What Are Your Plans

There are plenty of reasons to take out a loan, but what you need the money for can help you decide which loan is the better fit. If you are considering completing some home renovations, you may be able to deduct the loan interest with a home equity loan.

But if you dont own a home or want to consolidate your debt, a personal loan may be the better fit for your needs. The timeliness of your plans could also impact which loan is a better fit for you, which well discuss later.

Who Should Consider A Home Equity Loan

Taking out a loan against the value of your home is something you might consider if you have to pay for something but dont have the cash to do so, says Michael Caligiuri, CFP, founder and CEO of Caligiuri Financial.

One of the most common reasons to get a home equity loan is for home remodeling and improvements. Utilizing a relatively low-interest loan, especially if it is to cover the cost of a major home improvement or renovation, could be a smart financial move, says Pepper. This is because the improvements or renovations can increase the value of your home in the long run and improve your quality of life.

Another good reason to get a home equity loan is to consolidate debt, which can save you a lot of money in the long run if you have a large amount of high-interest debt you anticipate needing a long time to pay off. How much you can save will depend on how much debt you have, the interest rate on your current debt, and the interest rate you can get on a home equity loan.

But, since home equity loans come with fees and closing costs, make sure you do the math to determine whether youll actually save enough in interest over time to offset the upfront costs. And, think carefully before you consolidate unsecured debt into a secured home equity loan, as that increases the risk to you in the event that you default.

What Can I Use The Money For

Its your cash, its up to you! One benefit of borrowing money with a lower interest rate is to help consolidate and pay off higher rate debt, like credit cards, or old bills. You can also use the money to help finish the home project youve always wanted to do, or finally take that vacation youve dreamed up. Additionally, cash-out refinances are a great option to help pay for education like college, trade courses, grad school and more. Keep in mind that there are tax implications with a cash-out refinance. If you use the funds to make home improvements, then the interest paid on the loan is typically tax deductible. Speak to your tax advisor for more details on IRS rules related to how youll use your funds.

Don’t Miss: How To Eliminate Pmi Insurance On Fha Loan

How Second Mortgages Work

If youre considering a home equity loan or home equity line of credit, its important to understand how these second mortgages work.

One important point is that you keep your existing mortgage intact. You continue making payments on it as youve always done.

The home equity loan or HELOC is a second, separate loan with additional payments due each month. So youd have two lenders and two loans to make payments on.

Can I Get A Second Mortgage

Youll need to demonstrate good creditworthiness to qualify for a second mortgage. Aim for a credit score of 700 or higher and a debt-to-income ratio of 36% or lower to be eligible for lower interest rate and more preferred terms, says Orefice. Youll also probably need at least 20% equity accrued in your home.

As with any form of financing, its wise to have your financials and paperwork in order before attempting to apply for a second mortgage. Gather recent pay stubs, bank and investment account statements, proof of employment, and the last two years of tax returns, as the lender will likely request these documents.

To learn more, see our guides to home equity loan requirementsand home equity line of credit requirements.

Read Also: Best Home Loan Interest Rates

How To Qualify For A Home Equity Loan

You need an appraisal to qualify for a home equity loan, but you dont have to go out and spend $500 to $750 hiring an appraiser yourself, says Robert Heck, vice president of mortgage at Morty, an online mortgage broker. Most lenders will want to do an appraisal in-house, he says, so that step will probably come after youve selected a lender.

If you want an estimate of how much your house is worth before applying for a home equity loan, use free online tools from real estate marketplaces like Zillow or Redfin, or check if your primary mortgage lender can help. Some lenders actually have these systems available to consumers early on in the process, Heck says. And they may not charge for it.

Say your current home value is $500,000 and your remaining mortgage balance is $200,000. The portion of the home you outright ownyour equityis $300,000. Put another way, you have 60% equity the other 40% is owned by the financial firm that holds your mortgage.

Lenders typically require home equity loan borrowers to maintain at least 20% equity. That means you can borrow up to 80% of your current home value between your existing mortgage balance and your new loan. Heres the formula, using the numbers from the example above:

- $500,000 x 0.80 = $400,000

- $400,000 $200,000 = $200,000

Rate & Term Refinancing

If you want to lower your current interest rate and/or change the term length of your mortgage, then this option might work for you.

