 6 p.m. ETSat., 10 a.m. 4 p.m. ETClosed Sunday

- 24/7 messaging assistance: Message Fifth Third Bank via its website or mobile app.

Live Agents.Monday through Friday, 6 a.m. to 9 p.m. ETSaturday and Sunday, 8:30 a.m. to 5 p.m. ETAfter hours: Request agent chat help and a real agent will respond the following day.Virtual assistants are accessible 365 days a year.

Savings Accounts: Health Savings Account

| Key Features | |

| Current Terms and Rates | You must visit a branch to find accurate rates. |

A health savings account, or HSA, lets you save for medical expenses. You can access your savings in this account with a Fifth Third Bank Debit Mastercard®, but only to pay for qualified medical expenses. Luckily, the Fifth Third Health Savings Account helps you keep track of your purchases and manage a budget. Features include online bill payment so you can more easily pay your medical expenses to healthcare providers nationwide.

You can access your HSA with the banks HSA Mobile App. This allows you to view your transactions and balance and securely upload medical receipts. Plus, the account offers the opportunity for mutual fund investments. You can begin participation once you have an account balance of $2,000. Mutual fund participation will cost you an extra monthly fee of $2.

Youll have to visit your local Fifth Third Bank branch to open this account.

Benefits Of Fifth Third Bank Login:

- A bank near you is easily accessible.

- Pay bills without the hassle.

- Check your account balance, transaction history, and statement history.

- Check needs to be rearranged.

- Check should be reordered.

- Transfer funds from one account to another.

- Save data for use with personal financial software.

- Bank on a site that is safe, secure, and encrypted.

- Receive account alerts through email.

For the modern consumer, online banking has evolved into a necessary tool. The ability to bank from anywhere and on your own time, rather than during bankers hours, helps you to keep a closer eye on your accounts and better manage your money. Budgeting becomes easier and your financial life becomes more organized when you keep yourself informed and up to date.

You May Like: Best Rates On Auto Loans

Fifth Third Bank Personal Loan Details And Requirements

-

The APR range for a loan from Fifth Third Bank is 5.99% to 17.24%

-

Borrowers need to have a credit score of 600 or above to qualify for a loan from this lender.

-

Income Requirements

There are no income requirements listed on the Fifth Third Bank website for this personal loan.

-

Loan Amounts

The loan amount range for this loan is $2,000 to $25,000.

-

Loan Terms

The repayment terms available are from 12 months up to 60 months.

-

Permitted Uses

This loan can be used to fund debt consolidation, home improvement and more.

-

Prohibited Uses

Fifth Third Bank does not specify the prohibited uses for its personal loan.

-

Time to Receive Funds

Borrowers can receive funds within one day.

-

Origination Fees

There is an origination fee of 0.25%.

-

Late Fees

Fifth Third Bank charges a late fee but doesnt specify what that is on their website. They suggest borrowers check their loan terms for this information.

-

Prepayment Penalty Fees

There are no prepayment penalties.

-

Co-signers and Co-applicants

Co-signers are not allowed on Fifth Third Bank loans.

-

Perks

Fifth Third Banks Signature Loan is an unsecured loan, and you can apply online.

-

Mobile Application

Fifth Third Bank has a mobile app that allows users to manage their accounts from their Apple or Android devices.

Show more

Is Fifth Third Bank Right for You?

Certificates Of Deposit : Promotional Cd Standard Cd And 529 Cd

| Key Features | |

| Current Terms and Rates: Standard CD | Rates based on Ohio zip code 44223

|

The bank has a few CD offerings. A CD grows your initial deposit at the set rate for a set amount of time. You choose the term length you want. The bank offers accounts ranging from seven days to 84 months. Typically, you cannot touch the funds within a CD until the term length is over, also known as reaching maturity. Once a CD reaches maturity, you can renew the account or withdraw your funds.

You can open a 529 CD with the bank, as well. A 529 savings account helps you save for education expenses, like room and board or textbooks. This account wont be taxed while your money grows. Plus, your withdrawals typically wont face federal income taxes.

Fifth Third Bank CDs earn more thanks to compound interest. This means that your money is constantly growing since interest earned will earn interest and so on. You also have room to move the earned interest to a Fifth Third checking account or savings account if you dont want to keep it in the CD.

If you want to open a Fifth Third loan and you have a CD with the bank, the CD may be used as collateral for the loan.

You will have to visit a bank branch or give them a call to open a CD.

Recommended Reading: Should I Take Out Home Equity Loan

Who Fifth Third Bank Is Perfect For

A Fifth Third Bank personal loan is best for borrowers who need urgent funds. Fifth Third Bank approves an application almost immediately and can release the funds within one day. Therefore, if there’s a financial need that you have to resolve in a short period of time, this lender might be good for you.

