Exactly Just How The Charge Fees Function

Capital One Auto Finance assesses fees for refinancing your present auto lending, behind-time payment as well as altering your payment due date. Depending upon the information of your Capital One Auto Finance lending, you might be actually billed a safety and security down payment.

Re-financing fees -typical fees variety coming from $5 towards $65.Safety and safety down payment differs depending upon the problems of the lending.Behind-time payment fees cannot surpass $50 for every incident.Payment due date alter fees, as well as fees, differ.

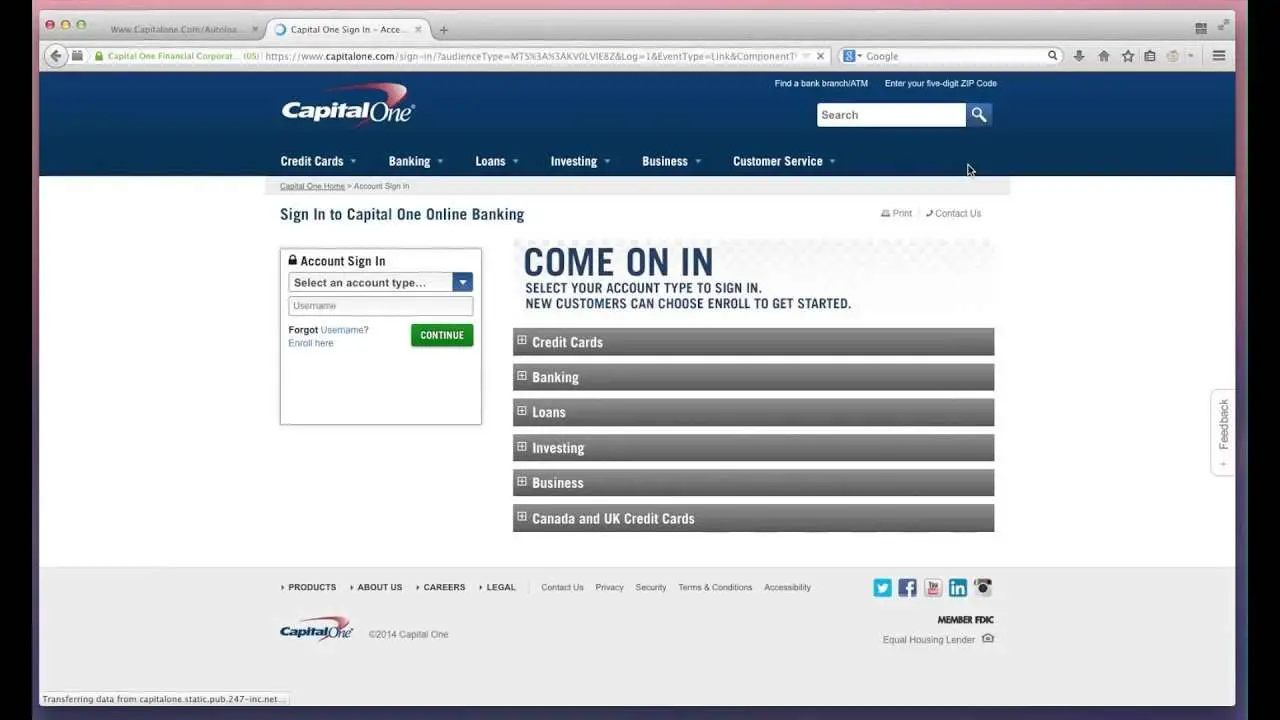

Capital One: Best For Convenience

Overview: Capital One will let you borrow as little as $4,000, but it requires you to purchase the car through one of its participating dealers. In a lot of ways, its financing works as a one-stop shop for your auto loan and vehicle purchase.

Perks: The Capital One Auto Navigator site lets you search for inventory in your area and gives you the ability to see how different makes, models and features will impact your monthly payment. This will give you a lot of information before you head to the dealer. Also, the quick prequalification allows you to check your rate through a soft inquiry, so your credit score wont be impacted.

What to watch out for: You can only use Capital One auto financing to shop at one of its participating dealerships, which makes this a poor option if you find a car you love elsewhere.

| Lender |

|---|

| Late fee |

Types Of Auto Loans Available Through Capital One Auto Finance

Capital One provides auto financing for both new and used vehicles that you can use only at participating dealerships. While choosing from a participating dealer can limit your car-shopping choices, Capital Ones network consists of 12,000 dealerships nationwide. You can find a participating dealership online.

You can easily get pre-qualified for a new or used car loan with Capital Ones Auto Navigator. The process takes just a few minutes, and you dont need to have already identified the vehicle you want to buy.

