What Is A No

Lets dive a little deeper into the definition of a no-closing-cost mortgage. When you buy a home, there are a number of different costs and fees that go into what is broadly referred to as closing costs. The amount can vary, but depending on a variety of factors, they can quickly become pretty substantial. Applying for a no-closing-cost mortgage helps with these fees, as the lender will commit to paying them up front and making their money up on the back end by charging a higher interest rate for the duration of the loan.

Recommended Reading: Usaa Car Loans Credit Score

How Long Do You Pay Pmi On An Fha Loan

Minimum Credit Score. To qualify for an FHA loan, you must have a credit score of at least 580. This includes both installment loans and revolving accounts such as credit cards. If you donât meet this requirement, itâs unlikely that youâll be able to buy a house with an FHA loan.

Refinancing a mortgage refers to taking out a new loan to settle an earlier one. The procedure is straightforward you receive a new mortgage with lower interest rates and a bigger loan amount than the one you now have. The rate of interest is the primary distinction between a refinance of a mortgage and a refinance of a home equity loan.

There are many different types of loans available, but one type of loan has made a huge impact on homeownership over the last ten years: the FHA loan. With lower down payments, FHA loans make homeownership easier to obtain. Even though FHA loans have been around since 1934, it was not until the mid-1970s that they began making a comeback. These low-down payment mortgages were created to help homebuyers purchase homes for low incomes.

What Are The Benefits Of An Fha Home Loan

FHA loans are a type of non-conforming loan available through private lenders. They are government-insured loans designed with low- and moderate-income wage earners in mind. Essentially, FHA loans are an option for borrowers who might not qualify for a conventional loan. They typically require only 3.5% down and are available even to those with past credit problems and lower credit scores.

FHA loans are also designed with some debt-to-income ratio limit flexibility, and can be manually underwritten. That means the decision to approve isnt left to an algorithm borrowers have an opportunity to explain why their credit problems are behind them to a human being.

Next, lets take a look at what your closing costs are comprised of with an FHA loan, and some strategies for reducing them

Don’t Miss: Do You Have To Be Married To Use Va Loan

Fha Loan Benefits And Advantages

FHA loans can go as high as 57% debt-to-income ratio with an automated underwriting system approval. Conventional loans can only go as high as 45% DTI. What does this mean? This allows the home buyer to purchase a higher sales price home. Lots of times, the higher DTI decides if a borrower qualifies for a home loan or not.

Prepaid Taxes And Insurance

Two big upfront costs are your prepaid property taxes and homeowners insurance. These arenât closing costs, but you will need to pay them before you take possession of the home, so youâll need to account for them in your homebuying budget.

Youâll pay the first year of taxes and insurance upfront . Thatâs one reason closing costs are so variable. If the local property taxes are high, they can add substantially to the amount of money needed upfrtong to close.

Same goes for homeowners insurance. Fortunately, you can â and should â shop around for the best rate. You may be able to save money by bundling your homeowners insurance with other policies, such as your car insurance.

If calling around to multiple companies for quotes sounds overwhelming on top of all the other to dos associated with buying a house, you can go through an insurance agency. Theyâll shop around for rates for you and can help you get set up with a new policy.

