What Does Property Eligibility Mean

While all lenders review the value of a property before deciding if they will approve a mortgage, the USDA loan program is designed to provide loans for low- and moderate-income households living in rural areas. The loan program is focused on improving access to affordable homeownership in rural areas.

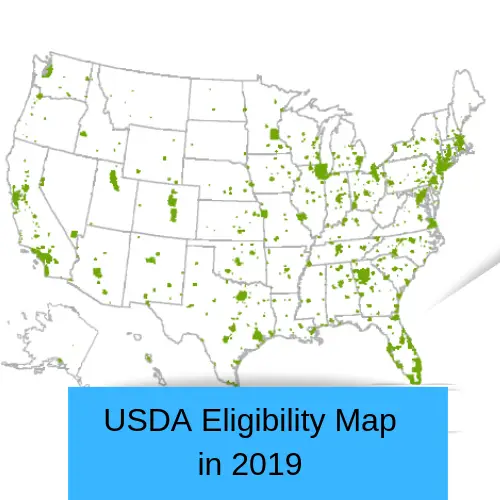

The USDA eligibility map offers an initial way to search locations and identify areas where USDA loans are available. Only properties within areas designated as rural qualify for the loan program. If youre shopping for a home in an area that could be defined as rural, checking the USDA property eligibility map is a first step to see if USDA financing is available.

How To Get A Usda Loan

The easiest way to get a USDA loan is to talk with a trusted loan provider. At Mortgage 1, weve been helping families secure non-traditional loans for years were one of the top USDA loan providers in Michigan. If you want to own your own piece of Michigans great outdoors, contact us today and well make sure you get the best deal.

Usda Loan Program Faqs

Are USDA loans better than FHA loans?

USDA and FHA loans each have pros and cons. Generally, FHA loans work better for people with lower credit scores. However, FHA loans require at least 3.5% down while USDA loans can offer zero down payment. Unlike USDA loans, FHA does not set geographic or income limits.

Are USDA loans good for first-time home buyers?

Yes, USDA can lower the barriers to homeownership by offering no down payment loans and less stringent credit requirements compared to conventional loans all while still offering competitive loan rates.

Do all lenders issue USDA loans?

No, but many do. USDA like FHA and VA is a widely used mortgage program.

Does the USDA set loan limits?

No, but your mortgage underwriters will cap your loan size based on your credit profile and ability to make payments.

What credit score do I need for a USDA loan?

In most cases you need a FICO score of 640 or higher to get USDA loan approval. However, some lenders can make exceptions, especially if you have a low debt-to-income ratio . Be sure to check your credit report before applying so you can dispute inaccurate credit data which can pull down your score.

How can I get out of a USDA loan?

Youd need to pay off the loan or refinance it to a non-USDA mortgage. Refinancing into a conventional loan lets homeowners stop paying mortgage insurance premiums if they own at least 20% of the homes value as equity.

Can I use a USDA loan for a vacation home or investment property?

Read Also: Usaa Auto Loan Refinance

Theres No Way My Area Is Eligible

This is what suburban home buyers typically think before they search eligibility maps.

Often, they discover USDA-eligible homes within 30 minutes of their workplace.

As stated above, map boundaries are still based on population numbers from nearly 20 years ago. Technically, to be USDA-eligible a city or town must:

- Have a population of less than 20,000

- Be rural in character

- Have a lack of available credit.

Yet, new rules still classify an area as rural if its population is below 35,000, until information is received from the 2020 census.

Cities with considerable population remain eligible for the Rural Housing loan for the time being.

What Are The Property Guidelines For A Usda Loan

In order for a property to eligible for a USDA backed mortgage, it must be in a solid, livable condition with no major defects. Most lenders offer this type of loan in suburban and rural areas. There is no requirement to be a first-time homebuyer, as long as you do not currently own adequate housing within a reasonable distance of the home you are attempting to purchase.

Also Check: Firstloan Com Legit

Usda Mortgage Lenders In Nc And Sc

Only USDA approved lenders can offer USDA home loans. Dash is an approved USDA mortgage lender that offers USDA loans throughout North Carolina and South Carolina. If youre interested in a USDA loan, get in touch. We have offices in Charlotte and Raleigh, and were always available to help you.

Let’s get started

Does Usda Offer A Streamline Refinance Program

Yes. To qualify, the borrower must currently have a USDA loan currently and must live in the home. The new loan is subject to the standard funding fee and annual fee, just like purchase loans. Refinancing borrowers must qualify using current income but may qualify with higher ratios than generally accepted if the payment is dropping and they have made their current mortgage payments on time.