Instead, you just need to have an idea of how much youll want to borrow. If youre approved, your pre-qualification letter can help you to bargain with a dealership. Plus, since theres no hard credit inquiry required upfront, getting pre-qualified with Capital One can be a great option when youre comparison shopping for the best auto loans.

Also Check: Usaa Car Loan Number

What Apr Does Capital One Auto Offer On Its Car Loans

Capital One Auto offers a fixed apr car loan productthat ranges from 3.99% APR.

Your APR can vary depending on several factors, such as your credit score. Find out what your credit score is and whether there is any false or inaccurate information in your credit history with these credit monitoring tools.

Can I Pay My Auto Loan With A Credit Card

Can you pay your auto loan with a credit card? Well, yestechnically you can. Most lenders wont allow you to use a credit card to pay your loan directly, but you know those convenience checks your credit card company sends in the mail, encouraging you to transfer a balance? You can use one of those in a pinch just be prepared to bite the bullet and pay whatever fee it entails.

Likewise, tapping your credit cards cash advance limit is another way to make your car payment when moneys tight but remember theres no grace period for cash advances, so that balance starts accruing sky-high interest charges immediately. And these days there are services that allow you to pay just about anything with a credit card, even your rent for a fee, of course.

Offers matched to your credit profile

- $0 Fraud Liability for unauthorized use offers you peace of mind

- Access to an unsecured credit card no security deposit required

- Nationwide acceptance use anywhere Mastercard is accepted in app, in store, and online

- Pre-qualifying is quick and easy and will let you know if you are qualified without impacting your credit score

- A card for your everyday needs

- Reports your payments to all three major credit bureaus

- Use your card in app, in store, and online Nationwide wherever Mastercard is accepted

So no, the question isnt whether you can pay your car loan with a credit card. Its whether youd want to.

Also Check: What Degree Do You Need To Be A Loan Officer

Should I Get An Auto Loan Through Capital One

Capital One delivers an intuitive and quick loan experience, but that comfort comes with a few limitations. You will only be able to shop with the dealers that enter into Capital Ones program, so your choices may be limited when it comes to vehicle type or configuration. Youre also limited by the pre-approval options that the bank issues at sign up, so youll need to contact a representative to ask about rate, term, and other changes you need to make.

Can You Pay A Capital One Car Loan With A Credit Card

I just got a car loan with Capital One. Is it okay to pay my bill with a credit card? I know some places do not allow loans to be paid that way.

Answer

does not allow borrowers to pay car loans with a credit card

- Directly from your bank account with your account number and routing number

- Over the phone

- By transfer via MoneyGram or Western Union

- By mail with a cashierâs check, money order, or personal check

Did this answer help you?

Recommended Reading: Usaa Rv Loan Calculator

I Can Not Create A Payment

When our team talked to the customer support agent at Capital One Auto Finance, they notified our team that they offer choices for customers that cannot pay their expenses. The choices offered consist of payment plans as well as altering the due date of your payment.

Payment plans contact customer support at 1-800-946-0332 to organize payment plans. Customers should contact before the developed due date.Alter payment day Capital One Auto Finance enables customers in monetary difficulties to alter their due date. The payment could be removed as much as 15 times past times the initial due date. Fees, as well as fees, might use.Will, certainly They Function Along with Me towards Pay My BillWas actually Capital One Auto Finance whatever you anticipated in a monetary organization? Performed Capital One Auto Finance offers support when you might certainly not pay your bill? Our team wishes to speak with customers much like you. Leave behind our team a remark.

Capital One Auto Loans: What You Need To Know

Capital One is a well-known financial institution with services such as banking, credit cards, and loans. Co-founded in 1988 by Richard Fairbank and Nigel Morris, the company is the 10th-largest bank in the U.S., according to the Federal Reserve.

Capital One moved its headquarters to McLean, Virginia, in 2018 and operated over 2,000 ATMs as of late 2020.

