What Is Personal Loan Emi Calculator

EMI is short form Equated Monthly Instalment or the Amount that is payable per month if you take a personal loan of a certain amount for a certain period. The calculation of EMI depends on 3 main factors:

- Personal Loan Amount The Rupee value of the loan that you take

- Personal Loan Interest Rate The interest rate that the bank will charge for the Personal Loan

- Tenure of Personal Loan The period for which you take the Personal Loan

What Credit Score Is Needed For A Personal Loan

Youll typically need a good to excellent credit score to qualify for a personal loan a good credit score is usually considered to be 700 or higher. Your credit score also plays a major role in determining what interest rates you qualify for. In general, the better your credit score, the lower the interest rates youll likely get.

Here are the credit score ranges you can typically expect to see as well as how they can affect the interest rates youre offered:

Poor :

Fair :

While there are several lenders that offer fair credit personal loans, you can generally expect to pay a higher interest rate. Having a cosigner might get you a better rate, even if you dont need one to qualify.

Good :

A good score greatly increases your chances of qualifying with several personal loan lenders. Youre also more likely to receive more favorable rates. While you likely wont need a cosigner to get approved for a loan, having one might help you get the best interest rates.

Fair :

Scores above 750 will qualify you for the vast majority of personal loans as well as help you get the lowest interest rates advertised by lenders.

Best Bank: Wells Fargo

Wells Fargo is probably one of the largest and most well-known banks in the U.S. Existing customers can apply for a personal loan online or over the phone, whereas new customers will need to head to their 8,000+ branches. Rates start as low as 5.74% if you can qualify for the relationship discount.

-

Different options to apply for a loan

-

Cannot prequalify, so youll be subject to a hard credit inquiry

-

New customers need to show up at a Wells Fargo branch

-

Bank has history of scandals

Other important information:

- Maximum/minimum amount you can borrow: $3,000 to $100,000

- 5.74%24.49% with relationship discount

- Minimum recommended credit score: 670

- Fees: None

- Other qualification requirements: Need to be the age of majority in their state and be a U.S. citizen or permanent resident

- Repayment terms: 12 to 84 months

- Time to receive funds: As soon as the next business day

- Restrictions: New customers need to show up in person

Read the full review:Wells Fargo Personal Loans

Recommended Reading: Is Student Loan Refinancing Worth It

What Are Coronavirus Hardship Loans

Coronavirus hardship loans are short-term personal loans designed by lenders specifically to help people affected by the coronavirus pandemic. These loans are typically less than $5,000 and may have to be repaid within three years or less. Coronavirus hardship loans are popular among credit unions, in particular; if you need short-term relief, ask your local credit union about its offerings.

Look For Top Personal Loan Providers

This personal loan tip might sound obvious, but for many borrowers its a step too often skipped.

Different kinds of lenders will be able to meet different needs, and youll want to find one that provides what youre looking for.

From a specific feature to low fees and rates, you can find what you want by checking different types of personal loan providers:

The only way to know youre getting your best possible personal loan rates is to check the terms and options different lenders offer.

Our marketplace of recommended personal loan lenders is a good place to start your search.

Don’t Miss: When Do Student Loan Payments Start After Graduation

Why Are Loan Rates Different

When a lender is deciding whether to give you a loan and how much interest to charge you, they will look at the risk of you not paying it back. If you are borrowing to buy a house, they could get their money back by repossessing your house if you didnt keep up with your mortgage payments. This is known as a;secured loan;because the loan is secured against the overall value of your property. It’s seen as much less risky for the lender.

If you’re borrowing a small amount that’s not backed up by the value of your house, the lender has less certainty that it will get its money back. So a;personal loan;is referred to as an unsecured loan. This is because the lender doesnt have anything it can claim back if you fail to pay, and the loan isn’t secured against an asset. That is why unsecured loans tend to not offer low interest loans, and have higher interest rates, even though the sums of money borrowed are much smaller than the average mortgage.

What Is A Good Personal Loan Interest Rate

Experian put the average personal loan annual percentage rate at 9.41% in 2019, while the New York Federal Reserve puts the average personal loan interest rate at 9.34% for the third quarter of 2020 on a 24-month loan.

But your financial history influences the rate you’re approved for, so might get approved for loans above or below the average interest rate. How do you know if the interest rate you’re offered is good for you?

A good personal loan interest rate depends on your credit score:

- Below 579: Around 30%

For a guide to finding the right loan for your credit score, check out our page on .

