Getting Rid Of Fha Mortgage Insurance Method #: Refinance Out Of It

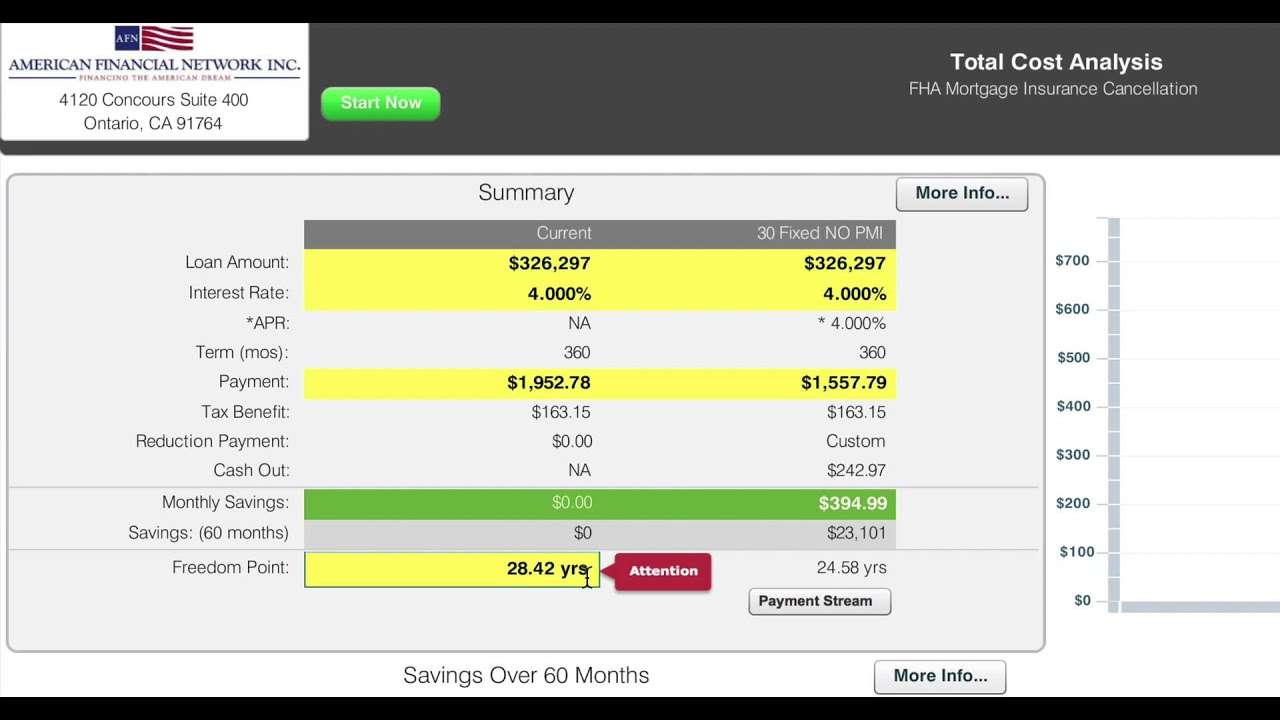

Canceling FHA mortgage insurance is also possible by refinancing into a conventional loan. Refinancing to a conventional mortgage is often the quickest and most cost-effective way to do it especially if mortgage rates have dropped since your original loan. And it can be the only way to do it if you opened your FHA loan on or after June 3, 2013, when FHA mortgage insurance became non-cancellable.

With todays rising home values, homeowners might be surprised how much equity they have. With a refinance, you can use your homes current appraised value rather than the original purchase price.

Replace FHA mortgage insurance with conventional PMI

Conventional private mortgage insurance, or PMI, has to be paid for just two years, then is cancellable. Converting your FHA mortgage insurance to conventional PMI is a great strategy to reduce your overall cost. Conventional PMI is usually much cheaper than FHA mortgage insurance, and you can cancel it much more easily.

You can often refinance into a conventional loan with as little as 5% home equity.

When your new conventional loan balance reaches 78% of the homes value, you can cancel conventional PMI. Some lenders and servicers will even let you cancel when you reach 80% of your homes current value.

