When Can I Apply For An Sba Loan

To apply for an SBA loan, you must have a business plan and be able to prove that your business is viable. You also need to meet the basic eligibility requirements, such as having a reasonable down payment, being independently owned and operated, and having a good credit history.

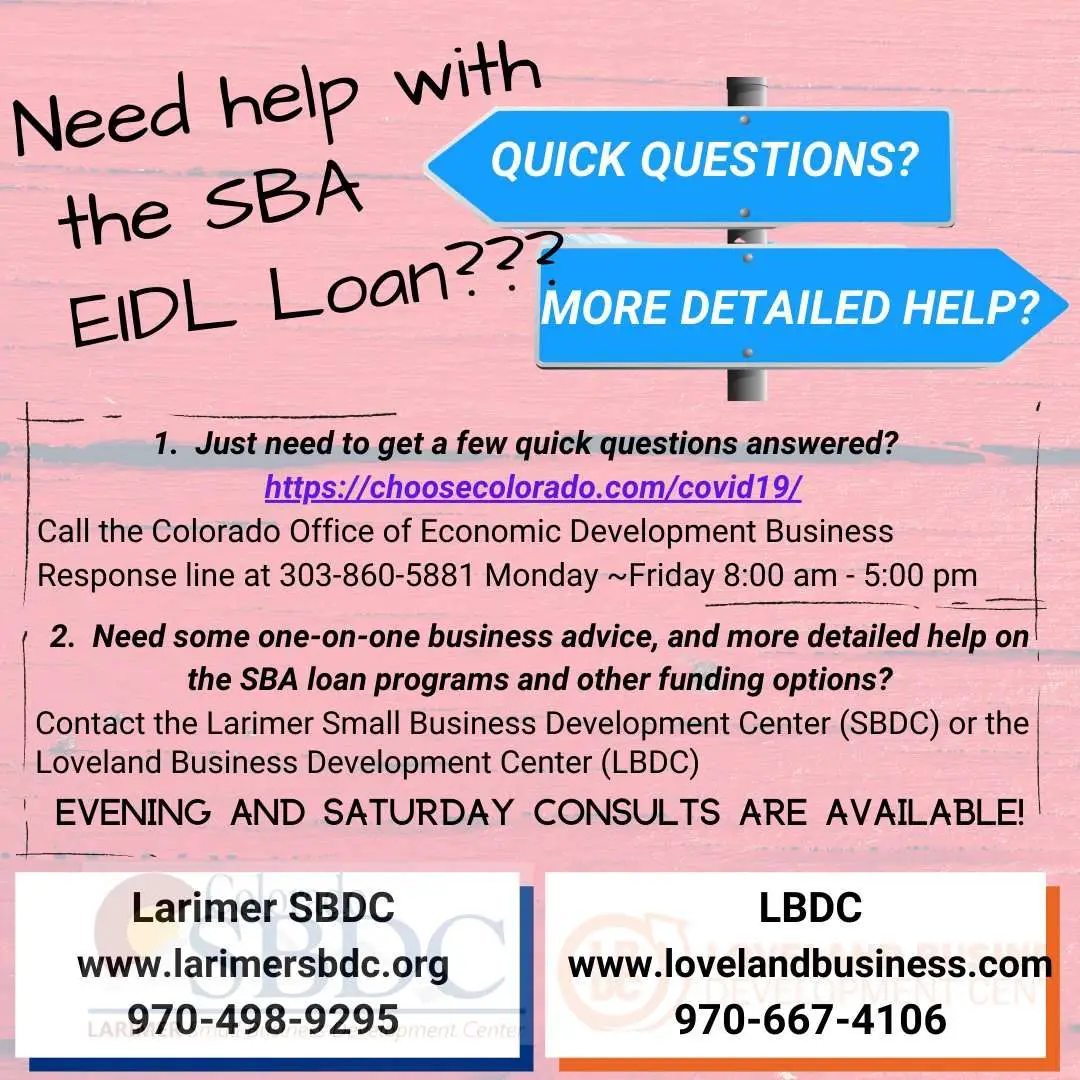

Contact your local SBA district office if you are interested in applying for an SBA loan. You can also visit the website at sba.gov to learn more about the different loan programs available.

