Grad Plus Loans Vs Private Student Loans

Another potential way to pay for graduate school is with private student loans. These loans are issued by private lenders, including banks, credit unions, and online lenders.

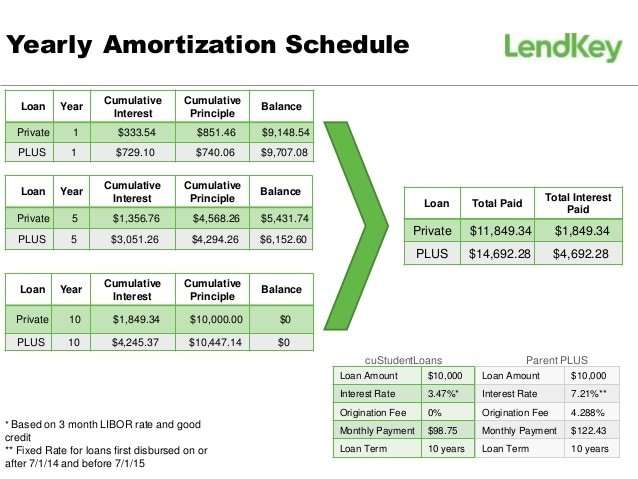

Depending on the lender and your credit, you might qualify for better interest rates or terms with a private loan than with a PLUS Loan.

Keep in mind that private student loans arent eligible for the federal benefits and protections that come with Grad PLUS Loans, such as access to income-driven repayment plans and student loan forgiveness programs.

Tip:

If you have poor or even no credit, you might need a cosigner to improve your chances of getting a private student loan.

Even if you dont need a cosigner to qualify, having one could get a lower interest rate than youd get on your own.

If youre comparing federal vs. private student loans, here are some important features to note:

Check Out: Best Private Student Loans

What Is A Plus Loan

A PLUS loan is available to graduate or professional students and parents of dependent undergraduate students. Undergraduates can take advantage of both subsidized and unsubsidized federal student loans, as well as parent PLUS loans.

PLUS loans are available for parents to take out on their students behalf or for graduate and professional students to continue their education. These loans cover any financial gaps left by other types of financial aid, including grants, scholarships and other federal student loans.

Where To Borrow Money Fast

Category: Loans 1. Fast Personal Loans: Best Lenders for Quick Cash NerdWallet Aug 12, 2021 Fast Personal Loans: Best Lenders for Quick Cash · Upstart · LendingPoint · FreedomPlus · Discover® Personal Loans · OneMain Financial · LightStream.How fast can I get a loan?Are online loans safe? Where

You May Like: Can I Loan Money To My S Corp

Grad Plus Loans Are Unlocked With A Fafsa Form

Your eligibility for a grad PLUS loan is determined when you fill out the Free Application for Federal Student Aid . In addition, you will have access to benefits typical of federal loans, including eligibility for income-driven repayment.

The borrowing process is relatively simple, and the benefits associated with federal student loans are generally more generous than whats offered with many private student loans. This can make graduate PLUS loans a very attractive choice.

Where Do I Send An Enrollment Verification Form For An In

Enrollment verification is done through the National Student Clearinghouse, which students can access for free via myUCF. On the Student Center page, there is a drop-down box that says Other Academic. Students can open that and select Enrollment Verification. In-school deferment is all handled automatically when the National Student Clearinghouse forwards their enrollment information to the National Student Loan Data System, so there is almost never a need for paper forms unless their information was reported incorrectly. Please note, we cannot certify anything until after the Add/Drop period of each semester.

Also Check: How To Get 0 Interest Loan

Federal Direct Graduate Plus Loan Program

The Federal Direct Graduate PLUS Loan is a fixed interest loan program that enables graduate students to borrow directly from the U.S. Department of Education to help pay for their educational expenses. The Program is administered by the Harvard Graduate School of Education Financial Aid Office, which works with the U.S. Department of Education to offer this loan. This loan is only available to U.S. Citizens and permanent residents students must be enrolled in a minimum 6 credits per term in a degree-granting program to be eligible.

This loan has many benefits such as a fixed interest rate, high credit approval rate and streamlined application process. Loan payments can be deferred while in school at least half time and the loan has flexible repayment options. As part of the Federal Direct Loan Program, this loan would also conveniently become part of your loan account that contains your Federal Direct Subsidized/Unsubsidized Loan, thus reducing your number of lenders. Since Harvard University participates in the Federal Direct Loan Program this is the only supplemental loan that is recommended by the HGSE Financial Aid Office, however students may select any supplemental loan of their choice.

