Loan Amount And Term Length

The loan amount and term will also have an effect on your commercial real estate loan rates. In most cases, short-term hard money loans will have higher interest rates because these lenders work with riskier borrowers. However, youâll pay more in total interest on a long-term loan, even if your interest rate is lower.

What Is A Loan

Its important to understand how the loan-to-value ratio affects your mortgage. The LTV is determined by dividing the amount of the loan by the value of the property. Generally, you would pay for part of the property yourself via a down payment. If your down payment is larger, your LTV would be lower, while a smaller down payment would result in a higher LTV. You may be able to receive a lower interest rate if your LTV is low, as this means that the lender is bearing less of the risk.;

Example:

- You buy a commercial property with an assessed value of $200,000. Your down payment is $60,000 and you will borrow $140,000. The loan amount of $140,000 divided by $200,000 results in an LTV ratio of 70%.;

While high LTVs are common with residential mortgages, they are less common with commercial mortgages, where LTVs generally range between 65 to 85 percent.;

Choosing The Right Commercial Real Estate Loan

If youre thinking about purchasing or renovating an income-earning property or one to run your business from, one of the first steps youll need to take is to determine which lending option is best suited for your needs.

For many, this decision comes down to traditional small business loans from financial institutions such as a bank or credit union vs. SBA-specific loans. There are, however, other commercial real estate loan options that you may want to consider, including commercial bridge loans, hard money loans, and construction loans.

Today, well take a quick look at some of the most popular commercial lending options, starting with one of the most popular and often most affordable commercial real estate loans the SBA 504 loan.

Recommended Reading: What Are The Qualifications For Rural Development Loan

Need A Commercial Mortgage Loan Right Now

Simply fill out the contact form or Call us at . Our Chicago based professionals will make finding the best commercial mortgage very easy. Simply tell us the loan amount, property type, location and the desired period, our team will quickly provide you the quote.

Did you know that finding a commercial loan lender is very easy with us? The reason: we are backed by some of the most competitive commercial mortgage lenders. You simply need to fill out one small application and our team will do the rest.

What Is A Commercial Real Estate Loan

A commercial real estate loan is typically used to purchase, construct, rehabilitate or refinance commercial, industrial and other non-owner-occupied property. That can include an office building, multi-unit rental building, medical facility, warehouse, hotel or vacant land on which to build one or more of these types of properties. Commercial mortgages can also be used to buy and develop land on which single- or multi-family homes will be constructed and sold.

Commercial real estate loans are secured by commercial property. Unlike a residential mortgage, the underlying asset is not a primary residence. Instead, the commercial lender underwrites the income such as rent from tenants and expenses that the property will generate.

Ideal candidates to pursue a commercial real estate loan include borrowers who either own the property and are seeking to lower their interest rate by refinancing or seek to obtain capital through a cash-out refinance, explains Chris Moreno, CEO of GoKapital, Inc., based in Miami. Also, investors who are interested in working with commercial properties and diversifying their portfolio should explore this type of loan option. Furthermore, business owners who rent a location and qualify for a commercial real estate loan may be better off obtaining financing to purchase their business property.

Also Check: How Long Does It Take To Get Student Loan Money

Debt Service Coverage Ratio

DSCR estimates your companys available cash flow. This is essentially the money that pays for your companys current debt obligations. DSCR is calculated by dividing the annual total debt service with your annual net operating income . The total annual debt service is the amount borrowers use to pay the principal and interest of a commercial mortgage.

Preferred DSCR for Commercial Loans

A good DSCR range for companies is between 1.15-1.35. Most commercial lenders require a DSCR of 1.25 for approval.

Established Business In Certain Industries

Another reason its difficult to get a business loan from the bank is that they typically choose to finance established businesses that have a proven track record of success. Banks are also unable to finance certain industries, so if your business isnt in one of their accepted industries, you may face hurdles in the lending process.

Recommended Reading: What Credit Score Is Needed For Conventional Loan

Are Startup Business Loan Rates Higher

In general, the average business loan interest rate for a startup is going to be higher than for an established business. This is because the chances of a startup failing are much higher than for a company that already has a solid track record.

In some cases, it might be difficult even to get approved for a business loan when youre just starting out. You may need to opt for a microloan, small business credit card, or an alternative form of financing to get the capital you need.

As you build your business credit history and establish a good history of strong revenues and cash flow, however, youll have a better chance of getting approved for a business loan with a lower rate.

