Understanding Forbearance Vs Deferment

Forbearance stops you from having to make monthly payments on your student loans. Similar to forbearance,student loan deferment also temporarily pauses your payments. Interest may accrue during both periods of forbearance and deferment, depending on the type of loan you have and the lender who services your loan.

One thing to keep in mind to help distinguish student loan forbearance and deferment is that deferment is offered only to students who choose this repayment option during the loan application process. However, student loan forbearance is an option only provided to eligible borrowers once they enter repayment. In some cases, students who apply for deferment may also qualify for student loan forbearance in the future.

In periods ofdeferment, youmay accrue interest if you have:

- Direct unsubsidized loans

However, interest doesnt accrue during your deferment on these loans:

- Direct subsidized loans

- Subsidized Stafford loans

Determining whether forbearance or deferment is right for you depends on your financial situation and the type of loan you borrowed.

If youre considering either forbearance or deferment, reach out to a financial counselor at your school or your loan servicer to weigh the pros and cons. Theyll have the resources and experience to help you.

Student Loan Forbearance: An Overview

With all student loan forbearance, interest on your loan continues to accrue during the deferral period and is usually capitalized at the end of the deferral period unless you pay the interest as it accrues.

Perkins loans are an exception to the capitalization rule. With a Perkins loan, your interest accrues during the deferral period but is not capitalized. Instead, it is added to the interest balance during repayment, unless you pay it as it accrues.

Federal student loan forbearance is usually granted for 12 months at a time and can be renewed for up to three years. Conditions and payment amounts for some types of federal student loan forbearance are mandated by law. In other instances, the loan servicer has discretion.

Private student loan forbearance is typically granted for up to 12 months, but lenders rarely offer renewal. Conditions and amounts for private loan forbearance are up to the lender.

If you are in default on your student loans, you are not eligible for any strategy discussed in this article.

Other Types Of Deferment

Many other scenarios, such as enrollment in a Graduate Fellowship program, may qualify you for loan deferment.

For example, you may apply for up to 36 months of Temporary Total Disability deferment. You may also qualify for Rehabilitation Training deferment, which is for individuals with disabilities in full-time rehabilitation programs.

To download any of these forms or those linked above, visit the repayment forms library available on the ED website.

If you think you may qualify for deferment but arent sure which option to request, the ED website includes a form navigator with a checklist of common borrower issues to guide you to the correct form.

Read Also: How To Get Loan For Property

Student Loan Forbearance Vs Deferment: Whats The Difference

Many terms are associated with student loans and repayment options, so its important to understand what it all means especially when making repayment decisions. Student loan forbearance and deferment are similar. However, there are key differences. For example, with deferment, subsidized loans do not accrue interest through the deferment period.

Perkins loans, direct loans, and parent PLUS loans qualify for deferment as long as they are subsidized. If youre in the military, there are military deferment options that can help to manage your student loan repayment plan.

Again, both are viable options when youre in a tight financial situation, but neither is ideal for long-term repayment.

What Happens If I Used Up My Grace Period During The Payment Pause

Your loan payments will remain suspended, and your interest rate will remain at 0%, until the end of theCOVID-19 payment pause . For example, say your loans entered repayment afterthe end of your grace period on October 15, 2021. In this case, your payments would continue to be suspendedfrom October 15, 2021, through December 31, 2022. The interest rate on your loans would be 0% during this period.

Unless you’ve requested a different repayment plan, we will place your student loans in theStandard Repayment Plan when the payment pause ends.

If you have concerns about your ability to make your monthly payment amount when payments begin, consider income-driven repayment options. Anincome-driven repayment plan may help provide a monthly loanpayment amount is affordable.

If you’re interested in applying for an income-driven repayment plan, you may apply online atStudentAid.govand select the box to be placed on the repayment plan that will provide you with the lowest monthly payment. You can self-certify your eligibility online.You can also call Great Lakes at 236-4300 to provide the information needed to request an IDR plan over the phone.

