Bank Of America Introduces Community Affordable Loan Solution To Expand Homeownership Opportunities In Black/african American And Hispanic

Bank-provided down payment, no closing-cost mortgage advances efforts to broaden access to homeownership and adds to its existing $15 billion Community Homeownership Commitment

Bank of America today announced a new mortgage solution for first-time homebuyers, that offers a bank-provided down payment and no closing costs. The Community Affordable Loan Solution is available in designated markets, including certain Black/African American and/or Hispanic-Latino neighborhoods in Charlotte, Dallas, Detroit, Los Angeles and Miami. The Community Affordable Loan Solution⢠aims to help eligible individuals and families obtain an affordable loan to purchase a home.

The Community Affordable Loan Solution is a Special Purpose Credit Program which uses credit guidelines based on factors such as timely rent, utility bill, phone and auto insurance payments. It requires no mortgage insurance or minimum credit score. Individual eligibility is based on income and home location. Anyone from any race or ethnicity is welcome to apply. Prospective buyers must complete a homebuyer certification course provided by select Bank of America and HUD-approved housing counseling partners prior to application.

Bank of America also has a 26-year relationship with the Neighborhood Assistance Corporation of America , through which the Bank has committed to providing an additional $15 billion in mortgages to low-to-moderate income homebuyers through May 2027.

What To Do If Your Bank Of America Mortgage Payment Is Late

According to Bank of America mortgage customer service, each account has their own payment due date. It is important to read your statement to see when your payment is due, when it is considered late and what your late fees are going to be if the payment doesnt arrive on time.

Customers who find it difficult to keep up with their mortgage payments on a regular basis might qualify for one of Bank of Americas loan assistance solutions. To learn more about these programs, or if you have any additional questions, use Bank of Americas store locator to find the branch nearest you and make an appointment to speak with a loan specialist.

Bank Of America Profits Rise Bank Warns Of Slowing Economy

NEW YORK Bank of America’s fourth-quarter profits rose slightly from a year ago, as higher credit costs and potentially bad loans more than offset the bank’s sharp rise in interest revenue.

The Charlotte, North Carolina-based bank said Friday that it earned a profit of $7.13 billion, or 85 cents a share in the three months ended Dec. 31, compared to a profit of $7.01 billion, or 82 cents a share, in the same period a year earlier. The results were better than analysts’ forecast of a profit of roughly 77 cents per share, according to FactSet.

Like its major competitors, Bank of America saw a sharp rise in interest income, helped by the Federal Reserve aggressively raising interest rates last year to stop inflation. BofA’s interest revenue was roughly $3 billion higher than it was in 2021.

But also like JPMorgan Chase and others, BofA saw a slowdown in its investment banking business and had to set aside more money to cover potentially bad loans. The bank had $1.1 billion in credit reserves added this quarter a year earlier, the bank released $500 million from that account.

Banks put money aside to cover potentially bad loans as their economists try to figure out where the U.S. and global economies are headed and use computer models to simulate how much in potential losses they may take in those scenarios. Most banks have predicted that there might be a recession this year as a result of the Fed’s rate hikes.

Don’t Miss: What Would My Loan Payment Be Calculator

How To Pay Off A Home Loan

You have several methods of paying back your mortgage:

- Enroll in PayPlan using your checking or savings account. The plan will adjust the amount debited from your bank account for free. You can enroll in the PayPlan via Online Banking.

- With an eligible Bank of America account, you can make payments using the “Bill Pay” or the “Transfers” tab. These tools can help you to schedule automatic payments and adjust the amounts if your payment amounts change.

- MortgagePay via Web is an online tool for one-time mortgage payments. You can use your checking or savings account with Bank of America to pay for your new mortgage or the one you refinanced. You can enroll in the MortgagePay via Online Banking.

Get Money Online Quickly With A Click

An Online Loan from Advance America gives you the money you need with the convenience you expect. Whether you are at home or on the go, you can apply for loans online 24/7 right from your laptop, tablet or mobile device. Plus, with an instant approval decision, you can get the money you need fast. Already have an account? .

