Does Bluevine Work With Doordash For Ppp Loans

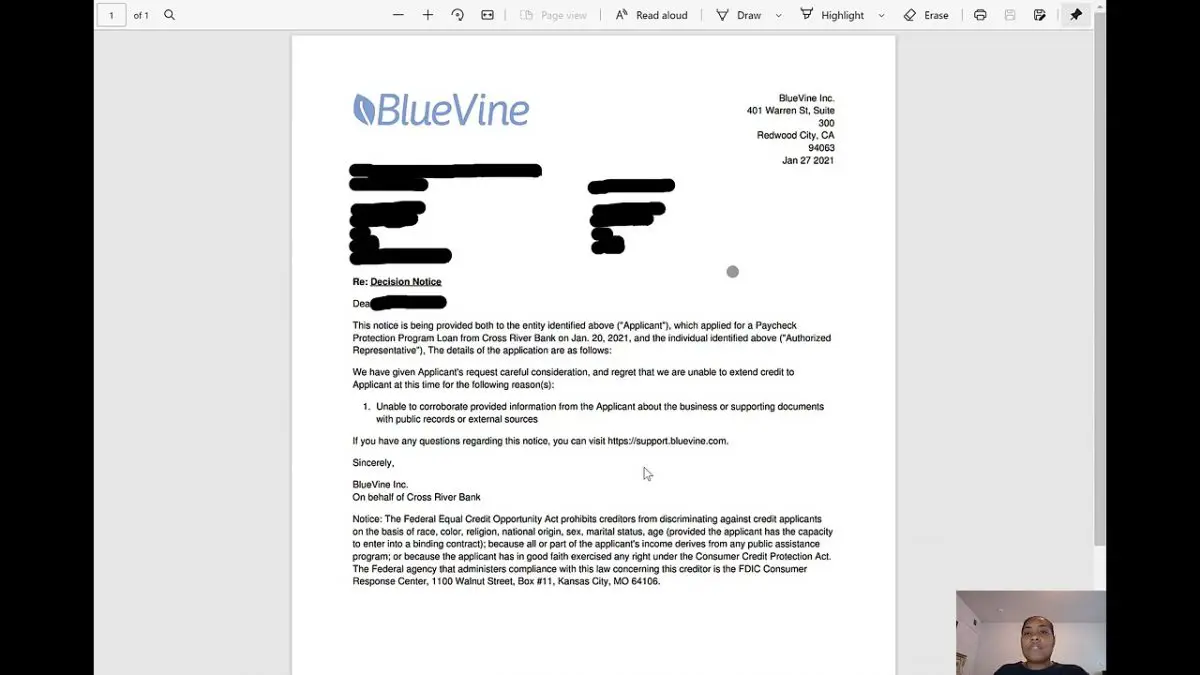

For all matters relating to your PPP loan with BlueVine you will need to work directly with BlueVine and not DoorDash. DoorDash is not a lender of PPP loans and does not take responsibility for any aspects of the PPP loan you receive through BlueVine, including servicing the loan or processing your forgiveness application.

Different Options In Loans For Doordash Drivers

When Doordash drivers want extra funds to meet certain expenditures, they have three fast alternatives for obtaining cash: payday loans , installment loans, and car title loans.

Payday loans are short-term loans that are paid back over a short period of time, whereas installment loans are paid in several months.

In the car title loans, the direct lender will retain the title of the car until you pay the obligation on the due date or in an extension agreed. You retain the car and utilize it as you wish.

Let´s see them in more depth.

The loans available without credit score checks and without Teletrack scrutinies are:

- Cash advances and . Payments are due in two weeks to a month.

- Installment loans: They have lower APR than payday loans and can be returned in monthly installments.

- Car title loans: These loans are issued with a registered vehicle as collateral. The vehicle can be used by the borrower as normal.

Please allow me to dedicate one paragraph to each of these financial instruments.