These Loans Can Help Pay For Collegebut Also Lead To Debt Troubles

Imagine this scenario: Your son or daughter has been out of college for over a decade and moved on to a successful career. Your own career is coming to a close and retirement is only a few years away. And yet, you still owe thousands of dollars for your childs college bills. This scenario is a reality for many parents who take out federal Direct PLUS Loans. While these loans might seem like an easy way for parents to help their child with today’s education costs, in far too many cases, they put the parents financial security and retirement at risk.

Read Also: How To Get 150k Business Loan

Grad Plus Loan Eligibility Requirements

As with other federal student loans, eligibility for a Grad PLUS loan isnt based on demonstrated financial need.

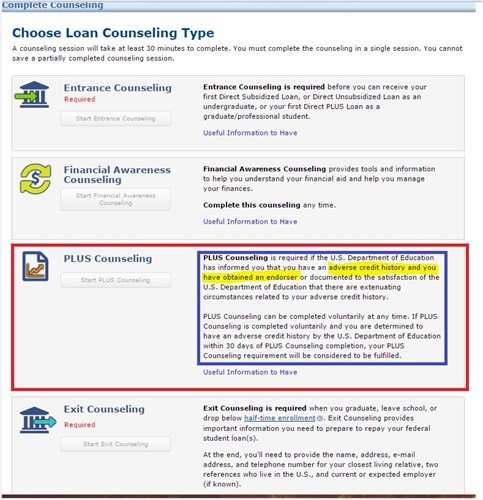

Eligibility also isnt based on income or debt-to-income ratios. However, eligibility does require borrowers to complete the Free Application for Federal Student Aid . Unlike some other federal loans, applicants do have to submit to a credit check to be eligible for the Grad PLUS Loan.

A cosigner isnt required with this student loan unless you have a less-than-perfect credit history. Some of the degree programs that may be eligible for this federal loan include masters degrees, doctorate programs, business degrees, law, medicine, dental degrees, nursing, and veterinary medicine.

Federal Graduate Plus Loan

Direct Graduate PLUS Loans enable graduate and professional students with good credit histories the opportunity to borrow funds to pay their educational expenses.

For more information regarding the loan program , please review the Federal Student Aid Website Federal Graduate PLUS Loans

For students who wish to apply for a Graduate PLUS loan you will need to make sure you have completed the following requirements:

Complete the FAFSAAll students who wish to apply for a Graduate PLUS loan must have a completed FAFSA on file

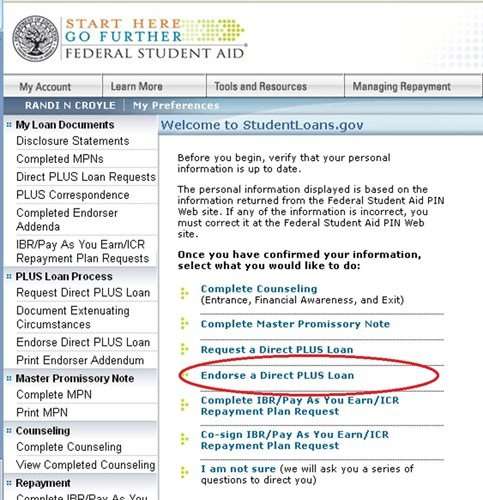

Complete a PLUS Loan applicationYou have the option to apply online or by submitting a paper form to our office for processing.Apply online at www.studentloans.gov

Allow up to 7 business days for result information – The Department of Education will notify you regarding the outcome of your loan application.

If your loan is approved complete the PLUS Loan Master Promissory Note

Here are some commonly asked questions about Federal Graduate PLUS Loans –

How much can I borrow?Students can borrow up to the financial aid cost of attendance for the academic year.

How will I know the credit decision of my Graduate PLUS Loan?The Department of Education will contact you regarding the results of your PLUS Loan application. If you complete the PLUS Loan request online you may have the results within 24 hours.

How many hours must I be enrolled to receive the loan?You must be enrolled at least half time to receive any PLUS loan funds, there are no exceptions.

Recommended Reading: Which Bank Gives Lowest Interest Rate For Business Loan

What Are The Eligibility Requirements

To qualify for a Grad PLUS loan, you must be a student in either a professional or graduate school. Students must be enrolled at least half-time to qualify for the loan.

