How To Get A Home Equity Line Of Credit

The process of getting a HELOC is similar to that of a purchase or refinance mortgage. Youll provide some of the same documentation and demonstrate that youre creditworthy. Here are the steps youll follow:

Determine whether you have sufficient equity, using a HELOC calculator.

Once you have an idea of what you can borrow, shop HELOC lenders.

Gather the necessary documentation before you apply so the process will go smoothly.

Once you have pulled together your documentation and selected a lender, apply for the HELOC.

Youll receive disclosure documents. Read them carefully and ask the lender questions. Make sure the HELOC will fit your needs. For example, does it require you to borrow thousands of dollars upfront ? Do you have to open a separate bank account to get the best rate on the HELOC?

The underwriting process can take hours to weeks, and may involve getting an appraisal to confirm the home’s value.

The final step is the loan closing, when you sign paperwork and the line of credit becomes available.

Hud Fha Reverse Mortgage For Seniors

The HECM is FHAs reverse mortgage program that enables you to withdraw a to use cash on hand to pay the difference between the HECM proceeds and the;

Mar 20, 2021 But with reverse mortgages there are no monthly payments. Instead, the borrower can draw on the equity in their home like a line of credit. The;

Reverse mortgages can be a useful financial tool for older homeowners to tap able to get out of this loan without selling your home to pay off the debt.

Things To Consider Before Borrowing Against Your Paid Off Home

When you take out a loan on a paid-off home, you introduce some financial risks into your life that you may not have had before. This includes the risk of foreclosure if youre unable to make your mortgage payments. Before you put your home on the line, you might want to ask yourself some of the following questions:

Is there another option?

There are other ways to get cash you might need to consolidate debt or pay for home improvements. Such options include personal loans and lines of credit. Unlike a home equity loan or mortgage, these won’t risk foreclosure on your home if you’re unable to pay them back.

Will the loan increase my overall wealth?

If the equity loan gives you money to use to increase your homes value, it might be worth taking on the added risks. If the loan is for something else, like a big-ticket purchase or vacation, you should evaluate whether that expense justifies the risk. Generally productive expenses like substantial home improvements, education and renovations fall under the category of productive spending as they have the potential to increase your wealth. Car purchases, vacations and weddings serve are non-productive expenses that sap at your ability to generate long-term investment returns on your home.

Are the payment terms reasonable?

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Recommended Reading: When Do Student Loan Payments Start After Graduation

Home Improvements Or Launching A Business

A home equity line of credit is a good fit for homeowners who will need access to cash periodically over a span of time. These expenses are usually incurred on an ongoing basis. A HELOC can be used for a series of home improvements, for example, or launching a small business.

HELOCs are generally the cheapest type of loan because you only pay interest on what you actually borrow. There are also no closing costs. You just have to be sure that you can repay the entire balance by the time the repayment period expires.

During the coronavirus pandemic, most banks are still offering these loans. However, some institutions have raised their requirements for credit scores and loan-to-value ratios. In addition, Wells Fargo and JPMorgan Chase announced freezes on applications for new HELOCs.

Mortgage lending discrimination is illegal. If you think you’ve been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report to the Consumer Financial Protection Bureau or with the U.S. Department of Housing and Urban Development .

Paying Off A Home Equity Loan Or Line Of Credit

Looking to pay off your home equity loan or line of credit? Calculate what it will take to pay if off with this financial tool.

May 7, 2018 An 18% interest rate paid on something like a credit card is bad debt. But taking a 4% HELOC or loan from your life insurance policy can be good;

Whether you need funds for a home project, a new kitchen appliance, a school tuition payment, emergency personal expenses or to pay off credit card debt, a home;

Don’t Miss: What Is The Best Student Loan Servicer

Can You Pay Off A Home Equity Loan Early

If you’re one of the lucky few, your savings or a financial windfall will cover the cost of buying your home, but if you’re among the masses, you will need to take. For many people, one of the greatest achievements in life is owning a home. Owning a home is a dream come true for many americans, and a federal housing administration loan can be a great tool for buying one. Getting it right means understanding the mortgage process, from start to finish. Many people dream of working from home but think it’s simply not practical.

