Types Of Secured Loans

Mortgages and auto loans are perhaps the most well-known secured loans, but there are a number of other financing options that may require collateral. These are the most common types of secured loans:

- Mortgages.Mortgages are a common type of loan used to finance the purchase of a home or other real estate. These loans are secured by the financed property, meaning the lender can foreclose in the case of borrower default.

- Home equity lines of credit. A home equity line of credit is a revolving loan that is secured by the borrowers equity in their home. The borrower can use the funds on an as-needed basis.

- Home equity loans. Like a HELOC, a home equity loan is collateralized by the borrowers home equity. With a home equity loan, however, the borrower receives a lump sum of cash, on which interest begins accruing immediately.

- Auto loans.Auto loans are secured by the vehicle being financed. To protect its interest in the collateral, a lender holds title to the financed vehicle until the loan is repaid in full.

- Secured personal loans. Secured personal loans let borrowers access cash that can be used for personal expenses like home improvements, vacation costs and medical expenses.

- Secured credit cards. With a secured credit card, a borrower gets access to a line of credit equal to the amount of cash she commits as a security deposit. This makes these cards an excellent option for borrowers trying to improve their credit scores.

Why Do Some Loans Require Collateral

It reduces the risk to the lender. Lenders specializing in business loans typically want collateral of some kind to minimize their risk of taking you on as a borrower.

Business loan collateral

If your small business is new or hasnt yet found its footing, you may not have the revenue to assure a lender that youre able to keep up with potential payments. Promising an asset or property like a bank account thats worth the cost of the loan cuts that risk down.

You can learn more about what types of collateral lenders might accept from businesses by reading our guide.

Loans backed by a purchase

The same principle applies to complex loans like those for cars, homes or even large personal purchases. All such loans can require collateral to ensure some form of repayment. Sometimes the collateral is the car, home or item youre buying with the loan.

Collateral Education Loan : All You Need To Know

Government/Public Banks | Updated 07 Aug, 2021

If you are a recent graduate and would like to pursue higher education abroad, you must be surely thinking about an education loan to cover the expenses related to your abroad education. Once you dive deep into the education loan process, you will encounter terms like secured or collateral education loan and if you are unclear about it, then this article is just for you. The below video will give you an insight into how collateral education loans work.

Read Also: Aer Loan Balance

Where To Find Collateral Loans

Consider the following types of lenders when doing your research for loans.

- National banks: borrowing from a bank is a good option if you are already a customer or if there are not any other convenient options near you.

- Community banks: small local banks are more likely to work with local customers if you do not have success with a national bank.

- Online lenders: online banks could have opportunities for you that you cannot find with banks or credit unions.

How Much Collateral Will I Need

In general, your collateral will need to be worth more than the amount of your loan. For example, if you’re using your home as collateral, many lenders will lend between 70 and 80 percent of the home’s value less any other debt you have against the property, like a mortgage.

The exact loan to value ratio will depend on your unique circumstances. The lender will consider things like your creditworthiness and what you intend to do with the money. For example, a lender may require that more collateral be put forth for a business start-up loan than it would require for a loan that will be used to expand an existing, proven business since the start-up is riskier.

You May Like: How Does Paypal Business Loan Work

Why Begin Education Loan Process Early

It is preferable to commence your loan process before you receive an admit because

- The legal report and property valuation can be done beforehand and it would clarify the chances of you getting a loan much earlier in the process. The legal report or valuation report has a validity period between three months to three years.

- There would also be plenty of time to arrange any land or other property documents that the bank requires. This increases the chances of getting your loan sanctioned well before the visa interview date.

If you have any other questions regarding abroad education loan or any other related topic, feel free to request a callbackfrom the WeMakeScholars support team to clarify those doubts. Our digital team is also very active online and would love to answer your comments.

Note: WeMakeScholars is an organization funded and supported by the Government of India that focuses on International Education finance. We are associated with 10+ public/Pvt banks/ NBFCs in India and help you get the best abroad education loan matching your profile. As this initiative is under the Digital India campaign, it’s at free of cost. The organization has vast experience dealing with students going to various abroad education destinations like the US, Canada, UK, Australia, Germany, Sweden, Italy, China, France among others.

FAQs:

Security Interest Vs Lien: Hand In Hand

The terms “security interest” and “lien” do have subtle differences, but generally, they are used interchangeably. A lien is a type of security interest, and a security interest creates a lien.

Liens are creatures of state law. The laws vary state to state as to how liens are created, perfected and enforced. However, most states follow the same basic rules, even if the procedures are different.

You May Like: Is Bayview Loan Servicing Legitimate

When Should I Consider A Collateral Loan

You might want to consider backing your loan with collateral in the following situations:

- You dont have good credit. This typically means a score around 670.

- You already have a lot of debt. Youll have trouble finding any personal loan with a debt-to-income ratio above 43%. But even if its just under that number, you might not be able to qualify for unsecured financing.

- You own a valuable asset or assets. Your collateral is key to a secured loan. Owning a home, a car without any debt makes you eligible for larger loan amounts.

- Youre a sole proprietor. If your business is a one-person show, you might have trouble proving you have steady income to a lender.