How Much Interest Will You Actually Pay

Note that the standard interest rate advertised by your lender is an annual rate the actual amount of interest youll pay will depend on your loan balance and how frequently you make repayments:

Annual interest rate

Number of repayments per year x loan balance = interest paid

With some types of business finance, like secured business loans, youll typically make fixed repayments on an agreed schedule, which may include repayment of some of the loan principal as well as interest, or be an interest-only payment.

With other types of financing, such as overdrafts and credit cards, the amount of interest you are charged and your minimum repayment amount will depend on how much you have borrowed, and is generally calculated on your debit balance then charged at the end of the repayment period.

With unsecured business loans the interest calculation used may not be based on a traditional annual percentage rate. Its more likely to be calculated using a factor rate. Use our business loan calculator here.

Grow the business you want.

You May Like: How Long Until You Can Refinance An Fha Loan

Sba Loans For Commercial Real Estate

Maximum Rates: 504 loans: 3.67% to 3.98% and 7A loans: 7.50% to 10.00%

With maximum rates in the range of 3.67% to 10.00%, SBA loans are often the least expensive way to fund the purchase of commercial real estate. The Small Business Administration guarantees repayment of a portion of the loan, which lowers the risk of making the loan for the lender and increases the favorability of the terms for the borrower.

In general, its easier to get an SBA 7a loan for commercial real estate. The 7a loan program is the SBAs most popular loan program, and its quicker and easier to obtain a 7a loan, especially for smaller loan sizes. That being said, 7a loans have slightly higher rates than 504 loans. Rates start at a variable 7.50% and are tied to the Prime Rate.

SBA 504 loans are a better option for loan sizes over $1,000,000. These loans come in three parts: 50% of the loan is from a bank, 40 % is from an SBA-approved Certified Development Company, and 10 % is the borrowers down payment. The rates on the CDC portion of the loan are in the 3-4 % range and are fixed rate. The rates on the bank portion are in the 5-6 % range and may be fixed or variable. Our recommended SBA 504 lender it Liberty SBF. If youve been in business 4+ years, are profitable, and looking to borrow $1,000,000+, set up a time to speak to a Liberty SBF loan officer today.

Comparing Commercial Mortgages With Residential Loans

There are many similarities between residential mortgage requirements and commercial real estate loans. Both need satisfactory credit scores, credit background checks, and the right down payment amount to secure financing. However, there are many differences between these two loans.

First, commercial mortgages require a stricter underwriting process. It also takes a lot longer compared to the average residential loan. Next, commercial mortgages entail higher costs compared to residential loans. They also usually have a higher interest rate compared to housing loans.

To detail the differences between commercial loans and residential mortgages, we came up with the table below:

| Loan Details |

|---|

| VA loans: 40-50 business days |

Recommended Reading: How To Take Loan From 401k To Buy House

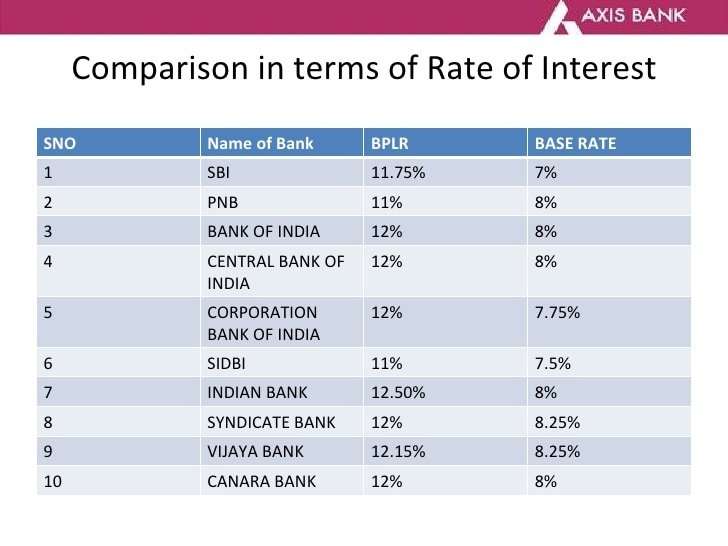

Enclosed Below Are Hdfc Bank Business Loan Interest Rates Charges

Business loan interest rate. The final rate of interest is dependent on the profile of the borrower credit score financials existing leverage business stability industry outlook and various other risk assessment parameters. Business Loan interest rate starts from 1499 onwards per annum. Company Profile eg Years of Establishment Industries etc 3.