If the new funding fee is not being financed into the loan, the lender may not require a new appraisal.

Read Also: How Much Do Loan Officers Make In Commission

Usda Property Eligibility Requirements

Mortgage loan programs typically require borrowers to meet specific requirements and a property appraisal. The USDA loan program has additional requirements because of the programs mission to support affordable homeownership in rural areas for low- to moderate-income households.

Eligibility requirements for USDA loans include:

- The property must be located within a rural area that is designated as eligible for USDA loans.

- The property must be a single-family dwelling and not an apartment building. By USDAs definition, this includes detached single-family homes attached homes such as a duplex, townhouse or villa a condo a modular home or a manufactured home.

- The home can be located in a planned unit development.

- The home must meet the Department of Housing and Urban Developments 4000.1 minimum standards that also apply to homes financed with an FHA loan.

- Theres no set maximum purchase price applicants must qualify for loan repayment, which will impact the maximum price.

- Theres no limit on the amount of acreage that comes with the property.

- There are no seasoning requirements, which means that properties that have been flipped by the previous owner may be purchased. Flipped homes typically refer to a home thats been purchased, renovated and sold within a short period of time.

Debt Ratios 2020 To Maintain Changes Rolled Out In 2014

The program adopted new debt ratio requirements on December 1, 2014. There are no planned updates to this policy in 2020.

Prior to December 2014, there were no maximum ratios as long as the USDA computerized underwriting system, called GUS, approved the loan. Going forward, the borrower must have ratios below 29 and 41. That means the borrowers house payment, taxes, insurance, and HOA dues cannot exceed 29 percent of his or her gross income. In addition, all the borrowers debt payments added to the total house payment must be below 41 percent of gross monthly income.

For example, a borrower with $4,000 per month in gross income could have a house payment as high as $1,160 and debt payments of $480.

USDA lenders can override these ratio requirements with a manual underwrite when a person reviews the file instead of the algorithm. Borrowers with great credit, spare money in the bank after closing, or other compensating factors may be approved with ratios higher than 29/41.

Read Also: Conventional 97 Loan Vs Fha

Single Family Housing Repair Loans & Grants

Also known as the Section 504 Home Repair Program, this USDA initiative lends funds to homeowners who wish to repair or upgrade their homes. The program is available to applicants with incomes that fall below 50% of the local median income who cannot get affordable credit elsewhere, to fund improvements on homes they occupy .

Single Family Housing Repair Loans offer financing of up to $20,000 at a fixed interest rate of 1%, to be repaid over a period of up to 20 years.

Single Family Housing Repair Grants allow applicants aged 62 or older who cannot afford home improvement loans to receive as much as $7,500 for projects that make their homes safer. Individuals can apply for multiple grants over time, but the total lifetime grant amount cannot exceed $7,500. The grant must be repaid if the property is sold within three years of the grant being issued.

Homeowners who can afford to make partial, but not full, repayment on Section 504 loans are eligible to apply for a combination of grants and loans to fund qualified home improvement projects, for total funding of up to $27,500.

The USDA Single Family Housing Section 504 Repair Pilot Program is offering qualified applicants even higher loan and grant amounts in rural areas of California, Hawaii, Illinois, Indiana, Iowa, Kentucky, Maine, Michigan, Mississippi, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, Puerto Rico, South Carolina, Texas, Tennessee, Virginia, Washington and West Virginia.

Usda Loan Eligibility Is Location

There arent many zero-down loans available in the market these days.

Only two major programs the VA loan and USDA mortgage allow for no down payment.

The VA loan requires eligible military service, but the USDA loans eligibility is based on something else: location of the property.

These loans were created to spur economic development in less-dense areas of the U.S. . As such, buyers can use the loan within certain geographical boundaries as published on USDAs eligibility maps.

So, how do you find an eligible property? Its easier than you think.

Also Check: Usaa Auto Refinance Rate

Advantages Of Usda Loans

You might be able to become a homeowner sooner without this obstacle in your way.

Lower interest rates

You can lock in a lower interest rate with a USDA loan than a conventional loan, especially if you have a good to excellent credit score. This could save you tens of thousands of dollars in interest over the lifetime of the loan.

Less expensive mortgage insurance

Although USDA loans do require mortgage insurance called a guarantee fee, it’s much more affordable than private mortgage insurance and FHA insurance. You’ll pay an upfront fee at closing equal to 1% of your loan amount and 0.35% of the loan amount annually .