What Happened To The Applications That Were Dropped Into The Drop Box

If EIDL applications were completed BEFORE Monday, March 30, they should be resubmitted using the online link. EIDL applications submitted March 30 or later received a verification number upon submission of the application. This verification indicates the application was received. No confirmation email will be sent as a follow-up confirmation of receipt of application.

How Can I Use The Loan Fund

The typical timeframe is 21 days for a decision on the application package as long as all information is provided accurately by the applicant. After decisioning, SBA legal prepares the closing documents to send to the borrower. After receipt of the signed documents the funds are direct deposited typically in 3 -5 business days. If collateral is required for the loan SBA will prepare a partial disbursement of $25,000 to submit to the borrower and release the remaining funds once all collateral is appropriately secured.

Recommended Reading: How Long Does An Auto Loan Approval Last

How Long Does It Take To Receive Eidl Funds After Approval 2021

How Long Does It Take To Receive EIDL Funds? The SBA reports that businesses that apply for a loan below $500K are typically waiting 2-3 weeks. Those that apply for an EIDL loan above $500K and have business real estate as collateral, can expect to wait about 45 days for their funds to be disbursed.

How Long Does A Sba Disaster Loan Take

Question: What’s the timeline like? o Answer: Once a borrower submits an application, approval timelines depend on volume. Typical timeline for approval is 2-3 weeks and disbursement can take up to 5 days. Borrowers are assigned individual loan officers for servicing of the loan. [email protected].

You May Like: Which Bank Has The Best Personal Loan Rates

How Do I Appeal A Declined Targeted Eidl Advance Application

Applicants can send a request for reevaluation of a Targeted EIDL Advance application that was declined to the following email address: .

Applicants should follow these instructions when requesting a re-evaluation:

- Send an email to

- Use the subject line Reevaluation Request for

- In the body of the email, include identifying information for the application such as application number, business name, business address, business owner name and phone number

- Important: Include an explanation and any documentation that addresses the reason for the decline, if available. SBA will contact applicants if additional documentation is required to complete the review.

What Is An Upstart Loan

Upstart is an online lender that offers consumer loans to qualified borrowers. It has relaxed credit score requirements, competitive terms and fees, and an easy application process. Upstart is an excellent resource for many people who do not fit the traditional model of a loan borrower. Apply Now. See Our Review.

Recommended Reading: What’s The Best Auto Loan For Bad Credit

How To Apply For A Sba Loan

According to the SBA, the steps to request a loan increase are:

- Confirm your loan eligibility and review the SBA Frequently Asked Questions .

- Log onto your Account on the SBA Portal to submit a loan modification request to your existing EIDL loan. …

- Complete the SBA Portal steps and upload requested documents, including a new version of your IRS Form 4506-T for the COVID EIDL disaster.

Check Your Eidl Loan Status By Email

You can also reach out to the SBA by email to learn more about your loan status or inquire about the EIDL program. All emails should be directed to the disaster assistance customer service team at . Use this method if you have additional questions about the program or submitted your application by mail. Otherwise, youll be better served using the online portal to check the status of your loan.

Read Also: How To Pay Loan Online

When To Use E

The Electronic Loan Origination Portal is an important part of checking loan application status on many of the non-emergency loans offered through the SBA. E-Tran is a part of the Capital Access Financial System, which is the portal lenders also use to service SBA loans.

The 7 loan program is for small businesses that are already in existence. There are more eligibility standards than the disaster assistance loans that have been rolled out in response to COVID-19. Small, established businesses can use these loans for up to $5 million of working capital or funds for equipment and supplies. In addition, the loans can finance the purchase of real estate on behalf of a business. Funds from the 7 program can also finance acquisitions, and you can even use them to refinance existing loans. The CDC/504 loan program has similar standards, but these loans are administered through Certified Development Companies rather than lenders.

