Fixed Or Variable Mortgage: How To Minimize The Risk Associated With A Variable Mortgage

Here we revisit the fundamental question of why we are even taking the time to a fixed or variable mortgage. The answer for most is to save more money on their mortgage, in one way or another.;

The strategy here will show you how to lower your risk on a variable mortgage while also setting you up to save substantially on interest over time.

I call this more specifically, variable rate risk mitigation and it involves using the extra payment/ prepayment privileges found in the mortgage fine print terms to increase your variable mortgage payment to the same payment that you would be making at a higher rate 5 year fixed rate mortgage.

For example:

25 YR Amortization

Payment: $1,270

Then using prepayments, boost the variable payment; by $72 per month to $1,342 the same payment as you would have been making on the fixed rate.

Weigh Your Options For Variable

If you must take out private loans and have the option to get a variable rate, look closely at the difference. A significant rate contrast lets say more than 1% to 2% could potentially be worth going this route if you can pay off the loan quickly.

You never know when variable rates may change, but if you can pay off your loans fast, a variable rate may help you save money on interest.

Variable rates are typically better when the Federal government drops short-term interest rates. This can be advantageous for the borrower and be a good time to choose a variable-rate student loan.

The London Interbank Offered Rate is used as the benchmark for current rates. You should plan to check it to see the average available interest rates before signing onto a variable-rate loan.

What If My Grants And Federal Loans Don’t Cover The Cost Of Attendance

If your grants and federal loans are not enough to cover the cost of your education, you should consider the following options:

- and scholarships using one of the many free scholarship search options available. Servicemembers, veterans, and their families may be eligible for GI Bill benefits and/or military tuition assistance.

- Cut costs. Consider getting one or more roommates or a part-time job, possibly through Federal Work-Study.

- See what your family can contribute. Your parents may be able to get tax credits for their contributions. Parents can also explore the federal Direct PLUS Loan program.

- Shop around for a private loan. Remember that these loans generally have higher interest rates and less repayment flexibility compared to federal student loans. You generally should turn to private loans only after you have explored all other grant, scholarship, and federal loan options. If you can show you have a very high credit rating, you may find an affordable private student loan, though you will likely need a co-signer, who will be legally obligated to repay the loan if you can’t or don’t. Look for the one with the lowest interest rate and flexible repayment options.

You May Like: Is It Easy To Get Approved For Fha Loan

Choosing A Student Loan That Works For You

The final decision depends on your unique situation, of course. If you plan to pay off your loan relatively quickly , a variable-rate student loan may help you spend less in interest.

However, be aware that the longer it takes you to pay off the loan, the more opportunity there is for interest rates to rise. You can help mitigate your risk by choosing a lender that caps its variable rates, but they will still fluctuate.

For borrowers who anticipate repaying student loans over a longer time period, or those whose future income level is uncertain, or those who are simply uncomfortable taking on extra risk, a fixed rate student loan may make more sense.

Getting The Lowest Rate

As a student loan borrower, you want to score the lowest interest possible. Interest is what can make paying off debt tough, as it accrues daily.

In order to score the lowest interest rate, there are a number of things you can do.

1. Sign up for autopay: If you sign up for automatic transfers from your bank account to your loan servicer, you can get a 0.25% interest rate reduction. Just make sure you have the funds in your account every month to avoid any overdraft fees or hassles.

2. Refinance your student loans: Heres the good news if you dont like your interest rate after graduating, you may be able to get a better interest rate by refinancing your student loans. If you have strong credit, you could save thousands of dollars by refinancing. If you refinance your federal student loans, however, youll give up your borrower protections.

3. Check various lenders: Not all lenders are alike, so to find the best rate, compare multiple lenders to see their offerings. They are likely similar, but one lender may be able to offer you a better rate.

4.;Keep your credit in shape: If youre applying for private student loans, your credit is used to determine your rate. If your credit score isnt that great, boost it up before refinancing or applying for a new loan. You can help your credit by making on-time bill payments and keeping your debt-to-credit ratio under 30%. Also, minimize the amount of credit you take out.

Following these simple guidelines could help your credit.

