Is It Best To Refinance A Car Loan With Your Current Lender

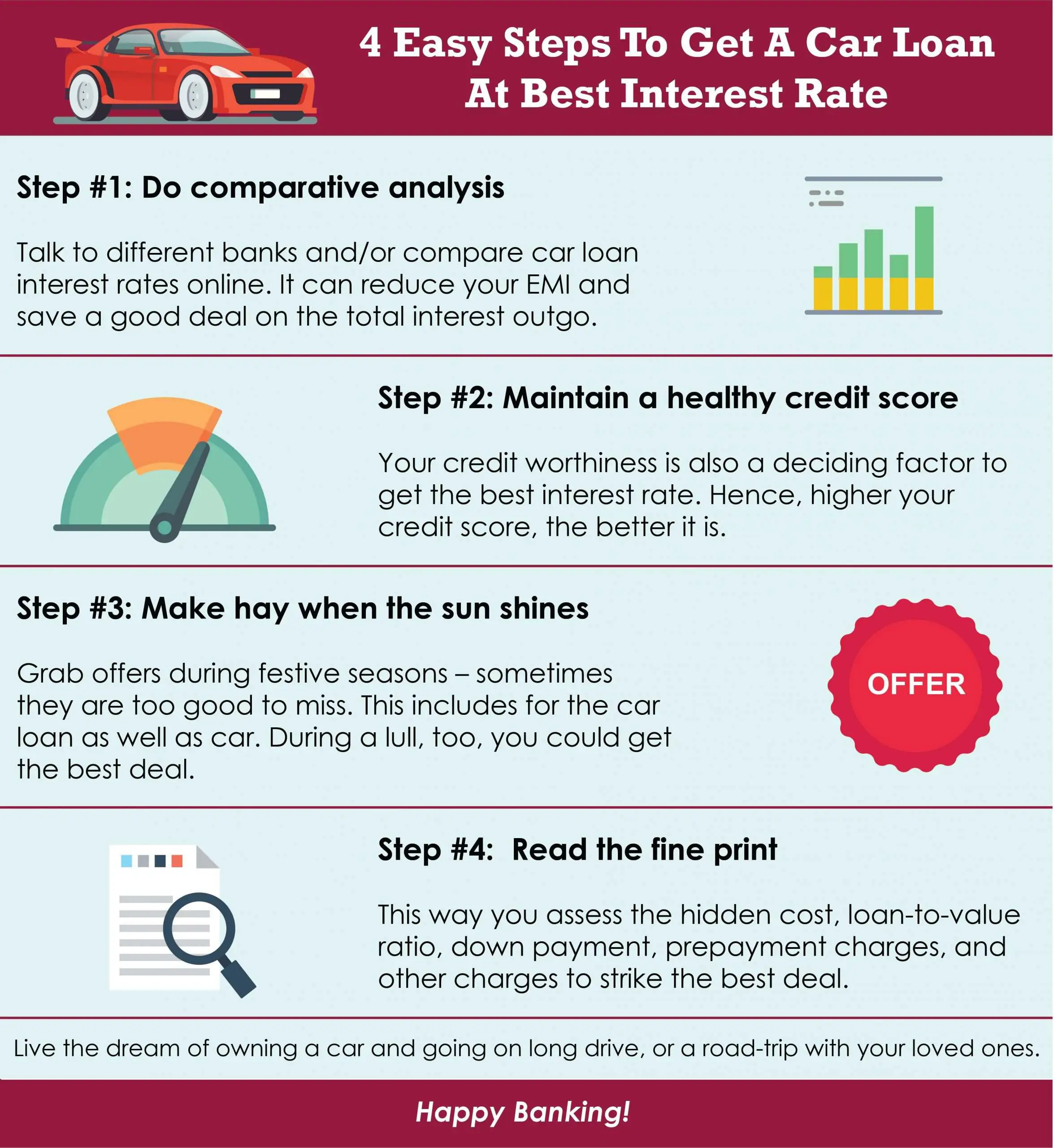

Many banks and credit unions offer interest rate discounts for current customers. These loyalty discounts are usually about 0.25%, but can be higher with some lenders. If the rate with the discount gets you a low rate that youre happy with, refinancing with your current lender could be your best option.