Also Check: Why Is My Auto Loan Not On My Credit Report

How To Apply For Student Loan Deferment

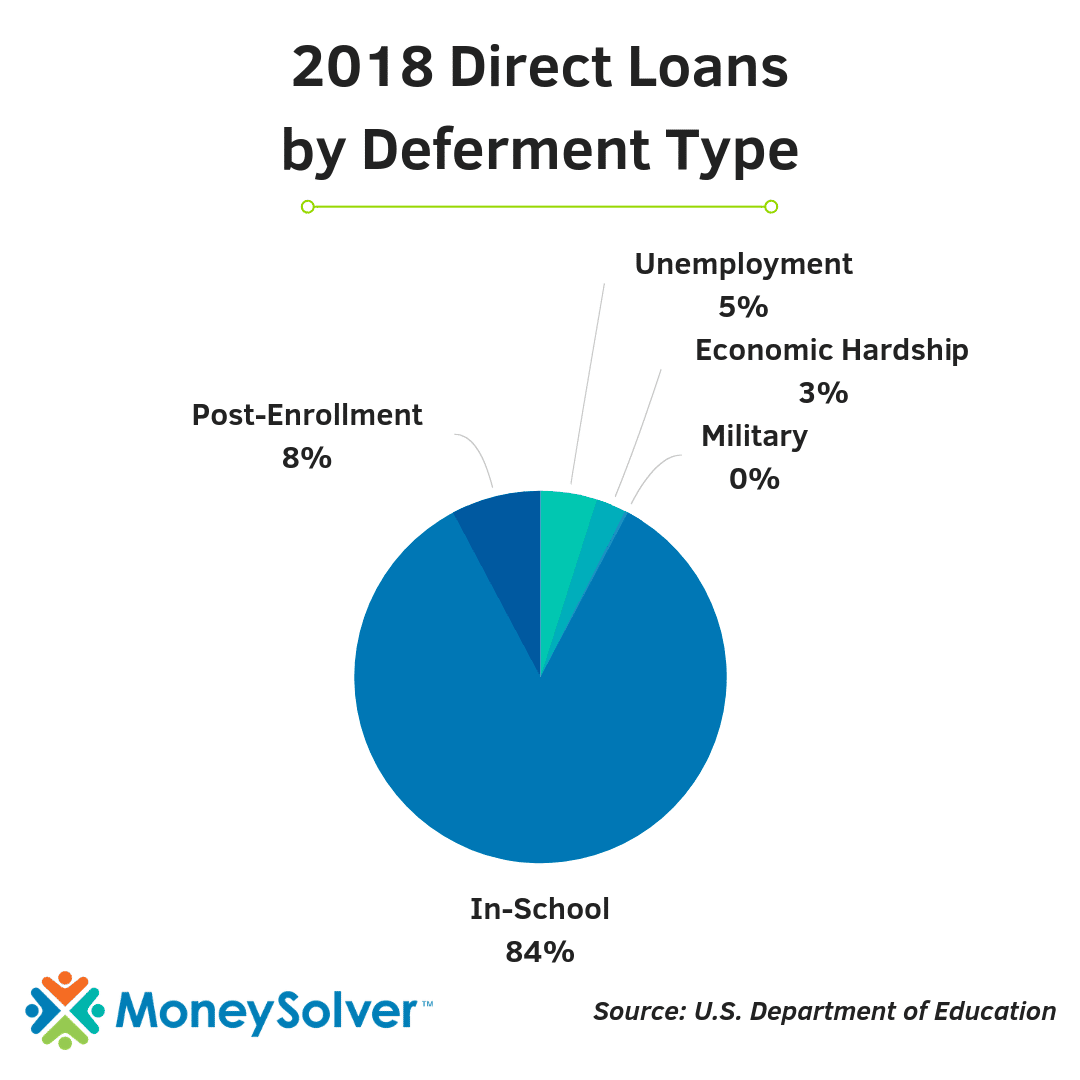

To be eligible for student loan deferment, you must meet one of the following criteria:

- You are unemployed or unable to find a full-time job.

- You are experiencing an economic hardship or are serving in the Peace Corps.

- You are on active-duty military service.

- You are undergoing cancer treatment or have completed treatment within the past six months.

- You are enrolled in an approved rehabilitation training program for the disabled.

- You are enrolled in an approved graduate fellowship program.

Deferments are not automatic. To request a deferment, you must complete the appropriate deferment request form, such as the Unemployment Deferment Request, In-School Deferment Request or Economic Hardship Deferment Request. Youll send the appropriate form and documentation showing you meet the eligibility requirements to your loan servicer for review.

If you dont qualify for deferment, you might still be able to pause monthly payments through student loan forbearance.

The Pros And Cons Of Student Loan Forbearance

While forbearance is an excellent tool for student loan borrowers who need help, it may not always be the best option for everyone.

