How Do You Apply For Student Loan Cancellation

If you dont qualify for a total and permanent disability , you may wonder if you will ever qualify for any student loan cancellation. For example, you may be asking: Did student loan cancellation get cancelled? It may feel that way if youre hoping for wide-scale student loan cancellation, but it hasnt happened. While the Education Department has already cancelled student loans for student loan borrowers who qualify under the borrower defense to repayment, you can still apply for student loan cancellation by completing the Application For Borrower Defense to Loan Repayment. The application is available both through the U.S. Department of Education and your student loan servicer. The application takes approximately 30 minutes to complete. You will need your Federal Student Aid ID, your school name and program of study, your enrollment dates, and any documentation to support your claim.

Student Loan Repayment Assistance Programs For Other Careers

Most state LRAPs award loan assistance to professionals in exchange for two years of service. The most common occupations are doctors, nurses, teachers and lawyers, but some other career paths qualify, too.

Several LRAPs for doctors, for instance, help out pharmacists and veterinarians. Other programs, like the Alfond Leaders Program in Maine, award people in STEM careers.

Even if youre not a doctor, nurse, teacher and lawyer, check your states offerings to find out if it has a loan repayment assistance program for you.

Consider Student Loan Refinancing

Refinancing gives you the chance to adjust your monthly payments and choose new repayment terms, often between five and 20 years.

You could qualify for a lower interest rate than you have now, thereby saving money on your loans. And if you refinance multiple loans, you can combine them into one single loan to simplify repayment.

Before you shop for student loan refinancing options, note that refinancing federal loans turns them private. As a result, youll lose access to federal forgiveness programs and repayment plans, which proved especially helpful while the coronavirus pandemic squeezed the economy in 2020 and 2021. If youre comfortable with this sacrifice, however, consider refinancing as a way to restructure your debt and potentially save money on interest.

Read Also: How Are Student Loan Rates Determined

Forgiveness With Pay As You Earn

Pay As You Earn is similar to Income-Based Repayment, in that it isnt a typical forgiveness program. However, you could be eligible for forgiveness after a certain period of time.

The PAYE plan caps your monthly payment at 10% of your discretionary income. After borrowers make payments for 20 years, any remaining balance becomes eligible for forgiveness.

As with IBR, your forgiven balance might be treated as taxable income.

To Make It Happen You Need To Follow Procedures Very Carefully

The Consolidated Appropriations Act , 2021, signed into law Dec. 27, 2020, provides renewed funding for Paycheck Protection Program forgivable loans, money for a new type of Economic Injury Disaster Loan advance, and funding for a new grant that targets shuttered venues.

Guidance from the Small Business Administration describes how to get part or all of your PPP loan forgiven as well as what you need to do to take advantage of the new EIDL and shuttered venue grant programs.

You May Like: What Is The Current Va Loan To Value Rate

Contact Your Loan Services Or School

Once you have all the relevant loan details at your disposal, reach out to your schools financial aid department and declare your intent to apply for;loan forgiveness.

The financial aid department will let you know if youre required to complete and submit an application with them or if they are already servicing;Perkins Loan;cancellation;applications via the end-servicer.

Loan Repayment Assistance For Health Care Professionals

Doctors and well being care professionals have varied choices for student loan forgiveness. Here are some applications that supply assist with student loan debt:

- National Health Service Corps loan compensation help

The NHSC affords as much as $50,000 to licensed well being care suppliers.

You need to be a dentist, a main care physician, behavioral or psychological clinician.

That having been stated, you might be obligated to work for 2 years at an eligible space to obtain loan help.

Recommended Reading: How To Calculate Loan To Debt Ratio

How Do I Get Student Loan Forgiveness If I Dont Qualify Under Bidens Student Loan Forgiveness

There are several ways to qualify for student loan forgiveness. . Among other student loan forgiveness programs, two popular choices are through either the Public Service Loan Forgiveness program or an income-driven repayment plan. Neither of these programs offer upfront student loan cancellation, so be prepared to wait several years. You can get federal student loan forgiveness through the Public Service Loan Forgiveness program after making 120 monthly student loan payments and meeting other requirements. You can get federal student loan forgiveness through an income-driven repayment plan such as IBR, PAYE, REPAYE and ICR after 20 years or 25 years .

Additional Ppp Forgiveness Requirements

In addition to the PPP loan’s permitted uses, you must also adhere to some additional requirements:

- You have your choice of between eight and 24 weeks from the first distribution of any loan amount to spend your loan funds.

- Payroll costs must make up 60% or more of the amount forgiven. This includes the first three categories listed under permitted uses above.

- Non-payroll costs can make up no more than 40% of the amount forgiven and are defined as the last seven categories under permitted uses.

