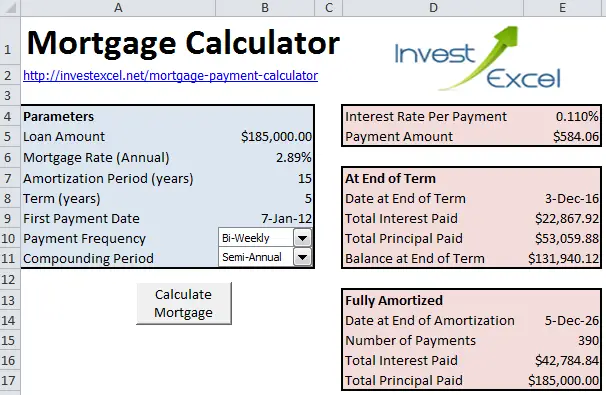

Calculating Mortgage Payments Using A Spreadsheet Program

Estimate The Future Interest

Estimate how many days of interest in this example, at $82.19 a day to add to the $600,000 balance from March 1 to the payoff date. After the closing on March 10, for example, be sure to include the three-day right of rescission, to which borrowers are entitled by federal law, and add a few more days to account for overnight delivery of the payoff check to the lender and the lender’s posting of the payoff to your account. Use 17 days for this calculation. Multiply $82.19 by 17 days . This interest amount plus the balance of $600,000 equals $601,397.23. If you overpay the lender by a day or two, the excess will be refunded back to you.

References

I Have A Loan Payoff Goal And Want To See How Fast Making Larger Payments Can Pay Down The Loan And How Much Interest I Can Save

If you want to pay down a loan ahead of schedule by adding a fixed amount to each payment, this extra payment calculator will show you how much quicker youll reach loan pay off time and how much money youll save. Almost every other loan pay off calculator out there uses initial loan amount, rate, date and term of loan. They assume you have not made any additional payments to your principal. If you have, your balance will not match and your answer will not be accurate. This one is smart enough to take that into consideration and use only your current balance, loan rate and payment amount. Accurate data to begin with gives an accurate answer.

Read Also: Usaa Credit Score Range

Calculate Your Payment And More

How much interest can be saved by increasing your mortgage payment? This mortgage payoff calculator helps you find out. Click the “View Report” button to see a complete amortization payment schedule.

Learn more about specific loan type rates| Loan Type | Purchase Rates | Refinance Rates |

|---|---|---|

| The table above links out to loan-specific content to help you learn more about rates by loan type. | ||

| 30-Year Loan |

Mortgage Payoff Calculator Terms & Definitions

- Principal Balance Owed â The remaining amount of money required to pay off your mortgage.

- Regular Monthly Payment â The required monthly amount you pay toward your mortgage, in this case, including only principal and interest.

- Number of Years to Pay Off Mortgage â The remaining number of years until you want your mortgage paid off.

- Principal â The amount of money you borrowed to buy your home.

- Annual Interest Rate â The percentage your lender charges on borrowed money.

- Mortgage Loan Term â The number of years you are required to pay your mortgage loan.

- Mortgage Tax Deduction â A deduction you receive at tax time on the interest you pay toward your mortgage.

- Extra Payment Required â The extra amount of money you’ll need to pay toward your mortgage every month to pay off your mortgage in the amount of time you designated.

- Interest Savings â How much you’ll save on interest by prepaying your mortgage.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Ready To Refinance Your Mortgage

If you want to refinance to a mortgage you can pay off fast, talk to our friends at Churchill Mortgage. The home loan specialists at Churchill Mortgage show you the true costand savingsof each loan option. They coach you to make the best decision based on your budget and goals.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Don’t Miss: What Car Loan Can I Afford Calculator

How To Pay Off A Loan Faster

The first rule of overpaying is to speak to the lender to ensure that any extra money you send comes off the principal debt, and not the interest. Paying off the principal is key to shortening a loan. Our Loan Payoff Calculator shows you how much you might save if you increased your monthly payments by 20%.

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Recommended Reading: Can I Refinance My Car Loan With The Same Lender

Benefits Of Paying Off Your Mortgage Early

Owning a home without a mortgage is financially liberating. Here are just a few of the key benefits:

- You save money. By paying off your mortgage you eliminate interest costs. This lowers your monthly expenses and reduces the total cost to own your home.

- No interest is better than a mortgage tax deduction. If you keep the mortgage to get the tax deduction then you’re paying $1 to the bank to get a $0.25 tax deduction . You’re still out $0.75. If you pay off the mortgage, you pay $0.25 in taxes and have $0.75 in your pocket.

