How To Get A Va Loan

VA loans are available from private lenders who have certificates of eligibility from the Department of Veteran Affairs. The following are the steps for obtaining a VA loan:

Basic Allowance For Housing

The Basic Allowance for Housing, or BAH, is a military entitlement given to active-duty personnel to provide housing for themselves and their families. The BAH is calculated according to location and pay grade, and the allowance is designed to provide servicemembers housing compensation equitable to local civilian housing markets.

The BAH can be used toward rent or a mortgage, allowing you to build equity in your home, even if you dont have a down payment to get started.

How To Apply For A Va Home Loan

After confirming eligibility for a VA loan, take the following steps to apply:

- Gather the information you need to apply for your Certificate of Eligibility . You can apply online through your lender using a WebLGY system or by mail downloading a VA Form 26-1880

- Submit your loan application. The lender will request a VA appraisal of the house. The lender reviews the appraisal and your credit income and decides if it accepts your loan application

- Apply for your COE and contact your states regional VA loan center to start the process directly with the government, in the case of Native American Direct Loans.

Once your lender accepts your application, they’ll work with you to select a title company to close on the house.

If you have any questions that your lender cant answer, please call your VA regional loan center at 877-827-3702. You can also watch a video on the official U.S. Dept. of Veteran Affairs YouTube page to learn more about VA home loans and how to apply.

When shopping for a VA loan lender, we recommend the following steps.

Key takeaways:

You May Like: When Do I Start Repaying My Student Loan

What Is The Va Guarantee

The US Department of Veterans Affairs guarantees a certain amount of the loan. This means that if a borrower defaults in any way on paying back the loan, the department will pay back a certain amount to the lender, depending upon your VA loan entitlement.

This VA guarantee makes it easy for lenders to provide mortgages at lower interest rates.

What To Know For The Real Estate Exam

VA loans are designed to help veterans, military service members, and their family members buy homes. These loans are the most cost-effective ones as they require zero down payment, no private mortgage insurance, and minimal credit requirements.

A good real estate agent that identifies and determines the needs of military buyers is very important. If youre preparing for a real estate exam, you must know the importance of understanding VA loans and how they work. A good agent will help military buyers identify homes that are best suited for VA loans and also assist the borrowers in negotiating a contract that results in huge cost savings. If you want to learn about more real estate terms, visit our Real estate flashcard app.

Read Also: How To Take Personal Loan From Bank

Va Home Loan Benefits

If youre eligible for a VA loan, its worth considering over other loan types. Heres why:

- The cost of borrowing is generally lower with VA loans.

- You can get approved for a VA loan with no down payment, but youll need at least 3 percent down for a conventional loan.

- The maximum DTI ratio is determined by the lender. So, you could still get approved even if you have a higher debt load.

- You wont pay mortgage insurance over the loan term. However, its required for conventional loans with a down payment less than 20 percent and for the life of the loan if you get an FHA mortgage.

- Closing costs may be lower, and there are no prepayment penalties should you decide to pay the loan off early.

Va Minimum Property Requirements: Whats Important And Whats Not

Before exploring the extensive list of VA MPRs, lets consider what the Department of Veterans Affairs has to say about its requirements.

VA appraisers should take the general condition of the home into account when determining its appraised value. But an appraiser shouldnt block a home purchase solely because of minor details, such as poor decoration or an overdue servicing of the furnace. The VAs guidelines say:

The appraiser should not recommend repairs of cosmetic items, items involving minor deferred maintenance or normal wear and tear, or items that are inconsequential in relation to the overall condition of the property. While minor repairs should not be recommended, the appraiser should consider these items in the overall condition rating when estimating the market value of the property.

The overarching objective of MPRs is to make sure the home buyer is getting a property that is safe, structurally sound and sanitary.

But, the VA says, The scope of MPRs also includes issues related to the propertys location and legal considerations.

You May Like: What Does Pre Approval For Home Loan Mean

Other Va Loan Requirements

You should also keep these other VA loan eligibility requirements in mind:

- VA loan limit: Since Jan. 1, 2020, there have been no official limits to the value of VA loans, but your lender may impose their own terms and your entitlement will still be pegged to conforming mortgage limits.

- Property type: Investment properties and vacation homes cannot be purchased using VA loan proceeds. Furthermore, you must occupy the home and use it as your primary residence.

- The VA does not specify a minimum credit score requirement. However, borrowers might have a hard time getting approved by a lender if they dont have at least a 620 FICO Score.