The rate of interest in business loans broadly range between 15-24 pa. Different types of loans charge different ranges of interest. However note that revolving facilities like trade financing or overdraft facilities have interest rates that can be periodically revised.

Annual Turnover RM300k – RM15m. Type of Loan and Typical APR Range. A notable exception to this is commercial property loans due to their long tenure.

Type of Loan Facility 2. Total Principal Paid 5000. 4 plus applicable taxes of the total withdrawable amount as per the repayment schedule on the date of such full pre-payment.

12 rows The average interest rate for a small business loan varies depending on your qualifications. The average interest rate on a business loan can depend on the type of lender and loan. Business loans usually are offered speedy approvals and most banks offer applicants with the.

75000- for self employed customers as per the. If you are borrowing below 25000 the loan term will be between 1 and 5 years with APR typically set at 10. These loans go up to 10 million have a 1 interest rate and may qualify for loan forgiveness.

Structure Of The Loan

Another factor that can affect your commercial real estate loan rate is the structure of the loan. Your loan might be fully amortizing for the entire term, which means that youll make a series of payments to pay off your loan, with a decreasing amount of your payment going to interest over time.

In contrast, some lenders structure commercial real estate loans with a balloon payment. In this case, you might make lower monthly payments for 10 years, at the end of which you will owe the remaining balance in one lump sum. At that point, if you cant afford the balloon payment, youll need to renegotiate with the lender or refinance your loan.

Don’t Miss: Who Can Loan Me Money

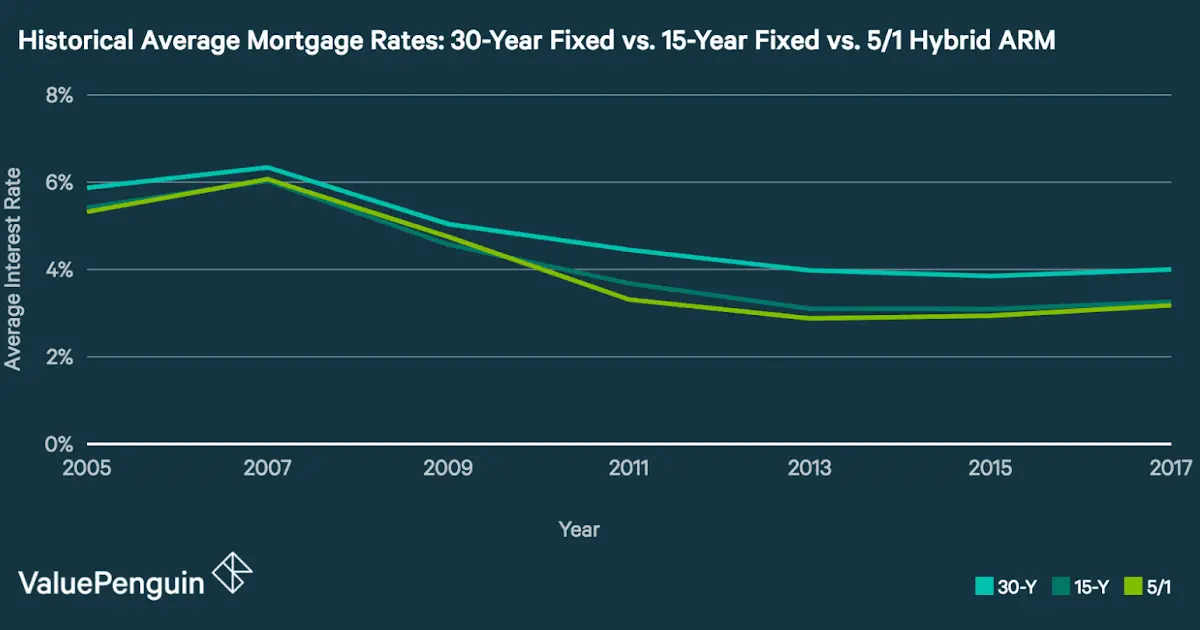

Fixed Vs Variable Rates

Some types of business financing carry fixed rates, which mean the rate will remain the same for the life of the loan. Others carry variable rates, which means the rate can change. Loans with variable interest rates may be tied to the prime rate or other rates in the economy. Variable rates are often lower than fixed rates but they may carry more risk for the borrower since both the rate and payment may change. Most small business credit cards and many lines of credit have variable interest rates.