You May Like: What Is The Maximum Home Equity Loan Amount

Rolling Closing Costs Into Fha And Va Loans

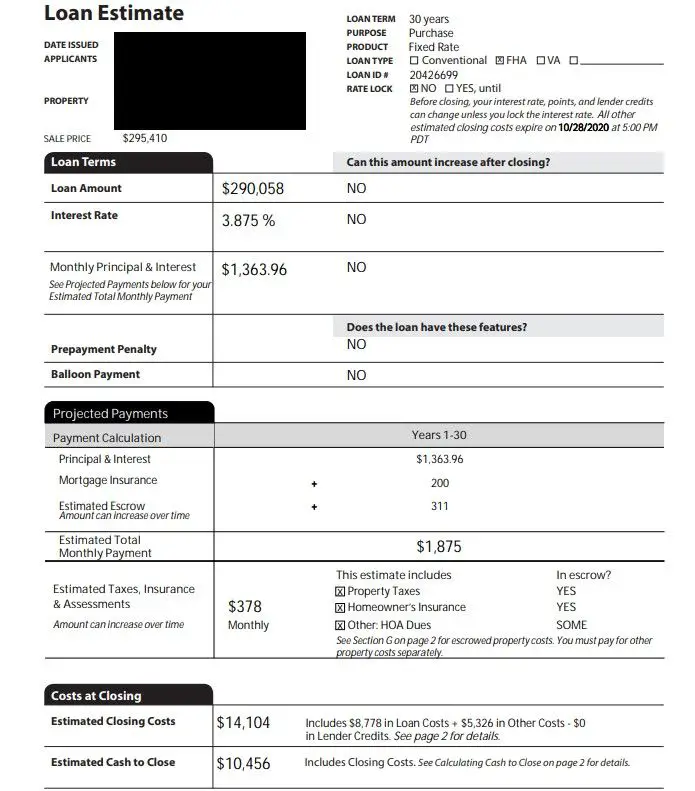

FHA and VA loans have some unique features and fees that require additional consideration when deciding if you want to roll your closing costs into the loan. You should discuss all features of the loan program with your lender to make sure you fully understand your obligations as a borrower.

FHA loans require the borrower to pay an upfront mortgage insurance premium . The UFMIP is generally 1.75% of your loan amount, and it can be rolled into the loan amount. There is one caveat: FHA loans require a minimum 3.5% down payment, not counting your closing costs. This means if you’re borrowing $100,000, you are required to pay at least $3,500 toward your down payment in addition to your closing costs.

VA loans require the borrower to pay a VA funding fee, which can be financed. This fee goes directly to the Department of Veterans Affairs to help cover losses and keep the loan guarantee program viable for future generations of military homebuyers. The amount of your VA funding fee will depend on your type of service and whether this is the first time you are obtaining a VA loan.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

What Is An Fha 203 Renovation Loan

If the home youd like to buy with your FHA loan doesnt meet the U.S. Department of Housing and Urban Development s livability standards, you might consider applying for a FHA 203 renovation loan to complete the repairs needed to make the home safe and sound. When the repairs are completed, you may move into your newly renovated space and the loans will be combined into one monthly payment.

Read Also: How To Loan In Bank

Closing Costs For Fha Loans

Closing costs encompass all the fees and charges owed at the closing of a mortgage. The FHA outlines “allowable” closing costs that may be reasonably charged to the borrower. The non-allowable costs are paid by either the seller or lender. Some closing costs are charged by the mortgage lenders, and others come from third parties such as home appraisers and title companies.

Can You Roll Closing Costs Into A New Mortgage

If your mortgage is for a new purchase, directly rolling your closing costs into the mortgage may not always be possible. However, there are other ways to save on your upfront expenses. You can reduce your down payment to decrease your out-of-pocket expenses at closing. However, keep in mind that a reduced down payment increases the LTV ratio. If your LTV goes above 80%, you’ll typically need to pay private mortgage insurance .

You could also try to negotiate a “sellers concession,” in which the seller of a property will pay for certain fees on the buyer’s behalf. Whatever you save on loan fees in this way can be put toward your down payment, reducing the overall upfront expense of the mortgage. However, sellers won’t make such concessions unless they’re willing to accept a lower net profit in exchange for a better chance at closing the sale.

Rolling closing costs into a refinance is permissible as long as the added costs don’t push your total loan over the lender’s LTV and DTI thresholds. Additionally, the increased loan amount cannot exceed the maximum loan-to-value ratio your lender is willing to extend. For example, if your home is worth $100,000 and the maximum LTV is 80%, your lender will lend you only $80,000. That number will not be extended to accommodate closing costs.

You May Like: How Do I Check Student Loan Balance

Ask The Seller To Foot The Bill

With an FHA loan, you can ask the seller to pay for some of your closing costs to help cut down your expense. This can be a tough demand to make in todays housing market, however, since sellers are garnering lots of offers these days. Every neighborhood is different, though, so, if the seller doesnt have other fish on the line and really wants to make a deal, you have some leverage that you might be able to convert to savings.

Do Fha Closing Costs Include The Down Payment

The down payment is not included in the closing costs and they are treated separately. FHA guidelines are clear that the borrower needs to come to the table with a minimum of 3.5% for the down payment even if that money is a gift. The closing costs can be funded by the seller, the lender, or any extra gift funds that are leftover.

Recommended Reading: What Is Deferred Student Loan

Where To Get An Fha Loan

FHA loans provide home buyers with an easier path to entry. You can get an FHA loan with a credit score as low as 500 if you can make a 10% down payment. You can also get an FHA loan with a 580 credit score and a 3.5% down payment. Conventional mortgages have a 620 credit score minimum, making them out of reach for some homeowners.

FHA loans make it easier for potential homeowners to buy their first home. loanDepot would be happy to provide you with this loan and help you on your path to homeownership. loanDepot offers home loans and mortgage refinancing to help you save money. Consumers have obtained over $275 billion in financing from loanDepot and over $179 billion for mortgage refinancing. You can fill out loanDepots form to learn more about their home loan options and get your FHA loan today.