- Income: Borrowers need to show they have the income to make the mortgage payments. Its equally important to not have a huge debt load since the lender will assess your debt-to-income ratio , or the percentage of your monthly income thats spent on debt payments.

- Assets and down payment: There is no down payment requirement for VA loans, but the lender may have overlays that mandate a down payment in place for borrowers with lower credit scores.

- Reserve funds: Many lenders require borrowers to have an adequate amount of reserves generally two to three months of mortgage payments before clearing you to close on your loan.

Its also possible to use home loan benefits after bankruptcy, as long as sufficient time has passed, typically two years after filing for Chapter 7 bankruptcy or 12 months after Chapter 13 bankruptcy.

How Does A Va Home Loan Work

The VA does not issue VA loans, but they do determine who qualifies for one and which lenders issue them. There are several types of VA loans, and they pose less of a risk to lenders because theyre backed by a government agency.

VA mortgages are considered non-conforming loans because they dont meet the guidelines of conventional lenders Fannie Mae and Freddie Mac. However, this allows more flexibility for clients to qualify because of their easier credit score requirements. They offer many advantages over conventional loans, including lower interest rates, more lenient borrowing requirements and no down payment due at closing. VA loans also never have monthly mortgage insurance.

Read Also: What Is An Equity Loan

How To Qualify For A Va Loan

The VA home loan program and its military benefits are available for:

- Active-duty military members

- Past and present members of the National Guard

- Surviving spouses of military personnel who died in combat

A VA home loan does not have a minimum credit score requirement, but most participating VA loan lenders require a minimum credit score of 620. Our advice? Always check your credit report and debt-to-income ratio before applying for a loan and improve it if you can.

For more information, read our 5 tips for getting a VA loan, as well as our guide on how to dispute your credit report.

Service requirements

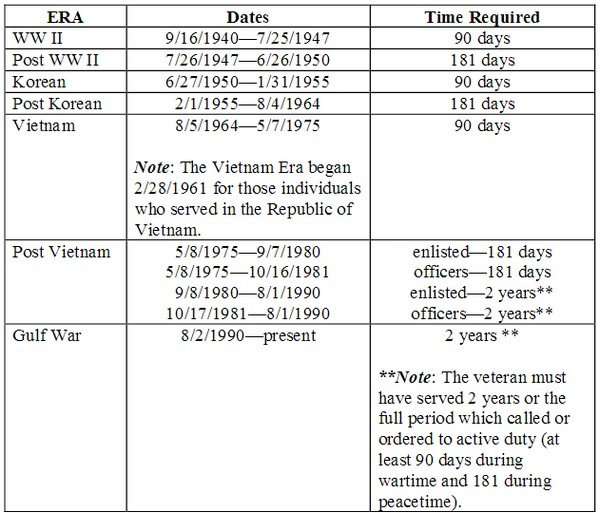

Veterans and active-duty service members must have served at least 90 days during wartime or 181 days during peacetime. National Guard members must have served at least 90 days of active-duty service during wartime or six years of creditable service in the Select Reserves or Guard.

Once deemed eligible, you must apply for a Certificate of Eligibility . The COE proves to the VA mortgage lender that you meet the VAs eligibility requirements.

What If I Dont Meet The Minimum Service Requirements

If you dont meet the minimum service requirements for a VA Loan defined by the VA, you might still qualify for the loan if your discharge falls under one of the following categories.

- You were discharged due to a reduction in forces, early-out or at the convenience of the government.

- You were discharged due to a service-connected disability.

- You served at least 21 months of the two-year enlistment and were discharged early.

You May Like: How Do You Refinance Your Home Loan

What Are The Drawbacks Of Va Loans

VA loans are very beneficial, but for military personnel and their family members only. Besides that, there are strict appraisal requirements, and the appraisal costs are higher than FHA loans or conventional loans. Another main disadvantage of a VA loan is that the borrower cant buy an investment property or a second home.

Can I Use My Va Loan Benefit More Than Once

Theres no limit to how many times you can use your VA loan benefit as long as you meet eligibility requirements. The Department of Veterans Affairs can help you understand your eligibility.

The Navy Federal report revealed that even though a VA loan benefit can be used more than once, nearly half of Active Duty servicemembers and one-third of veterans who participated in a survey believe it can only be used once, according to Kantar.*

Also Check: What Are Va Loan Equity Reserves

What Documents Will You Need

Depending on your military experience, youll need certain documents to meet VA home loan requirements.

