Jump To Fha Loan Topics:

Unlike conventional home loans, FHA loans are government-backed, which protects lenders against defaults, making it possible to for them to offer prospective borrowers more competitive interest rates on traditionally more risky loans.

An FHA home loan works like any other mortgage in that you borrow a certain amount of money from a lender and pay it back, typically over 30 years via fixed mortgages.

The main distinction is that FHA loans charge both upfront and monthly mortgage insurance premiums, often for the life of the loan.

However, they also come with low down payment and credit score requirements, making them one of the easier home loans to qualify for. Oh, and FHA interest rates are some of the lowest around!

Lets explore some of the finer details to give you a better understanding of these common loans to see if one is right for you.

Is Cash Back Allowed On An Fha Streamline Refinance

Cash back is not allowed for a streamline refinance loans. For that, youll need to apply for an FHA Cash-out Refinance.

The FHA does permit a small amount of cash, usually less than $500, to go to the borrower. Some lenders limit the amount to $250 or less. The cash back can only be the result of incidental changes in closing calculations, which happens often with all mortgages.

Will I Have To Pay Upfront Mortgage Insurance

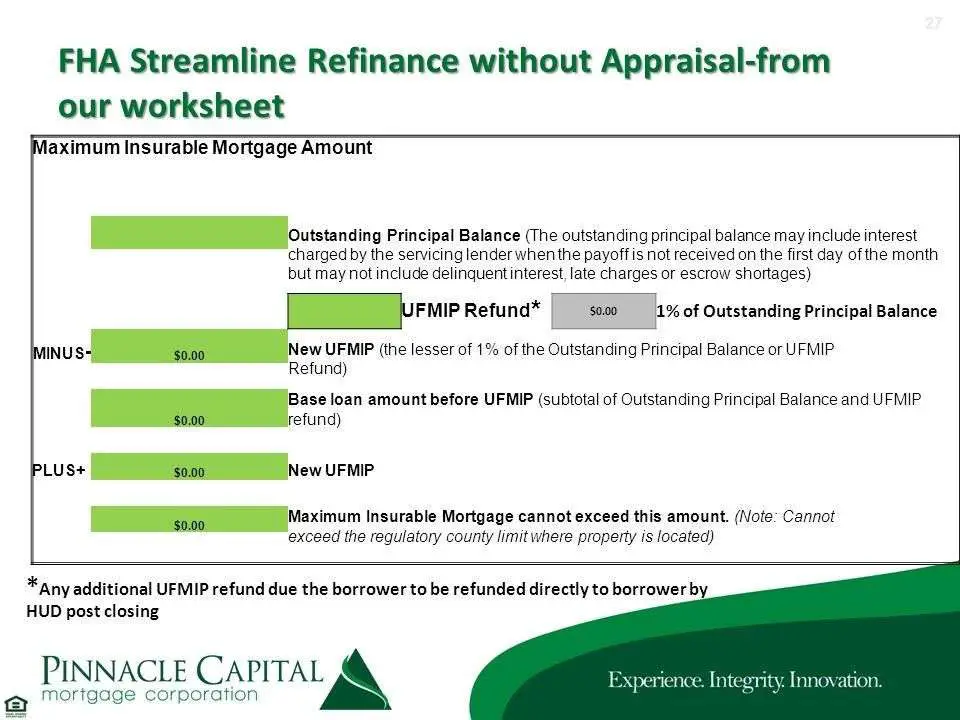

Yes. Similar to an FHA home loan, an FHA Streamline requires mortgage insurance. A one-time upfront mortgage insurance premium will need to be paid at closing, along with a monthly mortgage insurance payment. However, the U.S. Department of Housing and Urban Development will refund a prorated amount of the UFMIP when an FHA loan is refinanced within three years.

Mortgage insurance costs vary depending on when a homeowner first obtained their FHA mortgage:

- Prior to June 1, 2009 â Homeowners must pay an upfront premium of 0.01% of the loan amount and an annual premium of 0.55%.