Can I Request More Money If I Used Net Profit

If you applied for PPP as a self-employed individual using net profit, you may discover you could get a larger loan by using gross income. The change in calculation methods is not retroactive. The IFR states that it applies to loans approved after the effective date.

However, it appears that whether you can get a larger loan amount depends on the status of your loan. Information provided by SBA to lenders states that a lender may cancel a PPP loan application and submit a new application on behalf of the borrower all the way up to the point where the loan funds have been disbursed to the borrower but a Form 1502 has not been submitted by the lender to the SBA.

Once the loan has been disbursed and the lender has filed Form 1502 with the SBA, there is no option to reapply for a larger amount.

Contact your lender if you have already submitted a loan application based on Schedule C net profits and have questions about the new calculations.

Keep in mind that if you already qualified based on the maximum owners compensation of $20,833 based on net profit on your Schedule C there is no need to do anything. .

Recommended Reading: How Long Does Mortgage Loan Underwriting Take

Precisely What Do Independent Contractors Fool Around With Eidl To Possess

Instead of other bodies offered funding, the brand new Financial Burns Crisis Financing currency can be used for whatever of ones enterprises means that have maybe not of numerous constraints. New constraints is basically personal debt sustained before the COVID-19 pandemic, commission of returns to help you people or carry out regarding actual harm so you can possessions.

Uber drivers qualify Small business Commitment finance. The fresh new advent of Uber produced very good-can cost you performs available to of a lot whom you are not if you dont getting incapable of see a career. Because a keen Uber driver, you just need an automobile and you can a permit and you can also come promoting above and beyond minimum-wage.

Personal Loans For Doordash Drivers

These direct lenders already work with Doordash drivers and understand that the income of a dasher is not regular and might have huge variations every month.

They would decide almost immediately upon the completion of your form and transfer the funds to your checking account the next day or even the same day at night.

Read Also: What’s The Longest Personal Loan Term

Typical Issues The Drivers Come Across

In the United States, those who are not as reliant on their vehicles as delivery drivers can afford to make temporary plans to get to work or do other things before the car is fixed and ready to go. For experienced drivers, the truth is different.

For example, to continue working, independent delivery drivers need to repair their vehicles, as the doordash paycheck depends entirely on the serviceability of the car.

Therefore, the consequences of not being able to pay for the repair of the vehicle might be devastating. In this case, doordash drivers need personal loans.

How Could Doordash Drivers Need Loans

Many individuals, particularly the people who dont depend on their vehicles however much Doordash drivers, can stand to make other transportation plans to go to and from work or to perform other essential assignments until their vehicle is adjusted and ready to be used once more.

In any case, Doordash drivers should fix their vehicles to work. Hence conceivable neglecting to pay for car support might have negative repercussions.

On account of self-employed entities, for example, Doordash drivers, they are not viewed as laborers in the customary sense. To put it another way, being acknowledged for customary portion credits, loans, or payday advances for Doordash drivers is on a fundamental level hard for them to do.

Note:Dashers have found that to continue to dash, they should subscribe to the new refreshed Doordash Independent Contractor Agreement, which was simply updated again in 2021.

Also Check: How To Get 500k Business Loan

Starting The Application Process Through Womply

Womply.com makes software that helps businesses with customer management. They put together an extensive list of information and FAQ’s about the PPP Program for their customers, made up of business owners and sole proprietors. I found their information extremely useful when researching my article about the PPP for gig economy workers.

Womply also established relationships with lenders who are approved with the SBA, and provided an easy one stop place to enter your information and get directed to a lender that can help the business owner and contractor. I decided to apply through them, and I also established a referral relationship with them .

The initial signup was pretty easy. You fill in some basic information.

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Also Check: How Long Does An Auto Loan Approval Take

What Loans Are Appropriate For Doordash Drivers

Luckily, there are many reliable loan choices, which offer a wide decision of individual credits for conveyance drivers.

In the event that you want critical cash to take care of unexpected expenses, you can utilize the web-based administration of a capable loan specialist. You will be given a present moment doordash credit, which requires no credit check.