- You will gain the flexibility of using what had been the mortgage payment to invest in retirement or save toward other financial goals. Imagine! Not only will you avoid paying mortgage interest, but you’ll be making money in higher-yielding accounts!

Make Extra House Payments

Lets say you have a $220,000, 30-year mortgage with a 4% interest rate. Our mortgage payoff calculator can show you how making an extra house payment every quarter will get your mortgage paid off 11 years early, and save you more than $65,000 in interestcha-ching!

But before you start making extra payments, lets go over some ground rules:

- Check with your mortgage company first. Some companies only accept extra payments at specific times or may charge prepayment penalties.

- Include a note on your extra payment that you want it applied to the principal balancenot to the following months payment.

- Dont shell out your hard-earned cash for a fancy-schmancy mortgage accelerator program. You can accomplish the same goal all by yourself.

What Does Paying Your Mortgage Biweekly Do?

Some mortgage lenders allow you to sign up for biweekly mortgage payments. This means you can make half of your mortgage payment every two weeks. That results in 26 half-payments, which equals 13 full monthly payments each year. Based on our example above, that extra payment can knock four years off the 30-year mortgage and save you over $25,000 in interest.

Are Biweekly Mortgage Payments a Good Idea?

Also Check: Does Va Loan Work For Manufactured Homes

How The Loan Payoff Calculator Works

To use the loan calculator, youll start by entering two critical pieces of information the Loan Amount and the Loan APR youre paying.

From there, youll have the option to Calculate by Loan Term or Calculate by Monthly Payment. Click the bubble next to the one you want to calculate first.

Lets take a look at each, starting with the assumption of a $10,000 loan amount and a 7% loan APR.

How To Use The Early Payoff Mortgage Calculator

- Enter the original loan amount and date you took out the mortgage

- Input the loan term and interest rate

- Select the date of extra payment

- Along with the amount and frequency

To use the early payoff mortgage calculator, simply enter your original loan amount when you first received the loan, along with the date you took out the home loan.

Then enter the loan term, which defaults to 30 years. You may also enter 360 months for a 30-year loan, or 15 years for a 15-year fixed depending on loan type desired.

Speaking of loan type, youll save a lot more money by paying extra on a mortgage with a longer term, such as the 30-year fixed. And if the loan amount is larger.

Next, enter the mortgage rate and the date you plan to make the extra payment. Then input the additional payment amount and whether itll be a monthly, annual, or one-time extra payment.

For example, if you plan to pay an extra $100 per month, you shouldnt have to change anything with the default settings. If you want to make a lump sum extra payment of $1,000, enter it and change the Monthly to One Time for an accurate calculation.

Once you click compute, youll see how much the extra mortgage payments will save in the way of interest over the life of the loan, and also how much faster youll pay off your mortgage.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratio that lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

When To Consider Refinancing

Aside from making extra payments, mortgage refinancing is another strategy to shorten your term. But other than that, it can help you obtain lower interest rates. You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. If you have a 30-year mortgage, you can refinance to a 15-year mortgage with reduced interest. Moreover, it allows you to shift from a fixed-rate mortgage to an adjustable-rate mortgage , and vice versa. But dont forget: It should be done early enough into the loan term.

Heres when its good to refinance from a 30-year to 15-year term:

- If interest rates are low

- If you have a qualifying or high credit score

- If youve paid your loan for just a couple of years

- If you are not planning to move out of the house

- If you are able to make higher monthly payments Refinancing to a shorter term makes your monthly payment higher even with a reduced interest rate. This yields significant interest savings.

Moreover, refinancing is taking out a new loan to replace your old one with more favorable terms. This means you need to go through all the credit checks and paper work. It requires a high qualifying credit score , with the best rates going to consumers with 740 credit scores. On top of this, you must shoulder many fees, including inspection, recording fees, origination fees, and housing certifications.

Refinancing is not ideal under the following circumstances:

Whats the Ideal Interest Rate to Refinance?

Don’t Miss: Suntrust Car Loan Rates

How To Calculate Mortgage Payoff

This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems. This article has been viewed 99,370 times.