Comparing the benefits with the downsides should help you determine if forbearance is the best option.

What are the benefits of forbearance with student loans?

-

It helps you avoid delinquency, default, and collections.

-

It doesnt impact your credit score or show on your credit report.

-

It frees up your monthly budget to pay expenses.

-

It allows you time to consider other options like consolidation, income-driven repayment, or refinancing.

What are the downsides of student loan forbearance?

-

It can be expensive. When forbearance ends, your balance will be higher, and you will have a higher monthly payment.

-

You may not qualify or meet your lenders eligibility requirements particularly if youre hoping for private student loan forbearance.

-

Its not a long-term solution. Youll need to start making payments once forbearance ends, regardless of whether or not your situation has improved.

-

Forbearance periods dont count towards Public Service Loan Forgiveness.

-

Forbearance delays default status, which is usually a good thing. But, if you aim to negotiate a student loan settlement, you need to be in default which will tank your credit score but can lead to long-term benefits.

Learn More: Strategic Default For Student Loan Debt

Read Also: How Do You Spell Loan

How Long Does Forbearance Last

Forbearance on federal student loans can last for between one and 12 months. At the end of 12 months, if you still need to forbear your loans, you can request additional time. You can request up to 12 months at a time, up to three years total.

However, if you need to pause payments for this long, there are better alternatives than forbearance, such as income-driven repayment.

For private student loans, it varies by lender. Few lenders allow as much as three years of forbearance. Most allow only a few months at a time, up to 12 months total.

Federal Student Loans Are On Pause Until Sept 30 2021

As part of the CARES Act, the federal government has issued an administrative forbearance on federal student loans until Sept. 30 2021. This is a fancy way of saying your federal student loans are on hold for a while. And this change has taken place automatically. Theres no application to fill out or waiver to request. But if youre in a position to keep making payments during this time, do it! Use that gazelle intensity to drive you through uncertainty.

Read Also: Should I Do Fixed Or Variable Student Loan

When To Be Wary Of Forbearance

If youre enrolled in Public Service Loan Forgiveness, you need to make 120 qualifying payments while in an income-driven repayment plan. When applying for the annual certification to stay in that plan, your servicer may automatically place you in forbearance. Depending on the timing, it may rob you of a qualifying payment. Even if you make a normal payment, if your account is in forbearance, that payment wont count.

To make sure you dont miss out on any qualifying payments, you can choose to cancel that forbearance to return to your normal payment plan and make the monthly payment during that time.

But be careful: If your servicer takes its time to process your IDR application and your IDR year ends, youll be put back in the Standard plan, in which youll be expected to make a higher payment.

It’s also important to note that many student loan scams involve forbearance.

What Is Student Loan Forbearance And Should You Consider It

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

If you find yourself in a situation where you cant pay your student loans, your loan servicer might suggest forbearance. What does that mean? Is it really the best option?

That sounds pretty great, right?

Also Check: How To Get Cash Loan Same Day

Will My Payment Amount Change After The Payment Pause Ends

If you were in repayment before the payment pause, your monthly payment amount should not change unless youhave applied for an income-driven repayment plan or a recertification or recalculation of your IDR payment during the pause. If you were in a deferment or forbearance before the payment pause, it may be necessary to adjust your monthly payment amount to ensure you’re able to repay your loan within the remaining term.

Is Forbearance The Right Choice

It might be tempting to jump at the chance to not make any payments for any amount of time. But we suggest taking a close look at your situation before you leap. Consider the following questions:

- Why do you want to delay payments?

- Are you looking for a short-term or long-term solution?

- Can you use deferment instead?

- Is there anything else in your budget you can cut first?

- Would you benefit more from one of the federal repayment plans?

Depending on your answers, you may decide to pursue forbearance. If youre starting to think its not right for you, dont despair there are other options, most notably for federal loans.

Read Also: How Does Pre Approval For Auto Loan Work

How Student Loan Forbearance Works

OK, first things first. If youre in default on your loans, then student loan forbearance isnt an option. The type of loan you have determines at what point your loan is considered in default. For some lenders, that might mean missing even one payment. For others, it could mean missing payments for 270 days or more. The point is, once youre in default, the forbearance ship has sailed.

And second, student loan forbearance should never be your go-to relief strategy . Forbearance is a short-term Hail Mary after all your other options have run dry.