- Your home value must be greater than the amount owed on the mortgage.

- Appraisal fees and closing costs may be required.

- Use our Refinance Calculator to see if refinancing will be worthwhile

Don’t Miss: How To Find The Loan To Value Ratio

What Is A Home Equity Loan And How Does It Work

Getty

If you need money to cover life’s big expenses, tapping into the equity in your home can be a smart option. One way to do that is by getting a home equity loan. In the post below, I’ll describe what this loan is, how it works, and how to qualify for one of your own. Keep reading to learn if this financial move makes sense for you.

What is a home equity loan?

A home equity loan is often referred to as a second mortgage because that’s truly what it is. It’s a loan that lets you borrow against the value of your home. Often, this type of loan can be a way for homeowners to access large sums of money to pay for life’s big expenses. It’s not uncommon to see someone take out a home equity loan to finance home improvements, to cover medical debts, or to assist a child in paying for his or her education.

Home equity loans are often an attractive source of funding because they’re available at lower interest rates than credit cards or personal loans. However, be aware that those low interest rates come with a high amount of risk. Lenders feel comfortable offering lower rates because these loans are secured by your home, meaning that the lender can foreclose on you if you decide to stop making your payments.

How does it work?

With each payment, you’ll always be paying down a portion of both the principal and the interest. Also of note, home equity loans come with fixed interest rates.

Qualifying for a home equity loan

To find out how much you can borrow, follow this equation:

Who Should Not Consider A Home Equity Loan

Just because you have equity in your home doesnt mean you should borrow against it. Taking on any kind of debt can have a huge impact on your financial life, and this decision should not be taken lightly. Before you take out a home equity loan, think carefully about how youre going to use the money and whether you truly need to finance the expense or if its something you can save up for instead.

You should not take a home equity loan for personal expenses such as a boat or fancy vacation, says Lindsay Martinez, CFP, who owns financial planning firm Xennial Planning in San Juan, Puerto Rico.

Because home equity loans are secured by your house, you run the risk of losing your home if you default. Thats why you should be extra careful not to borrow excessively and to make sure you have a plan to pay back the loan.

You May Like: Can You Pay Off Mortgage With Home Equity Loan

How Does A Home Equity Loan Work

A home equity loan, also known as a second mortgage, enables you as a homeowner to borrow money by leveraging the equity in your home. The loan amount is dispersed in one lump sum and paid back in monthly installments. The loan is secured by your property and can be used to consolidate debt or pay for large expenses, such as home improvements, education or purchasing a vehicle. Both the interest rate and monthly payments are fixed, ensuring a predictable repayment schedule.

Here are some of the most commonly asked questions.

How To Qualify For A Heloc

Just like with the home equity loan, the HELOC has a set of qualifications you have to meet in order for a lender to work with you. Again, they’ll vary from lender to lender, and this is why shopping around is so important. You don’t want to cheat yourself out of a good rate because you went with the first lender that offered. If you’re a member of a Credit Union with good standing, you’re more likely to be pre-qualified and approved with a chance at a lower APR. The basic qualification requirements are below.

- Ideally, you’ll have a credit score of at least 680 or higher. There are lenders that work with people who have credit scores of 650, but you pay more in interest.

- Combined loan-to-value ratio. This is a core requirement. You get it by finding out the value of your home and dividing it by any other loan you have to secure your property and your remaining balance owed on the home.

- Your debt-to-income ratio should be no higher than 45%.

- You should have no history of bankruptcy or foreclosures.

- Employment length and monthly income

- Strong payment history with proof you can pay the line of credit.

The lower your credit score is, the less likely it is that a lender will take a chance and offer you a HELOC. If you do qualify at a lower credit score, you’ll pay for it with much higher interest rates because the lender sees you as very high-risk for defaulting before you pay it in full.

Don’t Miss: How Many Loans Does The Average Loan Officer Close

What Is A Reverse Mortgage

A reverse mortgage or home equity conversion mortgage is a loan that turns part of your home equity into cash. This loan gives you added income or credit without selling your home or increasing your monthly payments.