Recommended Reading: Bank Of America Rv Loans

Best Bank For Refinancing Your Bank Of America Loan

Best Auto Loan Refinance Companies of 2021

- Best for Great Credit: Credit Unions

- Best for Checking Rates Without Impacting Your Credit: Capital One.

- Best Trusted Name: Bank of America, Chase or WellsFargo.

- Best for The Most Options: WithClutch.

- Best for Members of the Military: USAA or Navy Federal CU.

- Best for Peer-to-Peer Loans: LendingClub although not recommendable.

- Digital Credit Union and PenFed.

How To Make A Bank Of America Mortgage Payment By Mail

Unless youve opted to go paperless, Bank of America will send you a statement with the payment address on it. Simply write a check and mail it to Bank of America along with the payment coupon found at the bottom of the statement. If you lose your statement, you can print one from your Bank of America online account.

Depending on your location, you might need to mail your payment to this address:

Bank of America Mortgage Department

PO Box 650070

Dallas, TX 75265

Or if you live in another part of the country, this could be your mailing address for your Bank of America Mortgage Payment:

Bank of America Mortgage Department

PO Box 15222

Wilmington, DE 19886

Contact a Bank of America customer service representative to find out which address is the one you should use.

Read Also: Is Closing Cost Included In Va Loan

How Can I Get A Loan Payoff Quote For My Vehicle Loan

Use our in-app Chat Feature on the ANB Go app to request a 10-day payoff that allows for mailing and processing time. The payoff and payoff instructions will be attached to your conversation for easy reference.

Or, contact Customer Service at and your payoff quote will be emailed to you. Please note: Interest accrues daily, the balance you view online/in the app is only valid if received the same day.

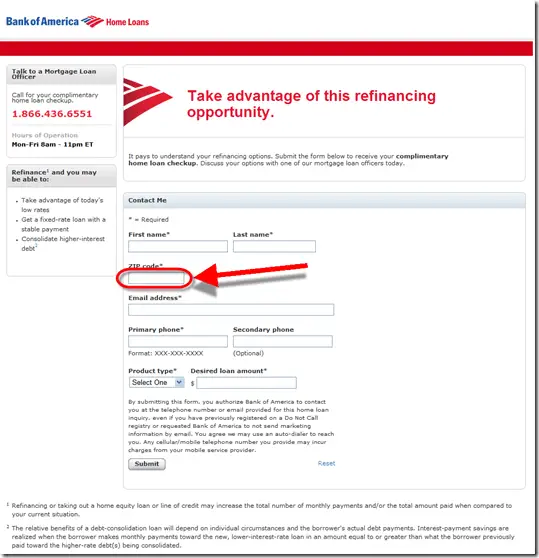

How To Make A Bank Of America Mortgage Payment Online

There are two ways to make your payment online, both of which can be completed in a matter of minutes.

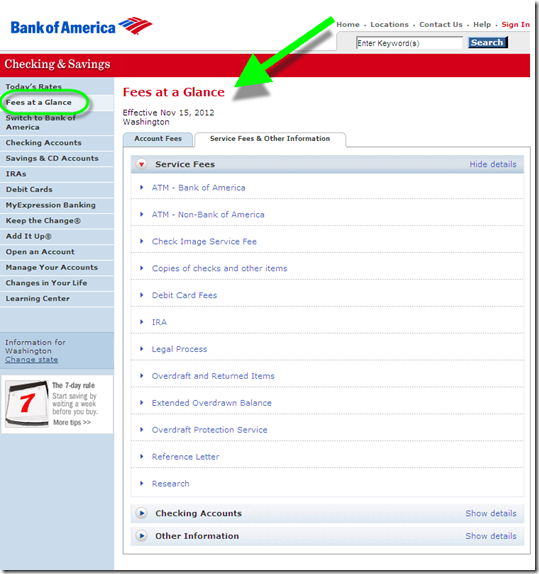

Read This: 5 Ways To Avoid Bank of Americas Monthly Maintenance Fees

Also Check: Fair Credit Loans Guaranteed Approval

Current 30 Year Mortgage Refinance Rate Falls

The average 30-year fixed-refinance rate is 6.41 percent, down 31 basis points over the last week. A month ago, the average rate on a 30-year fixed refinance was higher, at 6.53 percent.