When you forbear on a loan, youre basically hitting the pause button on making payments for up to 12 months. But guess whats not paused? Yup, interest. Thats right, that puppy keeps on growing even if youre not making payments.

And the interest is capitalized, which means if youre not making interest payments during your forbearance, it builds up each month and gets tacked onto your loans balance. Uh, this isnt good. So, you could easily end up owing more at the end of your forbearance than when you started. Wheres the relief in that?

See how this turns into a rotten deal pretty quickly?

Should You Apply For Student Loan Forbearance

Forbearance is not a long-term solution and because interest will accrue during your forbearance, you should think carefully about whether its the right choice for you.

With that said, student loan expert Mark Kantrowitz says that its better for a borrower to be in forbearance than in default. When you default on your student loans, your overdue balance could be turned over to a collection agency and could lead to a potential court case. Delinquency and default hurt the borrowers credit scores, while an authorized deferment or forbearance usually does not ding the credit score , says Kantrowitz.

Forbearance is not your only defense against student loan default. If youre anticipating long-term financial hardship, consider an income-driven repayment plan to make your federal student loan payments more manageable. You can also refinance your loans to bring down your monthly payment.

Whether or not you choose to apply for forbearance depends on your individual circumstances. If youre in between jobs or undergoing medical treatment for a few months, forbearance may make more sense than changing your repayment plan. If you need more sustainable change for your student loans, though, consider looking elsewhere.

Also Check: Is Credit Loan Llc Legit

Private Student Loan Forbearance

Your forbearance options with private student loans will vary by lender, but they are generally less flexible than those available on federal loans.

Many private lenders extend a forbearance option while you are in school or taking part in an internship or medical residency. Some let you make interest-only payments while in school. In-school forbearance typically has a time limit, which could create problems if you take longer than four years to graduate. Some lenders also offer a six-month grace period after graduation.

Some private lenders grant forbearance if you are unemployed or are having difficulty making payments after you graduate. Typically, these are granted for two months at a time for no longer than 12 months in total. There may be an additional fee for each month you are in forbearance.

Other types of forbearance are often granted for active-duty military service or if you have been affected by a natural disaster. With all private loans, interest accrues during forbearance and is capitalized unless you pay it as it accrues.

How To Get Student Loan Forbearance

If you’re interested in applying for student loan forbearance, you’ll need to get in touch with your lender or loan servicer.

Your lender may ask you to complete an application for forbearance and provide supporting documentation proving your reason for the request. For example, if you’re requesting forbearance due to financial hardship because you’ve been laid off from work, you may need a letter from your former employer showing your separation date.

You May Like: Best Student Loan Refinance Companies

If Youre Considering Bankruptcy

Its important to understand that many student loans are not discharged through bankruptcy, but an automatic stay is imposed when any bankruptcy is filed. The effect of the automatic stay and what we do depends on which type of bankruptcy is filed.

- If a Chapter 12 or 13 bankruptcy is filed, we suspend online access and communications, including billing statements, for both the borrower and the cosigner.

- If a Chapter 7 or 11 bankruptcy is filed by the borrower or cosigner , we suspend online access and communications for only the person who filed the bankruptcy.

In all cases, interest continues to accrue during the bankruptcy case, which is likely to increase the Total Loan Cost. After the automatic stay ends, servicing, collection efforts, online access, and all communications will resume if the student loan is not discharged. In cases where a loan is discharged, we remove the filing party from responsibility for the loan. The non-filing party remains responsible for the loan, no matter which type of bankruptcy is filed. If you have questions about the treatment of your student loan in bankruptcy, please consult with an attorney.

If youre experiencing financial difficulty, please chat with us or call 800-472-5543 so we can discuss any options that may be available for your loan.

How Forbearance And Deferment Works For Private Student Loans

Private student loans work quite differently than federal loans. While some private lenders offer forbearance programs for those experiencing financial hardship, not all of them do.

With private loan forbearance, interest always accrues on your loan and is capitalized to your principal balance. Private student loan forbearance typically is much shorter in duration than federal forbearance or deferment. You can usually postpone your payments for one to three months at a time, and most lenders cap the amount of time you can suspend payments over the life of your loan.

For example, private lender ELFI allows you to halt your payments for up to 12 months during your loan term. However, forbearance is up to the discretion of the lender.

If you have private loans and cant afford your payments, contact your lender to learn about your repayment options.

Also Check: Is Student Loan Interest Rate Monthly Or Yearly