Do All Interest Rates Move In Line With The Cash Rate

Fixed home loan rates and term deposit rates are not tied to the cash rate in the same way that variable rate products are. While they may seem to move in line with the cash rate, theyâre more so a reflection of how the economy is faring.

Itâs more accurate to say that rates like these are influenced by government bonds. By buying up government bonds with the aim of driving down medium term fixed rates, the RBA effectively pushes fixed mortgage and term deposit rates lower.

Whats The Average Interest Rate On A Car Loan

According to the Federal Reserve, in the first quarter of 2021, the average auto loan rate on a 48-month new-car loan was 5.21%, and the average rate on a 60-month new-car loan was 4.96%.

A range of factors can affect what interest rates you might be offered, including your credit scores, the size of your down payment and the length of your loan term. Your rate may be higher or lower than average depending on your financial situation.

Monthly Interest Rate Calculation Example

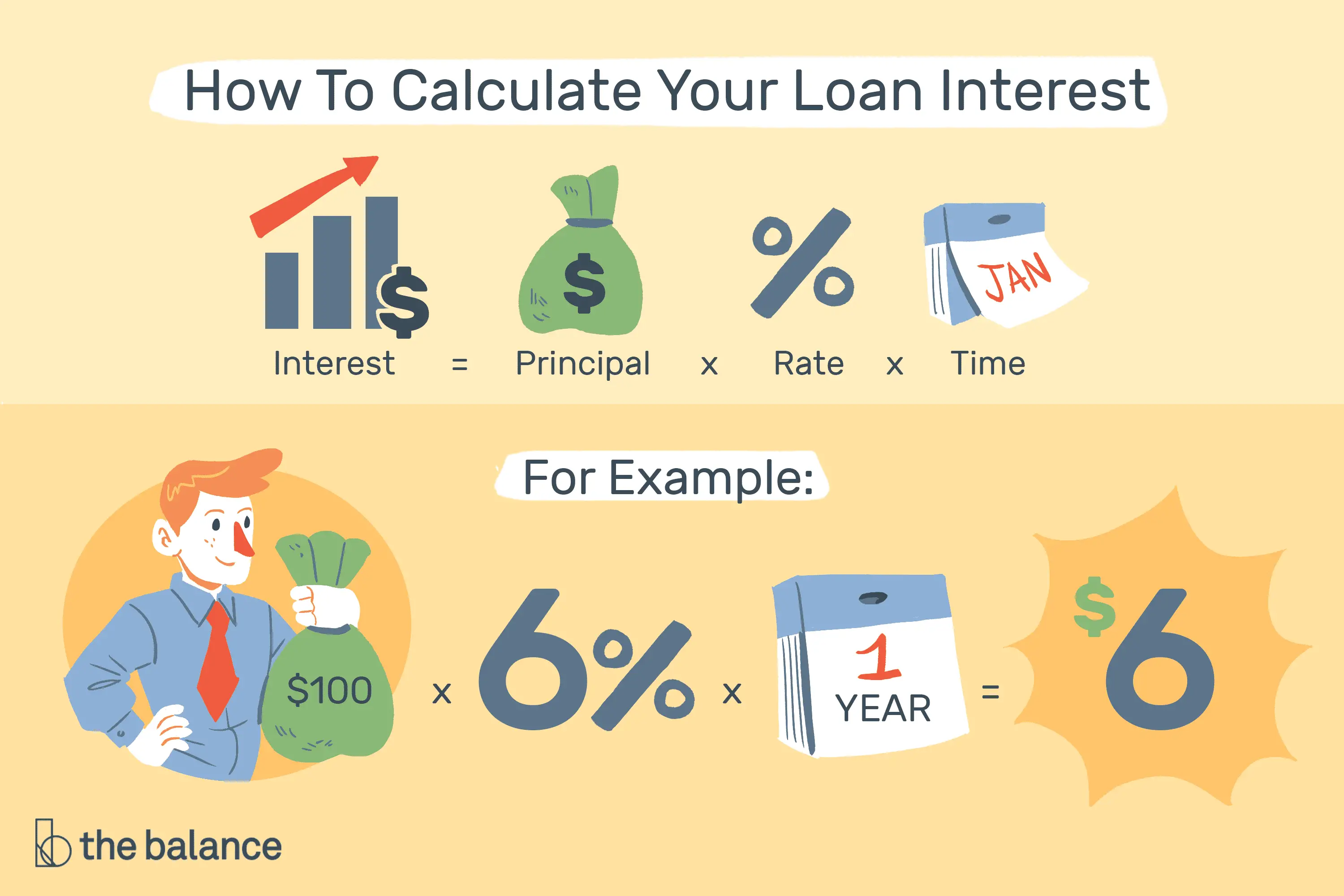

To calculate a monthly interest rate, divide the annual rate by 12 to reflect the 12 months in the year. You’ll need to convert from percentage to decimal format to complete these steps.