- After June 1, 2009 â Homeowners must pay an upfront premium of 1.75% of the loan amount, and the annual premium can range from 0.45% to 1.05%.

Also Check: Does Va Loan Work For Manufactured Homes

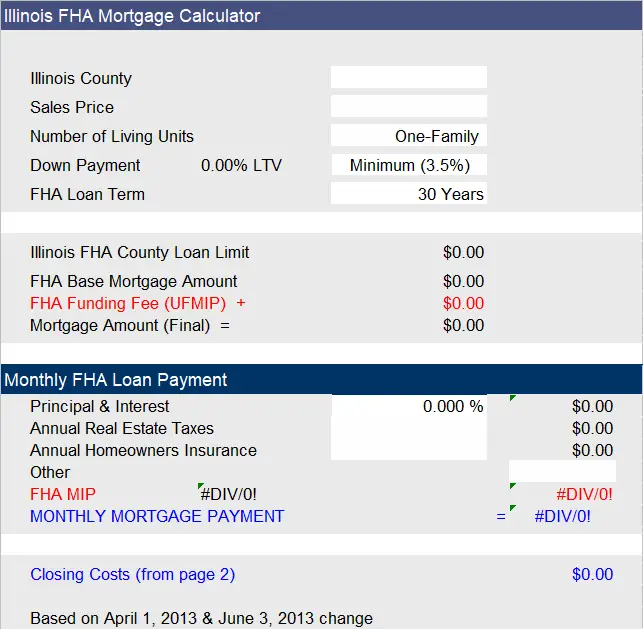

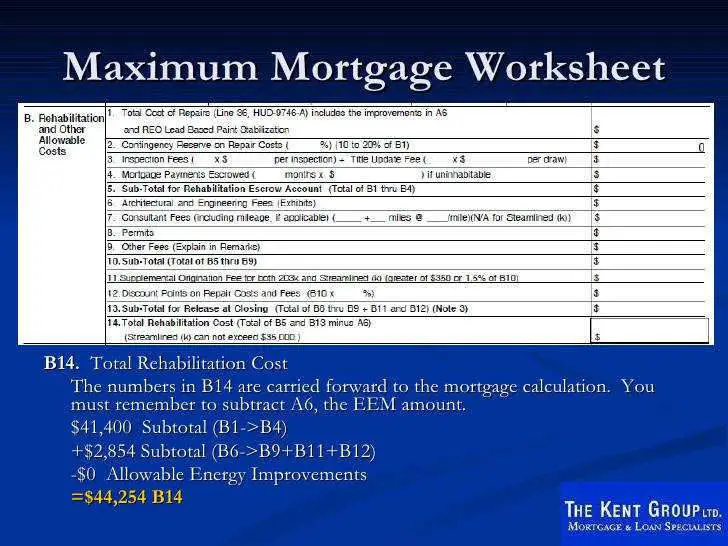

Down Payment And Base Loan Amount

Calculating a down payment for a specific purchase price is straightforward. For example, a 3.5 percent down payment on a Bay Area home purchase of $500,000 is equal to $17,500. Under FHA guidelines, the same home purchase would cost a borrower with poor credit a lot more upfront. For example, borrowers with credit scores between 500 and 579 need a 10 percent down payment, meaning that a $500,000 home would require a $50,000 down payment. The base loan amount is equal to purchase price minus the down payment. At 3.5 percent down, the base loan amount on a $500,000 is $482,500, or $450,000 with 10 percent down. Borrowers can contribute any amount desired as a down payment, as long as it meets the FHA’s minimum down payment guidelines.

Benefits Of Fha Streamline Refinance

Streamline refinancing makes it easier to lower your rate with less paperwork and faster closings. By refinancing, the total finance charges you pay may be higher over the life of the loan. To help make sure you save money by refinancing, keep your monthly payment and the length of your loan term the same.