However, some lenders will offer you a better deal to move your business to them instead. So, shop around and refinance with a lender that offers the best terms for your situation. You should aim to compare loans from at least three lenders before deciding to stay with your current lender.

What Happens If Interest Rates Change Between The Time I Apply And The Time I Use My Autocheck

If rates rise from the time you apply until the time you use your Direct Federal AutoCheck, you will get the lower rate that was in effect when you applied.

If rates rise from the time you apply until the time you use your Direct Federal AutoCheck, you will get the lower rate that was in effect when you applied. If rates fall from the time you apply until the time you use your AutoCheck, you will get the rate in effect at the time you useyour check.

Consider An Extended Warranty

On a related note, if you purchase an extended auto warranty through a dealership, the cost can often be rolled into your monthly car payment. However, that will increase your loan amount and the total interest you pay. It can be a better idea to purchase a standalone vehicle service contract a bit later on if you want to save money and keep your car protected.

Read Also: What Is The Best Online Loan

Auto Loan Default Rates Continue To Climb

News emerged in mid-2022 that auto loan default rates had started to rise, especially among younger generations. Since then, default rates have only continued to increase.

Younger age groups are still the most heavily affected. In 2022, data from the Federal Reserve Bank of New York revealed that 3.59% of auto loans held by borrowers aged 18-29 were headed into serious delinquency, which is defined as payments being 90 or more days late. That figure reached 2.3% for borrowers between the ages of 30 and 39.

In fact, auto loan delinquency rates rose in 2022 for every age group except for borrowers aged 60 to 69. Delinquency rates rose to an average of 1.85% across all age groups a 16% increase from 2021.

What Will My Monthly Payment Be

Many factors go into determining the final loan amount for the purchase of a new or used vehicle. These factors include any manufacturer’s rebate, the trade-in value of your old vehicle less any outstanding balance, your down payment, etc.

Once the loan amount is determined the interest rate and the term of the loan will be used to estimate your vehicle payment. To estimate your monthly payment, try our Monthly Payment Calculator.

Recommended Reading: How To Apply For Federal Direct Parent Plus Loan

How Is Interest Calculated On A Car Loan

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the five main points lenders consider when reviewing your application:

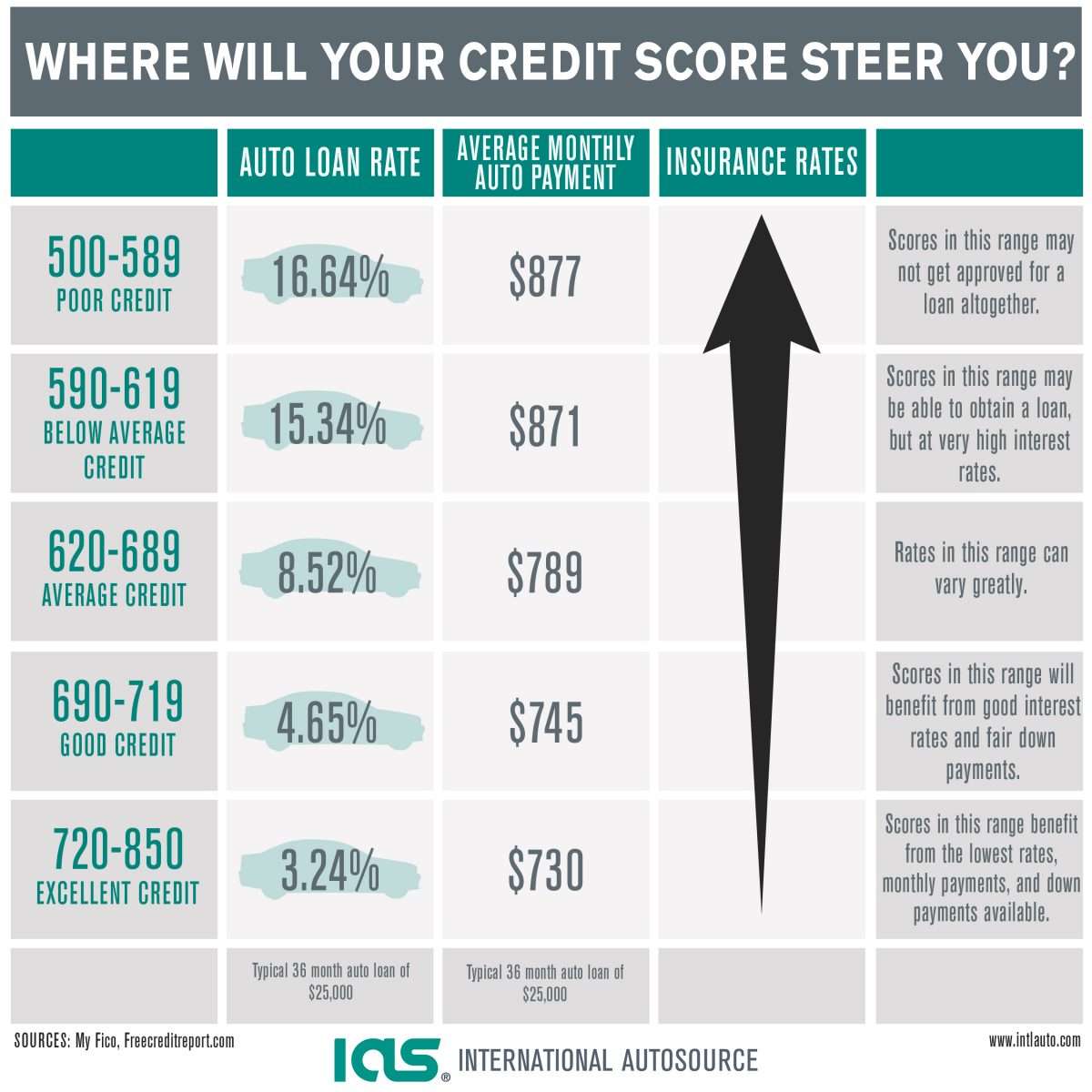

- Those with higher scores generally have access to lower car loan rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

- Type of interest rate. Banks and credit unions can offer fixed and variable interest rates on a car loan. Generally, variable-rate car loans have lower starting rates than fixed-rate car loans.

Which Lender Is The Most Trustworthy

We’ve reviewed each institution’s Better Business Bureau score to help you make the best decision possible when choosing an auto loan. The BBB measures businesses based on factors like truthfulness in advertising, honesty about business practices, and responsiveness to consumer complaints. Here is each company’s score:

| Lender | |

| PNC Bank | A+ |

A majority of our top picks are rated A or higher by the BBB, with the exception of Clearlane by Ally. Keep in mind that a high BBB score does not guarantee a good relationship with a lender, and that you should keep doing research and talking to others who have used the company to get the most helpful information you can.

The BBB currently rates Clearlane by Ally a D- because of 53 complaints filed against the business, including one unresolved complaint. Due to the lenders’ BBB scores, you might prefer to use a different auto loan company on our list.