Additionally, borrowers who think they will be able to pay off their loans early might want to consider Fifth Third Bank because this lender doesnt charge prepayment fees. Its also a good option for people who plan to set up autopay since borrowers can take advantage of a 0.25% autopay discount.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Are Student Loan Forgiveness Programs Legit

How Do I Apply

Youll need to schedule an appointment to apply. To do so, follow these five steps:

What documents do I need to apply?

To apply for a car loan with Fifth Third Bank, youll need to provide some basic information:

You make a payment one of five ways:

- Through Fifth Thirds website

- Through wire transfer or a third-party service

- At a Fifth Third branch

Your first repayment will be due 30 days after your loan is finalized. Fifth Third will mail you a coupon book that covers all of your monthly payments excluding the final repayment.

Your coupon book covers the same information as a monthly billing statement. Review it or log in to your account on Fifth Thirds website to see your past payments and future due dates.

If you dont live near a Fifth Third branch, read our guide to car loans and compare more options.

Why Cant You Log Into Fifth Third Online Banking

You may be unable to log in for a variety of reasons. The most common reason is entering account or password information incorrectly. By double-checking your information before logging in, you may avoid this.If you have tried the above ways and are still unable to log into your Fifth Third online banking account, please see the options below:

- Use an appropriate browser.

- Enable cookies in your browsers settings.

- Instead of using a favorite or bookmark, enter in the URL box.

- Check to see if you can access other websites.

- Clear your browsers cache.

- Delete cookies .

- Close all browser windows, then reopen and try to enter Fifth Third online banking again.

- Also, make sure youve selected the appropriate login account type in the browser by checking your IP address.

If your problem has not been fixed, please contact Fifth Third Banks customer service.

Recommended Reading: How To Get Instant Personal Loan Without Documents

What To Do If You Are Rejected From Fifth Third Bank

You dont need to worry if your application is rejected. Its not uncommon for borrowers to have their loan applications denied, and there are multiple reasons that can cause this to happen. Low credit scores, current debts, limited income, inaccurate information and other factors are among them.

The best thing you can do is contact your lender and ask why your application was declined. Once you know the exact reason, work on this factor and improve it. It will give you a better chance of being approved in the future.

Another solution is to make changes to your application. Lenders may allow you to modify details in your application. Examples of this include the loan amount or repayment terms since they impact your monthly dues.

After an application is denied, you can also apply with other lenders, but we do not recommend doing this immediately. You may face more rejections if you don’t address the factor that caused the original denial.

Whats The Process For Opening An Account With Fifth Third Bank

You can apply for most accounts online. This process typically takes 10 minutes and starts with the page shown here. However, not everyone can open an account, unless you open an account from the 10 states the bank has locations. For example, SmartAsset was unable to open an account online at the time using our NYC zip code. However, the bank encourages the applicant to visit a branch instead if you can.

If you are able to open an account, youll need to provide information including your Social Security number, date of birth, drivers license and a debit card to fund your account.

A number of accounts do require you to call the bank at 1-866-671-5353 or visit a branch in person right off the bat, without the option of opening online. These accounts include CDs, a couple checking accounts and the HSA.

Recommended Reading: Which Online Loan Site Is The Best

Interest Rates And Terms

Fifth Third Bank gives a 0.25 percent rate discount when the payment is deducted from a Fifth Third checking account. The starting 4.58 percent interest rate for all products reflects this discount.

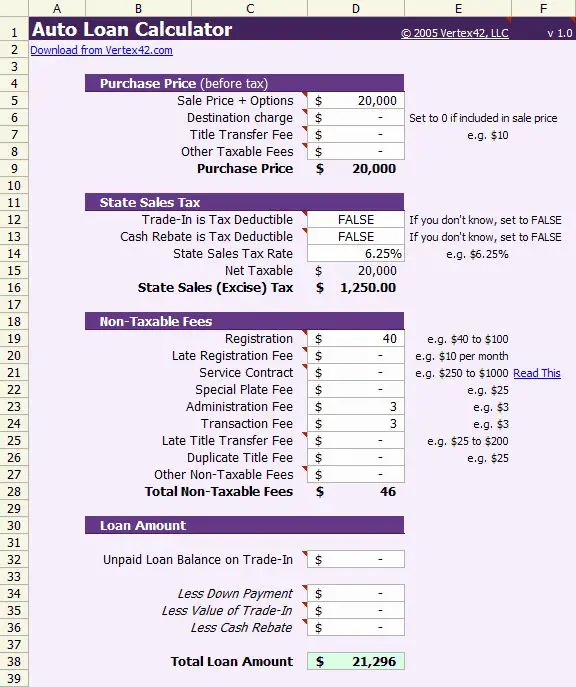

How to apply for a loan with Fifth Third Bank

To apply for a Fifth Third Bank auto loan you can either visit a banking branch in your area or call 866-671-5353. Unfortunately, you cannot apply online. But you can manage your loan through your account online following approval. Before heading to a banking office is it wise to take advantage of an auto loan calculator to understand how much you can afford.

While there is no application fee, you should prepare to pay an origination fee of $165 if you accept the terms of the loan. Following approval, take advantage of the automatic payment option to ensure you never miss a payment.