Example: Assume you have an APY or APR of 10%. What is your monthly interest rate, and how much would you pay or earn on $2,000?

Want a spreadsheet with this example filled in for you? See the free Monthly Interest Example spreadsheet, and make a copy of the sheet to use with your own numbers. The example above is the simplest way to calculate monthly interest rates and costs for a single month.

You can calculate interest for months, days, years, or any other period. Whatever period you choose, the rate you use in calculations is called the periodic interest rate. Youll most often see rates quoted in terms of an annual rate, so you typically need to convert to whatever periodic rate matches your question or your financial product.

You can use the same interest rate calculation concept with other time periods:

Also Check: Va Manufactured Home Requirements

Carvana: Best Fully Online Experience

Overview: Carvana lets you shop for a car online and pick up your purchase from a giant car vending machine. Its process lets you enjoy a unique experience, yet Carvana also offers competitive car loan rates and terms.

Perks: Carvana is a great option for those who want to shop for their new car from home, as well as those with poor credit. Carvanas only requirements are that you are at least 18 years old, make $4,000 in yearly income and have no active bankruptcies. When you prequalify, Carvana does not make a hard inquiry on your credit, so your credit score wont be impacted a hard inquiry is made only once you place an order.

What to watch out for: After you are prequalified, you have 45 days to make a purchase from Carvana inventory and either pick up the car, have it delivered to you or fly to the car and then drive it back.