Don’t Miss: Fannie Mae Home Loans For Bad Credit

Fha Mortgage Rates Are Generally The Lowest Available

One of the biggest draws of FHA loans is the low mortgage rates. They happen to be some of the most competitive around, though you do have to consider the fact that youll have to pay mortgage insurance. That will obviously increase your overall housing payment.

In general, you might find that a 30-year fixed FHA mortgage rate is priced about 0.25% to 0.50% below a comparable conforming loan .

So if the non-FHA loan mortgage rate is 3.75%, the FHA mortgage rate could be as low as 3.25%. Of course, it depends on the lender. The difference could be as little as an .125% or a .25% as well.

This interest rate advantage makes FHA loans competitive, even if you have to pay both upfront and monthly mortgage insurance .

The low rate also makes it easier to qualify for an FHA loan, as any reduction in monthly payment could be just enough to get your DTI to where it needs to be.

But if you compare the APR of an FHA loan to a conforming loan, you might find that its higher. This explains why many individuals refinance out of the FHA once they have sufficient equity to do so.

How To Apply For An Fha Streamline Refinance

To apply for an FHA streamline refinance, youll first need to find an FHA-approved lender. While you can use your current FHA lender, it pays to shop around, as loan requirements and fees vary from one lender to another.

Youll also need to gather some documentation. Even though minimal documents are required for an FHA streamline refinance, there are still a few essentials youll need. These can vary by lender, but here are the basics to keep on file:

- A current mortgage statement to show that payments are up to date

- A current FHA mortgage note to show your interest rate and payment

- Homeowners insurance information

- Two months of bank statements to prove you have enough funds to pay for out-of-pocket costs

When shopping around, remember that there are costs associated with this type of refinance. Youll have to pay the upfront MIP in addition to monthly premiums. FHA loans originated before June 2009 require an upfront premium of only 0.01 percent. All other loans require an upfront premium of 1.75 percent of the loan amount. Annual premiums are equal to 0.45 percent to 1.05 percent of the loan amount each year of your loan term.

Recommended Reading: Usaa Auto Loan Rates And Terms

What Do These Results Mean For Me

The above is based on the maximum allowable LTV on any cash out refinance loan which is through the FHA. The FHA cash out refinance allows borrowers to take out up to 85% of their home’s equity. There is no guarantee that you will actually qualify, and if you do qualify, you may not be permitted to take out 85%. Please contact us today to get prequalified or to submit a full loan application.

The above is based on the maximum allowable LTV on any cash out refinance loan which is through the FHA. The FHA cash out refinance allows borrowers to take out up to 85% of their home’s equity. There is no guarantee that you will actually qualify, and if you do qualify, you may not be permitted to take out 85%. Please contact us today to get prequalified or to submit a full loan application.

Consolidate My Debt

How to Use the FHA Cash Out Refinance Calculator

In order to use the FHA cash out refinance calculator you need to determine what you currently owe on your property .

In the two boxes, enter in your current loan balance and the estimated value of your home.

Then, click calculate. This will provide you with the maximum amount you are able to borrow apart from your current loan balance .

FHA loan guidelines restrict cash out loans to a 85% LTV. It used to be 95%, but HUD changed the guidelines in April, 2009.

FHA Cash Out Refinance Requirements

Below are the 2020 FHA cash out refinance requirements:

Eight Factors To Help You Qualify

Lenders understand that some things are simply out of your control, but there are several things you can control and you should be mindful of them when youâre waiting to qualify or close on your FHA loan.

- Donât make any random deposits into your bank accounts, and document each one when you make a deposit.

- If you have more than one bank account, donât transfer big amounts between them. Keep most of your money in one account if possible.

- Wait to buy a new vehicle or to upgrade to a bigger lease.

- If you get a cash gift, remember to fill out your gift paperwork before you accept it.

- Donât quit or switch jobs in the middle of the loan process. You want lenders to see you as a good choice.