Also Check: Usaa Approved Car Dealerships

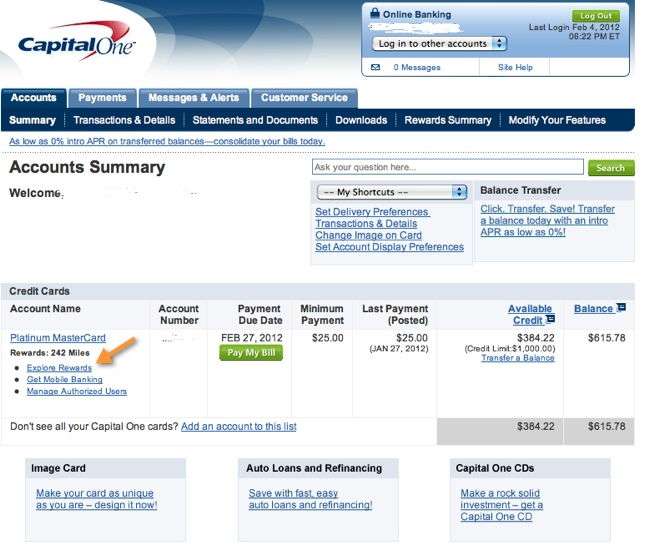

Visit A Dealer To Finalize The Auto Loan

The last step is to visit a Capital One network dealer to choose your car and finalize the loan. At this step, you should expect to complete a full credit application. Capital One will run a hard inquiry on your credit report, so your score may dip a few points.

You will need to supply the following required documents to complete the process:

- Proof of income

- Title and registration if you are trading in a vehicle

- Prequalification letter

It is possible that your final Capital One auto loan terms will differ slightly from those offered during prequalification. There are also rare cases where you may not be approved for a new loan after you do a full credit application.

Capital One Auto Loan Pros

- Easy prequalification. Prequalification can be done online and doesnt affect your credit score.

- Rates. Capital One offers competitive rates, but be sure to get multiple loan offers to compare.

- Terms. Capital One offers a wide range of terms to fit your needs.

- Fees. Capital One does not charge any fees to apply for an auto loan.

Don’t Miss: Usaa Car Calculator

Final Thoughts: Capital One Auto Finance

Capital One can be a solid option if youre looking to compare rates and dont want to damage your credit score. Having an in-house system of cars to choose from is a plus if youre eager to streamline the shopping process, but it doesnt necessarily mean youll land the best deal.

| Capital One Auto Loan Pros | Capital One Auto Loan Cons |

|---|---|

| Excellent way to compare rates without lowering your credit score | |

| Not available in every state | |

| Easy to consolidate if you already bank with Capital One | Excludes some vehicle types and brands |

Capital One Auto Loan Terms

Besides a limited number of vehicles available for financing, Capital One doesnt finance commercial vehicles, offer lease buyouts, or work with private-party sellers. Here is an overview of Capital Ones lending terms and potential fees:

- Origination fee:May or may not charge

- Prepayment penalty: No prepayment fees for refinanced vehicles

- Late-payment fee:$29 on the first late fee and $40 for late payments within 6 billing cycles

- Annual percentage rate range:Varies by credit score, loan term, and other factors

- Loan terms:24 to 84 months

- Loan amounts:Minimum of $4,000 for new and used vehicle financing, and a maximum of $50,000 on refinances

You May Like: Usaa Rv Loan Rates Calculator

Capital One Vs Bank Of America

Bank of America auto loan APRs start as low as 2.09%, the lowest of all when compared with Capital One or Chase. Like its competitors, youll need to take one of its auto loans to an approved dealership. However, unlike Capital One or Chase, you may use a Bank of America auto loan to buy from a private seller. You can also buy out your leased vehicle, something Capital One doesnt allow.

Like Capital One, you may shop for a car online where its also possible to apply for financing. Bank of America does not offer a prequalification process.

Apply At Capital One Auto Navigator

On the online form, you will need to supply:

- Personal information: Name, email, phone number and Social Security number.

- Residential information: Address, duration at current address, whether you rent or own and monthly house expenses.

- Employment information: Employer, length of employment and gross annual income.

You may be asked to upload proof of your residence or employment such as a copy of a utility bill or pay stubs.

Recommended Reading: Autosmart Becu

Capital One Auto Loan Cons

- Personal use only. You wont be able to purchase a vehicle for business use with Capital One.

- No specialty vehicles. You cant finance a boat, RV or motorcycle with a Capital One auto loan.

- Vehicle restrictions. Capital One finances cars, SUVs and trucks up to 10 years old with 120,000 miles. In some cases, you may be able to finance a slightly older vehicle with fewer than 150,000 miles. Capital One does not finance Oldsmobile, Daewoo, Saab, Suzuki or Isuzu vehicles.

- No lease buyouts or private party auto loans. To finance with Capital One, youll need to buy a new or used car from a dealership, not from a leasing company or private person.

- Limited dealerships. Keep in mind that although Capital One has a large network of dealerships, it may not include the particular dealer you had in mind.