More thorough appraisal

Lenders order an appraisal to determine a property’s value before finalizing your loan. This ensures they are not lending you more money than the home is worth, protecting their investment. USDA appraisals have stricter guidelines than conventional loans, which could save you from pulling the trigger on a home requiring expensive repairs.

Designed for low-income buyers

If a conventional lender has turned you down because of your income, a USDA loan might be the right option towards homeownership.

What Are The Qualifications For A Usda Loan

To qualify for USDA loans a borrowers income shouldnt be higher than 115 percent of the median income for the region and borrowers must also be able to afford to make the payments. With a USDA loan, the total cost of housing cant be more than 29 percent of your income. Borrowers can check here to see if they meet the income eligibility requirements for a USDA Rural Development Loan.

Recommended Reading: How Much To Loan Officers Make

What Is Considered A Rural Area

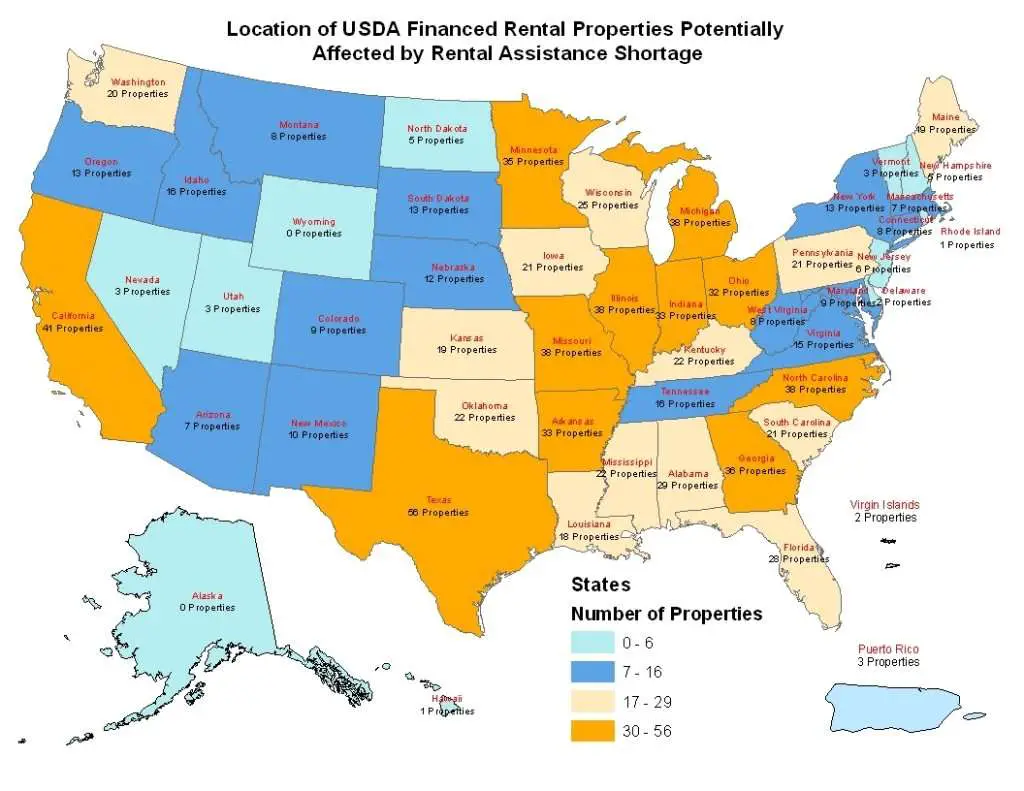

The USDA defines rural by exclusion, meaning that any area that does meet the criteria to be classified as metro/urban is, by default, classified as nonmetro/rural. According to the U.S. Department of Agriculture Economic Research Services Classifications, rural or nonmetro counties arent part of a larger labor market area and typically have open countryside and populations fewer than 2,500, though USDA loans are available in areas with higher populations. The map below illustrates how the borders of metro areas can extend beyond an urban center. Here, a rural area is any area that is not blue or green.

What Is A Rural Area

For a home to meet the USDA’s rural definition, it must be in an area that’s located outside of a town or city and not associated with an urban area

The USDA’s guidelines on the definition of a qualified “rural area” includes:

- A population that doesn’t exceed 10,000, or

- A population that doesn’t exceed 20,000 is not located in a metropolitan statistical area and has a serious lack of mortgage credit for low- to moderate-income families, or

- Any area that was once classified as “rural” or a “rural area” and lost its designation due to the 1990, 2000 or 2010 Census may still be eligible if the area’s population does not exceed 35,000 the area is rural in character and the area has a serious lack of mortgage credit for low- and moderate-income families.