What Closing Costs Will You Have To Pay With An Fha Mortgage

Most of the closing costs you’ll have to pay are the same expenses, regardless of the type of mortgage you get. For example, most lenders will charge mortgage applicants a fee for running their credit report and any county taxes are the same, regardless of how you finance your home purchase. On the other hand, some can be more expensive with an FHA loan and others are unique to this type of mortgage. Here’s a list of the most common FHA closing costs you can expect to pay when you obtain an FHA mortgage loan.

Mortgage insurance premium: Most mortgages with a down payment of less than 20% require the borrower to pay mortgage insurance on an ongoing basis, but FHA loans have an up-front mortgage premium as well. This is equal to 1.75% of the loan amount.

Prepaids and escrows: FHA mortgages, like most others, require the borrower to prepay a certain amount of property taxes, insurance costs, and/or mortgage insurance premiums, and put a certain additional amount for future use into an escrow account at closing. These costs can vary significantly depending on where the home is located.

Origination fees: FHA lenders typically charge an origination fee, but for this specific loan type, the origination fee is capped at 1% of the principal amount. In other words, if you obtain a $150,000 FHA home loan, your origination fee can be as much as $1,500.

Read Also: What Is The Loan Payment Calculator

Accept Gifts From Benefactors

There are rules in place regarding the use of gift funds when applying for a mortgage. Home buyers getting conventional mortgages will find that they must be able to account for the money in their bank accounts. Lenders will generally want you to explain any gift thats over half the amount of your households monthly income.

If your parents give you a $10,000 gift toward your home purchase, and that $10,000 suddenly appears in your bank account as you begin the home buying process, youll likely have to provide a gift letter to prove that those funds do not need to be repaid.

With an FHA loan, you must comply with the FHAs regulations to qualify. It allows you to use gifts from these sources toward your down payment and closing costs:

- Borrowers family member

- Borrowers employer or labor union

- A close friend with a clearly defined interest in the borrower

- A charitable organization

- A governmental agency assisting low/middle-income families or first-time home buyers

No Closing Costs Loan Good Idea

This page updated and accurate as of September 22, 2022 FHA Mortgage Source

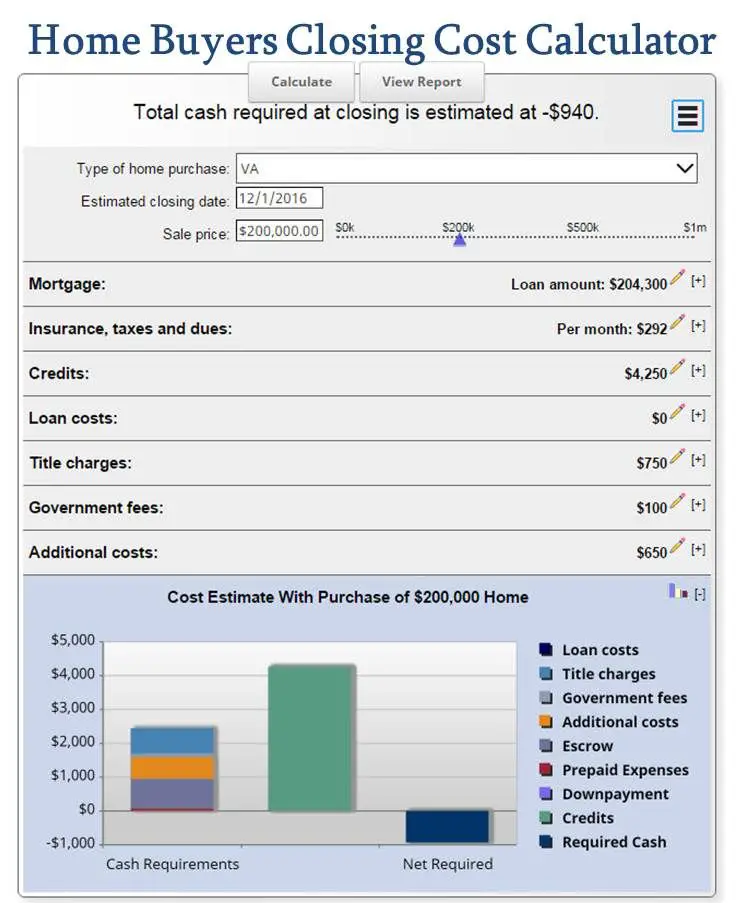

We often hear about lenders and banks offering No Closing Costs mortgages that are supposed to save homebuyers money. But does it in fact save borrowers money and is this option in the home buyers best interest? The short answer is it depends on the home buyer. Let us explain below:

All home loans regardless of loan program type will have closing costs associated with them. These closing costs will generally range around 3% of the total home purchase price. Keep in mind the majority of the closing costs dont have anything to do with the lender as a lot of the costs are related to government taxes, doc stamps, title-related fees, appraiser, inspector, surveyor, and the list goes on.