At the current average rate, you’ll pay $626.16 per month in principal and interest for every $100,000 you borrow. That represents a decline of $20.45 over what it would have been last week.

What Happens If I Cannot Pay Or Will Be Late Repaying My Online Loan

Advance America will work with you to establish payment arrangements for your Online Loan. And we’re committed to collecting past due accounts in a professional, fair and lawful manner. Past due payments may impact your ability to transact with Advance America or other lenders. If you are unable to pay your loan on time, please contact us at your local store or our toll free number 5626480.

Also Check: What’s The Longest Personal Loan Term

Thinking About Buying A Home Soon

Whether youre ready right now, or just want to start planning, our mortgage team has the experience and expertise to guide you through the process from start to finish. Know what do to do get your finances in order, get ready to apply and more by connecting with someone from our team today.

How Long Will It Take To Get My Cash After Applying For Online Loan

In states where Online Loans are available, click Apply Now to complete the application. If your application is approved before 10:30 AM ET , the loan is typically funded to your bank account by 5 PM ET same-day. Approvals after 10:30 AM ET are typically funded in the morning the next banking day.

Don’t Miss: Small Personal Loans With Bad Credit

Other Low Down Payment Options To Consider

Navy Federal Credit Union offers a VA home loan option that doesn’t require a down payment and is meant for current or retired members of the Armed Forces who have signed up for a Navy Federal Credit Union membership .

This lender also has another option called the Military Choice mortgage, which has similar guidelines to the VA loan, such as no PMI and a 0% minimum down payment, but allows sellers to contribute up to 6% of the home’s value toward closing costs.

-

Apply online for personalized rates

-

Types of loans

Conventional loans, VA loans, Military Choice loans, Homebuyers Choice loans, adjustable-rate mortgage

-

Not disclosed but lender is flexible

-

Minimum down payment

Online Loans Rates & Terms

Advance America offers a variety of Online Loan types, such as installment loans and lines of credit. Rates and terms for each type of Online Loans are based on state regulations. Finance charges for Online Loans vary by state and by length of loan term.

To get examples of the Online Loan rates and terms in your state, click Learn More below.

You May Like: Where To Apply For Small Business Loan

/1 Arm Moves Up +002%

The average rate on a 5/1 ARM is 5.52 percent, rising 2 basis points over the last 7 days.

Adjustable-rate mortgages, or ARMs, are home loans that come with a floating interest rate. In other words, the interest rate can change periodically throughout the life of the loan, unlike fixed-rate loans. These types of loans are best for people who expect to sell or refinance before the first or second adjustment. Rates could be substantially higher when the loan first adjusts, and thereafter.

While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen.

Monthly payments on a 5/1 ARM at 5.52 percent would cost about $569 for each $100,000 borrowed over the initial five years, but could increase by hundreds of dollars afterward, depending on the loan’s terms.

Can Mortgage Payments Be Increased

Image taken by: clearmortgagecapital.com

Will I be able to save more money by lowering the amount of the mortgage payment? You may be able to raise your mortgage payment. If youre on a fixed-rate mortgage, you might be surprised at how straightforward it is. However, you can expect your monthly mortgage payment to fluctuate several times throughout your loan term.

Aside from the obvious interest rate hike, there are numerous other reasons why mortgage payments may rise. If you have an adjustable-rate mortgage, the interest rate caps on your mortgage can change to adjust it up or down. When the interest-only period expires, mortgage payments rise as well. A fixed-rate mortgage is one in which the principal and interest payments are constant over time. In some cases, however, homeowners insurance may rise in tandem with property taxes. Borrowers may notice an increase in their monthly payments as a result, and many may refinance their mortgages. Examine your escrow account each year to see how much money you have on hand. You can usually choose to begin making the higher mortgage payment to cover the gap if your account has a shortage, such as when an escrow account has a shortage and is X.

Recommended Reading: Payment Calculator For Home Loan

How Can I Verify A Bank Of America Check

To verify a check, you need to contact the bank that the money is coming from.

When Will My Online Loan Payments Be Due

Your online loan payment due dates will depend on the type of loan and its terms. Due dates are noted on your loan agreement, so that you have clear expectations of when to make payments. To learn more about the loan options in your state, click .

