How To Find The Apr Of A Payday Loan

Although most lenders disclose the APRs of their loans, they often bury them in the small print. Payday lenders prefer to present the cost as a fixed fee for every $100 you borrow.

How do you find the APR using this information? Just add these two steps:

The result is the loans total finance charge. You can now calculate the APR using the method explained above.

As an example, lets calculate the APR on a $1,000 payday loan with a 14-day term that charges $20 for every $100 you borrow.

Private Student Loans: Good To Excellent Credit

To secure a private loan, youll typically need a score of at least 670 or a co-signer with a score in that range. However, knowing the precise cutoff is tricky, because private lenders consider their credit-score guidelines a trade secret.

The only way to find out if you qualify is to apply. Most student loans go to borrowers with good to excellent credit. According to the Consumer Financial Protection Bureau, more than 57 percent of student loans made in 2018 were issued to borrowers with credit scores of 660 or higher.

Some lenders offer prequalification, which allows you to see if you are eligible for a student loan without the lender pulling a hard check on your credit. Take advantage of these offers as much as possible when shopping around with private lenders.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What Credit Score Is Needed For Conventional Loan

How Interest Rates Work On Student Loans Nitro College

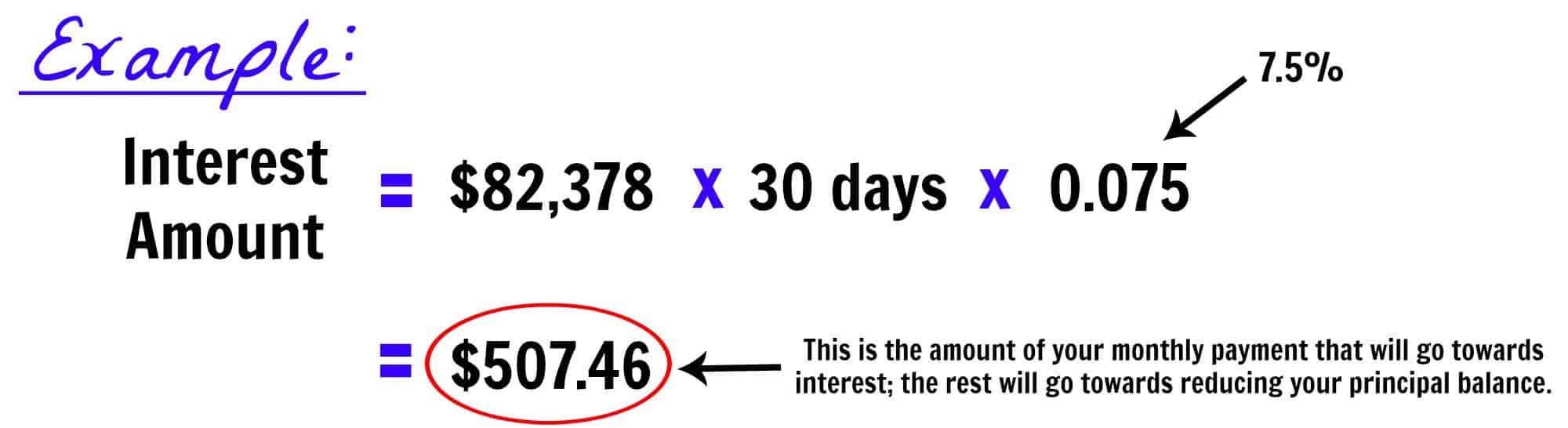

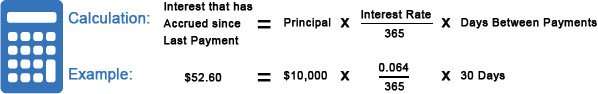

May 7, 2021 How Interest Rates Work on Student Loans And How to Spot a Good One · $10,000 principal x 0.05 APR = $500 in interest · 5% APR / 365 days =;

Each month, your loan payment is prorated based on the amount due. Your payment is first used to pay any interest that has built up since your;

Youre multiplying the daily rate by the principal and the amount of interest that accrued the previous day: $1.37. It works out well for the banks because, as;

Student loan deferment lets you stop making payments on your loan for up to three years, but it does not forgive the loan. · You must apply for;

Jul 18, 2021 Subsidized Loans do not accrue interest while you are in school at least half-time or during deferment periods. Unsubsidized Loans are loans;

Why You Should Keep An Eye Out For High

When reviewing your loans within the Federal Student Aid site, its also worth noting any loans with especially high interest rates. While federal student loans generally carry low rates, any that dont could be good candidates for refinancing with a private lender.