What some lenders can do is offer to pay all buyers closing costs which looks great on the surface. However, we all know things are rarely free in this world and the lenders are often accomplishing this by increasing the loans interest rate. Lenders make more money through higher tiered pricing and rates. As a result, this extra spread can be used to assist the buyer through lender paid closing costs.

Example:

- Option #1 Buyer purchases a home for $150,000 and the closing costs are $5,000. The current interest rate is 3.5%.

- Option #2 The buyer can take a no closing costs option and pay $0 closing costs. All costs in this case are paid by the lender. However, their loan interest rate is higher at 3.875%

Don’t Miss: Can You Buy Two Houses With One Loan

Youve Built Equity In Your Home

When you get an FHA loan, you must pay insurance premiums over the loans entire life. These are called Mortgage Insurance Premiums . One big reason for homeowners to consider refinancing to conventional is to get rid of this mortgage insurance. If you have at least 20% equity in your home, conventional loans dont require mortgage insurance.

You May Like: How To Get Someone Off Your Car Loan

Can Fha Closing Costs Be Included In The Loan

Many borrowers can add their closing costs to their base loan amount and include these costs in their FHA mortgage. If you are borrowing $250,000 to buy a home and your closing costs are $7,500, you may be able to get a mortgage for $257,500. Keep in mind, however, that increasing the amount of your mortgage will increase the total amount of money you pay in interest over the life of the loan. Sellers can also pay some closing costs of FHA loans for buyers, if they choose.

Also Check: What Is The Housing Loan Interest Rate

Homeowners Association Transfer Fee

Your homeowners association transfer fee covers the cost of moving the burden of HOA fees from the seller to the buyer. It ensures that the seller is up to date on their HOA dues. It also provides you with a copy of the associations payment and due schedule as well as their financials.

Most of the time, the seller covers this cost. However, you might need to pay for your own transfer fee if youre buying in a very competitive market, or if you agree to cover all closing costs.

The amount youll pay for your transfer depends on your HOAs policies. If you live in an area without an HOA, you wont pay this fee at all.

Should You Roll Closing Costs Into Your Mortgage Balance

When deciding if you should roll your closing costs into your mortgage, it’s important to understand the financial consequences of such a decision. Rolling your closing costs into your mortgage means you are paying interest on the closing costs over the life of the loan. For example, say your closing costs are $10,000 and your mortgage has an interest rate of 4% over a 30-year term. Your monthly mortgage payment would increase by almost $48 per month, and you would pay $17,187 over the term.

Alternatively, your lender may give you the option to increase your mortgage interest rate in exchange for a credit that reduces your closing costs. Known as premium pricing, the lender will credit you a percentage of your loan amount to reduce your out-of-pocket expenses at closing. Let’s say you have a $300,000 mortgage and you qualify for a rate of 3.875%. In exchange for an increase in your rate of 0.125%, the lender may give you a credit of 1% or $3,000. The increase will cost just over $21 per month and $7,753 over the life of the loan.

The increased mortgage balance used to cover your closing costs increases the LTV, narrowing the cushion between your loan amount and the value of your home. If you want to take out a home equity line of credit later on, there will be less equity to utilize. A higher LTV also means that your net benefit will be proportionally lower when you sell your home.

Don’t Miss: What Are Home Improvement Loan Rates

Down Payment Vs Closing Costs: Is There A Difference

Yes â your down payment and closing costs are distinct pieces of the total homebuying upfront expense. The down payment is the money you contribute to the cost of the house youâre buying, and your mortgage loan makes up the rest.

Related reading: FHA Loan Down Payment: Guide to 3.5% Down Homebuying

The closing costs largely cover your lenderâs expenses and third-party fees that are essential to the transaction.

For instance, you might see a title search fee on your closing cost estimate. The title company researches the previous ownership and certifies there are no outstanding claims against the property.

Youâll also pay an appraisal fee. This is required by the lender to verify the homeâs value and ensure that the home is in safe and livable condition.

There are many such aspects to the process, and your closing costs cover those expenses.