How Much Collateral Do Lenders Require

Loan-to-value ratio is a key metric lenders use to decide the collateral they need. LTV is the amount a lender will loan you based on the value of the collateral. For example, a bank might offer an 80% LTV ratio for a business loan if you pledge real estate as collateral. That means it will lend you $80,000 when the property is worth $100,000. The difference between the collaterals fair market value and the amount of the loan is called the discount, sometimes known as a “haircut” in this example, the haircut is 20%. Highly liquid assets will have a smaller haircut.

Typically, a borrower should offer collateral that matches the amount they’re requesting. However, some lenders may require the collateral’s value to be higher than the loan amount, to help reduce their risk.

How much collateral youre required to will depend on “The Five Cs,” which are common indicators of financial health:

- Collateral

- Conditions

Different lenders will approach these factors in their own way. For example, if you arent able to meet the collateral criteria but have an otherwise qualified application, the SBA wont decline your application based on the lack of collateral alone.

Recommended Reading: How To Find Student Loan Number

Types Of Registered Mortgage Charges

Learn about the different types of registered charges for real estate secured lending.

- Mortgages

- Types of Registered Mortgage Charges

When you need a residential mortgage to buy a home, lenders require security for repayment in the form of property, such as a house.

You need to sign a charge document, which is registered in the provincial or territorial land registry office where the property is located. The charge gives the lender certain rights, including the right to sell the property if you don’t repay your loan as agreed.

There are 2 types of charges a lender can register: standard or collateral. A standard charge is also referred to as a traditional, conventional or non-collateral charge.

How Much Are Assets Worth

Lenders typically offer less than the value of your pledged asset, and some assets might be heavily discounted. For example, a lender might only recognize 50% of your investment portfolio for a collateral loan. That way, they improve their chances of getting all their money back in case the investments lose value.

When applying for a loan, lenders often quote an acceptable loan to value ratio . For example, if you borrow against your house, lenders might allow an LTV up to 80%. In this case, if your home is worth $100,000, you can borrow up to $80,000.

If your pledged assets lose value for any reason, you might have to pledge additional assets to keep a collateral loan in place. Likewise, you are responsible for the full amount of your loan, even if the bank takes your assets and sells them for less than the amount you owe. If you do not comply, the bank can bring legal action against you to collect any deficiency .

Read Also: How To Get Loan Originator License

What Is A Collateral Mortgage

A collateral mortgage is a readvanceable mortgage product, meaning that your lender can lend you more money as your property value increases without having to refinanceyour mortgage. To do so, the lender registers your home with a collateral charge similar to what they do for a home equity line of credit, and have the ability to do so for a higher amount than the mortgage loan amount you need.

How To Get A Collateral Loan

While it takes money to build your business, you usually have to have assets to gain access to that money. If a lender will not approve your credit application for a personal loan, the asset you promise as collateral gives her the security of knowing she can take the asset should you default on the debt. While you still need acceptable credit to secure a loan, offering collateral makes loan approval more likely.

Recommended Reading: What Car Loan Can I Afford Calculator

Using Collateral On A Personal Loan

May 13, 2021 · 6minute read

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

There are a lot of reasons someone might need an injection of cash and seek out a loan from a bank: For emergencies, home repairs, to pay off credit card debt with a lower interest rate loan.

One consideration when taking out a personal loan is whether it is secured or unsecured. A secured loan is backed by an asset, called collateral, such as a home or car. An unsecured loan, on the other hand, is not collateralized, which means that no underlying asset is necessary to qualify for financing.

Whether to pursue a secured or unsecured loan will depend on a number of factors, such as your credit score, whether you have collateral, the type of financing you need, and when you need it. These personal loan requirements will be covered in full below, as well as discussing what can be used for a personal loan with collateral and financing options that dont require collateral.

How Do Collateral Loans Work

Collateral loans are also referred to as secured loans. When a borrower applies for a collateral loan, they agree to give up a specific asset in the event that they cannot repay the loan.

In the eyes of the lender, collateral loans are favourable because theres less risk. Even if the borrower is unable to make payments, they have the collateral as back up.

The amount of your loan depends on the value of the collateral. In addition, a portion of the collaterals value is usually considered for the loan, not the entire value. For example, if you have a car worth $5,000 being used as collateral, your loan might be approved for 60% of that value, or $3,000. This is to provide more protection to the lender.

