Car Loan Payment Calculator

Calculate how much you could expect to pay each month on your car loan. To see how much you could save with a down payment, put the price of the vehicle minus your down payment in the Loan amount field.

| Your loan |

|---|

principalinterest

-

How to use this car loan monthly payment calculator

- Enter the amount you want to borrow to buy a new car under Loan amount. This might not be the same as the cost of your car if youre making a down payment.

- Write the amount of time you have to pay off your car loan under Loan terms . If your loan term is in months, divide it by 12 first.

- Enter the interest rate you expect to pay on a car loan under Interest rate. If your car loan comes with fees, enter the annual percentage rate instead.

- Click Calculate.

In addition to your monthly payment, this calculator shows how much youd pay on your loans principle amount and how much youd pay overall in interest. The principle amount is the amount that you borrowed and should be equal to your loan amount. Total interest is the amount you would pay on top of the principle the cost of having your loan.

Can I trade in my old car to help increase my down payment?

Yes. While youll still want to save money for a down payment, you can also count your old cars trade-in value toward your total down payment. So if you saved $1,000 and your old car is worth $1,500, youll have a total of $2,500 to use as a down payment.

How To Get The Best Deal

Got new car fever? Well, first, you need to do a little homework. With the internet, the mystery of the automobile buying process has been unveiled and you can be a well-informed buyer ready to negotiate for the best price. First of all, go to ConsumerReports.org to check out vehicle reliability. You may be eying that shiny red sports car, but if its review states that this manufacturer has a history of poor performance or something like electrical issues, you may want to reconsider.

Test drive the vehicle you have in mind, but renting one from a car rental company for a couple days is the ultimate test.

How Much Are You Looking To Borrow

Enter the amount you need to finance your car into the auto loan calculator. To calculate this, subtract your down payment and trade-in value amounts from your cars sticker price or MSRP. Most customers try to put 15 percent to 20 percent down. To estimate your current cars trade-in value, use an online reference guide like Edmunds or Kelley Blue Book be sure to subtract any amount you owe from a previous auto loan from this price estimate.

Recommended Reading: Usaa Auto Refinance Phone Number

Car Loan Calculator: How Much Car Can I Afford

Modified date: Jul. 12, 2021

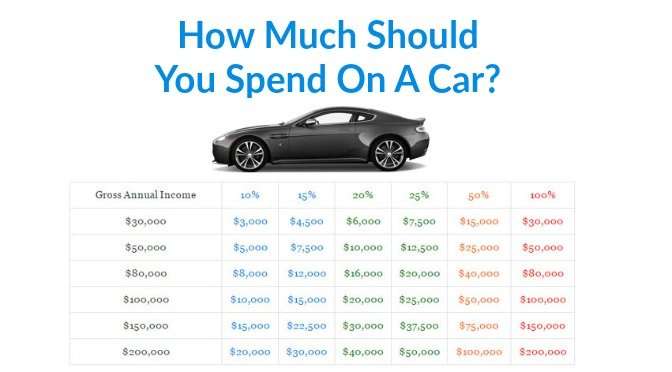

How much should you spend on a car? Probably not as much as you might think.

You can spend between 10% and 50% of your gross annual income on a car. Thats a big range, we know, so if we had to set a rule, it would be this:

Spend no more than 35% of your pre-tax annual income on a car.

Lower is better, but we recognize personal finance is personal. You might spend more only if you can securely pay cash for your vehicle and the kind of car you drive is important to you. You can explore how much car you can accord in our car affordability calculator below.

You can limit how much money you spend on your car by:

- Saving up and paying cash.

- Buying used.

If you do both of these things, youll save thousands of dollars compared to financing or leasing a new vehicle.

That said, sometimes you need transportation before you have cash saved to buy a car. So there are some additional rules to consider when you get an auto loan.

Whats Ahead:

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

Read Also: Commercial Loan Rates Today

There’s More To A Loan Than A Monthly Payment

That same wise shopper will look not only at the interest rate but also the length of the loan. The longer you stretch out the payments, the more expensive the loan will be. Let’s take that same $20,000 loan above at 5% at 5 years and see how much we can save by paying it off in 3 years. So, $20,000 at 5% for 36 months will cost $21,579.05 saving you $1,066.43. Using the calculator above you will see that the monthly payment for the 5 year loan is $377.42 and the monthly payment for the 3 year loan is $599.42. If you can easily handle the higher payment the savings are well worth it.