Recommended Reading: How To Get Personal Loan With Low Interest

You Think Interest Rates Will Remain Low

The variable rate for a loan will be tied to general interest rates. Its impossible to truly predict the future of interest rates. But if you look at trends you might decide that the lower interest rate now, particularly in this falling rate environment in early 2020, is worth the risk of it rising later.

If you get an offer for a variable rate thats a lot lower than your fixed rate offer, you could still save money over the life of the loan.

Variable Vs Fixed Interest Rates: What’s The Difference

After you submit an application and receive approval for a private student loan, you typically will be presented with the option to select a variable or fixed interest rate on your loan. The interest rate is the price you pay the lender in return for borrowing the money, so its important to understand what youre choosing and why.

Also Check: How To Get Loan Originator License

Pros And Cons Of Variable Vs Fixed Rate Loans

From personal loans for a new car to renewing the mortgage on your house, applying for a loan can seem like a daunting and complicated process especially when it comes to choosing the type of interest rate attached to your loan. The two most common types of loans youre likely to come across are variable or fixed rate loans.

This article will help you to understand exactly what they are, the key differences between the two, explain the dangers of taking a variable rate loan and answer the question is a student loan a variable or fixed rate loan?, starting with some guidance on which type you should choose.

Is A Student Loan A Variable Or Fixed Rate Loan

Student loans are available under both variable and fixed rate terms. However, all federal student loans have fixed interest rates, with only private borrowers offering variable rate loans. Choosing the right student loan for you depends on a variety of factors including:

-

How much money you need to borrow and for how long

-

Whether youre planning on paying off your student loan quickly or over the long-term

-

The current rate of interest on the market

Many lenders recommend that borrowers looking for student loans choose the safer, fixed option. However, if youre planning on getting a stable job and paying back your loan as soon as you leave college then a variable rate student loan might be a great option for saving you money.

Don’t Miss: Can You Ask For More Federal Student Loan

What Is The Danger Of Taking A Variable Rate Loan

Although some studies have shown that most borrowers pay less over the long-term with variable rate than they do with fixed rate loans, they might not always be the best option for everyone. Although the interest rates applied to variable rate loans are benchmarked, they can still move by a percentage or two with sudden changes in the market. This will impact those whore borrowing significant amounts of money considerably.

If youre looking at getting a long-term loan, then looking at anamortization schedule of the loan might help you to understand which option might be best. This schedule what percentage of each monthly payment is going towards the interest rather than theprincipal of the loan. Typically, the amount contributed towards interest drops over time. For long-term borrowers, this might make variable rates a better option.

However, if you prefer the reassurance of having the same loan repayment being taken from your account monthly or are borrowing for the short-term, then a fixed rate might be the option to go for. Taking the type of loan into account is also important. For example, choosing an adjustable-rate mortgage, where interest rates are fixed for five years before being made variable, is a great way to ensure security and potentially take advantage of a decreasing interest rate in the long-term.

Alternatively, for borrowers looking to get a student loan, then the options available for you to save in the long term are slightly different.

