Why Your Ltv Ratio Matters

The higher your LTV ratio, the riskier your loan may appear to lenders. Also, when you make a smaller down payment, you have less equity or ownership in your property.

That can be problematic for the lender because if you default on a loan, the lender might not be able to recoup its loss by selling your property.

As a borrower, there are several ways a higher LTV ratio could affect you.

Calculate your equity by taking the amount your property is currently worth and subtracting the outstanding loan amount on the property.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is The Maximum Loan

The maximum LTV for an uninsured mortgage is 80%, while the maximum LTV for an insured mortgage is 95%.

A low LTV ratio means that it would be more likely for your mortgage lender to recover the amount of the mortgage should you default, even if housing prices fall. A low LTV also gives you flexibility by having more equity in the home. This would allow you to take out asecond mortgageor when you need to borrow against your equity, such as through aHome Equity Line of Credit .

The Bank of Canada classifies mortgages into two types: high-ratio mortgages and low-ratio mortgages.

Read Also: Car Loans Usaa

Private Lenders And Secured Mortgage Options

If your credit has been damaged or income may have been reduced, private lending options are widely available for an Ontario homeowner. A private lender will be calculating the LTV on a secured private loan option just as all the other lenders in the Province.

Unlike other lenders that may lend up to 95% LTV, private lenders will be able to provide loan options based on LTV that will not exceed 75% LTV for homeowners that do not have strong credit or unable to meet the criteria that are required by the banks. Private lenders will assess the LTV and look at the property location when determining mortgage loan approval. These mortgage loans will be short-term loans and will be negotiated faster than with other Ontario lenders. Mortgage Broker Store can help you achieve your mortgage goals. We have access to a broad network of private lenders throughout the Province who can negotiate various private mortgage loan options depending on your unique set of financial circumstances. Dont hesitate to contact us at your convenience to secure your mortgage goals.

Whats A Good Ltv Ratio

Folks hoping to get a loan or refinance want to see something under 80 percent.

A good mortgage broker, like Cape Coral Mortgage, will take that ratio and help the borrower get the loan he or shes been hoping for. This isnt to say that a person with a higher ratio cant get that loan or refinance, but itll come with a few drawbacks. Granted, a good mortgage broker will make most cases work if given a chance.

A good LTV ratio leads to good loan options and could eliminate the need to pay for mortgage insurance. This saves borrowers money, which is everyones goal.

Improving LTV as a New Home Buyer

The following are some things homebuyers can do to improve their ratios:

- Save to make the most considerable downpayment possible.

- Find a cheaper home, maybe in a quieter city or a home that needs some work.

No one loves these suggestions. Coming up with a larger downpayment is a pain. It can make it harder to become a homeowner.

Finding a cheaper home isnt ideal. When someone is going to spend this much cash, they want it to be for the home of their dreams. Anything less than that feels wrong, but these are the only ways to improve that ratio.

Improve the Ratio When Refinancing

The following are some things that could be done to improve the LTV if refinancing is the goal. Doing the following could lead to lower monthly payments:

- Never miss a mortgage payment.

- Make improvements that increase the property value.

- Follow housing value trends in the propertys community.

Don’t Miss: Www.lowermycarloan.com

Look For Down Payment Assistance

If you have family members or a domestic partner) who can help you make a down payment, it doesnt hurt to ask for help. The IRS sets the rules on how much you can receive as a gift before the donor has to pay gift tax, but you may be surprised at how flexible many of the rules around gifting are.

If youre getting an FHA loan, you may qualify for down payment assistance from your employer, a labor union, a charitable organization or a state or community organization that helps first-time home buyers with down payment assistance.

What To Know About Loan To Value Ratio

Have you had your eye on a shiny new car lately?Are you ready to make your dream of owning a home a reality? Do you want to take advantage of the equity in your home to make some much needed repairs?

If your answer is yes to any of the questions above, youve probably thought about how these purchases will impact your monthly budget. But have you thought about how the amount of money you need to borrow compares to the value of your purchase? If not, you may want to start because loan to value is one of the factors lenders will consider when deciding whether to approve you for a loan.

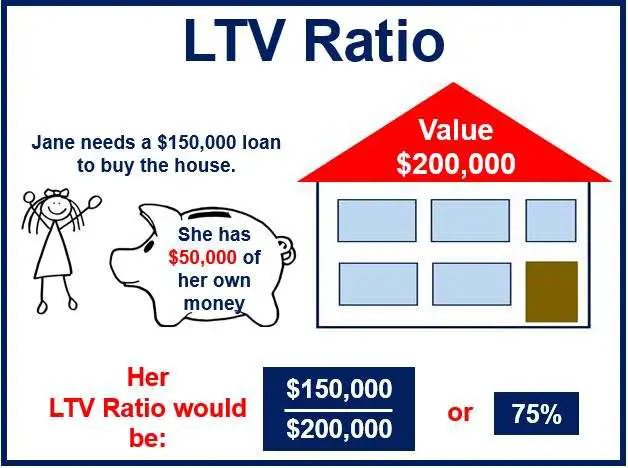

What is a loan to value ratio?