- If you work at a salaried job, donât switch to a heavily-commissioned job. Remember, your loan paperwork is based on your previous income from your salaried position.

- Donât fall behind on your bills or miss payments, even if youâre currently disputing them.

- Even if you get 20% off, donât open any new credit cards. This can skew your credit utilization ratio, and it can make your credit score drop.

Recommended Reading: How To Get 150k Business Loan

You May Like: Rv Loan 600 Credit Score

Do Fha Loans Require Mortgage Insurance

- FHA loans impose both an upfront and annual insurance premium

- Which is one of the downsides to FHA financing

- And it cant be avoided anymore regardless of loan type or down payment

- Nor can it be cancelled in most cases

One downside to FHA loans as opposed to conventional mortgages is that the borrower must pay mortgage insurance both upfront and annually, regardless of the LTV ratio.

This differs from privately insured mortgages, which only require mortgage insurance if the LTV is greater than 80%.

You Must Pay Mortgage Insurance Premiums

The FHA streamline refinance, like all FHA loans, requires you to pay mortgage insurance premiums . Getting a streamline refinance will not eliminate MIP.

First, youll be required to pay an upfront MIP. This is paid at closing, unless your lender offers a no-cost refinance in exchange for a higher rate.

Next, youll pay the annual MIP that is split into monthly installments and included in your mortgage payment each month. Heres the cost of each premium for FHA loans opened on or after June 1, 2009:

- Upfront MIP: 1.75 percent of the loan amount

- Annual MIP: 0.45 percent to 1.05 percent of the loan amount each year of your loan term

You May Like: Usaa Rv Loan Rates

C Cltvs And Subordinate Financing

Any existing subordinate financing must be subordinated to the streamline refi mortgage. A new subordinate financing may be permitted if its proceeds are used either:

- to reduce the existing mortgages principal amount, or

- to finance the discount points, origination fees, and other closing costs incurred in the refinance.

The FHA does not have a maximum combined loan-to-value limit for streamline refinances.

In the previous guidance, the calculation of the maximum loan amount would depend on whether the streamline refi has an appraisal or none. The current handbook notes that appraisals are not required on streamline refinances. And whether the lender has received one does not have a bearing on the eligibility or calculation of the maximum mortgage amount on streamline refinances.

The Upfront Mortgage Insurance Premium:

FHA loans have a hefty upfront mortgage insurance premium equal to 1.75% of the loan amount. This is typically bundled into the loan amount and paid off throughout the life of the loan.

For example, if you were to purchase a $100,000 property and put down the minimum 3.5%, youd be subject to an upfront MIP of $1,688.75, which would be added to the $96,500 base loan amount, creating a total loan amount of $98,188.75.

And no, the upfront MIP is not rounded up to the nearest dollar. Use a mortgage calculator to figure out the premium and final loan amount.

However, your LTV would still be considered 96.5%, despite the addition of the upfront MIP.

Recommended Reading: How To Refinance An Avant Loan

What Documents Do I Need For An Fha Streamline Refinance

Even though FHA streamline refinances have minimal documentation required for the loan application, that doesnt mean theres no documentation. Below is a list of things youll likely need for your refinance application, including your:

- Current mortgage statement

- Current FHA loans mortgage note, which shows your current interest rate and loan type

- Final settlement statement or Deed of Trust with the FHA case number of your current loan

- Employer HR departments contact information

- Two months of bank statements that show you have enough funds to pay for any out-of-pocket costs

- Homeowners insurance agents contact information to obtain current proof of insurance

Also, make your next months mortgage payment as soon as possible. This allows your lender to obtain proof that your FHA mortgage is current. Your lender may require more or less than the items listed above.

Do I Qualify For An Fha Streamline Refinance

FHA streamline refinance loans are available to homeowners who currently have an FHA loan with good payment history. Homes that have lost value and are now underwater are eligible too.