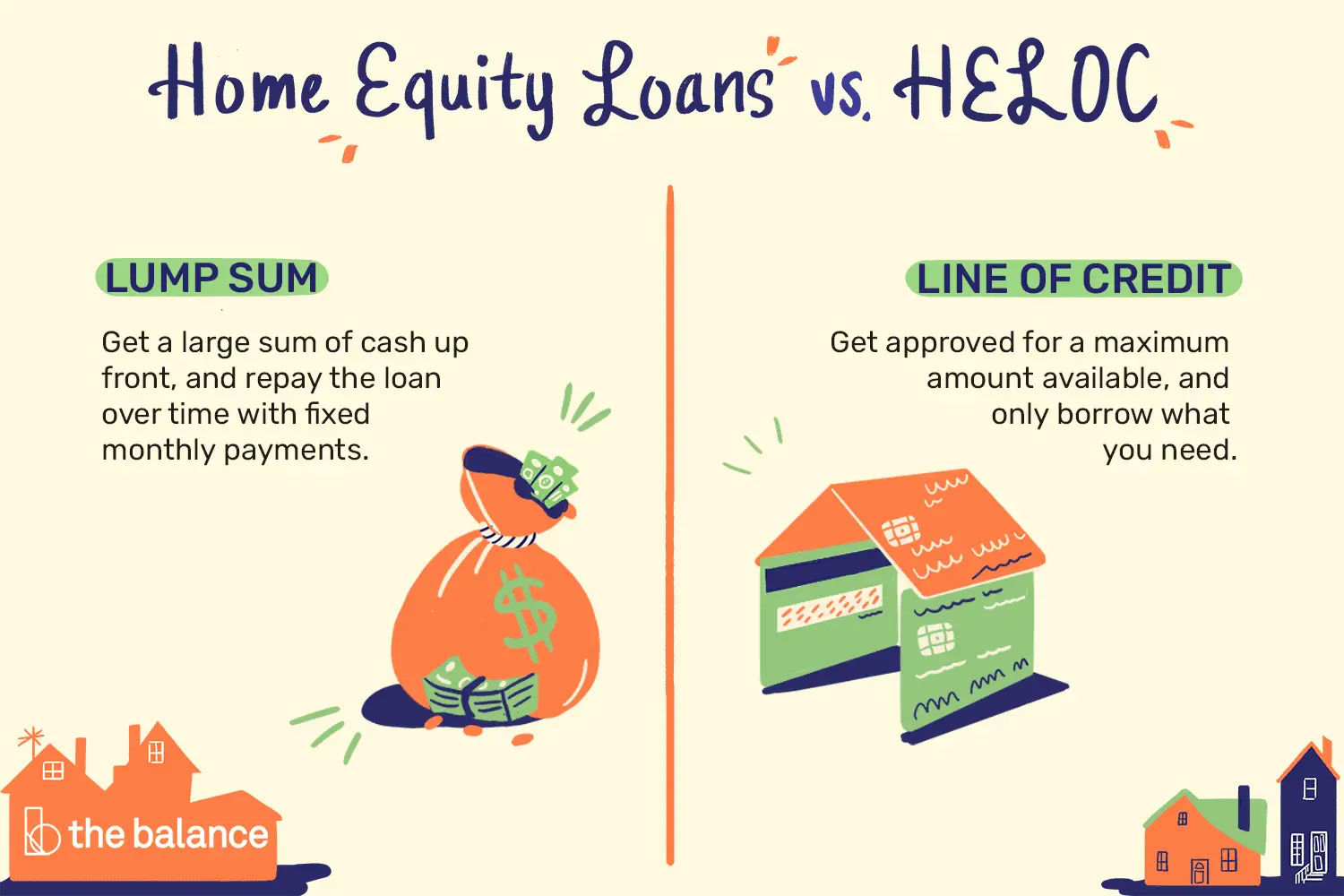

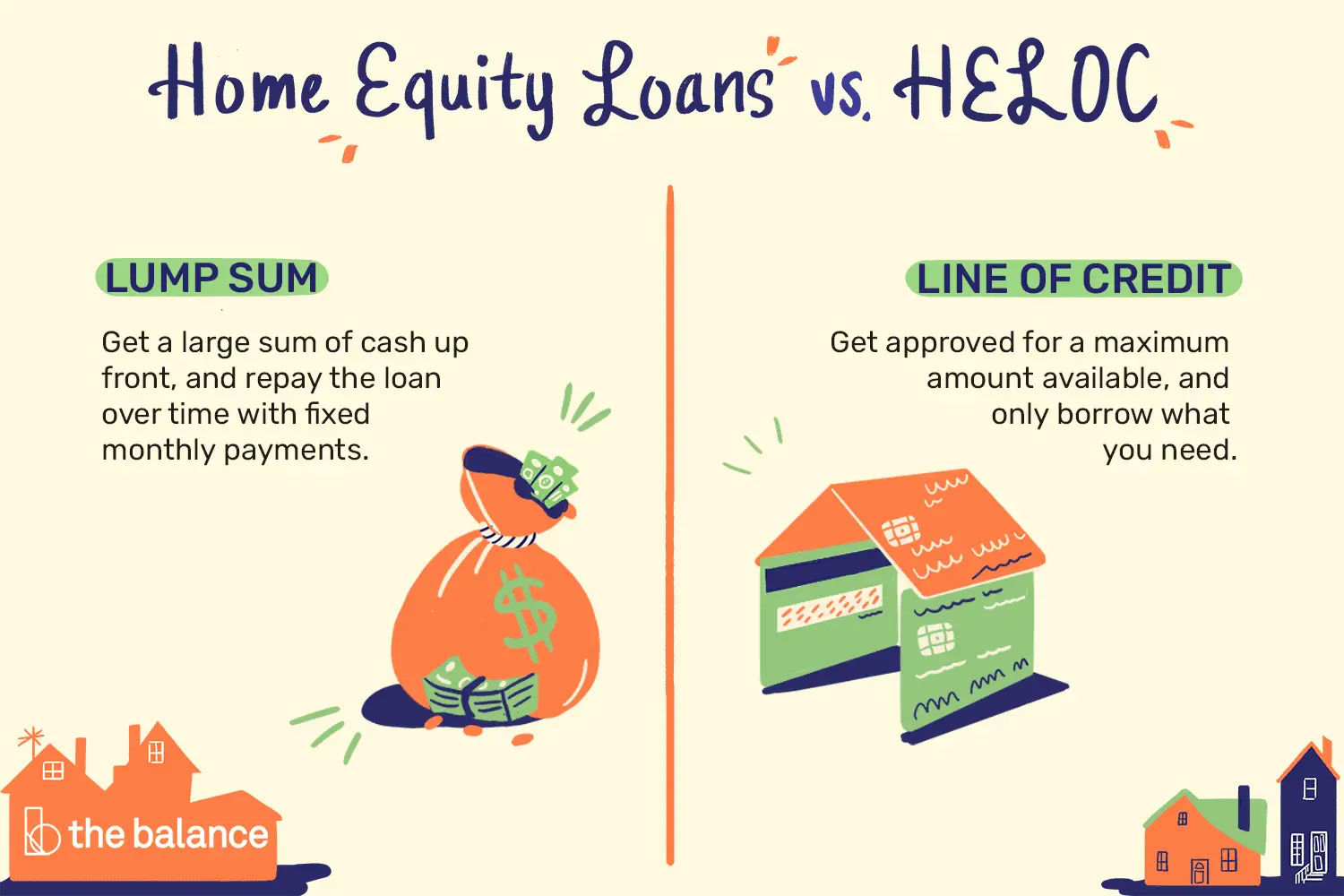

How Home Equity Loans Work: Rates Terms And Repayment

Traditional Home Equity Loan: This type of loan allows you to borrow a fixed amount of money in one lump sum usually as a second mortgage on your home in;

Looking to payoff your home equity loan or HELOC? Use our free payoff calculator to see how fast your can do it.

Use this calculator to see how long it will take to pay off a home equity loan or line of credit. Increase your payment for a faster payoff.