Student loan refinancing allows you to replace one or more loans with a single private loan, possibly with lower monthly payments and a lower interest rate. Alternatively, you can also use refinancing to shorten the terms on your loans, which could raise your monthly payment but save you money on interest costs.

A student loan refinancing calculator can make sense of the math. Input your combined federal loan information, which you can grab from your FSA account, plus your potential refinancing terms you can get a sense of refinancing rates comparing quotes online. Then the calculator will pump out your potential savings.

To qualify for refinancing, youll need a strong credit score, plus steady employment and income. Adding a creditworthy cosigner to your application, however, could make up for deficiencies in this area.

As lovely as the rewards may sound, refinancing isnt right for every borrower. If you count on your federal loan protections a list that includes access to income-driven repayment plans, mandatory forbearance and pathways to loan forgiveness youre likely better off keeping your loans where they are.

Read Also: When Do I Pay Back Student Loan

How To Find Your Private Student Loan Servicer

If you have private student loans, the process may not be as straightforward, and it may take a bit more work to locate your student loan servicer.

The best way to find your private student loan servicer is to pull up your credit report. You can check your credit report for free at annualcreditreport.com. You can also use a free tool like Credit Karma to monitor your credit and get help.

Once you see your credit report, you can see all your lenders listed. You will also be able to get contact information for these companies, along with your loan balance, account number, and more. With this information, you can start tracking down your student loans.

What To Do If The Education Department Doesn’t Own Your Loans

Having private loansor federal loans that aren’t owned by the Education Departmentdoesn’t mean you can’t get relief if you’ve been affected by the pandemic.

Under a state-led initiative, residents of California, Colorado, Connecticut, Illinois, Massachusetts, New York, New Jersey, Vermont, Virginia, and Washington are eligible for relief on student loans not held by the Department of Education. In these 10 states, you can get payment relief if your loan servicer is one of these companies:

Other companies may be participating as well. This state-led payment relief is less generous than what’s available through the CARES Act, but it’s better than nothing. You can:

- Request temporary forbearance for 90 days

- Get relief from late fees

- Get relief from negative credit reporting and debt collection activities, including wage garnishment

Although interest may still accrue, it will not be capitalized .

Also Check: How To Get 150k Business Loan

Make Some Financial Sacrifices

Remember when I brought up sacrifice earlier? Like saying no to late-night fast food? Heres where it comes into play.

Look at your lifestyle. What extra stuff have you been living with that you can do without? Bye bye, cable package. See ya, bougie subscription boxes. Maybe;cut your housing cost;in half by finding a roommate. Do you have a guest room thats not getting much use these days? Rent that sucker out! Just think how quickly you could pay off your loans if your housing costs were cut way down.

How;about selling some junk you dont need anymore? Dig through your closet, garage and storage to see what you could put on eBay, Facebook Marketplace or Craigslist. Then, add up what you spend eating out every week. Ditch the $7 oat milk lattes and brew your own coffee at home. Eat your leftovers or meal prep for the week instead of spending $1020 on lunch.;Get savvy at the grocery store. Trust methere are plenty of;creative ways to save. But it starts with being willing to make some temporary sacrifices for some long-term gains.

Types Of Student Loans Missouri Department Of Higher

This program provides student loans at a 5 percent fixed interest rate. If you do not, the loan will cost you significantly more in the long run.