The most important qualification though, is that borrowers must receive a benefit from refinancing. This is called a net tangible benefit FHA refinances can be approved if the combined interest rate drop is at least 0.5% .

You May Like: Can You Buy A Manufactured Home With A Va Loan

How Do You Calculate The Annual Mip On An Fha Loan

To calculate the annual MIP, you use the annual average outstanding loan balance based on the original amortization schedule. An easy way to ballpark the cost is to simply multiply the loan amount by the MIP rate and divide by 12.

For example, a $200,000 loan amount multiplied by 0.0085% equals $1,700. Thats $141.67 per month that is added to the base mortgage payment.

In year two, it is recalculated and will go down slightly because the average outstanding loan balance will be lower.

And every 12 months thereafter the cost of the MIP will go down as the loan balance is reduced .

However, paying down the loan balance early does not affect the MIP calculation because its based on the original amortization regardless of any extra payments you may make.

Note: The FHA has increased mortgage insurance premiums several times as a result of higher default rates, and borrowers should not be surprised if premiums rise again in the future.

Fha Streamline Refinance: What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

An FHA streamline refinance lets you skip right past one of the biggest hurdles to getting an FHA loan: The appraisal. This shortcut saves you time and money, but not everyone can take advantage of it. Only borrowers who meet certain conditions can get a break when refinancing a home purchase loan that was originally backed by the Federal Housing Administration.

Here’s what you need to know if you want to score this refinance.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Requirements For Fha Streamline Refinancing

To take advantage of the FHA Streamline Refinancing program, you must meet a few key requirements:

- You must have an existing FHA-insured mortgage.

- You must be current on your mortgage.

- You are allowed no more than one late payment in the past year, and are required to have made the six most recent payments on time.

- The refinance must produce a net tangible benefit for the borrower. It must either result in at least a 0.5 percentage point reduction in the combined interest rate and Mortgage Insurance Premium or, the benefit can occur from refinancing into either an adjustable-rate mortgage , or a fixed-rate mortgage .

- The new loan must not exceed the initial mortgage amount.

- The refinance cannot be used to obtain cash in excess of $500.

- You must pay on the original FHA mortgage for at least 210 days before qualifying for the refinancing.

Tip: Donât have an FHA-insured mortgage? There are several other refinancing options available. Learn more about PennyMac Refinancing.

Sorry the service is unavailable currently. Please visit Experience.com website to view PennyMac, LLC. reviews

How Does This Affect Reverse Mortgages

In addition to handling FHA loans, the FHA also is responsible for insuring conforming home equity conversion mortgages, more commonly referred to as reverse mortgages.

Reverse mortgages do not vary by county and have one set limit across the U.S. The FHA raised the limits on reverse mortgages from $765,600 in 2020 to $822,375 in 2021..

Rocket Mortgage® doesnt currently offer reverse mortgages, but cash-out refinance could be a great alternative.

Also Check: California Loan Officer License

Fha Mip Cancellation Policy

The FHA requires some homeowners to pay mortgage insurance for as long as their loan is in effect.

If your FHA Streamline Refinance replaces a loan from on, or after, June 1, 2009, the rules on your FHA MIP cancellation are as follows:

- LTV of 90 percent or less at the time of closing: MIP is required for 11 years

- LTV greater than 90 percent at the time of closing: MIP required for the life of the loan

The FHA MIP cancelation policy applies to 15-year loan terms and 30-year loan terms equally.

Note that refinancing homeowners are welcome to bring cash to closing in order to reduce their loan balance and change their MIP disposition. However, not everyone will have the cash to make such a move.

This is why, when exploring an FHAStreamline Refinance, you should also look at other mortgagerefinance options including the conventionalmortgage loan via Fannie Mae or Freddie Mac, which is available with nearlyevery mortgage lender.

What Is Your Current Loan Situation

| Availability Equity to Cash Out $0 |

You May Like: Can I Refinance My Sofi Personal Loan