- To receive full forgiveness, you must retain all full-time-equivalent employees according to the baseline used to establish your loan, except as described in the Tip box above. You must do this within the covered period for your loan or by June 30, 2021, whichever comes first.

- The amount forgiven will also be reduced in proportion to any reduction in employee salary or wages during the covered period greater than 25% of the average amount that employee made during the base period unless an exception applies.

- If you have any ownership interest in an S corporation, C corporation, partnership, or sole proprietorship , the maximum personal compensation you can count toward forgiveness for all companies you own is limited based on the length of the forgiveness period as a percentage of your 2019 or 2020 compensation, not to exceed $100,000. Health insurance and retirement plan costs are not part of this cap.

Don’t Miss: Does Applying For Personal Loan Hurt Credit

How To Explore Federal Loan Repayment Options On Your Own

Step 1:Create your FSA ID;and log in to studentaid.gov to review information about your loans.;

Step 2:;Learn aboutincome-driven repayment plans. Under income-driven repayment plans, payments are based on income and family size and can be as low as $0 per month. Income-driven repayment plans also offer potential interest subsidies and the possibility of loan forgiveness after 20 or 25 years of qualifying payments.

Step 3:;If you work for the government or a qualifying nonprofit organization, learn about Public Service Loan Forgiveness ;and;Temporary Expanded Public Service;Loan Forgiveness . These programs have many detailed requirements but enable public servants to receive forgiveness of their remaining loan balance after 10 years of qualifying payments in a qualifying repayment plan.;

Step 4:;Use the U.S. Department of Educations Loan Repayment Plan Simulator;to estimate your monthly payments, the projected total costs, and potential forgiveness amounts under income-driven repayment plans and/or the PSLF program.;

Step 5: Apply for an income-driven repayment plan;through studentaid.gov;or mail the application to your federal loan servicer with your income documentation.

Private Student Loan Forgiveness Facts And Statistics

Forgiveness of private loans is rare. There is no current legislation regulating any kind of debt cancelation or forgiveness among private companies. Under certain circumstances, however, private loans may be forgiven on a case-by-case basis. There is no available data regarding how many loans or how much debt has been forgiven by private lenders over the years, and no entity collects such data.

- 7.7% of outstanding student loan debt comes from private loans.

- In the wake of COVID-19, some legislators promote private student loan forgiveness as a method of debt relief.

- In July of 2020, the U.S. House of Representatives passed a bill to cancel up to $10,000 in private loans for each borrower.

- The Coronavirus Aid, Relief, and Economic Security Act, while providing some relief in the form of deferred payments and collections, does not specify cancelation of any loans.

Recommended Reading: What Is The Housing Loan Interest Rate

Questions To Consider When Evaluating Residency Programs

- Does your potential residency location qualify as a non-profit organization?

- Will it meet the criteria for this loan forgiveness program?

The best way to find out the answers to these questions is to ask during your interview. The answers you receive may help you decide where you want to do your residency.;The PSLF Help Tool may also help you with determining if your potential employer may qualify as an eligible employer.;

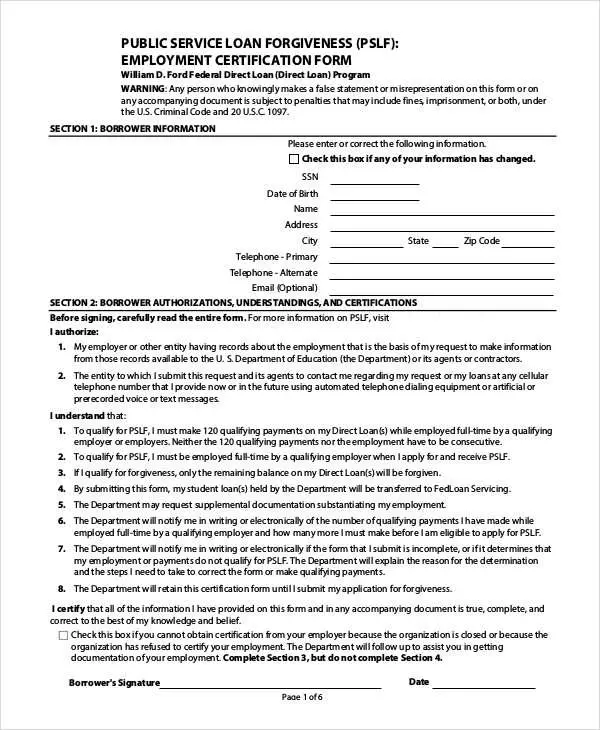

Use the Public Service Loan Forgiveness Formto indicate your interest in the PSLF program. This form will also track your eligible PSLF employment so it should be submitted annually and immediately before and after a change in employment.