VA Loan Required Documents| Active Duty Members |

|

|---|---|

| Active Duty, Veteran, Current or Former National Guard or Reserve Member |

|

| Current Reserve or National Guard Member |

|

| Discharged National Guard Member |

|

| Discharged Reserve |

|

| Surviving Spouse |

|

Best For Low Credit Scores Runner

New American Funding is our second pick for low credit score requirements for VA loans. While its 580 minimum credit score requirement is not unique on the list, it has one of the broadest selections of mortgage loans among similar lenders.

Notably, it offers what NAF refers to as an I CAN loan, which allows you to choose a custom fixed loan term between 8 and 30 years. It also offers a buydown mortgage option for VA loans, which allows borrowers to reduce the number of their mortgage payments for the first 1-3 years of their loan.

- No branches in Alaska or West Virginia

- Rates not disclosed unless you call or submit an online form requesting a callback

- Phone customer service hours may be too restrictive for some

Why we chose it:Fairway Independent Mortgages presence in 48 out of 50 U.S. states makes it our top pick for in-person mortgage loan servicing.

Fairway Independent Mortgage is notable for its many branches across all but 2 U.S. states , making it an ideal choice for individuals who prefer in-person service.

Fairway also offers a broad range of mortgage products which can be helpful for those who are unable to qualify for a VA loan. Among these loan products are specialized physician loans aimed at medical professionals still working through repaying their student loans.

Recommended Reading: How To Get Personal Loan With Fair Credit

Options To Buy A Home That Does Not Conform To Va Mprs

Home buyers who have fallen in love with a home that doesnt comply with the VA MPRs may struggle to buy it with a VA loan. However, that doesnt mean you wont be able to at all.

The good news is that you do have options to purchase a home that does not meet the VA minimum property requirements. It may just take a little extra work.

Talk with your loan officer and real estate agent to explore your options.

Dont Meet Va Loan Requirements

Dont panic. If you dont meet the requirements for a VA loan, you still have options. Maybe an FHA loan is the right choice for you. Like VA loans, FHA loans have lower down payment requirements and lower interest rates than regular commercial loans. With an FHA loan, you wont be able to put 0% down like you could with a VA loan, but your down payment requirement will be well below what you would need for a conventional loan. Some banks also offer special perks to military customers for conventional loans.

Also Check: Government Loans For Small Businesses

Special Flood Hazard Area

If you want to buy a home or plot that floods regularly, you wont get a VA loan. There are restrictions even if it doesnt flood, but is in a high-risk area.

FEMA designates special flood hazard areas . You can still buy a home in one of these, but only if you buy flood insurance. Note that flood insurance is not included in standard homeowners insurance policies and must be purchased separately. If the homes uninsurable or you cant get that insurance, the VA wont guarantee your loan.

That last paragraph applies in almost all SFHAs. But it doesnt if your homes in those zoned B, C, X or D by FEMA.

How Many Times Can You Get Va Loans

You can get VA loans as many times as you wish. Keep in mind that the rules and requirements may change each time you apply for a new VA home loan. In most instances you can only carry one VA mortgage at a time, so you would probably have to payoff your existing mortgage before qualifying for the next one.

Also, make sure you dont have any unpaid periods of active duty service when applying again. You also must wait at least two years to reapply if your initial application was denied or withdrawn.

Don’t Miss: What Is The Difference Between Direct Loan Subsidized And Unsubsidized

Va Home Mortgage Limits

You might be wondering exactly how much house can you buy with a VA loan. According to the VAs loan limit documentation, eligible veterans, service members, and survivors with full entitlement no longer have limits on loans.

With that being said, it is still up to your lender to determine how large of a mortgage you can borrow. Your mortgage banker will determine the size of loan you can afford by assessing your credit history, income, and any assets you may be holding.

How To Apply For A Va Loan Certificate Of Eligibility

If youre looking for a VA loan Certificate of Eligibility, you can get one by applying through your eBenefits portal online or even applying through your lender.

In order to apply, you do need to provide different information, based on your current status. Veterans do need to provide a DD Form 214, and active duty service members need a signed statement of service. A statement of service should include:

- The date you started duty

- Name of the command providing the information

Different requirements may apply for National Guard or Reserve members, as well as surviving spouses. You can find more information through the VAs benefits website, or by speaking to a qualified lender.

Also Check: How Can I Refinance My Car Loan With Bad Credit

Your Path To Buying A Home With A Va Loan:

Navy Federal Credit Union makes the process easy for you. Theyre a top VA lender and can help you determine if you meet VA home loan requirements and answer any questions along the way.