The enrollment requirement may seem concerning for students who are doing research to complete their thesis. However, these students will almost always qualify for the PLUS loans. In general, students doing research on a full-time or half-time basis will be awarded credit hours that will allow them to qualify for these loans.The last requirement for these loans is that borrowers cannot have an adverse . There is no particular credit score minimum, but anyone with bad credit may want to spend a year or two repairing their credit before applying for a Grad PLUS loan.

Learn About Borrowing Federal Loans To Finance Your Graduate Education

The Federal Direct Graduate PLUS loan program is designed to help graduate and professional students pay for their educational expenses. You must be enrolled in at least half-time status in order to be eligible for the PLUS loan program to support your education at University of Maryland Global Campus.

Don’t Miss: Is My Home Loan Secured

How To Repay A Plus Loan

PLUS loans require repayment to start within 60 days of disbursement, but parents can defer the repayment until the student graduates or drops below half-time enrollment. The repayment period is typically 10 years, although you can choose from among other plans that allow repayment over 25 years.

Parent PLUS loans also are eligible to start repayment six months after the graduation grace period. Interest accrues while the student attends school but isnt subsidized by the federal government, like direct subsidized loans are.

Both graduates and parents are eligible for a few different repayment plans. The grad PLUS loan is eligible for all repayment plans, including all income-driven repayment plans. The parent PLUS loan, however, is only eligible for the income-contingent repayment plan after its been consolidated into a direct consolidation loan.

If youre struggling to repay your PLUS loan, contact your loan servicer to see if you qualify for deferment or forbearance. This allows you to stop paying your loan without facing a penalty, although interest will still accrue.

Plus Loan Limits And Disbursements

The academic year limit is equal to your cost of attendance minus all other financial aid, including scholarships, grants and stipends.

- Loans will be processed for the fall/winter period and are generally disbursed at the beginning of each semester. Spring-summer is a separate semester. If you need funds during this semester, apply for a new loan at studentaid.gov.

- If you are in the MD program, loans will be processed for the entire semester. The second disbursement will occur after one half of your academic period has been completed.

Recommended Reading: How To Transfer Car Loan To Another Person

What If My Educational Or Career Plans Change Or Something Happens After Im Out Of School And Working

A change in career goals, the loss of a job, or other unexpected changes in your situation could make repaying your loan more difficult than you expected. In some cases, and at the lenders option, you may be permitted to temporarily stop making your payments, or your lender may accept smaller payments than scheduled. This is called a forbearance. In addition, for some loans, you may defer repayments temporarily which may help. The promissory note outlines the specific terms under which you may be granted a deferment. Contact your loan servicer if you think you may need to make arrangements. To view your servicers contact information, please visit the National Student Loan Data System .

Grad Plus Loan Limits

Unlike other types of federal student loans, Grad PLUS Loans dont have a specific limit on how much you can borrow per year, nor do they have an aggregate limit.

Instead, you might be able to borrow up to your schools certified cost of attendance, minus other financial aid youve received.

Tip:

If you decide to take out a private student loan, be sure to consider as many lenders as possible to find the right private student loan for you. Credible makes this easy you can compare your prequalified rates from our partner lenders in two minutes.

Check Out: Average Cost of College in the U.S.

You May Like: Can I Get Home Equity Loan On Investment Property

What Is A Mezzanine Loan

Category: Loans 1. How Are Mezzanine Loans Structured? Investopedia Mezzanine financing is the part of a companys capital that exists between senior debt and common equity as either subordinated debt, preferred equity or a A mezzanine loan is a form of financing that blends debt and equity. · Lenders

What Do You Need For A Signature Loan

Category: Loans 1. How Does a Signature Loan Work? WalletHub Credit Score Needed for Signature Loans A signature loan is an unsecured personal loan that does not require collateral other than the borrowers Whats a good lender for a small unsecured personal loan?What is an unsecured personal loan? 8

Recommended Reading: How To Apply For Student Loan For Masters

How To Apply For A Plus Loan

While PLUS loans are available for both graduate students and parents of undergrads, there are two separate applications. If youre a graduate or professional student, youll need to apply using a Direct PLUS application for graduate or professional students. Before you apply, youll need:

- Student information

- Personal information

- Employers information

To receive funds for both the graduate/professional or parent PLUS loans, youll need to complete a Master Promissory Note. The federal government will disburse funds directly to the school for tuition and fees with any extra funds directed to you. If youre the parent, you can determine if the excess funds go to you or your student.