You May Like: Is It Good To Refinance Your Car Loan

What Is A Good Auto Loan Interest Rate

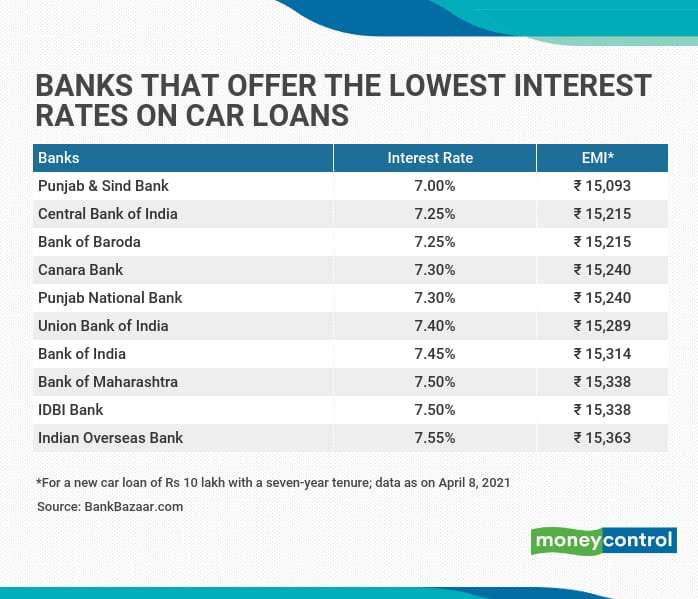

A good auto loan interest rate is usually 4% or lower, but typically the best auto loan rates are for new cars. According to the 2022 report from the National Credit Union Administration , the average 60-month new car loan from a credit union has an interest rate of 2.78%. From a bank, the average rate is 4.69%. So, if you find these rates or lower, you know youre getting a fair rate on your car loan.

Compare Current Car Loan Rates In Canada To Find Competitive Auto Loans For Your New Or Used Car Purchase

If you need financing to buy a new or used car, the interest rate youre offered will affect how much your loan will cost you and ultimately how much your car will cost you. You need to be in a strong place financially to qualify for the most competitive car loan rates that lenders advertise and thats not the only factor to consider when shopping around for the best deal on car loan interest rates in Canada.

Also Check: Is Home Equity Loan Good Idea

Best For Excellent Credit: Lightstream

- Loan amounts range from $5,000 to $100,000

- Loan term lengths range from 24 months to 84 months

- Rate discount of .50% when you sign up for AutoPay

- No restrictions on age or mileage of your car

- Loans made by Truist Bank, member FDIC

If you have a good or excellent credit score, you might want to consider LightStream in addition to Bank of America. A part of SunTrust Bank, Lightstream focuses on auto loans to customers with good or better credit.

Because it focuses on a narrow subset of customers, its rates don’t go too high For a 36-month loan for a new car purchase between $10,000 and $24,999, interest rates range from 2.49% to 6.79%. However, borrowers with lower credit scores may find better rates elsewhere.

Should You Get An Auto Loan From A Bank Or Dealership

It’s worth shopping at both banks and dealerships for an auto loan. New car dealers and manufacturers, just like banks, can have attractive loan products. Depending on the borrower’s credit score and market-driven circumstances, the interest rate offered by a car dealer can be as low as zero percent or under the going rates offered by banks.

It’s important to keep dealership financing as a possibility, but make sure to look for auto financing before deciding where to buy a car. Know your credit score and search online for bank and other lender rates. This should give you a range of what you can expect in the open market and help you determine if seller financing is a better deal for you.

You May Like: How To Get 500k Business Loan

How To Apply For An Auto Loan

Follow these general steps to apply for an auto loan:

What Are The Pros And Cons Of Car Loans

There are both pros and cons to car loans. While a car loan might enable you to purchase a more expensive vehicle, and to balance repaying costs over a longer timeframe, youll usually need to pay interest, and there can be associated fees to consider. There are also the risks of repossession. Your credit score may also be impacted by you taking out a car loan.

You May Like: How To Get Help With Student Loan Forgiveness

How Do You Get Prequalified For An Auto Loan

You can get prequalified for an auto loan online and without ever leaving your home. All you have to do is select one of the lenders on this list and choose its online option to get prequalified or apply for a loan. Many lenders let you get prequalified for an auto loan without a hard inquiry on your credit report.

Best Auto Loan Rates Providers

Based on our research, myAutoloan.com currently offers the best annual percentage rate at 2.49%, and PenFed Credit Union and Consumers Credit Union also generally offer some of the lowest rates and financing terms. In the table below are five top providers with some of the best auto loan rates in 2022.

Don’t Miss: How Long Before I Can Refinance My Car Loan

What Factors Contribute To Auto Loan Interest Rates

While it is true that the interest rate you will receive varies depending on the lender and is somewhat out of your control, there are still choices you can make to increase approval. Consider these aspects and how they will affect loan approval and rates:

- Your credit history. Lenders use credit scores to measure the risk that borrowers carry. Very simply, the lower your credit score is, the higher your interest rate will be.