Is It Safe To Use The Fifth Third Banking App

If youre hesitant about using a mobile banking app, remember that security risks may be located anywhere, including in bank lobbies. A bank employee stealing your banking information is one example of an insider threat. A mobile app may be vulnerable to data transmission vulnerabilities as well as potential vulnerabilities relating to the apps security posture . However, the bank makes significant investments in both cases to built-in security. Financial institutions monitor their employees behavior and look for holes in their applications that may be corrected before crooks use them. You can also take efforts to reduce your risk.

Thank you for reading! HDBank Career hopes these information meet your needs. Leave a comment if you want to contribute more info about this topic. Our community of readers will be very grateful for your shares.

Recommended Reading: How To Pay Huntington Car Loan Online

How To Pay Your Fifth Third Bank Mortgage

As soon as youve created an online account, youll be able to log in and initiate mortgage payments. Heres how to do it:

Go to 53.com, select Login, type your User Name and Password, and click on Log In.

After gaining access into your account, youll be able to make monthly mortgage loan payments through your Fifth Third Bank savings account or checking account. You can also make payments using external depository accounts that youve previously linked to 53.com.

Use Mobile Banking to Pay Your Fifth Third Bank Mortgage

Once youre a customer, you can download the Fifth Third Bank Mobile App to your phone or mobile device.

After downloading the app, youll be able to log in to your account. Select Transfer and Pay Menu to make your mortgage bill payment.

Automatic Payments

Do you want to make automatic payments? You can do so by completing the following form: .

About Fifth Third Bank 53 Bank

Fifth Third Bank was founded in 1858 as Bank of the Ohio Valley and became Fifth Third Bank in 1908. The name Fifth Third comes from the merger of the banks two predecessor businesses, Third National Bank and Fifth National Bank, in 1909.

On the Fortune 500, The Fifth Third Bank is ranked 384. It is one of the biggest banks in the United States. The Fifth Third Center in Cincinnati, Ohio serves as the companys headquarters.

The bank has over 1,300 locations in Ohio, Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, North Carolina, Tennessee, and West Virginia.Fifth Third Bank is a regional bank, therefore it may be more attractive to those who live in the areas where it has branches. However, if youre not in that location, dont write it off because you can still do it thanks to online and mobile banking services, but you need to login first to use the internet banking features.

Recommended Reading: What Are The Best Student Loan Refinancing Companies

Best Bank For Refinancing Your Fifth Third Bank Loan

Best Auto Loan Refinance Companies of 2021

- Best for Great Credit: Credit Unions

- Best for Checking Rates Without Impacting Your Credit: Capital One.

- Best Trusted Name: Bank of America, Chase or WellsFargo.

- Best for The Most Options: WithClutch.

- Best for Members of the Military: USAA or Navy Federal CU.

- Best for Peer-to-Peer Loans: LendingClub although not recommendable.

- Digital Credit Union and PenFed.

The Bottom Line: Who Is A Fifth Third Bank Auto Loan Best For

If you live in Florida, Georgia, Illinois, Indiana, Kentucky, Michigan, North Carolina, Ohio, Tennessee and West Virginia, you can apply for an auto loan from Fifth Third Bank without working with a franchised auto dealer. For residents of other states, it may not be possible to finance your car loan through Fifth Third Bank unless you go through the dealership where you purchase your car.

Also Check: Who Is My Auto Loan Through

What Are The Benefits Of Online Banking

Many customers love the flexibility and convenience of online banking, especially with features like online bill payment, requesting a new card or any other bank transaction without the inconvenience of driving to a physical branch to do so.

With Fifth Third Bank, customers are provided features like online bill pay, scheduled payments, paperless statements and sending and receiving money electronically. With mobile banking, customers can get mobile alerts and easy deposit features.

More From Fifth Third Bank

Sydney Garth Credit Cards Moderator

@sydneygarth04/02/18 This answer was first published on 04/02/18. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Yes, you can. All you need to do is log into your account at . If you don’t have one yet, select “First-Time User” and follow the prompts to register. You will need to provide information about your loan type, account number and Social Security number. You should have your loan documents at hand so you can answer a few security questions as well. You can also make automatic payments online through the Auto BillPayer® service or Online Bill Pay — to enroll, call Fifth Third Bank at 800-991-7771.

Read Also: Ppp Loans For Doordash Drivers

Fifth Third Bank Savings Overview

Fifth Third Bank offers a few different bank accounts from the simplest checking account to a high-earning relationship money market account. You can even find specialized checking accounts for students and military members and family members here.

Once you have an account, youll have access to them online, on mobile, over the phone and at a branch if there is a nearby one. You also have access to over 45,000 ATMs. Plus, the bank can cover the fees that come with using a foreign ATM so you dont have to worry about withdrawing money at an extra cost. Youll also often have access to Identity Alert® and overdraft solutions.

The banks offerings are limited to customers in certain locations, however, meaning not everyone in the U.S. can open an account.