The SBA also funds a microloan program, in which loans are administered through non-profit organizations. Loan applicants can receive up to $50,000 for startup costs or for expanding a small business. For all of the aforementioned loan options, access E-Tran on CAFS to check your application status.

Check Your Eidl Loan Status By Phone

You can also find out the status of your EIDL loan application by phone. You can use this method if you submitted your application online or by mail. Call 1-800-659-2955 and ask for Tier 2. These reps can answer questions about the application process and your EIDL loan status. If you applied through the COVID-19 portal, the SBA will contact you, but you may be able to get answers by calling the toll-free number.

If you mailed in your application, this is the best way to find out your loan status, as you wont have a username and password to log onto the online portal. On the plus side, this method allows you to talk to an SBA rep that will answer your questions, even if these go beyond finding out your loan status. On the other hand, though, you may be stuck waiting on hold, as other business owners are also inquiring about the EIDL program and loan statuses.

Don’t Miss: How Long To Pay Off Student Loans

I Entered My Personal Bank Account And My Bank Put A Hold On My Loan What Can I Do

Unfortunately, some borrowers that had funds deposited into a personal bank account encountered holds and freezes due to their banks policies. If your loan is on hold, contact your bank or financial institution to determine the next steps you need to take to access your money. In some cases, borrowers were able to have their funds released by providing the bank with loan paperwork, business licenses, and other documentation.

Economic Injury Disaster Loan Update

SBA is currently accepting new COVID-19 Economic Injury Disaster Loan applications from all qualified small businesses, including private nonprofit organizations.

As of August 5, 2021, New Mexico entities have received $988.7 million in Economic Injury Disaster Loans comprising 15,207 loans.

The following is a synopsis of the COVID-19 EIDL, Targeted EIDL Advance, and Supplemental Targeted Advance. All of the following information and more can be found here www.sba.gov/EIDL. Indeed, these COVID-19 programs are extended through the end of the year.

New applicants can apply here: EIDL Application or call 1-800-659-2955.

Also Check: Can You Reuse Your Va Home Loan

How To Check My Ppp Loan Status With Sba In 2022

First, you need to understand that the SBA has no facility for borrowers to check the status of their PPP loans. Truth be told, contacting the SBA to check the status of any of the loans you applied for can be a bad idea as you will likely not get any tangible answer.

If you are looking to check the status of your SBA loan, there are different methods for different loans, and some methods of checking loan application status can be more effective than others. While you can leverage different methods to check your loan status, note that the information you need to check the status of your PPP loan application will depend on how you applied for the loan in the first place.

If, for instance, you applied via SBA.com, you will have to enter your login information for the application portal. You will also need to have whatever information you provided in the application process to ensure that you can expressly check the status of your application in case a representative asks for it.

If you applied for a PPP loan directly from your bank or other lenders, you will have to comply with the specific steps stipulated by your lender to check your application status. When checking your application status through your bank or another lender, you must have whatever information you provided on your original application just in case your lender asks for it again.

How Can I Refinance My Sba Loan

It is possible to refinance your SBA loan after its approval. But it is important to note that this is only possible under specific circumstances. The SBA officially says that existing SBA loan refinancing will only be considered if, the borrower has new financing needs that the existing lender has declined or the existing lender has refused to modify the terms of the existing SBA loan to accommodate the new loan. However, it is important to understand what this wording means in practice. As an SBA loan borrower, you must first reach out to your existing SBA lender. In order to seek additional funds, a new interest rate, or modified payment terms. Only if this is unsuccessful could you then attempt refinancing with another bank offering SBA loans.

Due to these strict requirements for refinancing with the SBA. Our team at Vetted Biz believes it is very important that you find the right lender for your financing needs when initially seeking your SBA loan. We have put together a list of the top 25 SBA lenders based on research into loan terms and success in past years. Be sure to look into each lenders profile to learn which lender is right for your businesss needs. Finally, it is important to note that business owners who initially did not take advantage of the SBAs loan programs could later through refinancing .Non-SBA loans are eligible for refinancing through the SBAs 7 loan program if their original loan would have been SBA eligible.

Don’t Miss: What Does Cash To New Loan Mean

What Is A Targeted Eidl Advance

If you’re in a low-income community, you might be eligible to receive up to $15,000 in additional funds from the SBA that don’t need to be repaid through the Targeted EIDL Advance and Supplemental Targeted Advance programs.

You can think of these loan advances like a grant, but without the usual requirements that come with a federal government grant. To get these advance funds, first apply for a COVID-19 Economic Injury Disaster Loan . You don’t need to accept the loan or be approved to get an advance. If you’re an eligible business, the SBA will invite you to apply. And, depending on your business’ size and the losses you suffered, you could receive both of these advances.

The Targeted EIDL Advance program offers up to $10,000 in aid. Eligibility requirements include:

- That you live in a low-income area. Check to see if your area qualifies with this map.

- You can show a 30 percent reduction in revenue during an 8-week period starting March 2020, compared to the previous year.

- Have 300 or fewer employees

Meanwhile, the Supplemental Targeted Advance offers $5,000 in aid. Eligibility requirements include:

- You must be located in a low-income community .

- You can show a greater than 50 percent economic loss over an 8-week period since March 2, 2020, compared to the previous year.

- Have 10 or fewer employees.

How To Check Your Sba Eidl Loan Status

There are three ways to check your EIDL application status, and all are directly through the SBA.

- Check Your EIDL Loan Status Online Through The SBA Website. If you submitted your application online, you can check your loan status through the SBA …

- Check Your EIDL Loan Status By Phone.

- Check Your EIDL Loan Status By Email.

log in to your COVID-19 EIDL applicant portal

Read Also: What Car Loan Would I Qualify For

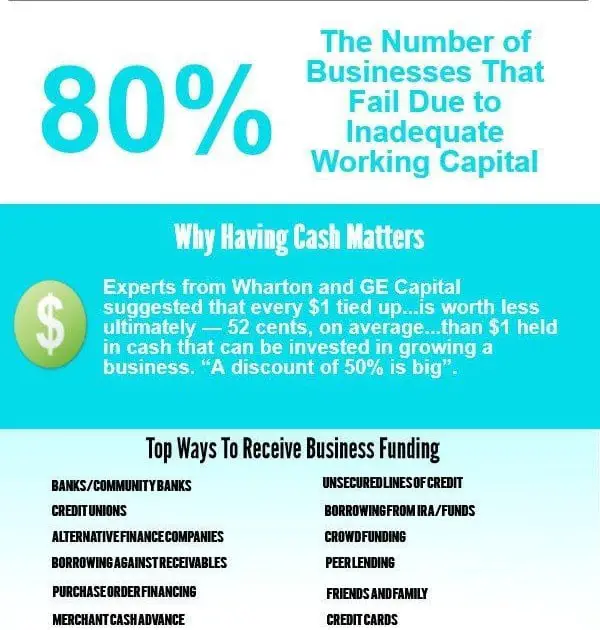

Other Options To Consider:

Ask for deferred payments to banks and creditors: Businesses should ask for a payment deferral before applying for additional credit . Banks have the ability to defer SBA guaranteed loans under their unilateral authority. The decision to defer is ultimately up to the bank. Any business, especially those with notes, should have a conversation with their banker. The structure of the deferment is up to the bank. The payment history/status of commercial notes are not normally reported to the credit reporting agencies and most dont unless theres a default.

As always, proactive communication from both parties provides for better overall outcomes.

Make significant changes to your operations. Monitor all expenditures and try to encourage receivable collections when possible.All business owners need to remember the basic premise of business: CASH IS KING. Cash will be needed to allow the business to rebound when conditions stabilize.

Can a business receive both a Paycheck Protection Program loan and an EIDL? What are the relevant considerations for deciding which type of loan is more appropriate?