Reverse mortgages are popular among people of retirement age, as it gives borrowers more monthly funds and can help pay down other bills. However, a reverse mortgage can also eat up your home equity and ultimately lower your assets.

Keep reading to learn more about how reverse mortgages work, what kinds of reverse mortgages are available, and whether reverse mortgages are right for you.

- Unsolicited emails, mail, calls, etc.

- Companies that advise you not to talk to your financial advisor

- Anyone who charges fees for learning more about reverse mortgages

Below are some of the more common reverse mortgage scams. Remember that new scams pop up all the time, so be smart about who you share your financial information with.

Foreclosure Scams

This scam targets seniors in danger of losing their homes. These lenders promise a reverse mortgage to help stave off foreclosure. However, reverse mortgages still require you to pay home upkeep, taxes, insurance, and homeowner’s association fees.

Other options can help you keep your home if you are facing foreclosure. Talk to your financial institution or advisor about your options if you’re facing foreclosure on your home.

Home Equity Theft Scams

House Flipper Scams

Relative or Financial Planner Scams

Home Contractor Scams

What Is Your Credit Situation

If you dont know what your credit report looks like, be sure to check before deciding which loan to choose. If you have good to excellent credit, you can qualify for a personal loan and take advantage of their lower fees. However, if you have a poor credit score, a personal loan may not be possible to get.

If you own a home and have some equity, a home equity loan may be the better choice for you. Keep in mind that you may not be able to qualify for better interest rates if you apply for a home equity loan and you have shaky credit.

