The Key Advantages Of A Home Equity Loan

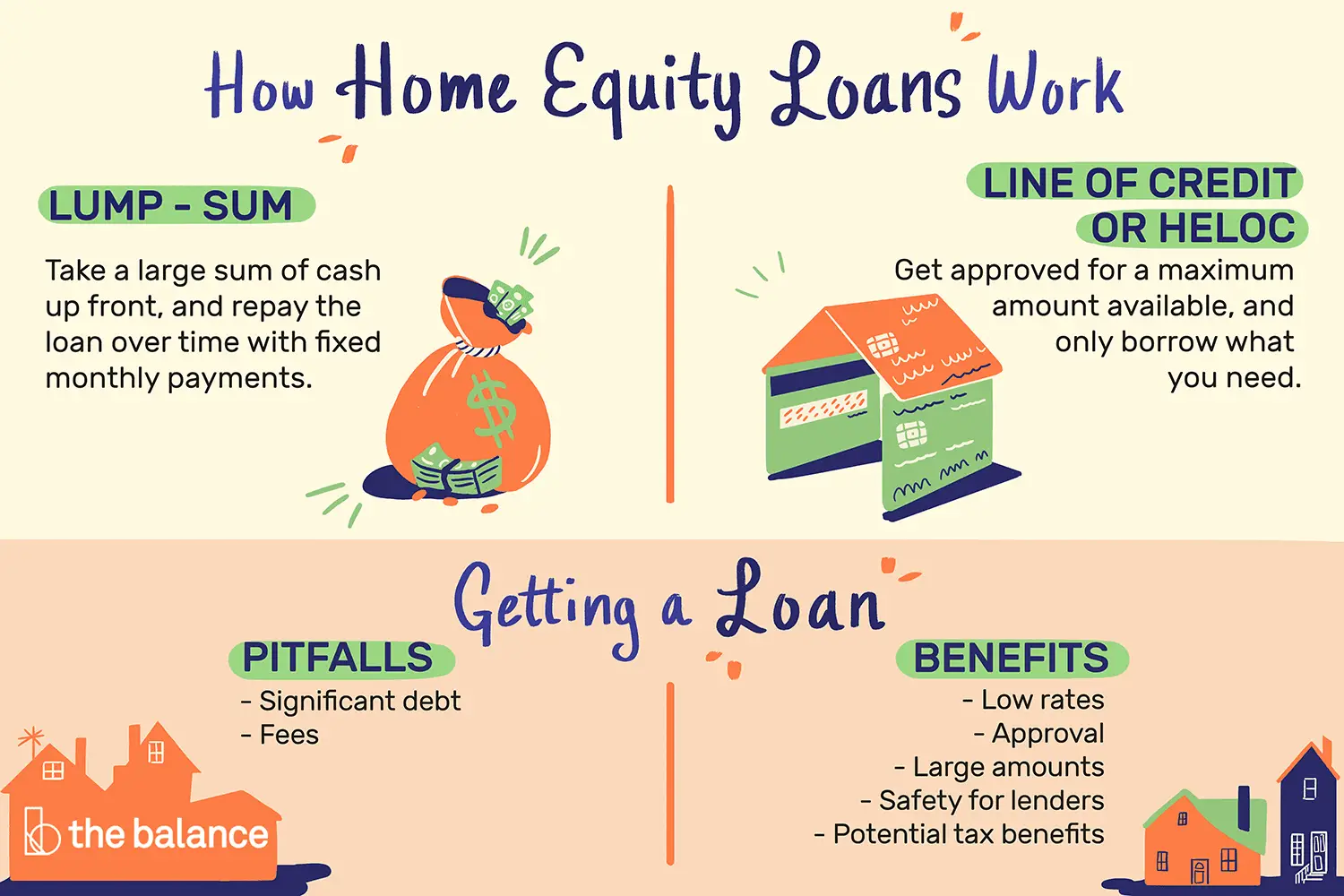

Since youre pledging a valuable asset as collateral, you can typically get a more favorable interest rate on a home equity loan than youd find on a credit card or personal loan. Like a personal loan, home equity loans also usually offer a fixed APR, fixed term and fixed monthly payments.

Although the Tax Cuts and Jobs Act of 2017 has impacted the tax deductibility of interest on home equity loans, you may still get a tax benefit if youre using the loan for home improvement. Consult your tax advisor for more information.