If your credit drastically improves & your initial loan was at a higher interest rate, it may be worth looking into refinancing at a lower rate.

Calculate Your Automotive Budget

Take a few minutes to run down what you spend every month. From your monthly take-home pay, deduct rent or mortgage, bills, groceries, child expenses, savings, and spending on entertainment. You will then discover how much car you can afford.

Not sure what kind of vehicles can you buy with this monthly payment ? Take a look at the Edmunds affordability calculator, which lists vehicles that fall into the price range you’ve predetermined. Keep in mind that the prices on the calculator results page will change based on the trim level, options, sales tax and registration fees, etc.

Does it seem like you might not be able to afford the purchase? We know that feeling. New vehicles have gotten more expensive over the years and our salaries haven’t kept up. In any case, this amount now represents your automotive budget, which, as we’ve noted, is more than just the monthly payment. On to estimating fuel costs and insurance fees.

Recommended Reading: Aer Loans

Examine Your Buying Patterns

In addition to the formula for car affordability, recognizing your own car-buying habits, good and bad, can offer clues to the best strategy for you.

For example, are you someone who buys a car, pays it off and then keeps it for a few years? Buying a new car would work for you: You have a track record of shopping within your means, finishing off the loan and going payment-free for a while. That’s smart.

Do you get bored with a car after a few years? Then leasing is your best bet. What good is it to take out a six-year loan if you’re going to trade in the vehicle during the fourth or fifth year? You’ll likely owe more than the car is worth and will have to roll that balance into the next loan. You’d be better off leasing and paying less per month. Leasing also lets you get a nicer car for less money.

Finally, are you trying to make the most financially sound decision possible? Then buy a lightly used car, pay it off, and keep it for many years. The first owner takes the depreciation hit, and you’ll have a car that’s new enough to avoid major repairs for a while.

How To Get A Car Loan

Its time to buy a new car, but youre not flush with cash. You need to figure out how to get a car loan. Whether youre thinking new or used, securing a car loan is one of the first steps you should take in the car-buying process. Breaking the process down into pieces rather than trying to tackle it all at once makes it easy. Heres everything you need to know about how to get an auto loan with the best rates, even if you dont have the best credit score.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Auto Loan Payment Calculator Results Explained

To use the car loan calculator, enter a few details about the loan, including:

- Vehicle cost: The amount you want to borrow to buy the car. If you plan to make a down payment or trade-in, subtract that amount from the car’s price to determine the loan amount.

- Term: The amount of time you have to repay the loan. In general, the longer the term, the lower your monthly payment, but the higher the total interest paid will be. On the other hand, the shorter the term, the higher your monthly payment, and the lower the total interest paid will be.

- New/Used: Whether the car you want to buy is new or used. If you don’t know the interest rate, this can help determine the rate you’ll get .

- Interest rate: The cost to borrow the money, expressed as a percentage of the loan.

After you enter the details, the auto loan payment calculator automatically displays the results, including the dollar amounts for the:

- Total monthly payment: The amount you’ll pay each month for the duration of the loan. Some of each monthly payment goes toward paying down the principal, and part applies to interest.

- Total principal paid: The total amount of money you’ll borrow to buy the car.

- Total interest paid: The total amount of interest you’ll have paid over the life of the loan. In general, the longer you take to repay the loan, the more interest you pay overall. Add together the total principal paid and total interest paid to see the total overall cost of the car.

Cibc Personal Car Loan

With up to 8 years to pay off the loan and the possibility of no down payment, this loan makes it easy to purchase a new or used vehicle.

Term: 1 year – 8 years

Special offer: Get up to 10% cash back with a new CIBC Dividend Platinum® Visa* Card. Plus, save up to 10 cents per litre3,4 on gas at participating Chevron, Pioneer and Ultramar gas stations4 when you link and use your CIBC card with Journie Rewards. Learn more about Journie Rewards.

This personal car loan is for you if you want:

- Help with financing a new or used vehicle

- Lower monthly payments by taking up to 8 years to pay off your loan, giving you maximum flexibility

- The choice of weekly, bi-weekly, semi-monthly or monthly payments to coincide with your pay periods

- To apply online for a faster approval

Other loan details:

- Borrow a minimum of $5,000

- Once youve been approved for a CIBC Personal Car Loan, your information only needs to be updated for future credit applications

- To make scheduled payments from your CIBC account at no charge with an Electronic Fund Transfer

- Pay off all or part of the loan at any time without penalty

- You can also skip up to two payments yearly2

You may also want to consider:

- Using a personal loan to buy a used car

- Applying for a Home Power® line of credit for a lower interest rate and a higher credit limit

Tools and advice

Read Also: Classic Car Loans Usaa

Benefits Of Making A Large Down Payment On Your Car

From lower interest rates to increased equity, making a larger down payment can help you save in both the short and long term.