Get rid of FHA mortgage insurance today with a loan that doesnt require PMI

Canceling FHA MIP with a VA Loan

Making A Plan To Get Rid Of Fha Mortgage Insurance Is A Great Financial Decision

When youre youre making a home purchase, youre mainly focused on getting into a place where you can set down roots and build a solid future. The down payment can be a big hurdle so high FHA PMI costs can be a worthwhile trade-off.

But now youre settled in, its time to think about getting rid of FHA mortgage insurance. These high monthly PMI payment costs could and should be going into savings, a childs college fund, or toward loan principal.

Dont delay. Even if youre not able to cancel your mortgage insurance now, make a plan for how youre going to do it.

Ten or twenty years down the road, youll be glad you did.

Refinance To A Conventional Loan

Most homeowners who are tired of FHA mortgage insurance premiums opt to refinance into another home loan. Getting out of an FHA mortgage by taking on a new conventional mortgage is one surefire way to stop paying the premiums required by FHA lenders. Refinancing comes with its own costs, however. Closing costs may be necessary, and you may ultimately reset the total repayment term of the loan.

Fortunately, refinancing may also give you the opportunity to lock in a lower interest rate, reduce your mortgage term, or both. This can be a powerful cost-saving strategy when combined with the benefit of eliminating MIP requirements.

One item to note is for borrowers who took out an FHA home loan prior to June 2013. If you have at least 22% equity in your home, and all mortgage payments have been made on time, you are eligible to request cancellation of your MIP after five years. For all other homeowners, refinancing your home mortgage is typically the best solution to eliminate FHA mortgage insurance premiums.

Related Content:

Read Also: How Much Do Loan Officers Make Per Loan

How To Remove Mortgage Insurance From Your Mortgage Home Loan

How Can I Remove PMI From My Loan?

The first step in determining whether your mortgage insurance can be removed is to identify what type of mortgage you have conventional or FHA. It is important to know the type of mortgage because the mortgage insurance removal guidelines are different for each mortgage type. The most important difference between conventional and FHA mortgage insurance is that conventional mortgage insurance will consider home appreciation when it comes to your request to remove the mortgage insurance. FHA only takes into account your principle reduction via regular mortgage payments to calculate your current loan to value. Additionally FHA mortgage insurance rules have changed so if you have an FHA loan you need to know the date your loan funded to truly know the type of FHA mortgage insurance you have. FHA loans funded prior to 2014 typically require the mortgage insurance to be on the loan for a minimum of 5 years. After the five year period you can request your mortgage insurance removed but only if you have made the principle reduction payments to get to a 78% loan to value. FHA loans funded after 2014 are not eligible for mortgage insurance removal. Conventional mortgage lenders will typically allow you to remove your mortgage insurance after you have made your mortgage payment on time for a minimum of two years. In addition, you must also have 22% equity in your home for the loan servicer to consider removing your mortgage insurance.

If Your Mortgage Is From A Federally Chartered Lender

Under federal law, lenders are not required to take market appreciation into account when determining the value of your home. Federal law requires lenders to cancel PMI, upon request, when the homeowner has made payments that reduce the principal amount owed under the mortgage to 80 percent of the homes value at the time it was purchased. For example, if a homes purchase price was $100,000, the lender is not required to cancel the PMI until the principal amount due on the mortgage is reduced to $80,000. Because the first years of a mortgage payment are mostly interest, a homeowner making only the minimum required payments would have to wait years, sometimes a decade or more, before reaching the required 20 percent threshold as calculated under federal law.

Once a homeowner pays the mortgage principal down enough to qualify for PMI cancellation, federally chartered lenders may require an appraisal to ensure that the homes value has not declined below its original value when purchased. Although federal law does not require lenders to take market appreciation into account, some lenders may agree to do so. For example, some lenders may agree to cancel PMI based on the homes current value if you have made substantial improvements to it others may elect to cancel PMI if an appraisal shows that the value of your home has markedly appreciated. You must contact the lender directly to begin the appraisal process.

You May Like: How Do I Find Out My Auto Loan Account Number

How To Remove Pmi & Mip Without Refinancing

The loss of mortgage insurance as a tax deduction now has many borrowers looking dump PMI and MIP as soon as absolutely possible.

There are several ways to do this without refinancing your mortgage to remove mortgage insurance, and possibly losing a very low interest rate.

The first step to remove mortgage insurance is to be up to date with your monthly payments. Federal laws provide two ways for you to remove PMI: Canceling PMI or PMI Termination.