| Lender |

|---|

| Varies |

Determining The Amount To Finance

Also Check: Do Underwriters Verify Bank Statements

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

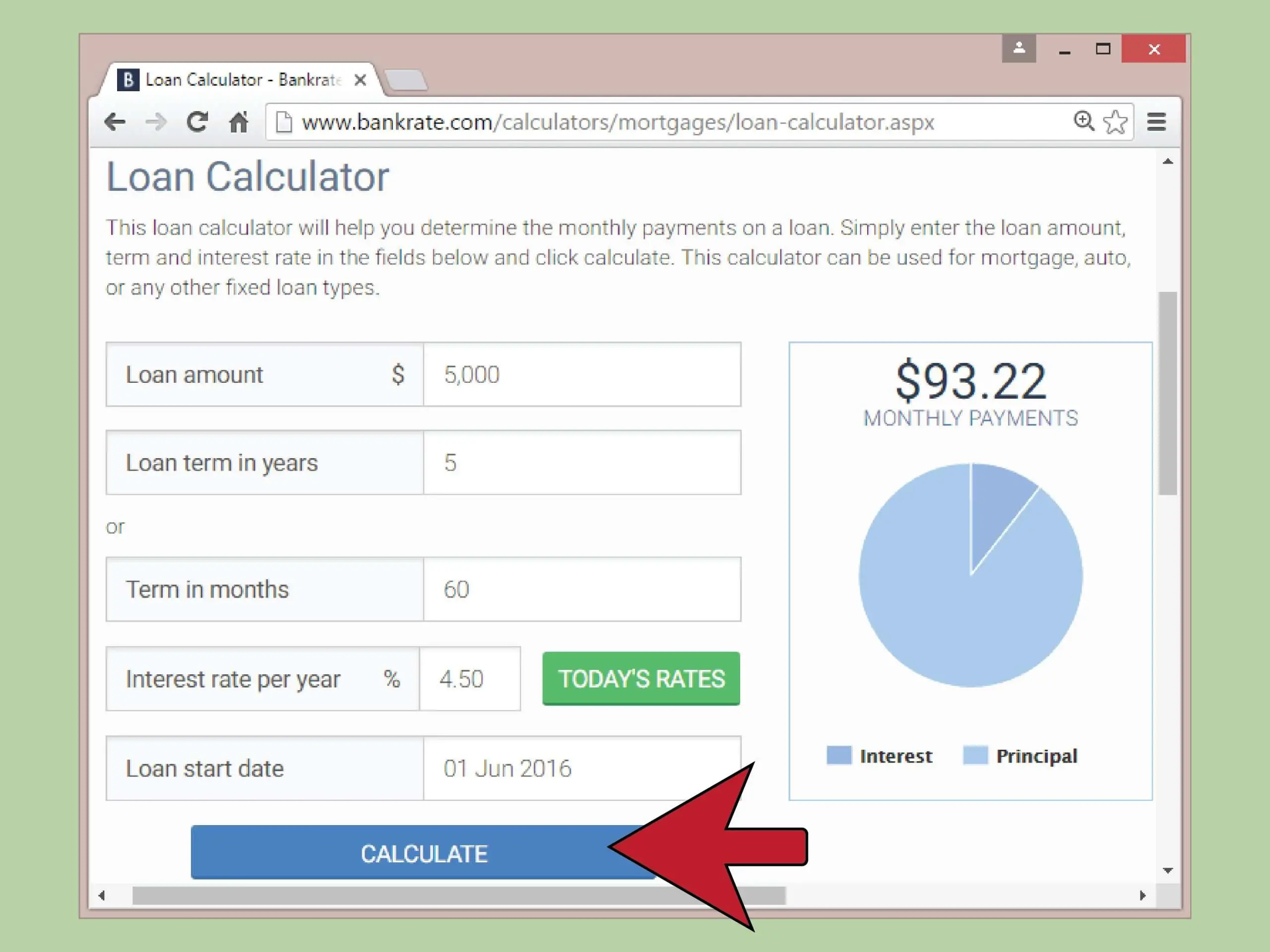

An Auto Loan Calculator Reveals More Than Payments

In addition to looking at the monthly car payment result, be sure to consider the total amount you’ll spend on the car loan. If you’re using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost.

Be aware that you could have costs on top of the auto loan payment calculator’s “total cost of car” result, since it does not reflect state and local taxes, dealer documentation fee and registration fees. You can search online or call the dealership and ask them for estimates of these costs in your area.

An auto loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates and loan terms. The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation.

NerdWallet recommends that you shop for an auto loan before you visit dealerships you’ll give the dealer a rate to beat and won’t worry that you won’t be approved for loan.

Recommended Reading: Directloantransfer

How To Get The Best Deal

Got new car fever? Well, first, you need to do a little homework. With the internet, the mystery of the automobile buying process has been unveiled and you can be a well-informed buyer ready to negotiate for the best price. First of all, go to ConsumerReports.org to check out vehicle reliability. You may be eying that shiny red sports car, but if its review states that this manufacturer has a history of poor performance or something like electrical issues, you may want to reconsider.

Test drive the vehicle you have in mind, but renting one from a car rental company for a couple days is the ultimate test.

Advantage Of Car Loan Emi Calculator

As I said above that you can calculate car loan EMI using a formula or online loan calculator. However, a car loan calculator has an advantage over formula calculation. A car loan EMI calculator gives accurate results and has less probability of calculation error compared to the manual calculation using formula.

So, it is always recommended to use an online car loan calculation tool to calculate and plan your loan repayment. By using the EMI calculator youll save time as well as find accurate calculation results.

You May Like: What Credit Score Does Usaa Use For Mortgage

How Much Interest Will I Pay On My Car Loan

Our car finance calculator works out the interest that you might pay as part of your car finance plan. It does this by taking your interest rate and compounding it over the course of the loan period. It is this compounding of interest rate that forms the basis of the effective annual rate we feature in our calculator. You may be interested to note that we have a compound interest calculator for compounding interest on savings.

Computing Your Total Interest Using An Online Calculator

Don’t Miss: Fha Mortgage Refinance Rate

Why Take Out A Car Loan

When it comes to financing a new car, there are a number of options available to you: outright purchase, personal loan, leasing, hire purchase or dealer financing. It’s advisable to read up on the pros and cons of each of these before deciding upon the best one for you. Should you be considering taking out a different type of loan, give our standard loan calculator a try.

Uncontrollable Economic Factors That Affect Interest Rate

There are many factors that affect what interest rates people get on their mortgages and auto loans. Although these largely cannot be controlled, having knowledge of these factors may still be helpful.

Economic Policy and Inflation

In most developed countries today, interest rates fluctuate mainly due to monetary policy set by central banks. The control of inflation is the major subject of monetary policies. Inflation is defined as the general increase in the price of goods and services and the fall in the purchasing power of money. It is closely related to interest rates on a macroeconomic level, and large-scale changes in either will have an effect on the other. In the U.S., the Federal Reserve can change the rate at most up to eight times a year during the Federal Open Market Committee meetings. In general, one of their main goals is to maintain steady inflation .

Economic Activity

Unemployment Rate

When the unemployment rate is high, consumers spend less money, and economic growth slows. However, when the unemployment rate is too low, it may lead to rampant inflation, a fast wage increase, and a high cost of doing business. As a result, interest rates and unemployment rates are normally inversely related that is, when unemployment is high, interest rates are artificially lowered, usually in order to spur consumer spending. Conversely, when unemployment within an economy is low and there is a lot of consumer activity, interest rates will go up.