The relationship between the amount of money you borrow, and the value of your purchase is also known as your loan to value ratio. If you have a high LTV ratio, it means you have little to no equity in the product youre buying. If you have a lower LTV ratio, it means you have a greater amount of equity in your purchase. The larger your down payment is, the lower your LTV will be.

How do I calculate loan to value ratio?

Easily calculate loan to value ratio by dividing the amount of your loan by the value of the item youre purchasing. For example, if youre buying a house thats been appraised for $300,000, and you take out a loan for $240,000, your LTV will be 80 percent. .

Your LTV and home loans

Your LTV and auto loans

Recommended Reading: Usaa Used Car Loan Restrictions

Summary: Ltv Is Just One Factor

Remember, your LTV is only one piece of your mortgage application. The lower your LTV, the lower your interest rates and mortgage insurance is likely to be. Understanding your LTV can help you determine if youre ready to get a mortgage and show you what home loans are available to you.

Our Home Loan Experts can guide you through each loan option and help you decide what will work for you. Visit Rocket Mortgage®or give us a call at 785-4788.

How Do You Calculate A Stock Price Projection

Calculate the final stock price projection. Gather the companys price to earnings ratio figures for the previous five years. The companys P/E ratio can have some variation over the years. Taking a conservative approach, choose the lowest P/E ratio, and multiply this number by the projected earnings per share.

Read Also: Is It Better To Get A Fixed Or Variable Student Loan

Which Loan To Value Ratio Should I Go For

With LTV ratio, a good rule of thumb is as low as you can go. The bigger your deposit in relation to your property value, the better mortgage deals you will be offered, the lower your repayments will be, and the less money youll repay overall. Its sad but true: the more money you have to buy a property, the less you need.

On the other hand, there can be some advantages to buying with a smaller deposit . For one thing, you should be able to buy sooner, get on the property ladder, save on rent and benefit from any increases in house prices. The longer you wait, the more house prices may rise out of reach unless you can save at a faster rate.

As with many things, its a balancing act. What you may be able to do is buy with a high LTV ratio and then try to reduce it step by step every time you remortgage. Remember that you may benefit from more income in the future so your first mortgage is only your first step.

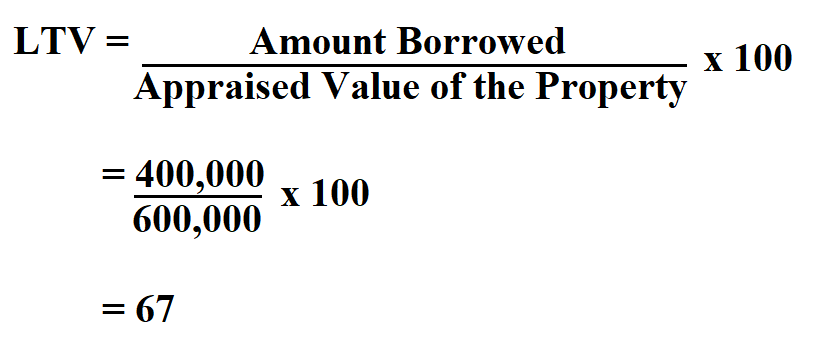

What Is The Formula For Calculating The Loan

Secured loan amount

To calculate the loan-to-value ratio, divide the amount of the loan being requested by the market value of the asset that the business gives as collateral to the lender.

The market value may be lowered if the asset has low liquidity, that is, if it could take time before the financial institution can have the money on hand. This length of time often comes with associated costs, such as hiring a real estate broker to look at a building. The institution factors that in by reducing the market value.

The market value given to an asset varies depending on the context and the financial institution.

Don’t Miss: Does Usaa Do Car Loans

How Is Ltv Calculated

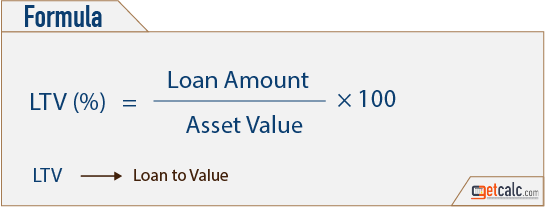

LTV is a relatively straightforward concept with massive implications for borrowers. Want to know your LTV ratio? Just use this simple formula:

* 100 = LTV

In this case, LA refers to your loan amount and PV is the property value. Lets quickly walk through each step you need to take to figure out LTV:

How does that work in a real-world scenario? Heres how itd look if you were buying a $500,000 house with a 10% down payment option:

How To Calculate Your Loan To Value Ratio

Calculating your loan to value ratio is simple. All you do is take your loan amount and divide it by the purchase price or, if youre refinancing, divide by the appraised value.

The loan to value ratio is always expressed as a percent. So if your result is 0.75, for example, your LTV is 75%.

Related

- Loan-to-value: 80%

You May Like: Usaa Credit Score Requirements

Presume Housing Market Shifts

Based on your homes location and how many people are interested in buying a home, your property value could naturally increase over time as demand increases. Of course, the market could experience a downturn. Before you decide to refinance your mortgage, try using the Federal Housing Finance Agencys House Price Calculator to see how homes in your area have appreciated in value.