You May Like: What Is The Lowest Car Loan Rate

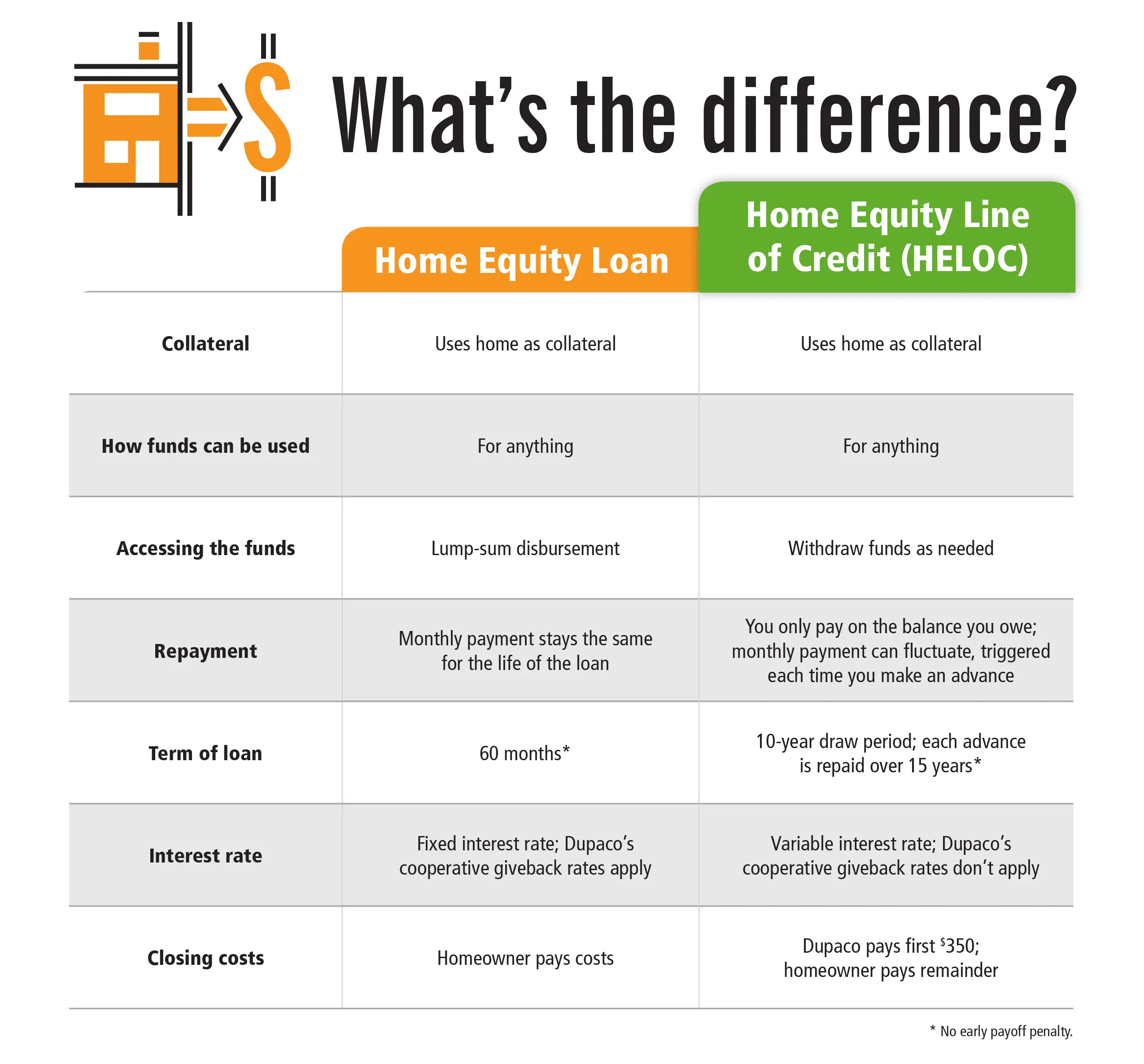

Home Equity Loans Vs Helocs

A home equity loan and a home equity line of credit, or HELOC, are both types of second mortgageways to leverage the wealth youve built in your home to get access to cash.

In both cases, you need an appraisal of your home to determine its value, and a lender will evaluate your credit score and other financials to decide how much you can get.

Youll need to repay what you borrow from either a home equity loan or a HELOC, but the timing and size of the loan and repayments differ. A HELOC is similar to a credit card, Heck says. You have access to cash for a preset amount of time known as the draw period, which is usually 10 years. Youll have to make interest-only payments during that time, and rates are variable. When the draw period is up , you start repaying what you borrowed, with interest. The repayment period for a home equity loan begins immediately after you get the cash.

While the mortgage you get when you first buy a house can include exorbitant closing costs, home equity loans and Helocs typically dont include those fees. If theyre not free, they are usually fairly inexpensive, says Alexander.

Another tool for tapping home equity is a cash-out refinance. This method requires taking out a new loan thats larger than your existing mortgage balance so that you can pay off the debt and pocket some cash. Your new mortgage will have a lower interest rate, too, which may lower your monthly payment.

Home Equity Line Of Credit

A home equity line of credit, or HELOC, is a line of credit that uses your home as collateral. Just as with home equity loans, you can be approved for an amount of up to 85% of your equity, depending on your repayment ability. Unlike home equity loans, lines of credit tend to feature variable interest rates as opposed to fixed.

This line of credit is similar to a credit card, except it only lasts for a limited time. Lenders provide you with a draw period , during which you can take money out of that line of credit up to the original agreed amount youll only need to pay interest during this period. After that time is over, youll begin to make monthly payments on the amount you borrowed for a fixed term of five to 20 years.

One of the advantages of a HELOC is the flexibility of borrowing small amounts as you need them , as well as the draw periods interest-only payments.

Recommended Reading: How Do Car Loans Work With Interest

Mortgage Refinancing For Dummies

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Mortgage Refinance: Quicken Loans, AmeriSave, Rocket, New American Funding, Guaranteed Rate, Magnolia Bank, Credible, Figure, Beeline, AAG, and Zigzy.

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

For example, when company ranking is subjective our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don’t click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process,

Advantages Of A Home Equity Loan:

- When used well, money from a home equity loan can act as an investment of sorts. For example, if you use the money to do a value-added renovation project, you increase the value of your home, which increases your equity.

- Both a home equity loan and a home equity line of credit usually have a relatively low-interest rate and low fees, typically much lower than a personal loan or credit card debt.

- The interest you pay may be tax deductible if the debt is within limits and the money is used to buy, build or substantially improve your home.

- A home equity loan has fixed monthly payments that you can count on over time. A HELOC is flexible while you are pre-approved to a certain amount, you only take the money you need when you need it, and you pay the loan down as you go.

Also Check: Can You Refinance Your Car Loan With The Same Company