Interest is charged from the day the Student Loans Company makes your first payment to you or your uni or college, until your loan is repaid in full or;

Interest and monthly payments on federally held loans are suspended through January 31, 2022. You do not need to contact your student loan servicer or take;

Also Check: Is My Loan Fannie Mae

About Student Loan Interest

The longer you take to pay off your loan, the more interest will accrue, increasing the amount you will need to repay.

Interest rates vary depending on the type of loan and lender, as well as the year the loan was disbursed if it is a FFELP or Direct Loan from the U.S. Department of Education.

These details are generally found in the agreement and disclosures you received when you took out your student loan.

What Is The Student Loan Interest Deduction

The term student loan interest deduction refers to a federal income tax;deduction that allows borrowers to subtract up to $2,500 of the interest paid on qualified student loans from their taxable income. It is one of several tax breaks available to students and their parents to help pay for higher education. Individuals must meet certain eligibility criteria, including filing status and income level, in order to qualify for the deduction.

Recommended Reading: What Are Assets For Home Loan

Pay Off Student Loans With The Debt Snowball

The;debt snowball method;has helped a ton of people dump their debt, and it can work for student loans too. First, list;all;your loan debts from smallest balance to largest. Start paying on the smallest student loan balance first. Throw any extra money you have into paying off that first debt while still paying the minimums on everything else.

Once youve paid off the first debt, move to the second-smallest balance. Take everything you were putting toward the first one and add it to the minimum of the second balance. Once that debt is paid, move on to the next one and repeat the process until youre finally out of debt. Boom.

You might be thinking,;Nopethis is going to take forever!;Dont get it twisted. Most people that go all in on this plan pay off their debt in 18 to 24 months! Thats not quite forever, is it?;My favorite thing about working the debt snowball method is that youll feel the progress youre making as each student loan disappears.;Knocking those smaller loans out first will give you a couple of quick wins and help you stay motivated to crush the bigger student loans fast!

Just make sure you dont pocket the extra payment money as you pay off each loan. Keep the momentum going by rolling that money into the next loan payment.

Education Loan Repayment Things You Should Know

The process of education loan repayment planning starts even before taking the loan. Anyone who is planning for repayment after taking student loan or after completing education is likely to suffer financial constraints. Besides the basic financial planning students also need to be aware of banking norms related to a student loan to take timely advantage in terms of repayment. All the top education loan providers in India have various options for students to manage their student loan repayment. Student loan repayment involves three major considerations namely:

- Education loan repayment calculations: comparison of amount of each EMI vs. no of EMIs to be paid

- Education loan repayment modes: how, when and how much loan amount to repay

- Student loan management: tips and hacks to maximize the loan scheme features

Don’t Miss: How To Get Better Interest Rate On Car Loan

Refinancing Student Loans: Good To Excellent Credit

If youre out of college and paying down your student loans, you might benefit from refinancing. This process can let you consolidate multiple loans, lower your interest rate and shorten or lengthen the term of your loans. If youre refinancing private loans with a private lender, you will need to pass a credit check, and the requirements are generally the same as with new student loans. With anything under 620, youre not very likely to qualify for a refinance unless you have a creditworthy co-signer, Kantrowitz says.

What Is The Standard Repayment Plan

The standard repayment plan has fixed monthly payments that you pay for 10 years . Youll make the same monthly payment throughout the repayment period, fixed to ensure youll pay off your loan in a decade, with interest.

When you start making payments on your federal loans, youll automatically be enrolled in the standard repayment plan unless you otherwise decide to switch to another plan, like income-driven repayment plans. Youll make 120 paymentsor monthly payments for 10 years.

While your payments may be as low as $50 a month, theyre not guaranteed to be that low; your monthly cost will be determined by the size of your loan. That means your monthly payments might be higher compared to other repayment plans.

Read Also: What To Do If Lender Rejects Your Loan Application

What Exactly Is The 1098

Officially known as the Student Loan Interest Statement, Form 1098-E is a tax form that all of your student loan lenders must send you if you paid $600 or more of interest during the tax year. The form lists all the interest included in your loan payments through the full tax year. This form helps eligible borrowers to claim a partial or full deduction on that interest paid when filing taxes. Youll do this by inputting the allowable amount into your main tax form, the 1040.