The following PMI cancellation guidelines are taken from the Consumer Finance Protection Bureau , updated August 28th, 2014.

When And How Can Pmi Be Removed From My Loan

Fortunately for homeowners with conventional loans, private mortgage insurance wont be part of your mortgage payment forever.

The Homeowners Protection Act requires that lenders send homeowners annual notices that remind you that you have the right to request cancellation of your PMI.

As a homeowner, you can request that the mortgage insurance be removed when you have reached the date when the principal balance of your mortgage falls to 80 percent of the original value of your home.

Even if you do not request it be removed, lenders are required to cancel PMI automatically on conventional loans once youve reached the date when your principal balance reaches 78 percent of the original value of your home.

You should be able to locate these dates on your closing paperwork. More specifically, you should have a PMI disclosure form that you signed when you closed on your home loan.

You can request that your PMI be dropped earlier than these dates if you meet the following criteria:

- You must be up-to-date on your monthly payments.

- Your request must be in writing.

- You may need to certify that you do not have any 2nd mortgages on your home.

- It may be necessary that you provide an appraisal to support the value of your home.

Generally, assuming you meet these requirements, your lender must cancel your PMI.

It is important to note that some lenders have a minimum requirement. That means you will have to wait at least two years before being able to get rid of your mortgage insurance.

Don’t Miss: Usaa Refinance Car

What Is Pmi And How Does It Work

PMI is is a form of insurance that mortgage lenders use to reduce the risk of loss on low down payment mortgages. Lenders typically require it on mortgages for more than 80% of a homes value. Basically, PMI will get the bank some of its money back if you default on your loan. PMI doesnt cover the entire value of the mortgage, of course. If you default and go into foreclosure, the sale of the home covers a portion of the banks losses. But PMI can make up for the rest.

As an example, if a buyer puts 5% down on a home, the lender will require a level of PMI that reduces that mortgage to something less than 80% of the homes value. On a 95% mortgage, the lender will typically require 30% coverage. That will reduce the lenders exposure on the property from 95% down to around 68% .

Next: Contact Your Lender

Once you feel that you have an 80% loan to value on your home, you can contact your lender using the general customer service line. Each lender has a different protocol for exactly how they process PMI removal requests. Some will ask that you pay for an appraisal and then send the appraisal in to them for review, while others will review your history of payments to make sure that you qualify prior to requesting that you pay for the appraisal.

In any case, the process isnt free. You should expect to pay around $400-550 for an appraiser of the banks choosing to come out to your house, take pictures and measurements and review the comparables in your neighborhood. The appraiser will then send his or her final opinion of value to your lender. If the value proves your LTV is 80% or less, they will remove the PMI.

Keep in mind that every lender has different rules and requirements. Many will allow you to remove your PMI if your LTV is 80% or less, but some require it to be 78% or less. This is why its so important to call the customer service department before you begin the process to find out exactly what youre aiming for.

Also Check: How Long For Sba Loan Approval

Remove Your Mortgage Insurance For Good

PMI is a big cost for homeowners often $100 to $300 extra per month.

Fortunately, youre not stuck with PMI forever. Once youve built up some equity in your home, there are multiple ways to get rid of PMI and lower your monthly payments.

Some homeowners can simply requestPMI cancellation others will need to refinance into a loan that doesntrequire mortgage insurance.

With mortgage rates near historic lows, its a great time to get rid of your PMI and lock in a lower rate on your loan.

Skip Monthly Premiums With Pmi Advantage

Another option worth considering is PMI Advantage. Rocket Mortgage® allows you to buy a home without having to put 20% down and without having to pay a monthly mortgage insurance payment. With PMI Advantage, youll accept a slightly higher mortgage rate and eliminate monthly mortgage insurance payments. While this option still requires PMI on your home, it removes the monthly premium that you would otherwise have to pay.

If you still have questions, we’re here to help! Reach out to one of our Home Loan Experts to discuss your loan options.

Recommended Reading: When Can I Apply For Grad Plus Loan

To Get Rid Of Fha Mortgage Insurance: Check Your Loan Balance

You can request the cancellation of your FHA mortgage insurance when you meet certain requirements.

If you bought a house with an FHA loan some years back, you may be eligible to cancel your FHA PMI today. This option is attractive because it wont require you to get a new mortgage. If your loan balance is 78% of your original purchase price, and youve been paying FHA PMI for 5 years, your lender or service must cancel your mortgage insurance today by law.