Home Equity Loan Requirements

Each lender has its own requirements, but to get approved for a home equity loan, most borrowers will generally need:

- Equity in their home > 20% of their home’s value

- Verifiable income history for two or more years

- A credit score > 600

Though it is possible to get approved for a home equity loan without meeting these requirements, expect to pay a much higher interest rate through a lender that specializes in high-risk borrowers.

Determine the current balance of your mortgage and any existing second mortgages, HELOCs, or home equity loans by finding a statement or logging on to your lender’s website. Estimate your home’s current value by comparing it to recent sales in your area or using an estimate from a site like Zillow or Redfin. Be aware that their value estimates are not always accurate so adjust your estimate as needed considering the current condition of your home. Then divide the current balance of all loans on your property by your current property value estimate to get your current equity percentage in your home.

| Average Home Equity Interest Rates | |

|---|---|

| Loan Type | |

| 5.61% | 3.50%-8.63% |

Rates assume a loan amount of $25,000 and a loan-to-value ratio of 80%. HELOC rates assume the interest rate during initiation of the credit line, after which rates can change based on market conditions.

Starting Your Own Business

Many people who want to start their own business may not have the funds to do so, which is why home equity loans may be an option to explore. Whether you want to start a company from scratch or open a franchise, home equity loans can help you access money that you may not have had in your personal savings account.

You May Like: How Long For Prosper Loan Approval

How Your Homes Equity Can Make It Happen

HELOC features

Want lower rates? Put away the credit card and tap into your HELOC.

Only borrow what you need. It replenishes as you repay itand you choose fixed or variable rates.2

It takes minutes to apply and decisions are quick. Plus, a dedicated loan officer will be there to answer all your questions.

When you use it for home improvements, the interest you pay could be tax-deductible.3

How To Use Your Home Equity To Your Advantage

Tapping into your home equity is a great way to gain access to the funding you need. Because the equity youve worked hard to build acts as collateral for the loan or line of credit you applied for, youll be able to access more affordable rates and often better terms.

When it comes to using your home equity to borrow, its always in your best interest to spend the money on something that will help you save or make more money in the future. Some of the best ways to use your home equity to your advantage are:

- Kitchen or bathroom upgrade

- Add a basement suite

Don’t Miss: Can You Put Closing Costs Into Va Loan

Draw And Repayment Periods

HELOC terms have two parts. The first is a draw period, while the second is a repayment period. The draw period, during which you can withdraw funds, might last 10 years, and the repayment period might last another 20 years, making the HELOC a 30-year loan. When the draw period ends, you cannot borrow any more money.

During the HELOCs draw period, you still have to make payments, which are typically interest-only. As a result, the payments during the draw period tend to be small. However, the payments become substantially higher over the course of the repayment period because the principal amount borrowed is now included in the payment schedule along with the interest.

It’s important to note that the transition from interest-only payments to full, principal-and-interest payments can be quite a shock, and borrowers need to budget for those increased monthly payments.

Payments must be made on a HELOC during its draw period, which usually amounts to just the interest.

Home Equity Loan Vs Refinancing Cash

Whether it makes sense to choose a home equity loan vs. refinance loan can depend on your goals and what you need the money for. So what are the advantages of home equity loan vs. refinancing?

In a nutshell, getting a home equity loan could be a good fit if youre comfortable with having two mortgage payments and you want to borrow at a fixed interest rate. Its also possible that you could take out more of your homes equity with a home equity loan vs. refinancing cash out.

| Refinancing Cash Out | |

|

|

Don’t Miss: What Happens If You Default On A Sba Disaster Loan

How To Qualify For A Home Equity Loan

Getting approved for a home equity loan is similar to going through the process for a new mortgage. Your lender will review your application along with your credit report, credit score, debt-to-income ratio, and your homes equity.

While each lender has its own approval criteria, youll typically need the following to qualify for a home equity loan:

- Youll generally need a credit score of at least 680 to qualify for most home equity loans though, the higher your score, the better your interest rate could be. And although you might get a loan with a score of 660, you could end up with a higher interest rate.

- DTI ratio: Your DTI ratio is the percentage of your monthly income that goes toward debt payments, including your mortgage, student loans, credit cards, and car payment. When applying for a home equity loan, your DTI ratio shouldnt exceed 43%.