Certain limitations apply. Subject to approval. See your local store for more details and additional disclosures. Checks or money orders may be issued instead of cash. Licensed by the California Department of Business Oversight pursuant to the California Deferred Deposit Transaction Law. Licensed by the Delaware State Bank Commissioner to engage in business in Delaware. Delaware Licensed Lender License #s: 6996 4472 9644 4474 8061 6971 7092 8052 6076 7400 4473 7556 010431 and 012075. Rhode Island Licensed Check Casher. In Ohio, loans offered by Advance America Cash Advance Centers of Ohio, Inc., Lic.# ST. 760166.000, main office located at 135 N. Church St., Spartanburg, SC 29306. In Texas, loans arranged with an unaffiliated third-party lender by ACSO of Texas, LP. d/b/a Advance America, a registered credit services organization , and subject to lender’s approval.

Short-term loans are not intended to be long-term financial solutions. Customers with credit difficulties should seek credit counseling. A single payday advance is typically for two to four weeks. However, borrowers often use these loans over a period of months, which can be expensive.

You May Like: How To Find Student Loan Number

+ Handwritten 5 Star Reviews

I would like to thank Mortgage America for making my home buying experience easy and uneventful. My broker was always pleasant and knowledgeable about every question that I had. I would love to work with her again on any future purchases I may have. I would certainly recommend Mortgage America to someone looking to purchase.

I Ryan M. would love to thank mortgage America for making my first home buying very easy. Would like to give a special thanks to Jason. I would recommend mortgage American to all

Mortgage America came to my rescue after several other nightmare experiences with other lenders. Angela was phenomenal. She was responsive, helpful, and patient throughout the entire process and my closing was as smooth as can be. Thank you so much, Mortgage America. Im extremely grateful and will certainly be in touch the next time I need lending!

Everyone was very helpful and very informative. They also took time to explain things if I had any questions.

Do More With The Mobile Banking App

- Set customizable alerts

- Snap a photo to deposit a check, and get instant confirmation

- Use your fingerprint or Face ID for quicker access on the go

Get the Mobile Banking app

Get it on the App Store

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies.

Or we can text a download link directly to your phone

Apple, the Apple logo, iPhone, iPad, Apple Watch and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Get it on the App Store

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies.

Or we can send you a link by email

Apple, the Apple logo, iPhone, iPad, Apple Watch and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Get it on Google Play

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies.

Or we can text a download link directly to your phone

Android is a trademark of Google Inc. Samsung is a registered trademark of Samsung Electronics Co., Ltd.

Our mobile app isn’t available for all devices

You May Like: Personal Loans No Income Verification

Key Takeaways From Big Bank Earnings

Americas largest banks offered a glimpse of the economic road ahead as they reported earnings for the last three months of 2022 in mid-January.

Heres what we learned.

Thats how much JPMorgan Chase added to reserves to cover potential loan losses after releasing $1.8 billion in the same period in 2021 as it anticipates a mild recession.

How To Increase Payments On Mortgage Bank Of America

Jordan

If youre struggling to make your mortgage payments each month, youre not alone. Mortgage rates have increased significantly over the past year, and many homeowners are feeling the squeeze. If youre looking for ways to make your mortgage payments more manageable, here are a few options to consider: 1. Refinance your mortgage. If you can find a lower interest rate, refinancing your mortgage can help reduce your monthly payments. 2. Get a home equity loan or line of credit. If you have equity in your home, you can take out a home equity loan or line of credit to help cover the costs of your mortgage payments. 3. Make a budget. If youre not already doing so, creating a budget can help you see where you can cut back on expenses in order to free up more money for your mortgage payments. 4. Get a part-time job. If you have some extra time, getting a part-time job can help you bring in additional income to help with your mortgage payments. 5. Make a lump-sum payment. If you come into some extra money, making a lump-sum payment on your mortgage can help reduce the amount of interest youll pay over the life of the loan. If youre struggling to make your mortgage payments, there are options available to help you get back on track. Talk to your lender about your options and see what might work best for you.

Also Check: Va Home Loans With Bad Credit