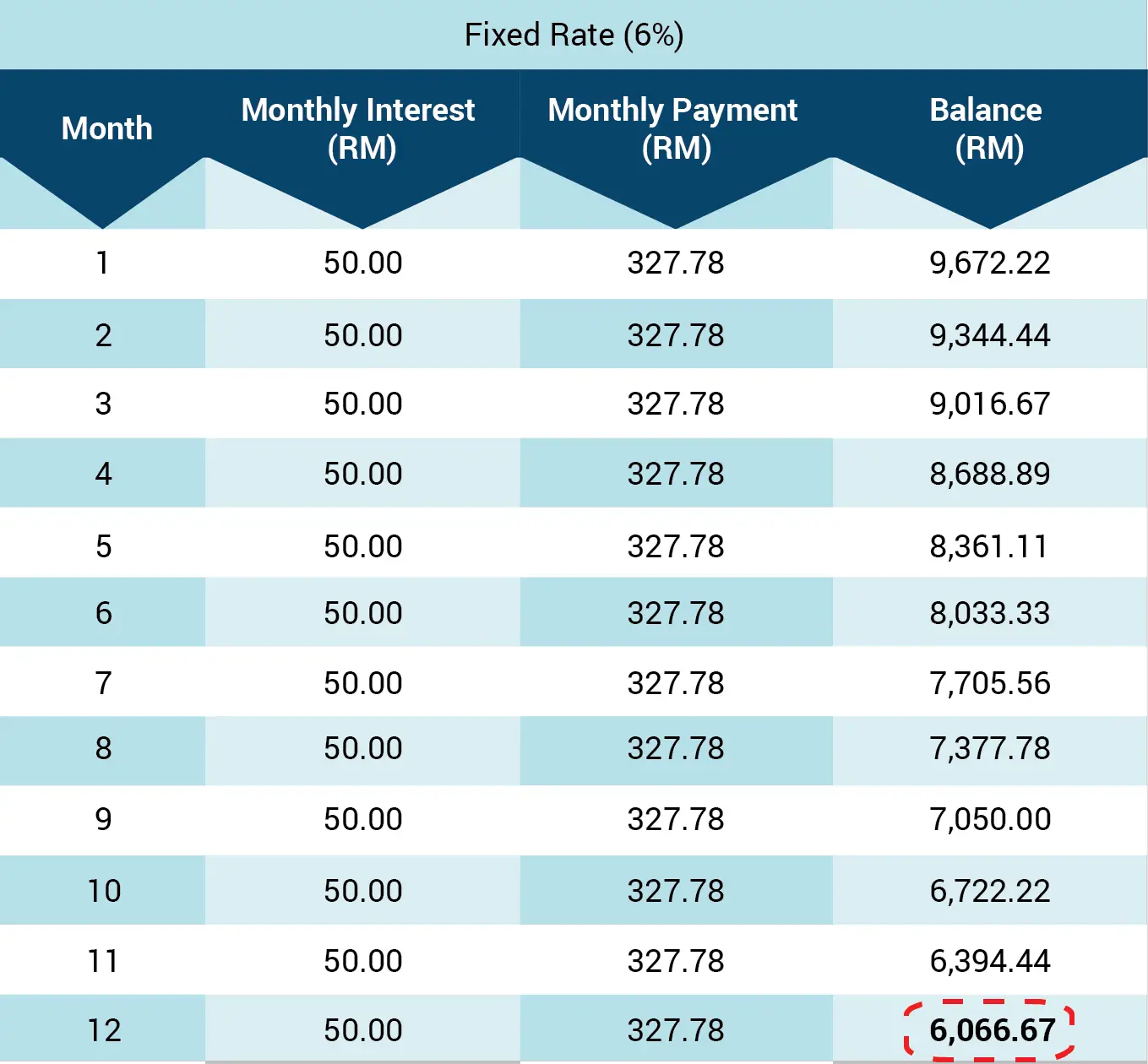

You can use the loan calculator below to see how different interest rates affect your monthly payment.