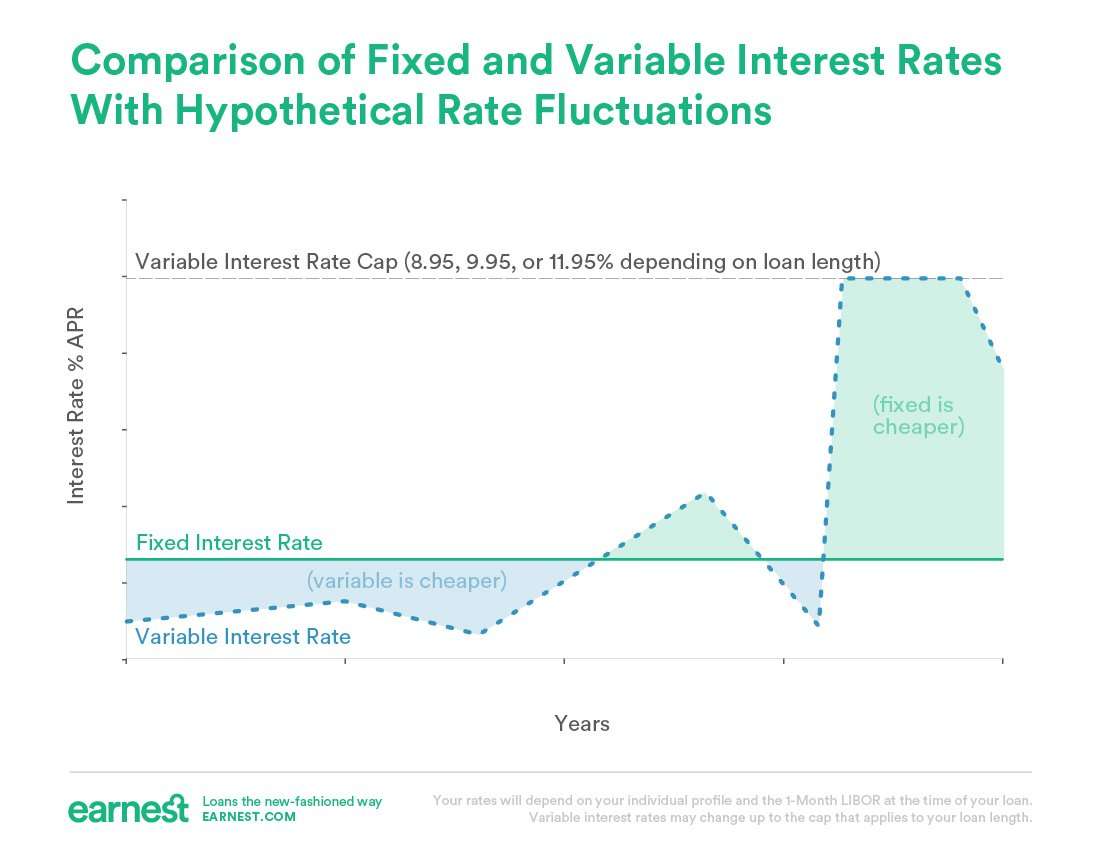

What Is A Variable

A variable rate may start out lower than a fixed rate, but it will fluctuate over the life of the loan as its underlying reference rate changes. This means your minimum payment will change as rates change.

The reference rate Earnest uses is 1-month LIBOR.1 At Earnest, we update the rate monthly, according to figures published in the Wall Street Journal.

Some borrowers prefer variable rates because they dont want to pay a premium for the interest rate insurancethey are making a kind of bet that rates wont rise significantly during their loan term, which is why these tend to be better for shorter terms.

A final thing about variable rates to keep mind: There is no limit to how much the reference rate can rise or fall in any one year, but each loan does have a maximum . At Earnest, any variable loan that has a term of 10 years or less has a lifetime cap of 8.95% For any loan term of more than 10 years and up to 15 years, its 9.95%. Any term longer than 15 years is capped at 11.95% subject to state availability.

You May Like: Who Should I Refinance My Car Loan With

Refinance Rates With Laurel Road Start At 189%

Checking your rates wont affect your score.

Note that many student loan lenders and servicers are offering relief options during the coronavirus outbreak, so be sure to also check out our;Student Loan Hero Coronavirus Information Center;for additional information.

*; ; ; ; ;*; ; ; ; ;*

Private lenders offer variable rate student loans to borrowers looking to take out a new student loan or refinance their existing student debt. Unlike fixed rates, which stay the same over the life of the loan, variable rates fluctuate over time.

Because they can go up or down, variable rates entail more risk than fixed ones. But they also have the potential to save you hundreds of even thousands of dollars in interest payments.

When you borrow or refinance, youll have to choose between a variable and fixed rate student loan. Read on to learn whether variable rate student loans could be right for you.

The Ascent’s Best Personal Loans For 2021

The Ascent team vetted the market to bring you a shortlist of the best personal loan providers. Whether you’re looking to pay off debt faster by slashing your interest rate or needing some extra money to tackle a big purchase, these best-in-class picks can help you reach your financial goals. on The Ascent’s top picks.

Read Also: When Can I Apply For Second Ppp Loan

Pros And Cons Of Fixed

Opting for a fixed-rate loan is generally a better choice if you want to minimize risk. Youll know going in exactly how much youll be paying each month and you wont take a chance on your payments rising and becoming unaffordable over time.