The Problem With Paying Your Auto Loan With A Credit Card

While saving money is almost always a good thing, paying your auto loan with a credit card isnt the no-brainer it sounds like. For starters, this financial move changes the nature of the loan itself. By transferring your auto loan to a credit card, youre taking a secured loan and turning it into revolving credit. On the upside, this means your car cant be repossessed if you quit paying your bill. However, simply moving the debt can wreak havoc on your credit score in a number of ways.

For starters, credit scoring companies view revolving debt very differently from installment loans and not in a good way. In general, steady installment loans are better for your credit score.

Another impact on your credit score could be the result of increased . By transferring your car loan to a credit card, youre charging up a huge balance that wasnt there before. Since how much you owe on your credit cards helps determine your score, increasing your credit utilization could cause your score to drop.

Another important drawback to consider is the precedent set by paying your auto loan with a credit card. While moving balances around might make you feel like youve paid off debt, you havent really accomplished much yet. In reality, balance transfers are really nothing more than a shell game if you dont take your debts seriously. And if you let your balances grow as you bounce them around, you wont end up any better off.

Don’t Miss: Transfer Auto Loan To Another Bank

How The Application Works

Capital One allows you to apply as an individual or with a coapplicant. To get prequalified, youll need to submit some information about yourself and your finances, including your income and Social Security number.

If youre prequalified, you can use your finances to shop at participating dealerships for up to 30 days. The dealership will present you with a final loan contract.

Capital One Auto Loans Vs The Competition

To compare Capital One to the competition, we looked at lenders with similar credit score requirements that allowed customers to get pre-qualifications before going to a dealership.

| Capital One |

Capital One has an advantage over Bank of America for borrowers looking for affordable used cars. While Bank of America has a minimum loan amount of $7,500, Capital One only requires minimum loans of $4,000. Bank of America will finance cars valued as low as $6,000, but the $7,500 minimum loan amount means that borrowers could be underwater, or have a loan worth more than the car’s value.

Bank of America auto loans are a good option for current customers, as interest rate discounts are based on customer relationships with the bank and categorized by status. Customers with gold, platinum, or platinum honors status will receive up to 0.5% off their auto loan’s APR. But, status requirements mean that discounts are only available to customers with three-month average balances of $20,000 or more.

If you have a good or excellent credit score, you might want to consider LightStream. Its rates don’t go too high for a 36-month loan for a new car purchase between $10,000 and $24,999, interest rates range from 2.49% to 6.79%. However, borrowers with lower credit scores may find better rates elsewhere.

Read Also: Fha Loan Refinance Requirements

How Capital One Auto Loans Work

Capital One auto loans are only available at certain dealerships. While this lender does have a wide array of dealers available, there’s no option for other financing for private party purchases, and this could limit your ability to purchase from some independent dealerships. Information on dealers that work with this lender is available on Capital One’s website, and is worth checking out in advance if you want to work with a certain dealership or find a specific vehicle.

Loan terms range from 24 to 84 months and loans are available in the contiguous 48 states.

Other requirements include:

- A minimum income between $1,500 and $1,800 a month, depending on credit

- A minimum financing amount of $4,000

- Used vehicles must be model year 2011 or newer and have less than 120,000 miles. However, Capital One states that financing may be available for vehicles model year 2009 or newer and with 150,000 miles.

A Capital One auto loan might be for you if you have a nonprime or subprime credit score. In these credit categories, borrowers may be rejected by many lenders or offered high interest rates.

Capital One works with borrowers with credit scores as low as 500. Auto loan interest rates at Capital One tend to start lower than the typical interest rates, and could help people in this credit category get lower interest rates, too.

Refinance Auto Loan From Capital One

Capitol One saves consumers an average of about $500 per year on their monthly car payments when they refinance their auto loan through them. There are various terms and conditions to their program that will need to be met in order to receive this form of assistance. However when qualified this is the average savings level obtained.

Not all applications are approved and not all borrowers will save money, but an auto loan refinance from Capital One is another option that should be explored. It can offer help to lower income families that are struggling to keep up with their car payments, and it can also just assist anyone who is looking to save money each month. If you apply for this offering from Capital One, some or all of the conditions below will need to be met.

You May Like: Va Manufactured Home Guidelines

Drive Capital Portfolio Company Aver Raises $58m Rebrands As Enlace Healthyour Browser Indicates If You’ve Visited This Link

One of the earliest companies in the Drive Capital LLC portfolio enters 2022 with $58 million in fresh venture funding and a new brand. Enlace Health is the new identity of Aver Inc., which drive moved to Columbus from Wisconsin in 2014 to continue its quest to bring about the long-awaited shift in healthcare to a payment system that rewards better outcomes instead of doing more stuff.

The Business Journals