How To Get Your Best Business Loan Rates

The business loan rate you receive is often tied to the type of financing you choose to borrow. But there are a few ways to improve your chances of getting your best business loan rates.

Offer collateral

Some types of funding may require collateral, such as equipment financing or invoice factoring. Offering collateral when its not required could help you receive more favorable rates. When you provide collateral, you give the lender the ability to seize the assets you offered if you default on the loan. This reduces risk for the lender, and may reduce the amount of interest the lender charges. Loans secured with collateral generally come with lower rates than unsecured business loans.

Boost your personal credit

The higher your credit score, the less risky you may seem to a business lender, which could result in low-interest financing. Depending on your credit score, you may want to improve your credit profile before applying for financing. Some quick ways to build up your credit include:

- Paying down any existing debt, including credit card balances.

- Making on-time or early bill payments.

- Disputing any errors that currently appear on your credit report. You may be able to remove those errors as well.

Boost your business credit

Establish a relationship with a lender

Read Also: How To Get Sba 7a Loan

Sba Cdc/504 Loan Rates

The SBA CDC/504 loan program is for loans that are used to finance fixed assets such as land, real estate, and machinery. To offer these loans, the SBA works with Community Development Companies and other financial partners. The project is typically funded 40% by the CDC, 50% by a financial partner , and 10% by your business. If your business is new or youre funding a special property, you might have to pay a larger percentage of the cost.

While borrowers can use a general 7 loan to finance fixed assets, CDC/504 borrowers benefit from low, fixed, interest rates and larger possible borrowing amounts.

Commercial Real Estate Loan Rates Summary April 2020

| Type of Loan* | |||

|---|---|---|---|

| 3.76% to 5.29% | $1,000,000+ in most cases | ||

| 5-10 years with balloon payment | Difficult | ||

| 10 to 18% | $50,000+ | 6 months – 3 years | Moderate |

*Insurance companies and conduit lenders also make commercial real estate loans, but they primarily work on projects that are worth more than $2 to $3 million. We only briefly mention them in this article because most small businesses are ineligible for these types of loans.

Read Also: Who Should I Refinance My Car Loan With

Faqs About Sba Loan Rates

Typical rates for SBA small business loans in September 2021 are as follows:

- Current rates for SBA 7 loans: 5.50% 9.75%

- Current rates for SBA CDC/504 loans: Approximately 2.85% 3.44%

- Current rates for EIDL loans for COVID relief:

- 3.75% for for-profit businesses

Because most SBA loan interest rates change over time based on the prime rate or another variable base rate, its difficult to give a specific number to the average SBA loan rate. However, SBA loans tend to have lower rates than lenders in the private marketplace.

In addition to the interest rate, the SBA, issuing lenders, and intermediaries charge extra fees. These fees will vary depending on the amount of money you are requesting and the organizations you are working with.

For example, SBA 7 loan intermediary SmartBiz states that SBA lenders in their network typically charge an application fee of up to $3,000, bank closing costs which typically add up to around $450, and some third party fees. All SBA loans are also subject to guarantee fees which are between 0% and 3.75% of the guaranteed portion of the loan.

What Factors Impact Business Loan Rates

No matter what type of interest rate a lender assigns, there are general factors that could impact whether its high or low.

Lenders assess both personal and business credit when reviewing loan applications. If you have a newer business that has yet to build up business credit, a lender may heavily weigh your personal credit when making a decision.

A higher credit score generally leads to a lower interest rate. Most lenders require a minimum credit score to qualify for financing. Banks may look for scores of 680 or higher, while alternative lenders may accept scores in the 500s.

Business finances

Your businesss financial standing indicates your likelihood of repaying a loan, which would impact your interest rate. If a lender perceives you as a high-risk borrower, you would likely receive a higher rate. Be prepared to share information illustrating items like your revenue, cash flow and profitability.

Lenders may have certain revenue requirements, similar to credit scores. You may also be required to explain how you plan to spend loan funds, should you be approved.

Time in business

The amount of time youve been in business also indicates how risky you may be as a borrower. Businesses or startups that have been open less than two years are often considered risky because they typically lack capital, collateral or business credit.

Also Check: What Does Jumbo Loan Mean

How To Get A Commercial Real Estate Loan

The process of pursuing and applying for financing for a commercial property involves several steps.