For this situation, it will be the appropriate answer for your obligation circumstance, and on account of a dependable help group, you will actually want to figure out any arisen monetary issues in brief periods.

I Bought An $85k Tesla Model S To Drive For Uber And Lyft

Driving a Tesla for Uber and Lyft is that a good idea? That may be many drivers first thoughts when hearing this story below, but its true and its paying off big time for RSG reader and rideshare driver Shannon J.! He shares what its like driving a Tesla for Uber and Lyft, including the cost of the vehicle, fuel costs, and tips for electric vehicle drivers.

Heres what readers are saying:

Some drivers were skeptical about Shannons return on investment with a Tesla:

No way. I dont care how much he is saving on gas

If you compare it to a Prius, he would need to save $50,000 in gas to be less expensive. At four dollars a gallon and 40 miles per gallon with the Prius, thats 500,000 miles of gas.

No way he can make up the difference in the life of the car.

Other drivers, on the other hand, were positive about the idea of using an all-electric vehicle for Uber and Lyft, but expressed concerns about home charging:

Was thinking of doing this, getting a Tesla Y to use as Uber XL / Black SUV etc. as well. But I rent my home, and there is no free supercharging for these newer vehicles. So it is something to think about. Only year 16′ and older have free supercharging on them and their range is barely over 200 miles. That is whats stopping me. Might go for a Highlander Hybrid instead. Less of a headache with the charging.

Chime in on the discussion here.

Also Check: How Much Will The Va Home Loan Give Me

Where Can An Independent Contractor With Doordash Uber Eats Grubhub Postmates Lyft Etc Get More Information About The Sba Paycheck Protection Program Loan

I’ve found a lot of information out there, most which says the same thing. Generally they’re putting out the wording and the language put out by the Small Business Administration.

The best assembly of information that I’ve seen out there, especially for self employed individuals, was assembled by Womply.com .

Womply provides business software, generally for other types of businesses. I’ve been incredibly impressed with the depth and quality of their information.

Womply also has a portal where you can apply for a Paycheck Protection Program loan and they’ll get you in touch with lenders.

Update: The deadlines have passed for the original rounds of funding. However, in December 2020 congressional leaders have approved a new stimulus. At that time the portal will be available again, and I’ll have a link for the renewed portal.

Here’s a list of articles if you want to dig further into the program:

Is Additionally Doordash Pros Rating Ppp Mortgage

For those who have schedule C money, you actually qualify for PPP funding. The Laws and regulations once the often means Big bucks so you can has actually Plan C anyone! Tell you advantages, artisans, Uber/Doordash/Postmates anybody, Vrbo/Airbnb citizens, freelancers, Upworkers, and much more! Its able to incorporate, together with your capital will be one hundred% forgiven!

Don’t Miss: Should I Refinance My Va Home Loan

Personal Loans Best For Installment Plans

- Loans from $500 to $35,000

- Large lender network

| 3 to 72 Months | $4,000 loan at 15.0% APR = $193.95/month for 24 months |

PersonalLoans.com stands out as a matching service for personal loans in amounts much larger than those available from its competitors. You can arrange a loan repayment term long enough to make the monthly payments of even large installment loans affordable. Prequalified applicants will be 18+ and U.S. citizens or residents with dependable monthly income, a Social Security number, and an active bank account

Personal Loans is one of the few lending services out there today that offers you the choice of dealing with two separate networks of lenders.

One of these networks consists of lenders that specifically cater to those with bad credit ratings. Neither of these networks requires you to pay any hidden fees or extra costs.

you only have to provide basic information before accepting any invitation.

It takes only minutes on this platform to connect with borrowers, as that is how much time it takes to fill in the online form. This form does not require too many details, and you will find you can complete it in no time.

Your application will then be forwarded to the relevant lenders, who have the option of choosing to approve or disapprove of your application.