- Equity: To qualify for a home equity loan, youll need to have at least 15% to 20% equity in your home. If your house is worth $250,000 and you owe $200,000 on your mortgage, your homes equity is $50,000, or 20%.

Learn More: Have Bad Credit and Want a Home Equity Loan? Heres What to Do

Is A Home Equity Loan Or A Heloc Better

What’s best for you will depend on your individual circumstances, but here’s a general guideline.

If you’ll need a fixed amount of money all at once for a certain purpose , you might want to take out a home equity loan.

If you’ll need an indeterminate amount over a few years , you might want to obtain a HELOC.

Recommended Reading: How To Get A Car Loan When Self Employed

Definition Of An Equity Loan

An equity loan is a loan secured by real estate, where the amount of the loan is based upon the equity of the owner.

Equity is the value of the property minus any mortgages against it. If the property is residential real estate, it is referred to a home equity loan. The equity loan will almost always be a second mortgage and will not replace the first mortgage, if any, on the property. This means, in the event of default the first mortgage is paid first. You will typically need equity of at least 20% to qualify for an equity loan.

Example

Mr. McGillicuddy has a house with a fair market value of $500,000. There is a first mortgage against the house with a balance of $100,000. Mr. McGillicuddy has $400,000 in equity in the property. He needs cash but doesnt want to sell the home. Mr. McGillicuddy can take out an equity loan, using the $400,000 as collateral for the loan.An equity loan can be used for a number of purposes, including home renovations, repairs, bill consolidation, or other purposes. Some equity loans are a line of credit, with the borrower using portions of the loan at different times, as needed. This is known as a HELOC, for short.

Want to talk with a mortgage broker about your situation? Contact us anytime!