Unfortunately, this certainty can come at a cost. Fixed-rate loans generally have higher rates than the initial starting interest rate on a variable- or adjustable-rate loan. This means youll be paying more up front for the loan that you take on than you would if you opted for a variable-rate loan.

Fixed And Variable Student Loan Rates Plunge To Near

The latest private student loan interest rates from the Credible marketplace, updated weekly.

The average private student loan rates for borrowers with credit scores of 720 or higher who used the Credible marketplace to take out student loans fell for both fixed and variable rates during the week of Aug. 30, 2021.

- 10-year fixed rate: 5.29%, down from 5.78% the week before, -0.49

- 5-year variable rate: 2.67%, down from 3.89% the week before, -1.22

Through Credible, you can compare private student loan rates from lenders without affecting your credit score.

Private student loan rates fell this past week for both fixed and variable rates. Ten-year fixed rates are at the fourth-lowest level of the past year the lowest was the week of March 29, 2021, when they hit 4.99%. Five-year variable rates, at 2.67%, are also at one of the lowest levels of the past year the lowest point was during the week of February 8, 2021, when they were 1.84%. Now could be an excellent time to lock in low interest rates on private student loans.

You should always exhaust federal student loan options first before turning to private student loans to cover any funding gaps. Private lenders such as banks, credit unions and online lenders provide private student loans. You can use private loans to pay for education costs and living expenses, which might not be covered by your federal education loans.;

Private student loan rates

Student loan weekly rate trends

You May Like: Is Student Loan Refinancing Worth It

Are Fixed Or Variable Student Loans Better

are fixed or variable student loans better is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on .

Note: Copyright of all images in are fixed or variable student loans better content depends on the source site. We hope you do not use it for commercial purposes.

Variable Vs Fixed Interest Rates For Student Loans College Ave

How Does An Interest Rate Change Affect My Student Loan Earnest

Should I Choose A Fixed Or Variable Rate International Student Loan Edupass

Fixed Or Variable Rate Loan Which One Should You Choose

Fixed Or Variable Student Loan Which Is Better Nerdwallet

How Does An Interest Rate Change Affect My Student Loan Earnest

Fixed Or Variable Student Loan Which Is Right For You

Fixed Vs Variable Student Loan Rates Bankrate

Are Fixed Or Variable Rate Student Loans Better Find The Best Loan For You Us News

Fixed Or Variable Rate Student Loans How To Choose

Variable Rate Loans Overview How It Works How To Structure

Variable Interest Rate Index

The second part of a variable rate is based on an interest rate index. This is the component of a variable rate that makes it variable. The index of a variable interest rate is based on an interest rate benchmark. While the lender selects which index to use, they do not control the value of the index. The most common index used for student loans is the London Interbank Offered Rate index, the rate at which international banks lend each other funds. As this changes, so will the index component of your interest rate. The margin plus the index totals the interest rate you are charged.

Don’t Miss: What Is The Commitment Fee On Mortgage Loan

Securing A New Interest Rate With Student Loan Refinancing

Whether you originally borrowed a fixed rate or variable rate student loan, the main thing to remember is that the rate assigned when the loan was initially borrowed doesnt have to be the rate for the entire life of the loan. Knowing your refinancing options can help put your mind at easeand hopefully help you spend less in interest over the life of the loan.

While refinancing student loans can potentially help borrowers secure a lower interest rate, its not always the right option. Refinancing a federal student loan eliminates them from federal benefits and borrower protections like income-driven repayment plans or deferment.

Private Student Loan Interest Rates

The interest rates on private student loans are set by individual lenders based on market conditions. Many private lenders offer both fixed- and variable-rate student loans.

Keep in mind:

There are also some lenders that offer private student loans for bad credit. However, these loans usually come with higher interest rates compared to good credit loans.

Here are the rates you can expect on the private student loans offered by Credibles partner lenders as well as how variable rates have shifted on private loans over time:

- Fixed rates from : 3.00%+

- Variable rates from : 1.04%+

Check Out: Private Student Loans & COVID-19: What You Need to Know

Don’t Miss: What Car Loan Can I Afford Calculator