1. Lower interest rates

Having a decent-sized down payment can help you snag a lower interest rate for 2 reasons:

- You pose less risk to the lender. A down payment shows youre committed to your purchase and demonstrates your ability to save. Because of this, some lenders may be willing to extend a lower interest rate.

- You have to borrow less money. Typically, the smaller your loan amount the lower your interest rate.

2. Lower monthly payments

When deciding how much to put down on a car, remember that the more money you put down, the less youll need to borrow. This not only makes for smaller monthly repayments, but also means you wont have to pay as much in interest over the life of your loan.

3. Higher chance of loan approval

If you dont have the best credit, a larger down payment may help you qualify for a car loan. Typically, banks and want to see that you have around 15% of the cars value saved up when you have a that just barely meets the minimum requirements.

But you dont necessarily need it all in cash. Many lenders are willing to count cashback rebates and the trade-in value of your used car toward your total down payment amount.

4. More equity

5. Avoid becoming upside down on your car loan

6. Less cost overall

Like This Please Share

Please help me spread the word by sharing this with friends or on your website/blog. Thank you.

Disclaimer: Whilst every effort has been made in building this tool, we are not to be held liable for any damages or monetary losses arising out of or in connection with the use of it. Full disclaimer. This tool is here purely as a service to you, please use it at your own risk.

You May Like: How Do I Find Out My Auto Loan Account Number

How Much Is Disability Insurance On A Car Loan

These types of additional insurance products are optional to the consumer and are not required for you to be approved for an auto loan. Its ultimately your choice to buy credit life and disability insurance when purchasing a vehicle and there may, or may not, be good reasons to purchase it.

Also, how much does disability insurance normally cost? The average cost of disability insurance is typically between 1 percent and 4 percent of your annual income. Another rule of thumb is that you should expect to pay between 2 percent and 6 percent of your policys monthly benefit amount in premium.21 jui. 2019

People ask , what insurance pays off your car if you die? Credit insurance

, how disability insurance is calculated? Calculating Benefit Payment Amounts. Your Weekly Benefit Amount depends on your annual income. It is estimated as 60 to 70 percent of the wages you earned 5 to 18 months before your claim start date and up to the maximum WBA. Note: Your claim start date is the date your disability begins.

, does a car loan include insurance? Keep making your loan payments Since your auto loan now includes force-placed insurance to protect your vehicle, any lapses can get you in trouble, especially if something happens to the car.19 nov. 2020

Contents

Determine Your Fuel And Insurance Costs

Before you set out to buy or lease, find out what your fuel expenses will be and what it will cost to insure the vehicle. Both costs vary considerably based on your location, your driving history and the vehicle you’ve chosen. Even though it takes a little work to come up with these estimates, you shouldn’t overlook them. Knowing these costs can help you choose among multiple vehicles. Some may cost more to fuel up others might have a higher cost to insure.

The EPA’s Fueleconomy.gov website has a detailed listing of fuel economy figures as well as annual fuel cost estimates for both new and used vehicles.

For insurance quotes, contact your agent or insurance company about the vehicle you’re interested in. You should be able to get an accurate estimate. Or go to the auto insurance website of your choice, and there should be an option to get an online quote. Do insurance and fuel costs add up to 7% or less of your monthly paycheck? Then you’re OK.

Don’t Miss: Va Home Loan For Manufactured Home

What Is A Balloon Payment

A balloon payment is a large, lump-sum payment made at the end of a long-term loan. It is commonly used in car finance loans as a way of reducing monthly repayment figures. Be aware that once you reach the end of your loan period, the balloon amount becomes payable. You can learn more about balloon payments in our article, What is a balloon payment?.

If you have any problems using this car loan payoff calculator then please contact me.

Find Out The Guidelines For How Much To Put Down On A Car And How A Down Payment Can Save You Money

Most car loan providers and dealerships recommend that you make some sort of a down payment when buying a car. A substantial down payment not only helps you qualify for a lower interest rate, but it decreases the overall cost of your loan and prevents you from owing more than your car is worth. Keep reading to discover how much to put down on a car.

Also Check: Becu Autosmart