With a lower LTV, you may qualify for a loan you werent eligible for when you purchased your home. It could be time to refinance your mortgage to improve your interest rate, take cash out or eliminate PMI.

Why Ltv Is Important In Real Estate

LTV is important when you buy a home or refinance because it determines how risky your loan is.

The more you borrow compared to your homes value, the riskier it is for lenders. Thats because if you default on the loan for some reason, they have more money on the line.

Thats why all mortgages have a maximum LTV to qualify. The maximum loan to value can also be thought of as a minimum down payment.

For example, the popular FHA loan program allows a down payment of just 3.5%. Thats the same as saying the program has a max LTV of 96.5% because if you make a 3.5% down payment, the most you can borrow is 96.5% of the home price.

Don’t Miss: How To Transfer Car Loan To Another Bank

What Is A Good Ltv

If you’re taking out a conventional loan to buy a home, an LTV ratio of 80% or less is ideal. Conventional mortgages with LTV ratios greater than 80% typically require PMI, which can add tens of thousands of dollars to your payments over the life of a mortgage loan.

Some government-backed mortgages allow you to get away with very high LTV ratios. For example, the minimum down payment for a Federal Housing Administration loan is 3.5% . Loans through the U.S. Department of Agriculture and the Department of Veterans Affairs don’t require any down payment at all . Those loans typically require a forms of mortgage insurance or include extra fees in the closing costs to offset the risk connected with their higher LTVs.

LTV ratio is a less crucial factor with auto loans. While you might pay higher interest on a car loan with a higher LTV ratio, there’s no threshold comparable to the 80% LTV that earns the best mortgage loan terms.

What Is A Good Loan To Value Ratio

A good loan to value ratio varies by industry. For example, in commercial real estate, a good loan to value ratio is normally 80% or less. What a good loan to value ratio is can vary from institution to institution, of course. But in general, this figure is widely accepted in the financial industry. The average loan to value ratio varies by state, which could affect what your lender will accept. Make sure to do your research after you calculate your ratio and compare it to the average in your state.

Read Also: Usaa Rv Loan Calculator

How Is Heloc Ltv Calculated

They determine this amount by dividing the appraised value of the house by the amount remaining on your mortgage, and the amount you’d like extended. For example, if your home is worth $300,000 and you owe $90,000 on it, divide the balance by the appraised value: 90,000/300,000= . 3, or a 30% LTV ratio.

What Does Ltv Mean

A loan-to-value ratio measures what percentage of a real estate purchase comes from financing. Basically, lenders want to know how much of the total cost theyre loaning compared with the amount the borrower is paying. To do that, your lender compares the value of the property with the amount of the loan. The result: your LTV ratio.

Read Also: Prequalify Capital One Auto Loan

Invest In Home Improvements

You could increase your home value by making significant improvements, such as remodeling your kitchen or fixing the roof. Just ask yourself which will save you more money in the long run: Paying for improvements to secure a better deal on refinancing, or paying more to refinance now?

Understanding your LTV ratio can prepare you for the refinancing process, and hopefully get the best deal possible.

Homes & Loans: A Quick Explanation Of The Loan To Value Ratio

As a homebuyer, youre going to hear about the LTV ratio. First of all, the LTV ratio refers to the loan-to-value ratio.

When someone mentions this ratio, they are talking about the difference between the loan and the overall value of the property or house. This is essential information that lenders use to ensure the loan wont be too risky for them.

Ensuring the LTV is low means that the loan is likely to be approved, so this value is a big deal.

You May Like: Does Usaa Refinance Student Loans

How To Calculate Loan To Value

Your LTV is calculated by dividing the value of the mortgage you need by the value of your property . For example, if you want to buy a house with a value of £250,000 and you have a deposit or equity of £100,000, then you will need a mortgage of £150,000. Here is the LTV calculation:

£150,000 / £250,000 = 0.6

Choose A Less Expensive Home

If youre unable to make a larger down payment and are on a strict budget, the other option is to focus on less expensive homes. This will lower your LTV and might help you get a preferable loan option.

Remember, you already have the equation. That means you can manipulate the variables to get a lower, preferable LTV. Finding a home with a lower property value will improve your LTV ratio.

For example, if you know you only have $10,000 to use toward a down payment, this is how the price of a home can lower your LTV:

Home One

Read Also: Refinance Auto Loan Usaa

Ltv And Refinancing: The Ongoing Cost Of Pmi

Lets say you want to refinance your mortgage.

The most common reasons to refinance are:

- Lowered interest rates

- Lowered monthly payments

- Shortened mortgage payment term

Another big reason to refinance? Getting rid of or reducing your mortgage insurance. To do that, youll want to wait until you have an LTV of 80% 85%. Otherwise, youll be stuck paying mortgage insurance for a little longer.

MoneyTermEquity

Home equity is the opposite of LTV. Equity is the value of the home minus the amount you owe. If your LTV is 80%, your equity is 20%.