Don’t Miss: Can You Get Personal Loan From Bank

Repay The Heloc Within The Draw Period

This could be a good option if you want to pay down your debt quickly and save on interest. Your monthly payment would equal about $1,437, and you end up paying just $4,215 in interest over five years.

Compared to your first mortgage, the HELOC saves you $90 on your monthly payment and $4,581 in total interest. Of course, any rate increases will drive up your interest costs this is why opting for a fixed-rate HELOC is typically a better option.

Using A Heloc To Pay Off Your Mortgage

December 4, 2019 by Elizabeth Dyer

A home equity line of credit, more commonly known as a HELOC, works a bit like a credit card. You get approved to borrow a certain amount and you can draw from that amount throughout a pre-determined draw period, usually about 10 to 15 years.

The advantage of a HELOC is that you can often borrow much more than you could with a credit card, and you can do so at a lower interest rate. The current average interest rate on credit cards is around 17 percent, while HELOC rates tend to hover just over 5.5 percent.

While a HELOC can offer tax benefits, there are limitations: You must be putting your HELOC towards buying, building, or significantly improving your home to qualify for deductions. These possible tax advantages are why many homeowners choose a HELOC, not only to pay off a mortgage, but also to make home improvements.

In This Article

You May Like: Is Homeowners Insurance Included In Fha Loan

What Is The Best Option

The smartest strategy for accessing your home equity depends mostly on what you want to do with the money. Of course, your credit score and financial situation matter, too. However, they will be factors regardless of the option you choose. These choices usually match with the situations and goals listed below.

It is often a good idea to speak with a qualified credit counselor before applying for a loan.

Understand Your Mortgage Payment

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest.

Keep in mind that you may pay for other costs in your monthly payment, such as homeowners insurance, property taxes, and private mortgage insurance . For a breakdown of your mortgage payment costs, try our free mortgage calculator.

Also Check: What Does Jumbo Loan Mean

There Are Better Ways To Pay Off Your Mortgage Early

There are less complicated ways to pay off your mortgage early, and they will generally give you more control over the process.

Use Figure as your HELOC solution. The above talks about why a traditional HELOC wont be your best option for paying off your mortgage early. But what;Figure offers isnt a traditional HELOC. Its backed by blockchain, which helps improve financial transactions behind the scenes to make them more efficient, secure, and less costly.;You fill out an application online and youll have a decision in about five minutes. Plus, you can borrow up to $250,000 with a one-time origination fee¹;and rates as low as 2.49% APR²; and enrolling in AutoPay . This rate also includes the payment of a 4.99% origination fee in exchange for a reduced APR, which is not available to all applicants or in all states.).

¹You will be responsible for an origination fee of up to 4.99% of your initial draw, depending on the state in which your property is located and your credit profile. You may also be responsible for paying recording fees, which vary by county, as well as a subordination fee if you ever ask Figure to voluntarily change lien position.

Try Hometap.;By now, you realize that paying off your mortgage early with a HELOC is easier said than done. And if worst comes to worst, you could find yourself buried in debt and concerned about losing your home.

If youre interested in tapping into your homes equity such as to take on a renovation project ;Hometap;can help.

Pro #: Youll Have Fewer Monthly Payments

When youre juggling multiple payments to several different creditors each month its easy to lose track of when things are due. If you end up paying something late, youll likely have to fork over a fee and theres also a chance that your credit might take a hit. When you consolidate everything into a home equity loan, you only have one payment to worry about so theres less of a chance of overlooking something.

You May Like: Can I Get An Auto Loan With No Credit

Home Equity Line Of Credit

This type of loan is the most flexible of the three, and there may be no funds issued upon approval. Some HELOCs, however, require a minimum initial amount to be disbursed. You can then draw on this line of credit when you need it. It works in the same manner as a credit card. Most lines of credit now come with a checkbook or a debit card to provide easy access to funds.

HELOCs usually offer future amortization because of their structure. You also only have to make payments on the amount that has been drawn. Unlike the other two forms of secondary home loans, HELOCs usually come with no closing costs.

There is an option for this type of loan where you pay only the interest each month on what you have taken out. However, all the money you withdrew will be due at the end of the term, so this option should be considered with care.