PSLF is in the news.Discussion is on-going regarding the continuation of the program in its current state. The AAMC is collecting examples of why students plan to enter PSLF.;;Submit your PSLF story here.

Review recorded webinars on PSLF and other repayment topics at aamc.org/videowebinars.

Disclaimer: This fact sheet provides a summary of the Public Service Loan Forgiveness Program and is intended as general information only. See thePublic Service Loan Forgiveness Checklist for more details. The information in this document is based on federal regulations and is subject to change.

Forgiveness With Revised Pay As You Earn

Revised Pay As You Earn works much the same way as Pay As You Earn. Under this plan, your payments will be capped at 10% of your discretionary income. Undergraduate loans are forgiven after 20 years, while graduate school loans are forgiven after 25 years.

Unlike IBR and PAYE which require you to end up with a lower payment than on the standard plan, theres no such requirement for REPAYE; anyone with eligible loans can apply, even if they end up paying more with an income-based payment. As a result, you could end up with high monthly payments on REPAYE if you suddenly start making a lot more money.

Recommended Reading: Who Has The Best Student Loan Refinance Rates

Student Loan Borrowers Affected By Targeted Student Loan Cancellation

Biden will continue to employ targeted student loan cancellation to bring student loan relief to groups of student loan borrowers. Since becoming president, Biden has cancelled nearly $10 billion of student loans through targeted student loan cancellation. By January 31, 2022, Biden will have cancelled at least $70 billion of student loans for student loan borrowers. This includes student loan borrowers with a total and permanent disability as well as student loan borrowers who were misled by their college or university and have sought student loan forgiveness under the borrower defense to repayment rule.

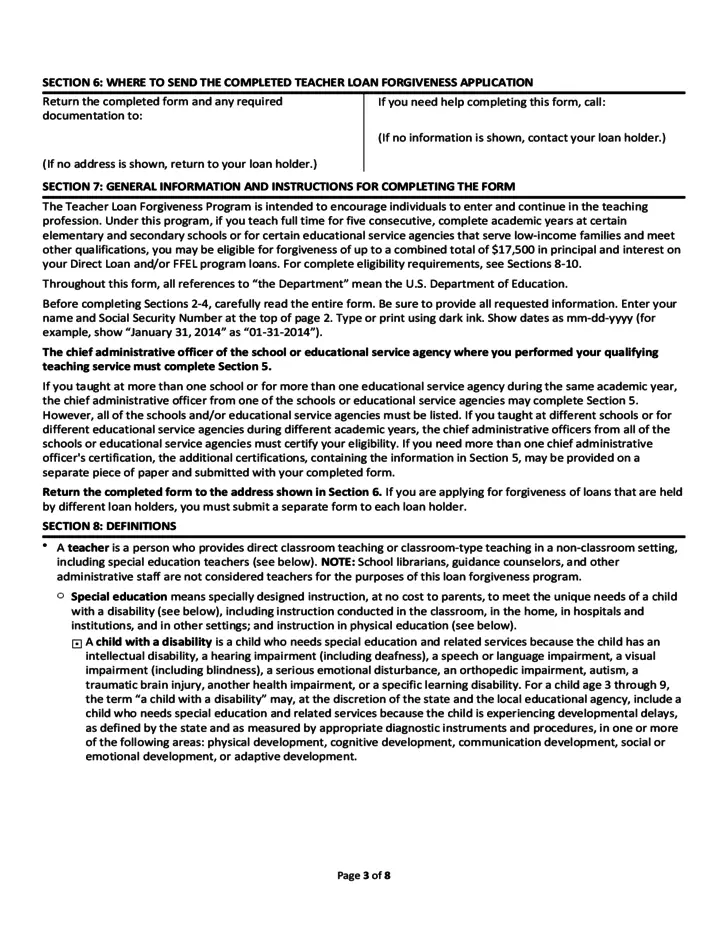

Student Loan Repayment Assistance Programs For Teachers

The Teacher Forgiveness Program isnt your only option for student loan help. Many states also offer loan repayment assistance for teachers. Most of these programs require state licensure, as well as a commitment to working for two years in a qualifying area.

The Teach for Texas Program, for example, gives yearly assistance to teachers in designated shortage areas.

To find programs in your state, check out the full list of loan repayment assistance programs and filter the results by occupation.

Read Also: How To Refinance Sba Loan

How To Qualify For Public Service Loan Forgiveness

Everyone wants their student loans forgiven. The perception is that very few qualify. But did you know that there is one broad, employment-based forgiveness program for federal student loans? Let me break down some key points of PSLF to help you figure out if you could qualify.