Repaying Your Grad Plus Loan

You do not have to begin making payments until six months:

- After graduation

- After you leave school

- After you are no longer enrolled at least half-time

Interest will accrue on your loan once it is disbursed you have the option to pay the accrued interest or add to your principal balance when you begin making payments.

Your loan servicer will let you know when payments are due and provide status updates for your loan.

Read Also: What Are Conventional Loan Rates

Alternative Options To Pay For Your Graduate Degree

When it comes to paying for grad school, federal student loans are a good resource. Before you take out student loans, though, explore money you dont have to repay, like scholarships, grants, fellowships, and assistantships.

Use online tools, like this free tool, to connect you to scholarships specifically designed for grad students. After youve maximized money you dont have to pay back, and youve explored federal student loans, you still may need additional funds.

Thats when a private student loan may make sense. Most private student loans dont have an origination fee, and some offer expanded repayment terms, so they could be a competitive option.

Whatever methods you choose to finance your graduate degree, you can rest assured youre making a commitment, and an investment, in your future.

Ashley is a Sallie Mae employee and a graduate of Immaculata University. A mom of two young girls, her favorite dinner topic is the Free Application for Federal Student Aid .

Related Within Reach articles

Borrowers Defense To Repayment

This program is available to Direct Loan borrowers, including Graduate PLUS Loans. Borrowers Defense rule protects students that the school misled. If a school lied to you about job replacement rates, quality of education, or the true cost of education, you could request debt relief. However, you need to first prove that if the school did not engage in fraudulent activity, you would not have taken the debt for education in that school.

Therefore, you need to develop strong arguments and support them with documents- physical evidence. For example, you can submit email communications, a contract with false information, marketing materials with false advertising to indicate that the school engaged in unethical and illegal activities. As a result, you can receive up to 100% discharge.

The recent years were not kind to borrowers who wanted to benefit from this program. Unfortunately, the previous Education Secretary did not favor this program. Hence, many borrowers received rejections, or their cases were delayed. Luckily, new Education Secretary and president Joe Biden aims to improve the effectiveness of Borrowers Defense rule. Therefore, more borrowers can qualify for full debt elimination.

Read Also: How Much Is Va Loan Entitlement

Types Of Student Aid Offered To Graduate Students

The U.S. Department of Education and your schools financial aid office use your FAFSA to determine if youre eligible for student aid, and for which kinds. Some forms of aid are need-based, which means they are granted to students with a proven gap between grad school costs and their ability to pay.

Graduate students have fewer federal student aid options than undergraduates, generally speaking. However, your own university or graduate program might provide merit- or research-based assistance, and many private and nonprofit organizations offer scholarships and grants for graduate students as well.

Here are the types of federal need-based aid offered to graduate students:

- Federal Pell Grantsare largely reserved for undergraduate students, but graduate students in a post-baccalaureate teacher certification program may also be eligible for them. You dont have to repay Pell Grants, and the maximum award is $6,345 for 2020-21.

- TEACH Grants offer up to $3,772 for the 2020-21 school year to students in participating undergraduate, graduate, or postbaccalaureate programs who are pursuing a teaching career. To receive this aid you must sign an agreement committing to teach in a high-need area for at least four academic years, within eight years of leaving the program you received the grant for.

- Federal Work-Study provides aid in the form of wages earned through part-time employment.

What Is The Difference Between Fixed And Variable Rate Loans

As mentioned, Graduate PLUS Loan has a fixed interest rate. Fixed-rate loans offer the same monthly payments over the repayment period. Meanwhile, there also exist variable rate loans. The rate of such loans is tied to an external indicator such as the LIBOR rate. As the connected rate changes, the interest rate you also pay changes.

When interest rates decrease, it is good to have a variable-rate loan because you will pay less. However, the adverse situation can also happen you can end up paying more and more. Compared to such volatility, fixed-rate loans provide certainty.

Usually, government loans are fixed-rate. Therefore, if you wish to get a variable-rate loan, you can get a private student debt. If you change your mind, you can always refinance the student loan to move from variable-rate loan to fixed, or vice versa.

Recommended Reading: Can I Get Another Loan From Upstart