Features

The following are the main features of Personal Loans:

Pros

- Not available in a few U.S. states

Customer Experience

What Does This Mean If You’ve Already Applied And Been Funded

Those of us who applied under the old rules are, unfortunately, stuck under the old rules.

SBA’s Interim Final Rules on PPP Loan Calculations and Eligibility.

Hopefully you can tell by now, things are always changing. Many are putting pressure on the government to make this retroactive.

At this point, those of us who have already been approved for the Paycheck Protection Program probably won’t be able to apply for the difference between what we did receive and what we would have received under the new calculations.

The best thing I can tell you is keep an eye on things. You never know if things will change.

To me it would make sense. It feels kind of like we’re being penalized for being on top of things.

Read Also: How Do Mortgage Lenders Determine Loan Amount

Installment Loans And Instant Approval

Installment loans for Doordash drivers are a kind of short-term financial instrument that is available from direct lenders. This option falls somewhere amidst personal loans and cash advances in terms of costs and convenience .

In contrast to payday loans or cash advances, you may borrow substantial sums of money and return them to the lender over a longer period of time and lower APR.

Installment loans are an acceptable option if you require more than $ 1000 and have a bad credit score.

Our installment loans online do not have any credit check at all, and they enjoy almost instant approval if the eligibility requirements are met, such as being able to pay the corresponding installments evidenced by the demonstration of a recent source of income.

Furthermore, installment loans can be split into several months and have lower interest rates than payday loans . These loans are suitable if you request more than $1000.

So, with installment loans, you do not have to repay everything in two weeks or in one month or at your payday. In installment loans, you have to pay the installment every month, so the total loan amount is split over several months and does not stretch your budget so much.

Prospective borrowers possessing credit scores below 580 encounter distress to become eligible for conventional loans for Doordash drivers. Moreover, when a hard inquiry is performed to the credit bureaus, the credit score becomes slightly affected, once more.

Exactly Why Is It So Very Hard Pick An Uber

Uber and you may Lyft is actually against a supply manage off, since during the last and you may has just vaccinated pages immediately following once again flooding brand new software, only to understand listed here are perhaps not sufficient people hence you can easily suffice them. It is sooner fees fund Louisiana leading to extended hold off minutes and you may better costs taking bikers.

Recommended Reading: How Long Does An Auto Loan Approval Last

Can I Use Ppp To Refinance My Eidl Loan

Some borrowers have received both a PPP loan and an Economic Injury Disaster Loan . There are some very specific but limited circumstances where you can refinance an EIDL loan with PPP. Pay careful attention to the dates here!

- You must use PPP to refinance your EIDL if you received EIDL loan funds from January 31, 2020 through April 3, 2020 and used the EIDL loan funds to pay payroll costs.

- You may use PPP to refinance EIDL loan funds received from January 31, 2020 through April 3, 2020 and you used the EIDL loan for purposes other than payroll costs.

- You cannot use PPP to refinance an EIDL loan if you received EIDL loan funds before January 31, 2020 or after April 3, 2020. This is the majority of borrowers.

Doordash Loans In The Usa:

Luckily, in the USA individual advances for doordash drivers are dependably accessible. Since conveyance drivers have work autonomy, all through their normal working day, they are liable for every one of the expenses of tasks.

This accepts they cant work assuming that they wind up between a rock and a hard place financially taking care of the expense of fuel.

There are numerous inward issues that can happen with your vehicle inside a solitary week. Such unsavory circumstances beat your money and obliterate your work plans.

For instance, in the event that new tires or mechanical upkeep is expected for the vehicle, the drivers working for doordash or another conveyance organization need to have the cash to take care of those expenses to work.

Consequently, we will investigate credits for conveyance drivers.

Note:As Dashers for DoorDash, drivers are not viewed as workers of the business and accordingly shouldnt anticipate getting cash from it in return for their administration. Similarly, those autonomous drivers who work for Uber might get advances from outsider loan specialists, drivers at DoorDash can do likewise assuming their income and bank records are palatable to the moneylender.

Read Also: How To Pay Towards Principal On Car Loan