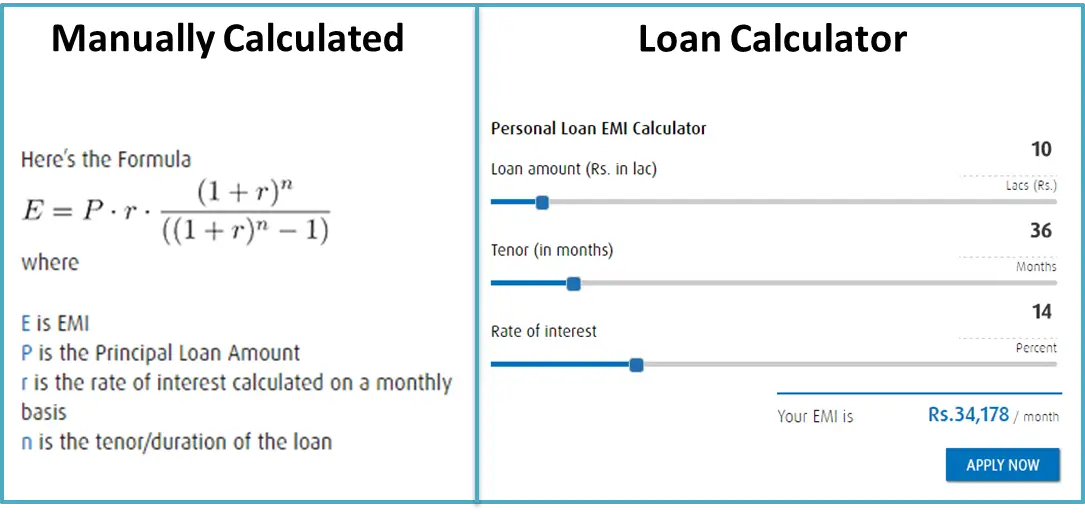

The method for precisely determining the rate of amortization, which is the amount needed to pay off a particular mortgage loan, will vary depending on factors like the type of loan, its terms, and what options are exercised by the borrower. However, there is a standard formula used for calculating the loan payoff amount of a mortgage based on the principal, the interest rate, the number of payments made, and the number of payments remaining. This article provides detailed information that will assist you in calculating your mortgage payoff amount based on the terms of your loan. Contact your lender to confirm that your calculation is correct based on the particulars of your mortgage.

Mortgage Early Payoff Calculator

How much interest can you save by increasing your mortgage payment? The mortgage payoff calculator helps you find out. Click the “View Report” button to see a complete amortization payment schedule and how much you can save on your mortgage.By changing any value in the following form fields, calculated values are immediately provided for displayed output values. Click the view report button to see all of your results.

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues. Calculators are not guarantees of credit.

Ready to pay off your home loan?

Here’s what you need to do next.

Also Check: Usaa Car Loans Credit Score

Refinanceor Pretend You Did

Another way to pay off your mortgage early is to trade it in for a better loan with a shorter termlike a 15-year fixed-rate mortgage. Lets see how this would impact our earlier example. If you keep the 30-year mortgage, youll pay more than $158,000 in total interest over the life of the loan. But if you switch to a 15-year mortgage, youll save over $85,000and youll pay off your home in half the time!

Sure, a 15-year mortgage will probably come with a bigger monthly payment. But if it fits within your housing budget, itll totally be worth it! And hey, maybe youve boosted your income or lowered your cost of living since when you first took out your mortgagethen youd definitely be able to handle the bigger payment.

You can refinance a longer-term mortgage into a 15-year loan. Or if you already have a low interest rate, save on the closing costs of a refinance and simply pay on your 30-year mortgage like its a 15-year mortgage. What if you already have a 15-year mortgage? If you can swing it, imagine increasing your payments to pay it off in 10 years!

Try Refinancing From Fha Loan To Conventional Loan

Federal Housing Administration loans help millions of Americans secure affordable homes. FHA loans are backed by the government to help consumers purchase houses with low down payments . Loan rates are also typically competitive at the beginning of the term.

Conventional home loans only require property mortgage insurance if the loan balance is above 80% of the home’s value. As the homeowner pays down their loan the insurance requirement is dropped. FHA loans charge an annual mortgage insurance premium which must be paid for the entire life of the loan. MIP is around 0.80 to 0.85 percent of the loan value. This premium cannot be canceled and must be paid yearly until the end of the mortgage.

Is There a Way to Eliminate PMI?

Yes. You can get rid of the PMI cost if you refinance from FHA to a conventional loan. To do so, you must raise your credit score to qualify for refinancing. At the very least, you should have a 620 credit score to obtain a conventional loan. But the higher your credit score, the more favorable rates you can get . This helps lower your current interest rate once you shift to a conventional loan. But again, if you shorten your term to 15 years, be ready for higher monthly payments.

To learn more about when to refinance, read our feature on top reasons for refinancing.

Don’t Miss: Commitment Fee On Mortgage