HELOCs are divided into two parts: the draw period and the repayment period. The draw period is often 10 years; during this time, you can withdraw money up to your line of credit. During the repayment period, the final amount you’ve withdrawn becomes a loan to be repaid with interest, within a specified time period . During this time, you can no longer draw against the account.

Saving And Paying Cash Is Smarter In The Long Run

Taking on debt of any kind robs you of true financial peace. When you lay your head on the pillow at night, what would you rather be thinking about: planning a party in your paid-for kitchen, or making payments on your new marble countertops ;. . . for the next;30 years?

With tools like;Dave Ramseys 7 Baby Steps, you can create and stick to a savings plan. Youll still have that remodel project done in no timebut itll be finished debt-free!

Recommended Reading: What Type Of Loan Is Needed To Buy Land

How You Receive Your Funds

Cash-out refinance gives you a lump sum when you close your refinance loan. The loan proceeds are first used to pay off your existing mortgage, including closing costs and any prepaid items ; any remaining funds are yours to use as you wish.

Home equity line of credit lets you withdraw from your available line of credit as needed during your draw period, typically 10 years. During this time, youll make monthly payments that include principal and interest. After the draw period ends, the repayment period begins: Youre no longer able to withdraw your funds and you continue repayment. You have 20 years to repay the outstanding balance.

Alternatives To Home Equity Loans

If a home equity loan isnt quite right for you, here are a few other forms of credit that might be a better financing option:

- HELOC: A home equity line of credit is a revolving line of credit that you can tap into again and again. You pay interest only on the amount you use. HELOCs also tend to have lower closing costs.

- Cash-out refinance: If you have more equity in your home than you owe on the mortgage, a cash-out refinance might be a good choice. With this option, youll take out a new mortgage thats big enough to pay off your old mortgage and leave you with left-over cash to use however youd like.

- Personal loan: If you have a short-term financial need, you might be able to take out an unsecured personal loan. Getting an unsecured loan means you wont have to use your property as collateral.

| Loan type | ||

|---|---|---|

|

||

| Home Equity Line of Credit |

|

|

|

|

|

|

|

|

| Note: Credible Operations, Inc. does not offer Home Equity Loans or HELOCs |

Credible doesnt offer home equity loans. But a cash-out refinance could be another option for you.

- Compare lenders

- Get cash out to pay off high-interest debt

- Prequalify in just 3 minutes

Also Check: Does Refinancing Car Loan Hurt Credit

Pay The Minimum During The Draw Period

If your monthly income recently dropped, you might choose to just make the minimum payment during the draw period.

In the aforementioned example, the minimum interest-only payment is about $136. Once the repayment term starts, the monthly payment rises to $527. Over the entire 20-year HELOC term, youd pay $21,073 in interest and thats without any rate increases.

This option wont save you money on interest compared to the first mortgage, but it can put breathing room in your budget.

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Also Check: How To Pay Down Student Loan Debt

Can You Use A Home Equity Loan For Anything

There arent many limits on home equity loan uses. You can use your loan for consolidating debt, paying for medical expenses or financing a vacation. However, not all of these are the best uses for a home equity loan. Typically, its best to use your home equity loan for things that will add value to your home, such as home renovations, since this will give you even more equity.

According To Beuro And Labor Statistics There Are Over 15 Trillion Loans That Are Currently Unpaid In The United States

Many people dream of working from home but think it’s simply not practical. Renting means following the rules, not being able to decorate and having restrictions on pets. If you’re one of the lucky few, your savings or a financial windfall will cover the cost of buying your home, but if you’re among the masses, you will need to take. While we receive compensation when you. If you are currently paying student loans you are not alone. Getting it right means understanding the mortgage process, from start to finish. Many of us dream of owning our home, but it’s getting harder to achieve. According to beuro and labor statistics, there are over 1.5 trillion loans that are currently unpaid in the united states. Here’s a look at how to modify your home loan. Rates for tuition have quadrupled in recent years. Read on to learn more about home equity loan requirements and answer your hom. Weigh the pros and cons and find out if it’s the right choice. Owning a home is a dream come true for many americans, and a federal housing administration loan can be a great tool for buying one.

You May Like: What Is The Average Auto Loan Interest Rate