Supply and Demand

You May Like: How Much Commission Do Loan Officers Make

Dealership Financing Vs Direct Lending

Generally, there are two main financing options available when it comes to auto loans: direct lending or dealership financing. The former comes in the form of a typical loan originating from a bank, credit union, or financial institution. Once a contract has been entered with a car dealer to buy a vehicle, the loan is used from the direct lender to pay for the new car. Dealership financing is somewhat similar except that the auto loan, and thus paperwork, is initiated and completed through the dealership instead. Auto loans via dealers are usually serviced by captive lenders that are often associated with each car make. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Getting pre-approved doesn’t tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it’s there for convenience for anyone who doesn’t want to spend time shopping or cannot get an auto loan through direct lending.

The First Necessary Step In The Car Buying Process

Whether you buy new or used, it’s wise to get pre-approved for a loan before you ever step on a car lot. Go to your bank or credit union and ask the agent if you qualify for a loan and how much. The agent will check your FICO credit score and other obligations and provide you with an amount and interest rate. A FICO score can be between 300 and 850. The higher the score the lower the interest rate you will be offered. People with a bad credit history may pay interest rates that are more than double prime rates. You can also shop for auto loans online if you aren’t concerned about where your personal information goes. Armed with a pre-approved loan you are now in control and have a choice to go with dealer financing or stick with your bank, whichever rate is lower.

Don’t Miss: Should I Get A Fixed Or Variable Student Loan

Home Loans And Credit Cards

Home loans can be complicated. It is smart to use an amortization schedule to understand your interest costs, but you may need to do extra work to figure out your actual rate. You can use our mortgage calculator to see how your principal payment, interest charges, taxes, and insurance add up to your monthly mortgage payment.

You might know the annual percentage rate on your mortgage, and keep in mind that APR can contain additional costs besides interest charges . Also, the rate on adjustable-rate mortgages can change.

With credit cards, you can add new charges and pay off debt numerous times throughout the month. All of that activity makes calculations more cumbersome, but its still worth knowing how your monthly interest adds up. In many cases, you can use an average daily balance, which is the sum of each days balance divided by the number of days in each month . In other cases, your card issuer charges interest daily .

How Does The Interest Rate An A Car Loan Work

When it comes to car loans, the stated interest rate is not the same as the real interest rate . This is because car loans always use whats called a flat interest rate.

With a flat interest rate, the amount of interest you pay is fixed upon the principal. For example, say the loan amount is RM84,000, and the interest rate you pay is 3.4% per annum for 7 years.

Using the rest rate method of calculation, the interest you pay is based on the principal of RM84,000 every month. So the interest payable works out like this:

Your interest per year would be: 3.4% of RM84,000 = RM2,856.00

Total interest paid over 7 years: RM2856.00 x 7 = RM19,992.00

Now, added to your initial loan of RM84,000, the total amount you need to repay is = RM103,992.00

Divided over a period of 84 months, that comes down to: RM103,992.00/84 = RM1,238 per month.

In this case, the effective interest rate for this car loan is 6.27%. In the simplest words, EIR is the true rate of interest earned, factoring in compounding effect.

Generally, the EIR is higher than the flat interest rate. It is important to find out both before taking on a loan. Read this to learn more about Effective Interest Rate.

You May Like: Usaa Auto Refinance Rates

How Does The Cash Rate Affect Commercial Interest Rates

The cash rate reflects the market interest rate on funds banks lend and borrow from each other overnight. It is set by the Reserve Bank of Australia , which meets on the first Tuesday of every month to discuss any potential moves.

But what does this have to do with commercial interest rates? Simply put, the cash rate serves as a benchmark rate for savings accounts and variable rate home loans. When the RBA raises or lowers the cash rate, banks and lenders tend to modify their own home loan and deposit interest rates soon after.

How To Use The Reverse Auto Loan Calculator

If you know what you can afford each month, a reverse auto loan calculator can tell you how that translates into the total amount you can borrow. Of course, there are variables: the length of the loan and the interest rate you get.

Below you can see how your loan amount changes by moving the sliders for payment and loan term. We’ve provided average rates by credit tier as determined by Experian Automotive.

About the authors:Philip Reed is an automotive expert who writes a syndicated column forNerdWallet that has been carried by USA Today, Yahoo Finance and others. He is the author of 10 books.Read more

Shannon Bradley covers auto loans for NerdWallet. She spent more than 30 years in banking as a writer of financial education content.Read more

Don’t Miss: Drb Loan Consolidation Reviews

How To Calculate Total Interest Paid On A Car Loan

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 345,921 times.

There are several components that are used to compute interest on your car loan. You need to know the principal amount owed, the term of the loan, and the interest rate. Most car loans use an amortization schedule to calculate interest. The formula to compute amortization is complicated, even with a calculator. Car buyers can find amortization calculators on the web. If your car loan uses simple interest, you can use the calculator to determine your monthly payment amount.