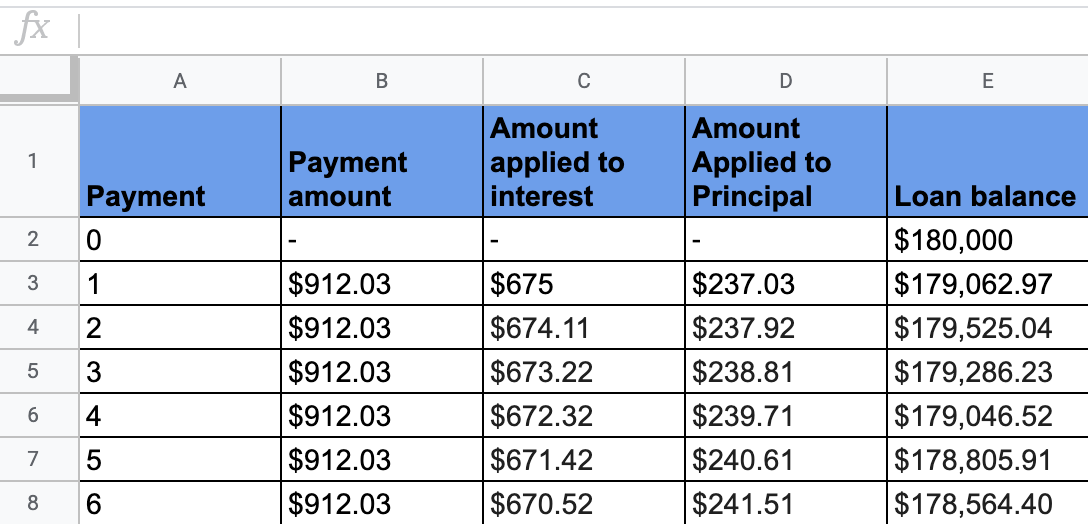

Read Also: How To Calculate Amortization Schedule For Car Loan

To Secure Or Not To Secure: That Is The Question

Theres no way around it: You need cash to grow your business. No matter your industry or what type of company you operate, reliable access to funding is crucial.

Research your secured and unsecured loan options and determine if a business loan with collateral requirements is best for your business.

Apply to multiple lenders with just one application

The 3 C’s Of A Mortgage Application

Of course, collateral is only one part of a mortgage. While lenders will want to know the value of the home you’re purchasing, there are other factors they will take into consideration when deciding who to lend to.

InterContinental Capital Group has made mortgages as simple as possible, and part of that is helping borrowers understand what lenders are looking for. When applying for a mortgage, remember the 3 C’s:

Your credit score is actually the first thing lenders will assess when determining your eligibility for a loan. It will paint a picture of your past borrowing and payment behavior to help lenders understand how you manage debt and if you’re a reliable borrower.

Capacity – Your capacity is your ability to make your monthly loan payments. Lenders will look at a few key aspects – like your debt-to-income ratio – to calculate this aspect. They will also want to ensure you have a steady income.

Collateral – Your collateral is the value of what you’re financing in comparison to the amount of the loan.

Read Also: What Happens If You Default On Sba Loan

Why Secured Loans Require Collateral

If collateral is used, a lender may be able to offer larger loans, more favorable interest rates, and better terms. Thats because the lender can take possession of the collateral if the loan isnt repaid as agreed. This is not the case with an unsecured loan.

Because of the lack of collateral, unsecured loans are often limited to borrowers who are viewed as trustworthy. For example, higher credit scores are usually necessary for an unsecured loan.

If collateral is used, a lender is often able to offer larger loans.

Unsecured loans usually have higher interest rates, although this is changing somewhat as online-only lenders such as SoFi aim to offer competitive rates for unsecured personal loans. Unsecured loans can be easier to qualify for, simply because there are fewer hoops to jump through.

Digging up all the paperwork for the asset youll use as collateral can take quite a while, and then a bank needs to verify it all. When youre not tying your loan to collateral, the approval process may be a bit smoother.

What Is Business Collateral

Collateral is an asset that a borrower provides a lender to secure a loan. Assets can be tangible, which can be seen and touched, such as buildings, or intangible, such as accounts receivables.

Lenders assume financial risk whenever they hand money over to a business looking to scale. To mitigate that risk, many creditors require business collateral.

Even though lenders take precautions to vet applicants to allow only the most creditworthy borrowers, most banks still insist that business owners offer collateral to hedge the inherent risk of lending. Indeed, an impressive credit history, positive cash flows and other attractive attributes arent enough to bypass this requirement.

Chances are youll need to set aside a sum of cash or other assets to get approved for a business loan. According to the Small Business Administration , business owners looking to borrow funds that require collateral should assume that all assets financed with their loan will be used to secure that loan, though additional assets may be needed.

Recommended Reading: Nslds Ed Gov Legit

Find Out What Can Be Used As Collateral

Most lenders have similar definitions of what can be used as collateral, but it is important to understand what your options are so you can secure a loan.

- Equipment if you default on payments, the equipment becomes the lenders property.

- Automobiles you can use your car as collateral if you own it or if the amount that is owed is less than its value.

- Home equity this type of collateral is the most valuable asset of an individual.

- Commercial properties if you are buying property, that property can be used as collateral.

- 401k – although you can use a 401k as collateral, they have some limitations and tax limitations.

- Accounts receivable and purchase orders asset-based lenders will give your loan 100% of the value of your receivables. The benefit is that the lender decides to pursue the payment from the customer of the unpaid invoices and if the customer does not pay then you will be responsible of only paying the initial invoice amount and are not risking losing any assets.

- Merchant cash advances your business can also trade a portion of credit card sales for a lump sum loan. This type of financing is very flexible, but interest rates can be high.

- Cash savings personal savings that you have will also work as collateral because it is a low risk for the bank.