Important Legal Disclosures And Information

Loan proceeds from the Personal Installment Loan cannot be used to pay for post-secondary educational expenses or to refinance student loan debt. For student loan & refinancing options, visit pnconcampus.com.

Through your Investment Line of Credit you can borrow up to 50% of the value of the eligible assets in your PNC Investments account. Credit is subject to approval. Certain terms and conditions apply.

*Check Personal Installment Loan and Personal Line of Credit Rates: APRs that will display include a 0.25% discount for automated payment from a PNC checking account. The lowest rates are available to well-qualified applicants. Your actual APR will be based upon multiple factors. Refer to Important Disclosures” under Get Rates for more details.

Bank deposit products and services provided by PNC Bank. Member FDIC

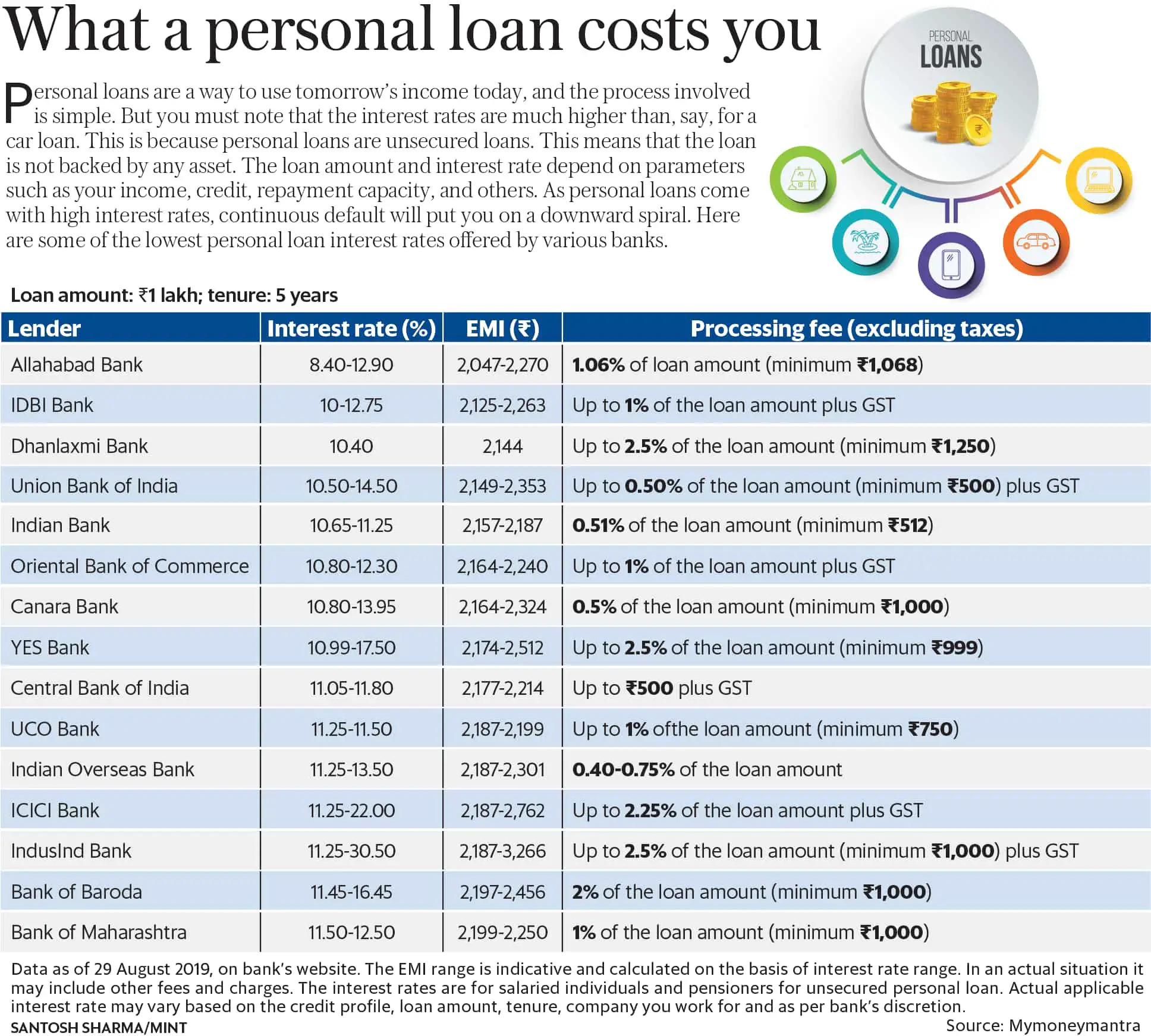

Factors That Affect Personal Loan Interest Rates

- Income: Loan providers take the applicants income into account when deciding the interest rate. Individuals who have a high income pose a lower risk to the bank and, thus, might be offered a lower interest rate. On the other hand, those with lower annual incomes may have to pay a higher interest rate.

- Employer Details: If you work for a reputed organisation, the bank/financial institution is more likely to offer you a lower rate of interest.

- Nature of the Employment: Loan providers may offer different interest rates to applicants based on whether they are self-employed or salaried.

- Age: The age of the applicant can also have an impact on the interest rate quoted by the loan provider. Individuals who are nearing the retirement age may be charged a higher interest rate.

- Relationship with the Loan Provider: Existing customers of the bank/financial institution may be offered a lower rate of interest at the time of applying for a personal loan, provided they have a good relationship with the loan provider. This is, however, at the discretion of the bank and not all existing customers will be offered a preferential interest rate.

Personal Loan Credit Score Requirements

play a big role in your ability to get a personal loan, and how much you’ll pay to borrow the money. The better your credit score, the lower your interest rate is likely to be, and the less you’ll pay in interest over the life of the loan.

You can find your credit report for free on annualcreditreport.com from any of the three major credit bureaus weekly through April 20, 2022. While this report won’t give you your credit score, it will show you information about your credit and payment history, which lenders use to decide whether to give you a loan. Reviewing your credit report can help you know what you need to improve.

You can get your score at no cost on your credit card statement or online account. You can also pay for it from a credit reporting agency.

- Very poor: below 579

- Fair: between 580 and 669

- Good: between 670 and 739

- Very good: between 740 and 799

- Exceptional: above 800

While credit does have an impact on your interest rate, it’s worth noting that interest rates can also change on their own, fluctuating based on the bank’s cost of borrowing called the federal funds rate. While there are alternatives to borrow money, like 0% APR credit cards and home equity loans, they don’t always work for every person or situation.

You May Like: What Is The Commitment Fee On Mortgage Loan

Discover Debt Consolidation Options Compared

|

Category |

|---|

Applicants need a credit score of 660 to get a personal loan from Wells Fargo, according to multiple third-party sources. That means the Wells Fargo personal loan credit score requirement is in the fair credit range. To put this in perspective, most other lenders’ credit score requirements for personal loans range between 585 and 700.

Keep in mind that just having a 660 credit score is not enough to qualify you for a Wells Fargo personal loan. Wells Fargo will consider your entire financial profile, including things like your income, existing debts and recent credit inquiries, when deciding whether to approve you. It’s also worth noting that some applicants might be able to get a personal loan from Wells Fargo with a slightly lower score if it’s offset by other factors like an especially high income. But it’s best to wait to apply until your score meets the threshold.

Wells Fargo does not offer so-called medical loans. But Wells Fargo does give consumers four options to borrow for medical expenses: personal loans, home equity loans, the Health Advantage Credit Card and traditional credit cards with low interest rates.

Lastly, you may just want to finance relatively minor medical expenses with a low APR credit card from Wells Fargo. The best choice is the Wells Fargo Platinum credit card.

Secured Line Of Credit

A secured line of credit can help you snag the best rates for personal loans. When you take out a secured line of credit or secured personal loan, you will typically pay a lower interest rate because you put something of value up as collateral. It may be anything of value, such as your car, home, boat, or jewelry. A line of credit offers greater flexibility. You can borrow up to your credit limit, depending on what you need, and you’ll only pay interest on the amount you borrow.

If you decide on a secured line of credit, you probably need to work with a brick-and-mortar financial institution — online personal loan companies rarely offer anything other than an unsecured personal loan.

Read Also: Usaa Certified Auto Dealers

What Should I Look For In A Personal Loan

There are a few key features youll want to consider when comparing loans. To find a better deal, ask yourself these questions:

- Do I qualify for this loan? Dont waste time researching a loan if you dont meet the requirements.

- Can I borrow the amount I need? Will you be able to take out the amount you need and afford to pay it back in a reasonable amount of time? If not, you might want to look elsewhere.

- Does it have a competitive interest rate? Most unsecured personal loans charge a fixed rate of interest, meaning your monthly repayments will stay the same throughout the loan. Remember that the advertised rate is not necessarily the rate that the lender will offer you. Lenders will look at factors like your credit score, income and expenditure when deciding what rate to offer you.

- What are the fees? Many lenders will charge an arrangement or set up fee.

- Can I make overpayments or repay the loan early? Most lenders will not penalise you for paying back some or all of the loan early, however that does not necessarily mean that doing so will save you money in interest. In many cases you will be charged one or even two months interest to settle your loan early.

- How long will I have to pay it back? Aim for a loan term that gives you monthly repayments you can afford without being too long. Otherwise, you could wind up paying a lot in interest in the long run.

What Is Loan Interest

Interest is the price you pay to borrow money from someone else. If you take out a $20,000 personal loan, you may wind up paying the lender a total of almost $23,000 over the next five years. That extra $3,000 is the interest.

As you repay the loan over time, a portion of each payment goes toward the amount you borrowed and another portion goes toward interest costs. How much loan interest the lender charges is determined by things like your , income, loan amount, loan terms and the current amount of debt you have.

You May Like: How Much Do Loan Officers Make Per Loan

Is A Personal Loan Worth It

Personal loans are best used for debt consolidation, planned home repair projects, and emergencies but only if the interest rate and repayment terms are favorable. If a personal loan is taken out without a clear plan for how to repay it, it is never worth it. If you have bad credit, no credit, or if youre unemployed, personal loans are probably not worth it.

Alternatives To Personal Loans

Personal loans arent the only alternative available for managing high-interest debt, covering emergency expenses, or consolidating credit cards.

If you need cash to do repairs or remodel your home, you might be interested in home improvement loans, which are secured by your home and tend to feature lower interest rates than personal loans.

Other alternatives to personal loans include:

| Pros |

| Not all employers offer this option The amount you borrow is taxed twice |

Payday lenders secure their money by demanding a postdated check or direct access to your checking account to withdraw the funds by your next paycheck.Failing to settle either of these loans in time traps borrowers in an endless debt cycle, where they have to renew or roll the loan over to a further date, stacking up higher interest rates and fees.

Title loans lenders use your vehicle title as collateral, so they can repossess and resell your car or motorcycle if you dont pay it back in time.

We do not advise these loans and stress that you consider alternative options. If you are limited by bad credit, and personal loans are designed specifically for that. If it is a time-sensitive issue, many reputable online lenders guarantee fast funding, with same-day or next business day disbursement.

Recommended Reading: What Kind Of Loan Do I Need To Buy Land

When Is A Personal Loan A Good Option

Personal loans are a good idea when you have a clear purpose in mind. For example, the top personal loans can provide you with the funds you need to repair or remodel your home, cover an emergency expense, or consolidate debt. As with any debt, personal loans are not a good option if you’re not sure how you’ll pay the money back or you’re borrowing for something you don’t actually need.

If you need the money from your personal loan quickly, look for a loan with “streamlined approval.” This means you won’t need to wait very long to receive the loan funds. Because some loans are funded same-day, if you run into a financial roadblock, a personal loan can help you overcome it — even when you need the cash fast.

How To Get Instant Approval On Personal Loan

To get instant approval on a personal loan, you need to fulfil the following conditions:-

- A good relationship with your existing bank is maintained by paying off dues and instalment on time. If you are a savings account holder, ensure that you maintain the minimum required balance per month. This way, the lender develops trust in you and grants you an instant loan based on your financial credibility.

- Make on time and maintain a good balance between no use and excessive usage of your .

- A good credit score is key to getting a loan quickly. Maintain a good credit score above 650 and get the loan amount sanctioned in the account within no time.

- If you are working with top corporations and getting timely salary credits, you stand a better chance of getting a loan.

Don’t Miss: Can You Refinance Your Car With The Same Lender

Best For Amex Cardmembers: American Express

American Express

- Minimum credit score: Not disclosed

- Loan terms: 12 to 36 months

American Express offers loans to its cardholders which is convenient and comes with varying loan terms.

-

Low APR available for borrowers with excellent credit

-

Can use loan for credit card debt consolidation

-

Must be an Amex cardholder and receive an offer

-

High minimum amount compared to other lenders

-

A hefty late fee

Read the full review: American Express Personal Loans

Do I Need To Be An Existing Bank Client To Get A Loan

If youre interested in a personal loan from a bank you don’t have a relationship with, make sure that being a client isnt a requirement before applying. Not all banks request personal loan borrowers be account holders, but some door they offer better terms to current clients. Also, you might need to open a checking or savings account there to take advantage of auto-pay discounts on the loan .

Don’t Miss: Fha Loan Maximum Texas

What Is Better: Personal Loans Or Credit Cards

Both personal loans and credit cards can be used to cover a variety of expenses. However, it’s important to keep their differences in mind as you comparepersonal loans vs. credit cards.

Personal loans

A personal loan is a kind of installment loan where you receive the funds as a lump sum to use how you wish and then pay off your balance in monthly installments over a period of time.

You might want to consider a personal loan if you:

-

Want a lower interest rate:

Personal loans tend to have lower interest rates than credit cards, which means you likely wont pay as much interest in comparison.

-

Want fixed monthly payments:

Personal loans typically have fixed interest rates, which means you can count on your payment staying the same from month to month.

-

Need a longer repayment period:

You could have one to seven years to pay off a personal loan, depending on the lender. Just keep in mind that choosing a longer term means youll pay more in interest over time.

Unlike a personal loan, a credit card is a type of revolving credit that gives you access to a credit line that you can repeatedly draw on and pay off.

A credit card might be a good choice if you:

Read more:Pay Off Credit Card Debt ASAP With a Personal Loan

Wells Fargo Vs Citizens Bank

- on LendingTree’s secure website

Unlike Wells Fargo, Citizens Bank does not require borrowers to have an existing account to apply. And even better, the bank offers lower annual percentage rates than Wells Fargo at 7.99% to 20.89% and longer terms up to 7 years. There are more restrictions with a Citizens Bank loan. You can only borrow up to $15,000 and you cannot use your Citizens Bank personal loan for business, educational or home improvement purposes . It may also take a few days to receive funds from Citizens Bank, so its not our top choice for getting funds quickly. To qualify, Citizens Bank requires borrowers have good credit, which is usually a credit score of 680 or above, and annual income of at least $24,000.

Recommended Reading: What Car Loan Can I Afford Calculator

What Interest Rate Can I Expect

Every lender has its own methods of evaluating borrowers and determining rates, so its a good idea to compare prequalified rates from more than one lender. Generally, the shorter the loan term, the lower the interest rate offered by most lenders and the better your credit score and credit report, the better the interest rate you can qualify for.

Some lenders even offer an autopay discount if you authorize your monthly loan payments to be directly withdrawn from your bank account.

Qualifying for the lowest rates offered by a lender is dependent on your online application, credit approval and score, loan terms, and other factors. Through Credible, you can easily compare loan offers, loan terms, origination fees, monthly payment amounts, and repayment terms.

Read More:Who Are the Best Personal Loan Lenders?

How Are Personal Loans Different From Personal Lines Of Credit

Personal loans and personal lines of credit can both be used for similar big purchases, such as the ones mentioned above. However, there are some significant differences between the two options. Think of personal loans like a one-time lump sum payment, that you then have to pay back, along with interest, in regular fixed installments by a set deadline. Its a one-and-done type of deal. Personal lines of credit are more flexible. Instead of borrowing one set amount, borrowers with a personal line of credit can borrow any amount within their established credit limit at any time and interest is charged based only on the amount used, not the total amount borrowed as with a personal loan. Both personal loans and personal lines of credit can be secured or unsecured.

Recommended Reading: How To Refinance An Avant Loan

How Much Can I Get For A Personal Loan

Personal loan amounts vary depending on the lender. With Credibles partner lenders, you can take out a $600 personal loan up to a$100,000 personal loan.

Keep in mind that your credit will also likely affect how much you can borrow. Youll typically need good to excellent credit to qualify for the highest loan amounts. If you have poor credit, you might need a cosigner to get approved for a larger loan.

What Are The Alternatives To Personal Loans

The best personal loan lenders can provide a great way to borrow money affordably, but they are not the right choice for everybody. Depending on your circumstances — for example, if you need money to fund a project or pay an unexpected expense — you may want to look at other options. Here are two alternatives to personal loans:

Also Check: Usaa 84 Month Auto Loan

Where To Find The Best Personal Loan Rates Online For You

If you want to refinance or consolidate debt, make a major purchase or cover another expense, a personal loan might be one of your best options as it will come with Fixed monthly payments Fixed APRs A set payoff period One of the best ways to get the lowest possible personal loan rates for your financial situation is to prequalify through several lenders, so you can compare offers. As long as you shop with lenders that use a soft credit pull, you can check your rate without hurting your credit score. In this guide … Personal loans for…