- Vehicle down payment. Putting down a large down payment will not only bode well with lenders but will decrease the amount you are borrowing saving you more money down the line.

- Loan term. Typically, a longer-term loan will equate to higher interest rates and more interest paid over the life of the loan. But a longer-term loan will decrease your monthly payment.

- Education and work history. Many lenders are expanding underwriting criteria outside of the sole measure of your credit score. This means you can still benefit from a competitive rate if you have a strong profession or educational background with or without a perfect credit score.

- Vehicle age. An older vehicle can carry additional risk of issues for both you and your lender. So, you can expect an older car to carry higher rates.

Best For Refinancing: Openroad Lending

OpenRoad Lending

-

No option to prequalify and check rates with a soft pull

-

Vehicle age and mileage restrictions

While getting a new set of wheels is exciting, there’s something to be said for sticking with a reliable ride. However, if your credit improved, you paid off debt, or you got a raise since you first financed your auto loan, you may be paying too much.

OpenRoad Lending allows eligible applicants to refinance existing loans and save an average of $100 per month on their car payments. The application process is simple and entirely online. Within as little as a few minutes of applying, you can receive your decision with complete details about the loan.

If you run into any trouble with your application, OpenRoad Lending’s customer service team can help. Perhaps that’s why 98% of customers say they’re satisfied with their loans. Before applying, you should know that there is only the option to apply with a hard credit pull. It’s not possible to prequalify or check rates with a soft pull, so this service is only for people serious about refinancing. The higher your credit score, the lower your rate will be.

Read Also: How Do You Find Out Your Student Loan Balance

Interest Rates Have Risen Dramatically

Another factor that has added to the cost of buying a car is the significant increase in auto loan rates over the past year. Spurred by multiple increases to the federal funds rate, automotive loan interest rates have grown even more quickly by percentage than car payments over the last year.

The average interest rate for used cars grew from 8.12% to 9.34% between Q3 2021 and Q3 2022, an increase of 15.02%. When it comes to new cars, the average interest rate grew from 4.09% to 5.16% during that same period, an increase of more than 26% on the year.

These increases mean that on top of historically-high prices for new and used cars, people have to pay significantly more to borrow the money to buy them.

How To Get An Auto Loan

Read Also: What Is Loan To Value Mean

What To Look For When You Apply

Agreeing to the wrong car loan can cost you money and damage your credit score if you cant make payments on time. Before signing for a loan, you need to consider a few critical details.

Type of car loan

Do you want to purchase a brand new car or are you in the market for a used car? Are you dissatisfied with your current loan and want to refinance? You should know the type of auto loan youre looking for before starting your search for companies that offer new car loans, used car loans or auto refinancing companies.

Estimated loan interest payment

Calculating how much interest you will pay on a car loan will help determine whether its worth purchasing. If you end up paying more in interest than the cars value, you may want to reconsider if the purchase makes financial sense.

The following calculation will help you determine the interest payment on your car loan:

- Interest rate ÷ 12 months x the loan balance = Monthly interest

For example, the monthly interest payment on a $10,000 loan with a 7% APR is calculated as follows:

- 0.07 ÷ 12 x $10,000 = Monthly interest payment of $58.33

Using this example, you would pay nearly $700 in interest over the first year of your loan.

Auto loan pre-approval

Pre-approval means that a lender has examined factors like your credit history and income and determined your eligibility to receive a loan.

Getting pre-approved for a loan offers several advantages:

- You can easily calculate your monthly payment to ensure you can afford the loan.

Top Car Loans To Help You Finance Your 2023 Car Purchase

New year, new car? If youre considering purchasing a new or used vehicle this year, its crucial that you compare your loan options carefully to ensure you choose the best option for your needs and budget.

The start of the new year is considered one of the more popular times to purchase a new or used vehicle. This is because dealerships will often offer clearance sales for the previous years models, as these older models become less attractive to buyers by February/March.

Whether youre considering purchasing a Ute for your business, or a hatchback to get you around your city, its worthwhile comparing a range of vehicle and financing options before you sign on the dotted line for your next car.

Also Check: Easy Student Loans To Get Without Cosigner