While a low mortgage balance is a sure-fire way to cancel FHA mortgage insurance, it can take a while to get there. On a 30-year fixed FHA loan, it will take you about ten years to pay your loan down to 78% of the original purchase price. If youre not quite there, continue making payments for a few more years, or make a one-time principal payment.

Borrowers who have hit the magical 78% loan-to-value ratio can potentially start saving hundreds on their monthly payments and keep their existing FHA loan and interest rate intact.

How To Get Rid Of Pmi

7-minute read

You probably had to add private mortgage insurance if you bought a home with less than 20% down. PMI can add hundreds of dollars to your monthly payment but you dont need to pay for it forever.

Well go over the basics of PMI and what it covers, and well also show you how and when you can stop paying it.

Also Check: Usaa Pre Qualify Auto Loan

Next Steps: Dont Drain Your Bank Accounts To Escape Pmi

While paying PMI each month or as a lump sum each year is no financial joyride, homeowners should be careful not to make their finances worse by hustling to get rid of PMI.

Most financial experts agree that having some liquidity, in case of emergencies, is a smart financial move. So before you tap your savings or retirement funds to reach that 20 percent equity mark, be sure to speak with a financial adviser to make sure youre on the right track.

There seems to be a philosophical aversion to PMI on the part of many buyers that is misplaced, McBride says. As long as youre not taking an FHA loan, youre not married to the PMI. You can drop it once you achieve a 20 percent equity cushion, which may only be a few years away depending on home price appreciation. But do not feel the need to use every last nickel of cash to make a down payment that avoids PMI, only to leave yourself with little in the way of financial flexibility afterwards.

With additional reporting by Jeanne Lee

How To Remove Pmi: Key Takeaways

Can you stop paying for mortgage insurance? The answer depends on your loan type and your current principal balance.

- Conventional PMI goes away on its own when youve paid off 22% of your loans principal balance

- You can request PMI cancellation when youve paid off 20% of your loan balance

- Contact your loan servicer to request PMI cancellation

The rules are a little different for FHA loans.

- FHA mortgage insurance lasts the life of the loan unless you put 10% or more down

- To get rid of FHA mortgage insurance, you must refinance to a conventional loan

- Youll need a 620 credit score and 20% equity to get rid of your FHA mortgage insurance premium

With home values rising nationwide, many homeowners who are still paying for mortgage insurance will now have enough equity to cancel or refinance out of their mortgage insurance payments.

If you meet the requirements to get rid of PMI, you could start saving on your home loan immediately.

Recommended Reading: Becu Auto Loan Payoff

How To Get Rid Of Your Private Mortgage Insurance

Let’s just say it: its hard not to resent PMI . It protects your lender, not you, yet youre the one who has to pay for it every month. Argh. And besides, after putting so much time, money, and heart into buying and maintaining a home, the last thing you’ll want to do is default on your mortgage.

But the thing is, most of us dont have a big enough down payment to avoid PMI or MIP, the version attached to some government-backed loans, such as FHA loans.

So the real question is, will PMI ever go away? Yes! Once you have enough equity built up in your home, you can get rid of mortgage insurance one way or another and put that money back where it belongs: in your wallet.

Heres the scoop on the various ways to do it.

Private Mortgage Insurance Coverage

First, you should understand how PMI works. For example, suppose you put down 10% and get a loan for the remaining 90% of the propertys value$20,000 down and a $180,000 loan. With mortgage insurance, the lender’s losses are limited if the lender has to foreclose on your mortgage. That could happen if you lose your job and can’t make your payments for several months.

The mortgage insurance company covers a certain percentage of the lenders loss. For our example, lets say that percentage is 25%. So if you still owed 85% of your homes $200,000 purchase price at the time you were foreclosed on, instead of losing the full $170,000, the lender would only lose 75% of $170,000, or $127,500 on the homes principal. PMI would cover the other 25%, or $42,500. It would also cover 25% of the delinquent interest you had accrued and 25% of the lenders foreclosure costs.

If PMI protects the lender, you may be wondering why the borrower has to pay for it. Essentially, the borrower is compensating the lender for taking on the higher risk of lending to youversus lending to someone willing to put down a larger down payment.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan