No Down Payment: Usda Loans

The U.S. Department of Agriculture offers a 100% financing mortgage. The program is formally known as a Section 502 mortgage, but, more commonly, its called a Rural Housing Loan or simply a USDA loan.

The good news about the USDA Rural Housing Loan is that its not just a rural loan its available to buyers in suburban neighborhoods, too. The USDAs goal is to help;low-to-moderate income homebuyers, wherever they may be.

Many borrowers using the USDA loan program make a good living and reside in neighborhoods that dont meet the traditional definition of a rural area.

For example, college towns including Christiansburg, Virginia; State College, Pennsylvania; and even suburbs of Columbus, Ohio meet USDA eligibility standards. So do the less-populated suburbs of some major U.S. cities.

Some key benefits;of the USDA loan are;:

- Theres no down payment requirement

- Theres no maximum home purchase price

- You may include eligible home repairs and improvements in your loan amount

- The upfront guarantee fee can be added to the loan balance at closing; mortgage insurance is collected monthly

Just be aware that USDA enforces income limits; yours must be near or below the median income for your area.

Another key benefit is that USDA mortgage rates are often lower than rates for comparable, low- or no-down-payment mortgages. Financing a home via the USDA can be the lowest-cost path to homeownership.

Use This Fha Mortgage Calculator To Get An Estimate

An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for qualified homebuyers. For instance, the minimum required down payment for an FHA loan is only 3.5% of the purchase price. The FHA mortgage calculator includes additional costs in the estimated monthly payment. Such as, a one-time, upfront mortgage insurance premium and annual premiums paid monthly.

This FHA loan calculator provides customized information based on the information you provide. But, it assumes a few things about you. For example, that youre buying a single-family home as your primary residence. This calculator also makes assumptions about closing costs, lenders fees and other costs, which can be significant.

Estimated monthly payment and APR example: A $175,000 base loan amount with a 30-year term at an interest rate of 4.125% with a down-payment of 3.5% would result in an estimated principal and interest monthly payment of $862.98 over the full term of the loan with an Annual Percentage Rate of 5.190%.1

Fha Minimum Credit Score: 500

FHA guidance allows lower credit scores, which is one reason first-time home buyers are often attracted to FHA loans. The FHA lets borrowers with credit scores as low as 500 be considered for home loans.

However, it’s important to bear in mind that while the FHA sets out guidelines for credit score minimums, FHA lenders may require higher minimum scores. FHA loans don’t come directly from the government; the FHA insures them on behalf of the lender. Despite having that as backup, lenders often choose to minimize their risk by mandating higher credit minimums. This is one of the reasons why it’s smart to shop and compare FHA lenders. Not only might they have different qualifications, but you can also weigh different lenders’ rates and fees.

It’s worth noting that even with a lender who’s following FHA guidelines to the letter, you’ll get better terms if you have a higher credit score. A stronger credit score should also help you get a better FHA mortgage rate.

You May Like: How To Apply For Direct Loan

What If I Cant Afford The Down Payment

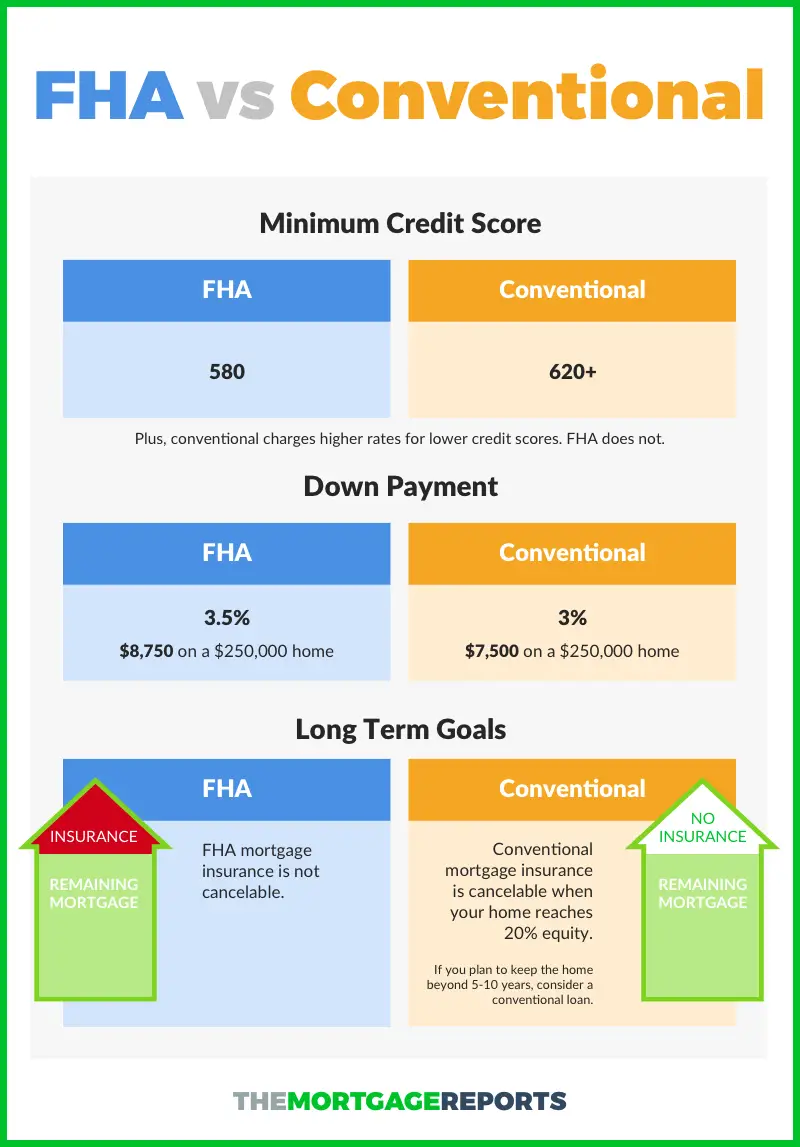

Not everyone qualifies for a zero-down mortgage. Most borrowers need at least 3% down for a conventional mortgage or 3.5% down for an FHA loan.

But what if you cant quite afford the minimum down payment? Three percent down on a $300,000 home is still $9,000 a considerable amount of money.

Luckily there are programs that can help.

For example, every state has multiple down payment assistance programs . These programs often funded by state and local governments and nonprofits offer money to make homeownership more accessible for lower-income or disadvantaged home buyers.

DPA funds can come in the form of a grant or loan, and the loans are often forgiven if you live in the home for a certain period of time.

To find out whether youre eligible for assistance, ask your Realtor or lender to help you find and apply for programs in your area.

How Usda Loans Work

Using a USDA loan, buyers canfinance 100 percent of a homes purchase price whilegetting access to better-than-average mortgage rates. This is because USDAmortgage rates are discounted as compared to other low-down paymentloans.

Beyond that, USDA loans arent allthat unusual.

The repayment schedule doesntfeature a balloon or anything non-standard; the closing costs are ordinary;and, prepayment penalties never apply.

The two areas where USDA loans are different is with respect to the loantype and down payment amount.

- With a USDA loan, you dont have to make a down payment. This is one of only two major loan programs that allow zero-down financing

- The USDA loan program requires you to take a fixed-rate loan. Adjustable-rate mortgages are not available via the USDA rural loan program

Rural loans can be used byfirst-time home buyers and repeat home buyers alike.Homeowner counseling is not requiredto use the USDA program.

Also Check: How Long For Sba Loan Approval

What Are Todays Low

Todays mortgage rates are low across the board. And many low-down-payment mortgages have below-market rates thanks to their government backing; this includes FHA loans and VA and USDA loans .

Different lenders offer different rates, so youll want to compare a few mortgage offers to find the best deal on your low- or no-down-payment mortgage. You can get started right here.

Popular Articles

Yes Or No For Down Payment Sources

What if you can’t come up with the entire down payment on your own? Lenders will require the full amount of money as the required down payment, but friends, family, and employers can make a down payment gift to you that reduces your financial burden. That money is required to be verified by the lender as having come from an approved source.

The FHA doesn’t just list who may give such a gift–it also has rules discussing who MAY NOT provide gift funds for an FHA loan down payment. The gift donor may not be a person or entity with an interest in the sale of the property, such as the seller, real estate agent, or the builder.