Generally, a business can apply for loans under both the Paycheck Protection Program and the EIDL program but must use the EIDL for a purpose other than covering payroll costs.

To determine whether to apply for a Paycheck Protection Program loan or EIDL, businesses should consider the following:

Sba Paycheck Protection Program Data Lookup

Under open government transparency guidelines, information on recipients of the $793B in forgivable government loans issued through the 2020 Paycheck Protection Program by the US Small Business Administration are a matter of public record. FederalPay.org has created a powerful search tool that allows public access to the PPP loan database.

Also Check: Closing Costs For Fha Loan

Ppp Loan Company Lookup Search Tool

Search our entire database for publicly released Paycheck Protection Program information by location, company name, industry , company type, or loan amount. Max 50 results provided for each query.

Information available through this dataset may include name, address, owner information, loan amount, and lender for all companies that received loans through the PPP.

| No Results Found – Please Modify Your Search! |

| } |

Tips For Checking Your Sba Loan Application Status

Right now, the SBA, its district offices and the lender partners that help bring SBA loans to the public are experiencing a heavy influx of traffic. Although the application period for new PPP loans has closed, these organizations are still working on processing the applications that theyve already received. Thus, you can anticipate that it may take some extra time to receive a response to your inquiry if you contacted the SBA by phone, mail or email.

The quickest method of obtaining your SBA loan application status is to use the appropriate online portal. First, identify the correct portal to use. In general, non-emergency assistance loans use the E-Tran feature of the CAFS portal. For PPP loans, you can use the portal provided by the bank you applied with. For any EIDL funding, the correct portal is SBA Assistant.

Once youve identified the correct portal, its important to have both your login credentials and loan number on hand. Depending on the portal, login credentials will generally include an email address or username and password, and youll have established these details when you initially applied for your loan online.

Read Also: How Long Does Loan Pre Approval Take

Can I Still Apply For A Loan Through The Paycheck Protection Program

The Paycheck Protection Program is no longer accepting new applications. It had been replenished in December 2020 when the Economic Aid Act was passed, enabling PPP lenders to grant new loans to borrowersâincluding borrowers who already received a PPP loan . The program, however, ended May 31, 2021.

If you got a PPP loan, and you’re planning to submit a loan forgiveness application, you can start applying the day after your covered period ends and for the 10 months thereafter. For people who applied early on in the program your deadline to apply for forgiveness was some time in mid-July 2021. If you don’t apply in time, you’ll be responsible for monthly interest and principal payments.

Top Questions For Eidl Advance Programs

Q: I cannot find my Targeted EIDL Advance invitation email.

A:Contact SBAs Disaster Customer Service Center at 1-800-659-2955 or by email at to request a new invite. Please note that this process may take several business days.

Q:I need a reconsideration/reevaluation of a declined application for a Targeted EIDL Advance or a Supplemental Targeted Advance.

A:Applicant should send an email to .

Q:What is the status of my application?

A:To check the status of an existing application, you can log in to your COVID-19 EIDL applicant portal where you find information about your application status or contact SBAs Customer Service Center at 1-800-659-2955 .

Don’t Miss: Does Collateral Have To Equal Loan Amount

How To Check Ppp Loan Status

The PPP extended forgivable emergency loans that provided funding to cover payroll and other eligible expenses related to ensuring employees could maintain their ability to earn a living during the pandemic. Application acceptance for both the first and second draws of the loan ended on March 31, 2021, but businesses that have already received loans can still apply to have their loans forgiven.

The lender partner servicing a PPP loan may be a valuable resource for determining application status. Many of the biggest banks, such as Wells Fargo, US Bank, Chase and Bank of America, have created online portals on their websites specifically for PPP applicants to access. If youre a business owner, you can establish login credentials with the specific bank that disbursed the funds to you and use these portals to check your SBA application status.

Entrepreneurs can also check their status with the SBA directly. You can email an inquiry including your name and loan number to [email protected], or you can call the SBA office for your region to learn more. This tool helps you identify SBA district offices by region.