These guidelines are generous in the sense that many small towns and suburbs of metropolitan areas fall within the requirements.

Read Also: Refinance My Avant Loan

Usda Home Loan Income Limits

Guaranteed loans are available to moderate income earners, which the USDA defines as those earning up to 115% of the areas median income. For instance, a family of four buying a property in Calaveras County, California can earn up to $92,450 per year.

The income limits are generous. Typically, moderate earners find they are well within limits for the program.

Its also important to keep in mind that USDA takes into consideration all the income of the household. For instance, if a family with a 17-year-old child who has a job will have to disclose the childs income for USDA eligibility purposes. The childs income does not need to be on the loan application or used for qualification. But the lender will look at all household income when determining eligibility.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Illinois Fha

What Is The Loan Limit In My Area

In most U.S. housing markets, the USDA loan limit for Single-Family Direct Loans is $285,000. But if youre buying in an area with higher housing prices, loan limits may be higher.

For example, in Wake County, N.C., the loan limit is $297,100. In Clark County, Wash., a homebuyer could borrow up to $439,800.

A USDA Direct Loan for a home in Suffolk County, N.Y., or Marin County, Calif., could be as high as $657,900.

You can look up your county here to find out what your USDA loan limit might be.

Usda Loan Income Limits

Because USDA home loans are oriented towards buyers with low- to moderate-incomes, there are set income limits based upon the Kansas county your home is in and your family size. For updated loan limits, feel free to review the USDAs Direct Limit Map or input your information into the Single Family Housing Income Eligibility form today.

Recommended Reading: Can I Buy A Manufactured Home With A Va Loan

How Usda Loan Programs Work

There are three USDA home loan programs:

Loan guarantees: The USDA guarantees a mortgage issued by a participating local lender similar to an FHA loan and VA-backed loans allowing you to get low mortgage interest rates, even without a down payment. If you put little or no money down, you will have to pay a mortgage insurance premium, though.

Direct loans: Issued by the USDA, these mortgages are for low- and very low-income applicants. Income thresholds vary by region. With subsidies, interest rates can be as low as 1%.

Home improvement loans and grants: These loans or outright financial awards permit homeowners to repair or upgrade their homes. Packages can also combine a loan and a grant, providing up to $27,500 in assistance.

Usda Loans Require Mortgage Insurance

USDA guarantees its mortgage loans meaning it offers protection to mortgage lenders in case USDA borrowersdefault. But the program is partially self-funded.

To keep this loan programrunning, the USDA charges homeowner-paid mortgage insurancepremiums.

As of October 1, 2016, USDA has lowered its mortgage insurance costs for both the upfront and monthly fees.

The current USDA mortgage insurance rates are:

- For purchases 1.00% upfront fee, based on the loan amount

- For refinancing 1.00% upfront fee, based on the loan amount

- For all loans 0.35% annual fee, based on the remaining principal balance each year

As a real-life example: A homebuyer with a $100,000 loan size would be have a$1,000 upfront mortgage insurance cost, plus a monthly payment of $29.17 for the annual mortgageinsurance.

USDA upfront mortgage insurance isnot paid as cash. Its added to your loan balance for you, so you pay it over time.

USDA mortgage insurance rates are lower than those for conventional or FHA loans.

- FHA mortgage insurance premiums include a 1.75% upfront mortgage insurance premium, and 0.85% in MIP annually

- Conventional loan private mortgage insurance premiums vary, but can often be above 1% annually

With USDA-guaranteed loans, mortgage insurancepremiums are just a fraction of what youd typically pay. Even better, USDAmortgage rates are low.

For a buyer with an averagecredit score, USDA mortgage rates can be 100basis points or more below the rates of a comparable conventional loan.

Read Also: Can I Transfer My Mortgage Loan To Another Bank

Usda Loan Property Eligibility Requirements

Though USDA loans are often referred to as rural housing loans, you dont have to live in the country or purchase farmland to use them. In fact, you might be surprised at just how much of the country is actually eligible for these loans.

According to the Housing Assistance Council, a whopping 97% of U.S. land is located within USDA-eligible boundaries. Those areas claim about 109 million Americans or around a third of the countrys entire population.*

Buyers in large cities and more densely populated suburbs arent eligible for these loans, but many living in surrounding towns and cities may be. An area with a population of 35,000 or less can be considered rural in the USDAs eyes.

The easiest way to determine USDA property eligibility is to look up the address in the map above. Simply type the property address into the tool, press enter, and youll see if the home is eligible for USDA financing. If the property shows up in a shaded area of the USDA eligibility map, it is not currently eligible.