FHA loan rules are specific and clear in these areas to insure fairness and to preserve the integrity of the home buying process with FHA loan funds.

Recommended Reading: What Are Assets For Home Loan

What Are The Pros And Cons Of Fha Loans

Even if your credit score and monthly budget leave you without other choices, be aware that FHA loans involve some trade-offs.

Benefits of FHA loans:

-

Lower minimum credit scores than conventional loans.

-

Down payments as low as 3.5%.

-

Debt-to-income ratios as high as 50% allowed.

Disadvantages of FHA loans:

-

FHA mortgage insurance lasts the full term of the loan with a down payment of less than 10%.

-

Property must meet strict health and safety standards.

-

No jumbo loans: The loan amount cannot exceed the conforming limit for the area.

Even though the FHA sets standard requirements, FHA-approved lenders’ requirements may be different.

FHA interest rates and fees also vary by lender, so it’s important to comparison shop. Getting a mortgage preapproval from more than one lender can help you compare the total cost of the loan.

» MORE:Learn how to compare FHA lenders

What Is The Lowest Credit Score For A Fha Loan

What is the lowest credit score for a FHA loan? The minimum credit score to qualify for an FHA loan is 580 with a down payment of 3.5 percent. If you can bump up your down payment to at least 10 percent, you can have a credit score as low as 500 and still qualify.

What credit score you need for FHA loan?;Youll need a credit score of at least 580 to qualify. If your credit score falls between 500 and 579, you can still get an FHA loan as long as you can make a 10% down payment. 1 With FHA loans, your down payment can come from savings, a financial gift from a family member, or a grant for down-payment assistance.

What is the lowest credit score that will qualify a potential borrower for FHA loans?;The Federal Housing Administration, or FHA, requires a credit score of at least 500 to buy a home with an FHA loan. A minimum of 580 is needed to make the minimum down payment of 3.5%. However, many lenders require a score of 620 to 640 to qualify.

Can you get an FHA loan with a 500 credit score?;The minimum credit score needed to get an FHA loan is usually around 580. If you can make a 10% down payment, you can probably get approved with a credit score between 500 579.

Recommended Reading: How To Get 150k Business Loan

Can Credit Score Increase In A Month

For most people, increasing a credit score by 100 points in a month isnt going to happen. But if you pay your bills on time, eliminate your consumer debt, dont run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

What Will Fail An Fha Appraisal

Structure: The overall structure of the property must be in good enough condition to keep its occupants safe. This means severe structural damage, leakage, dampness, decay or termite damage can cause the property to fail inspection. In such a case, repairs must be made in order for the FHA loan to move forward.

Also Check: How To Transfer Car Loan To Another Person

Pro: Better For Those With Poor Credit Or Dtis

The other big advantage of FHA loans is that they make homeownership accessible for people with worse credit scores than other types of loans. You can get an FHA loan with a credit score of just 500 , but this is not always possible with other loans.

The same is true of your debt-to-income ratio. FHA loans let it be up to 43%, and you may even secure a loan with a higher ratio.

Why Do Sellers Prefer Conventional Over Fha

There are two situations when a seller should choose a Conventional offer over an FHA offer. First, if the property has safety issues or things that need to be fixed, a Conventional appraisal will be less likely to point out those issues while an FHA appraiser will require those to be fixed prior to closing.

Recommended Reading: What Are The Qualifications For Rural Development Loan

Low And No Down Payment Programs

Just because you dont have 20% to put down on a house doesnt mean you cant get a mortgage. Gone are the days of needing such a large down payment to be able to buy a house.

The Government came along in 1934 and started the Federal Housing Administration to help more Americans become homeowners by insuring mortgages to reduce the risk to the lender.

Usda Loan Rates: How Do They Compare To Fha & Conventional

Compared to other loan programs, USDA mortgage rates are some of the lowest available.

USDA rates are typically only matched by the VA loan, which is exclusively for veterans. These two programs USDA and VA can offer below-market interest rates because their government guarantee protects lenders against loss.;

Other mortgage programs, like the FHA loan and conventional loan, can have rates around 0.5%-0.75% higher than USDA rates on average.;

That said, mortgage rates are personal. Getting a USDA loan doesnt necessarily mean your rate will be below-market or match USDA loan rates advertised.