Keep in mind that just because you receive a 1098-E does not mean you automatically qualify for the deduction.

Crucial Facts About Hecm Reverse Mortgage

HECM is the abbreviation for Home Equity Conversion Mortgage, a special program that is specifically tailored to give clients an opportunity to withdraw some of the equity in their property. One of the highlights of this program is that it gives American senior citizens a golden chance to become financially stable, as they are able to use it to cover unexpected medical expenses, carry out renovations, and supplement social security. Here are some of the facts that one should know about the program.

What Does This Plan Entail?

As mentioned, HECM is a unique type of mortgage that gives one a chance to convert a portion of the current property equity into liquid cash. It is important to note that this equity accumulates over the years as long as the client is making the stipulated monthly mortgage payments or premiums.

What Are the Qualification Requirements?

To benefit from this program, one needs to be aged 62 or more, be the legal owner of the home, have a low mortgage balance that can be cleared at the closing of the proceeds received from this type of loan, and have enough financial capability to pay the ongoing local government property charges such as insurance and taxes. It is also important to note that the applicant must be currently living in the house used in the mortgage.

Can Clients Benefit Who Did Not Purchase Their Current Properties Using This Plan?

What Types of Real Estate Are Eligible?

What Is the Difference Between HECM and Home Equity Loans?

Don’t Miss: What Is The Max Home Loan I Can Get

If You Have A Postgraduate Loan And A Plan 1 Plan 2 Or Plan 4 Loan

You pay back 6% of your income over the Postgraduate Loan threshold . In addition, youll pay back 9% of your income over the Plan 1, Plan 2 or Plan 4 threshold.

Example

You have a Postgraduate Loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 2 threshold of £2,274.

Your income is £650 over the Postgraduate Loan threshold and £126 over the Plan 2 threshold .

You will pay back £39 to your Postgraduate Loan and £11 to your Plan 2 loan. So your total monthly repayment will be £50.

Example

You have a Postgraduate Loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 1 threshold of £1,657.

Your income is £650 over the Postgraduate Loan threshold and £743 over the Plan 1 threshold .

You will pay back £39 to your Postgraduate Loan and £66 to your Plan 1 loan. So your total monthly repayment will be £105.

How To Find Out Who Owns Your Student Loans

Once you graduate or resume paying your student loans after a period of forbearance, you may find that your student loan servicer has changed. Unfortunately, the task of finding and paying the proper company rests on the borrower, along with other facts you probably didnât know about your student loans.

If you donât know where to send payment or who to contact for your student loans, you need to figure it out. If you delay, you could miss a payment and see your student loans go into default. Borrowers need to find out who owns their student loans so they can track student loan balances and make sure the payments are applied correctly .

Contents

You May Like: How To Transfer Car Loan To Another Person

How To Find Your Federal Student Loan Servicer

Below, we have listed some of the most common student loan servicers and their phone numbers below for your convenience:

If you donât know where to begin, start here.

Create Your Federal Student Aid ID:

Recently, the Federal Student Aid ID replaced the FSA PIN, a four-digit number federal loan borrowers used to use to fill out the FAFSA and log in to other Federal Student Aid websites.

The FSA Pin was replaced with a Federal Student Aid ID in 2015, so you will want to create a new FSA ID if you havenât logged in to a financial aid website in the last 3 years.

Not only is the FSA ID a useful tool to view your loan details, you can use it to apply for a direct consolidation loan or an income-driven repayment plan directly through the government.

Go to the Federal Student Aid FSA ID page.

- Create a new FSA ID: The site will prompt you to fill out your email address and choose a username and password, then click continue to proceed with the application after checking the box for age verification.

Get Your Account Information from the National Student Loan System

Once you get your account information and create an FSA ID, you can view your loan details on the National Student Loan Data System.

Once you are registered, you can connect your bank information and make payments directly from your bank account. You can send checks as well, but in my opinion, itâs much easier to do it online.