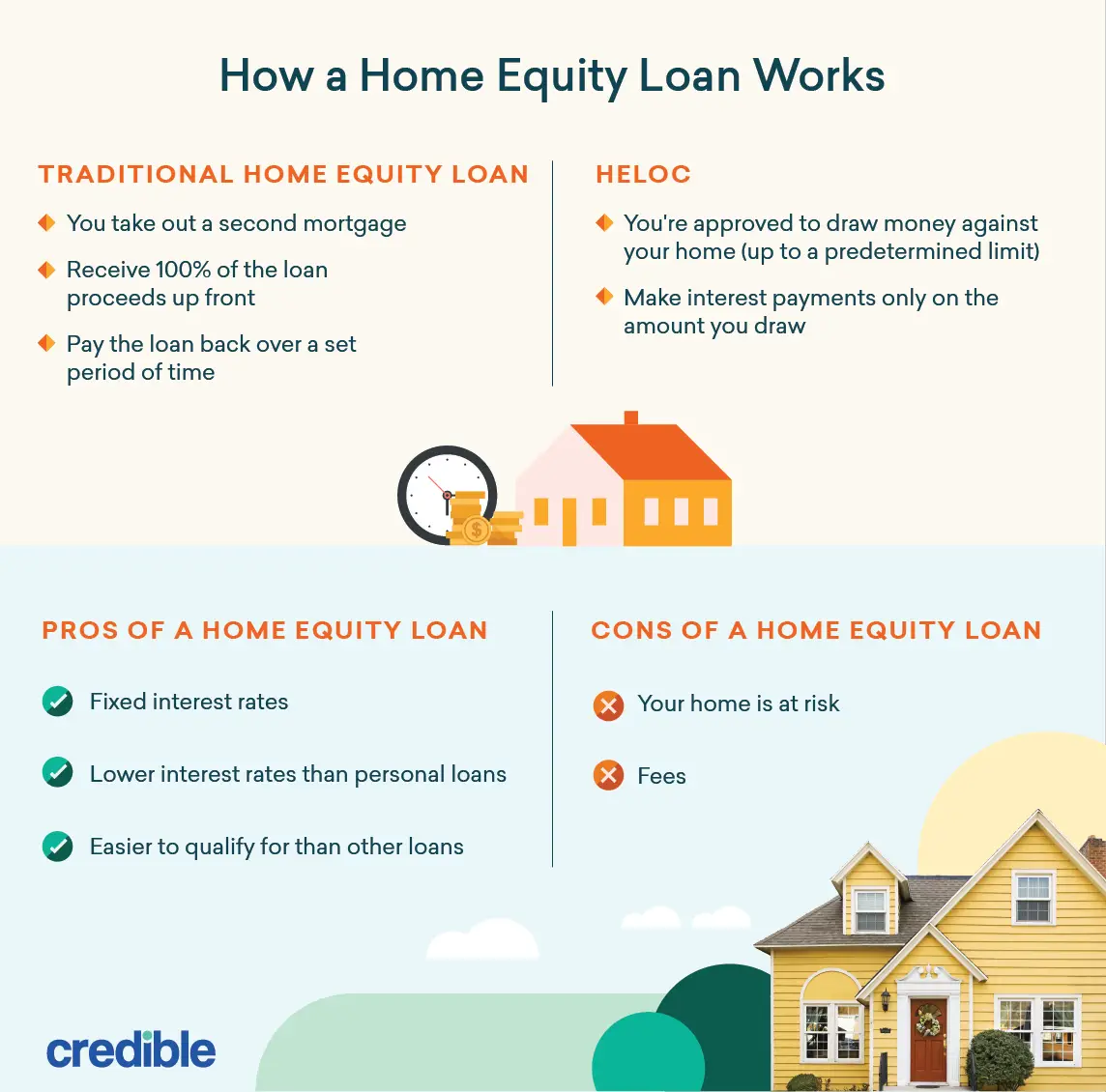

Differences Between Helocs And Home Equity Loans

Many things are set in stone with a home equity loan, such as your interest rate. In a HELOC, however, several factors can change over time. Heres an in-depth guide on a home equity loan versus a home equity line of credit, and we highlight the differences below.

| Home equity loan | Home equity line of credit |

|---|---|

|

|

Don’t Miss: What Percentage Do Loan Officers Make

What Is A Second Mortgage

A second mortgage is any mortgage loan thats subordinate to a first mortgage. Typically, a first mortgage is a loan thats used to purchase the home. First mortgages are usually larger than second mortgages.

The home serves as collateral for a second mortgage. Like a first mortgage, the loan must be repaid over time with interest. So if you have a first mortgage and a second mortgage, youll have two monthly mortgage payments.

If you default on either mortgage loan, the first mortgage lender takes priority over the second mortgage lender for repayment. This means that if the home falls into foreclosure, the first lender would get paid before the second and its possible the second might receive little to nothing at all.

Second mortgages tend to have higher interest rates than first mortgages for that reason. A borrower who now has two mortgage payments to make instead of one presents a greater risk for the lender. So they compensate by charging more in interest to offset the possibility of the borrower defaulting.

If You Have Poor Credit

Home equity loans can be easier to qualify for if you have bad credit, because lenders have a way to manage their risk when your home is securing the loan. Nevertheless, approval is not guaranteed.

Collateral helps, but lendershave to be careful not to lend too much, or they can risk significant losses. It was extremely easy to get approved for first and second mortgages before 2007, but things changed after the housing crisis. Lenders are now evaluating loan applications more carefully.

All mortgage loans typically require extensive documentation, and home equity loans are only approved if you can demonstrate an ability to repay. Lenders are required by law to verify your finances, and you’ll have to provide proof of income, access to tax records, and more. The same legal requirement doesn’t exist for HELOCs, but you’re still very likely to be asked for the same kind of information.

Your credit score directly affects the interest rate you’ll pay. The lower your score, the higher your interest rate is likely to be.

You May Like: How Long Does It Take Prosper To Approve A Loan

How Do I Shop For A Home Equity Loan

Consider contacting your current lender to see what they offer you as a home equity loan. They may be willing to give you a deal on the interest rate or fees. Ask friends and family for recommendations of lenders. Then do some research into the lenders offerings and prepare to negotiate a deal that works best for you. Use the Shopping for a Home Equity Loan Worksheet.

Home Equity Loans: How They Work And How To Use Them

A home equity loan can help you pay off debt or finance a major purchase, but there are also risks to keep in mind like foreclosure if you cant pay on the loan.

Edited byChris JenningsUpdated October 12, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youre a homeowner, you could have access to a form of credit you might not know about: your homes equity.

Home equity loans allow you to borrow money using the equity in your home as collateral, possibly at a lower interest rate than a personal loan. Youll get a lump sum loan that you can use for home renovations, paying down debt, or even to finance your childs college education.