Read Also: How Long Until You Can Refinance An Fha Loan

Best Personal Loans For Excellent Credit Of September 2021

- Best Overall and Lowest Rate: LightStream

- Best for Debt Consolidation: Payoff

- Best Customer Experience: SoFi

- Best Wedding Loan: American Express

LightStream, the online lending arm of Truist bank, offers some of the lowest fixed rates around: as low as 2.49% and no higher than 19.99%with automatic payments . Minimum rates and your repayment duration do vary, depending on the purpose of the loanLightStream is big on categorizing loans, offering financing for everything from autos to weddings. There are also no fees and borrowers may take out up to a maximum of $100,000.;

-

Extremely low APRs

-

Wide range of loans

-

Guarantees to better competitors’ rate

-

Hard inquiries only

-

Longer credit history required, usually several years

-

Inability to change due date once repayments start

Other important information:

- Minimum/maximum amount you can borrow: $5,000 to $100,000

- 2.49%19.99% with autopay

- Fees: None

- Minimum credit requirement: Not Listed

- Other qualification requirements: LightStream looks for borrowers with a decent credit mix, few delinquencies, a decent debt-to-income ratio and several years of credit history

- Repayment terms: 24 to 144 months

- Restrictions: LightStream wont count income from the cannabis industry. Plus, you cant refinance an existing LightStream loan and use the funds for educational or business expenses

- Time to receive funds: Could be as soon as the same business day

Read the full review:;LightStream Personal Review

Best For Home Improvement: Wells Fargo

;Wells Fargo

Wells Fargo offers loans for between $3,000 and $100,000 with rates starting as low as 5.74% APR, with a 0.25% relationship discount. That means that in order to get the best rates, you need to use other Wells Fargo products. This is one of the best personal loans from banks for home improvements because you can manage a number of projects, from a small, cosmetic project to a large remodel.

But be aware that if youre borrowing a large amount, youll be stuck with a large monthly payment. For example, a $90,000 loan at 10% interest and an 84 month term would result in a monthly payment of nearly $1,500.

Funding may arrive by the next business day and there are no origination fees. To get the best rate. You will have to have a checking account with the bank and make regular payments from it or another Wells Fargo account.

-

Relationship required for autopay discount

Don’t Miss: Can You Use Fha Loan If You Already Own House

Best For Flexible Payments: Marcus By Goldman Sachs

-

No fees for loan origination, prepayment, late payments, or other fees

-

Change your payment due date up to three times during the life of your loan

-

On-time payment reward that defers one payment after 12 consecutive on-time payments

-

Difficult to qualify without a strong credit history

-

Less competitive interest rates for longer-term loans;

-

No cosigners allowed

- Minimum/Maximum Loan Amounts: $3,500 to $40,000

- 6.99%19.99%

- Fees: None

- Minimum Credit Score: 660 or higher

- Other Qualification Requirements: Be at least 18 years old with a U.S. bank account and Social Security number or Individual Tax I.D. number

- Repayment Terms: 36 to 72 months

- Time to Receive Funds: One to four business days to receive the money after approval

- Restrictions: Cant be used to refinance student loans

;;;Read the full review:

American Express: Best For Debt Consolidation

American Express

American Express offers a solid personal loan for existing customers. Those targeted with an offer may check rates with a soft credit check. American Express personal loan may be a good option for those with good to excellent credit who want to consolidate credit card debt.

-

Competitive interest rates starting as low as 7.98%

-

Prequalify for personal loan without hurting your credit score

-

Consolidate credit card debt by sending proceeds directly to your creditor

-

Exclusive offer for existing American Express customers

-

No flexibility on payment due date

-

Slow loan funding compared with some competitors

Other important information:

- Minimum/Maximum Loan Amounts: $3,500 to $25,000

- 5.91%19.98%;

- Fees: Late fee of $39

- Minimum Credit Score: Reported to be 640

- Other Qualification Requirements: Must be an existing American Express customer with a targeted offer

- Repayment Terms: 12 to 36 months

- Time to Receive Funds: Three to five business days after approval

- Restrictions: Cant pay for education, real estate, or business costs; buying stocks; purchasing a vehicle; or debts on American Express credit cards

Read the full review: American Express Personal Loans

Read Also: What Is Interest Rate For Commercial Loan

Best Loan For Veterans: Penfed Credit Union

Pen Fed Credit Union

Personal loans from PenFed Credit Union are best for those looking for short-term loans and low borrowing amounts. Applicants can qualify for loans as low as $500 with rates starting at 5.99%. To become a member, applicants need to join the National Military Family Organization or Voice for Americas Troops for $17.

-

Loans as low as $500

-

Borrowers need to be member of credit union

-

Loans max out at $35,000

Other important information:

- Maximum/minimum amount you can borrow: $500 to $35,000

- 5.99%17.99%

- Fees: None

- Minimum recommended credit score: 580

- Other qualification requirements: The credit union will take your debt, income and credit history in addition to your credit score

- Repayment terms: 6 to 60 months

- Time to receive funds: As soon as the next business day

- Restrictions: Credit union membership required

Read the full review:PenFed Credit Union Personal Loans

Once you’ve decided which lender is right for you, it’s crucial to know exactly what kind of monthly payment, loan term, and interest rate you can afford. A personal loan calculator could be useful for this endeavor.