Work in Qualifying Employment

First, you need to work for the right employera public service employer. What does that mean? Everyone has a different definition. Ours is based on who employs you, not what you do at work. Heres what qualifies:

- Governmental organizations Federal, state, local, Tribal

- 501 organizations

- A not-for-profit organization that provides specific public services, such as public education or public health

Heres what doesnt qualify:

- Labor unions

- For-profit organizations

Qualifying Employment Status

If you work at one of these types of organizationsgreat! Next, you need to work in a qualifying employment status, which means that you must be a full-time employee. For us, full-time means that you meet your employers definition or work at least 30 hours per week, whichever is greater.

Have a Qualifying Loan

A qualifying loan is a Direct Loan. Its that simple. Of course, its the government, so nothing is actually that simple. There are three big federal student loan programs:

- The Direct Loan Program

- The Federal Perkins Loan Program.

Have a Qualifying Repayment Plan

You can apply for an income-driven repayment plan on StudentLoans.gov.

Make 120 Qualifying Payments

Nurse Corps Loan Repayment

As a medical student, you can clear your student loan just by dedicating your life to caring for others. With nurse Corps loan repayment which is a federal loan repayment program specifically designed to help cover 85% of student loans for RNs and APRNs after working for 2-3 years. This program covers any government or private loans for tuition and living expenses incurred while studying nursing. Further, apply for this program requires you to be in the US. Citizen, US national, or lawful permanent resident.

Also Check: How Much Business Loan Can I Get

Which Loans Are Eligible

ICR offers forgiveness on the following loans:

- Direct subsidized and unsubsidized loans

- Direct PLUS loans made to grad students

- Direct consolidation loans

- FFEL Stafford loans, if consolidated

- FFEL loans made to parents, if consolidated

- parent PLUS loans, if consolidated

- Federal Perkins loans, if consolidated

Student Loan Forgiveness For Doctors And Nurses In Canada

Eligible family doctors, residents in family medicine, nurse practitioners, and nurses can get Canada Student Loan forgiveness through the federal government. However, only the federal portion of the loan can be forgiven .

Eligibility For Student Loan Forgiveness For Doctors and Nurses in Canada

To qualify for this type of Canada Student Loan forgiveness, you must:

- Have a Canada Student Loan thats in good financial standing

- Be working as an eligible medical professional in an under-served or remote region with a lack of proper healthcare .

- Have been employed for at least one consecutive year in an underserved or remote community and provided at least 400 hours of in-person service.

- Submit an this application

Eligible Medical Professionals

To qualify for Canada Student Loan forgiveness, you must be one of the following medical professionals :

- Family

- Nurse Practitioner

- Family Medical Resident

You may get Canada Student Loan forgiveness for nurses and family doctors and if you are:

- Enrolled in full-time studies

- Repaying a student loan;

- In your non-repayment period

If your loan is in its repayment period, your monthly payments are still mandatory. That said, youre allowed to work as an eligible medical professional in more than one remote or under-served community and with multiple employers if you perform at least 400 in-person hours over a maximum period of 12-months.

Check out what happens to your student debt when you die.

You May Like: Who Should I Refinance My Car Loan With

Loan Forgiveness For Military

Each branch of the military has programs that help qualified members pay off their student loans, but the loan amounts forgiven and the requirements that must be met vary dramatically.

Visit the Complete Guide to Military Student Loan Forgiveness and Repayment and find the program that best suits your situation and branch of the military.

You Have Options If You Were Denied Pslf

If your application for PSLF was denied, you may be able to receive loan forgiveness under the Temporary Expanded Public Service Loan Forgiveness opportunity.

As part of this opportunity, the Department of Education reconsiders your eligibility using an expanded list of qualifying repayment plans.

This TEPSLF opportunity is temporary, has limited funding, and will be provided on a first come, first served basis. Once all funds are used, the TEPSLF opportunity will end.

Visit StudentAid.gov for detailed information on how to be reconsidered for loan forgiveness.

Recommended Reading: How Do I Get An Unsecured Loan

Shuttered Venue Operators Grant Program

The Shuttered Venue Operators Grant program was established under the CAA, 2021 as part of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act. The program includes $15 billion in grants to shuttered venues, to be administered by the SBAs Office of Disaster Assistance.

Eligible applicants may qualify for 45% of their gross earned revenue, with a maximum amount available of $10 million per grant, and;$2 billion is reserved for eligible applicants with up to 50 full-time employees.

Total And Permanent Disability

The first constituency is student loan borrowers with a total and permanent disability. Biden cancelled $5.8 billion of student loans for more than 300,000 student loan borrowers this week. To qualify for this federal student loan forgiveness, you must have a total and permanent disability, which prevents you from earning income and paying student loans. This student loan discharge is automatic. To qualify, your name will appear on a data match between the U.S. Department of Education and the U.S. Social Security Administration or between the U.S. Department of Education and the U.S. Department of Veteran Affairs.

Read Also: How To Apply For Student Loan For Masters