To get the lowest possible rate and monthly payments, youneed an excellent credit score and low debts. Making a bigger down paymenthelps, too.

You also need to shop around with a few different USDA mortgage lenders.;

Each USDA lender sets rates differently so comparing personalized rates from more than one company is the only way to find your lowest option.

Don’t Miss: Who Can Qualify For An Fha Loan

Are Fha Appraisals Strict

The FHA Appraisal

Federal Housing Administration loans can help buyers secure a home for as little as a 3.5 percent down payment. To secure a mortgage, the property must meet FHA minimum standards and meet a fair market value. As such, FHA appraisals are usually more strict than conventional appraisals.

How Do Fha Loans Work

FHA loans are backed by the Federal Housing Administration, which means that, if you default on the loan, the federal government guarantees to the lender that it will answer for the loan.

The FHA doesnt lend you the money directly; instead, you borrow from an FHA-approved lender like a bank or credit union.

You May Like: How To Calculate Amortization Schedule For Car Loan

Disadvantages Of Fha Loans

The main disadvantage of FHA loans is that the mortgage insurance premiums must be paid for the life of the loan for borrowers who make a down payment of 3.5 percent. FHA borrowers can only eliminate their mortgage insurance payment by refinancing into another type of loan.

Conventional loans require less mortgage insurance, Shalaby says. In addition, borrowers have the option of lender-paid mortgage insurance, which wraps the insurance into the loan with a slightly higher rate.

Unlike FHA loans, private mortgage insurance automatically ends on conventional loans when the borrowers reach 20 percent in home equity by paying down their loan. Borrowers can also request an appraisal and earlier end to their private mortgage insurance if their home value has increased.

One more disadvantage of an FHA loan is that FHA appraisals are stricter than those required for conventional loans, May says. Buyers purchasing a fixer-upper may have a harder time qualifying for an FHA loan unless they opt for a renovation loan.

Every mortgage loan choice should be made on an individualized basis that takes into consideration the borrowers entire financial plan. First-time buyers can ask their lender for a loan comparison of an FHA loan and a conventional to see which fits their needs best.

How Much Should You Put Down On A House

Should you put 20% down on a house, even though its not required? In many cases, the answer is no. In fact, most people put only 6-12% down. But the right amount depends on your situation.;

For instance: If you have a lot of money saved up in the bank, but relatively low income, making the biggest down payment possible can be smart. Thats because a large down payment shrinks your loan amount and reduces your monthly mortgage payment.

Or maybe;your situation is reversed.

Maybe you may have a good household income but very little saved in the bank.;In this instance, it may be best to use a low- or no-down-payment loan, while;planning to cancel your mortgage insurance at;some point in the future.

At the end of the day, the right downpayment depends on your finances and the home you plan to buy.

Read Also: What Size Mortgage Loan Can I Qualify For

Is Termite Inspection Required For Fha Loan

Is termite inspection required for FHA loan? Lenders must require a home inspection for FHA loans, typically at the buyers expense. The inspection is required in order to make sure the property meets the FHAs guidelines. When a termite inspection is needed, it should be conducted by a licensed termite inspector.

Is termite clearance required for FHA?;The lender must confirm that the property is free from termites and other wood destroying insects and organisms before the property can be financed with an FHA insured loan. The FHA lender is required to confirm the home is free of infestation or significant damage by viewing the FHA inspection report.

Do lenders require a termite inspection?;If you are a real estate agent, you know that most banks and lenders require home termite inspections before they approve a loan.

Does FHA require a termite inspection in Texas?;FHA requires inspection only if there is evidence of active infestation, if mandated by the state or local jurisdiction, if customary to the area, or at the lenders discretion. Please see: Mortgagee Letter 2005-48 for more information.

Qualifying For Fha Construction Loans

One thing to understand FHA construction loan is theyâre a little more difficult to qualify for than regular mortgages. Since the FHA is insuring the entire loan â including the construction and renovations phase â and they have their own building codes and guidelines, youâre facing more examination and scrutiny during the qualification process than if you were taking out a mortgage on an already-built home.

To qualify for an FHA construction loans, you go through the following steps:

Recommended Reading: How Do I Get My Student Loan Number