Personal Loan Interest Rates Can Vary Wildly Depending On The Lenders Youre Considering And Your Borrowing Power

The average annual percentage rate on a two-year;personal loan;from a commercial bank was 9.3% in the third quarter of 2020, according to Federal Reserve data.

While the average rate isnt too high, some personal loan lenders offer loans with annual percentage rates of up to 36%. Other lenders may charge even higher rates than that if you have;bad credit.

Qualifying for a personal loan with a low rate, one with an average rate and one with a sky-high rate often comes down to your credit history and credit scores. Generally, the higher your credit scores, the more likely you are to qualify for a loan with lower or more-competitive rates. And the lower your credit scores, the more likely you are to face higher interest rates.

Before applying for a personal loan, read on to learn about lenders with lower personal loan rates and some tips on how to prequalify for a loan with low interest rates.

Read Also: How Long Can You Finance An Rv Loan

Easy Steps To Apply For A Personal Loan

Being knowledgeable about your financial situation and researching lenders can help you find the best loan for your needs. Here are six steps for getting a personal loan:

Methodology

To select the top personal loan lenders, Bankrate considered factors that help consumers decide whether a lender is a good fit for them, such as credit requirements and minimum APRs. We sought lenders with low fees and a range of loan amounts for borrowers with varying budgets and credit profiles. We also looked for conveniences like online applications and fast funding.

In addition, the lenders featured here were evaluated for notable features like customer discounts and flexible repayment options.

Pay Attention To Total Loan Costs And Payments

As youre working to get your best personal loan interest rates, its important to keep an eye on how different terms will affect your monthly payments and total costs.

Use our personal loan calculator to see how different terms will affect the following factors:

- Total costs: These are all the charges youll pay over the life of the loan. Total costs will be higher with long-term personal loans since they carry higher rates and are repaid more slowly.

- Monthly payments: These also should be affordable. While a short-term personal loan will come with lower interest rates, it also will increase monthly payments. Youll need to choose a loan length that results in affordable payments so you wont fall behind.

Read Also: What Credit Score Do You Need For An Fha Loan

What Types Of Lenders Have Low Interest Loans In Canada

The following types of lenders might offer low interest rates, though you might not be able to qualify with all of them unless you have good credit.

- Banks. If youre in good standing with your bank, it may be a good start to inquire with them about a low interest loan.

- Credit unions often offer low rates to a wide range of credit types compared to other lenders since theyre owned by their customers. The process may take a bit longer, especially if you arent a member yet and need to apply to join first.

- Peer-to-peer lenders. An online peer-to-peer lending platform like goPeer can reduce operating costs and pass on the savings to the borrower.

- Online lenders. These lenders have higher rates on average, but typically put less weight on your credit score than a bank or credit union. You can research online lenders interest rates in the comparison table above or their websites.

- Connection services. A connection service such as Loans Canada and LoanConnect can help you quickly prequalify with multiple lenders to help you quickly find the lowest rate you qualify for with its partner lenders.

Why Should You Take A Personal Loan

These compelling reasons are why your search for personal loan ends with ICICI Bank:

- Get flexible tenure up to 60 months

- Avail of a fixed rate of interest. Interest will be charged on monthly reducing basis

- No need to put up any collateral against the loan

- Set up ECS, PDC or auto-debit for automatic repayment of EMI every month

- Minimal documentation and hassle-free application makes loan approval and disbursement a breeze

- Choose your tenure from 12 to 60 months.

Also Check: How Much Business Loan Can I Get

Do You Offer Top Up On Existing Personal Loans

We offer Top Up facility if you have paid 12 EMI on the existing Personal Loan. You can Place the request for Top up on existing Personal Loan through the following Channels:

Internet Banking

Log in to www.icicibank.com with your user ID and password–> Main Page –> Select Loans options in My Accounts –> Click on Apply for Loans –> Under Personal loan option – Click on Apply now –> Check the Eligibility and Click on Apply Now

Customer Care:

You may also call our Customer Care with your STD code followed by 33667777.

ICICI Bank branch :

Please visit the nearest ICICI Bank Loan servicing branch along with your valid ID proof,Address Proof, 3 Months bank statement in which his salary is credited, Latest 3 months Salary slips and Form -16 for the current / previous financial year.

We request you to look for the nearest ICICI Bank Loan Servicing Branch in our website: www.icicibank.com >> Find ATM/Branch.