But keep in mind that home equity loans come with their own benefits and drawbacks so they arent right for everyone.

Heres what you should know about home equity loans:

You May Like: Average Interest Rate For Commercial Real Estate Loan

What Cant You Do

- You cant get a home equity loan for more than your house is worth. In fact, your home equity loan amount plus your current mortgage balance generally must be less than 90 percent of your homes value.

- You cant use investment or commercial properties, or manufactured homes to get a Discover Home Loan.

Remember, a home equity loan uses your home as collateral. Make sure youre comfortable financially with the amount you borrow and the terms of the loan. Your Discover Personal Banking Specialist can answer all your questions to help you make the right financial decisions.

Find your low,

Related Article

- Main

-

- Home loans made by Discover Bank.

Calculating Your Home Equity

Home equity is the difference between the market value of your home and what you owe. For example, if the market value of your home is $200,000 and you owe $160,000 on the mortgage, you have $40,000 in home equity. For many lenders, your combined loan-to-value must be at or below 80 percent. CLTV is your home equity loan amount plus your existing mortgage balance, divided by your homes value. Some lenders, like Discover Home Loans, allow you to have a CLTV under 90 percent.

Your home equity typically increases as you pay down your mortgage. Renovations, when chosen and completely wisely, can accelerate home value too. This is often why homeowners take out home equity loans.

Don’t Miss: Bayview Loan Servicing Lawsuit

Disadvantages Of An Equity Loan

Since you will be carrying another mortgage payment on your home, you will have an additional monthly payment. The borrower will have to determine whether they can afford two monthly mortgage payments before obtaining an equity loan.Depending on the size of the loan, the equity in your home will be used until the loan is paid. If you are planning on selling your present home, purchasing a more expensive home, and using your equity as the down payment on the second home, the home equity loan in place may prevent you from doing so.If you are considering such a loan, it is best to sit down and discuss the merits and pitfalls with a mortgage professional at First Foundation, who can help in advising you the best course of action.

Relates Terms

Home Equity Loans Vs Lines Of Credit

You’ve most likely heard the terms “home equity loan” and “home equity line of credit” tossed around and sometimes used interchangeably, but they’re not the same.

You can get a lump sum of cash upfront when you take out a home equity loan and repay it over time with fixed monthly payments. Your interest rate will be set when you borrow and should remain fixed for the life of the loan. Each monthly payment reduces your loan balance and covers some of your interest costs. This is referred to as an “amortizing loan.”

Our loan amortization calculator may help you understand how a home equity loan works.

You don’t receive a lump sum with a home equity line of credit but rather a maximum amount available for you to borrowthe line of creditthat you can borrow from whenever you like. You can take however much you need from that amount. This option effectively allows you to borrow multiple times, similar to a credit card. You can make smaller payments in the early years, but at some point you must start making fully amortizing payments that will eliminate the loan.

A HELOC is a more flexible option, because you always have control over your loan balanceand, by extension, your interest costs. You’ll only pay interest on the amount you actually use from your pool of available money.

Interest rates on HELOCs are typically variable. Your interest charges can change for better or worse over time.

Don’t Miss: Do Private Student Loans Accrue Interest While In School

Home Equity Line Of Credit Definition

A home equity line of credit is a loan that uses your house as collateral. When a lender approves a HELOC, the homeowner is allowed to borrow up to a certain amount against the value of their home, with borrowers able to draw money as they need it and repay it as they can.

Lines of credit are split into two different partsthe draw period and the repayment period. In total, these lines can last up to 20 years, with the first 10 serving as the draw period. Once borrowers draw money against their line of credit, they make monthly payments equal to the amount of interest owed for the month. However, they only pay interest on the amount that theyve drawn against their line. Rates typically start at 2%, plus an underlying index like the prime rate.

In addition to their regular monthly interest payments, a borrower who has drawn money against their line of credit also is able to make payments against their outstanding balance as theyre able. And, as they pay down their outstanding balance, they are able to use their available credit again, just like with a credit card.

At the end of the draw period, HELOCs enter the repayment period, during which loans are repaid over time. In some cases, homeowners also may have the option of converting their outstanding balance to a fixed-rate loan in order to set level monthly payments. However, funds may not be drawn against a line after the draw period ends.