How To Determine Your Federal Student Loan Maximum

The maximum federal student loan amount how much you can borrow as direct subsidized, direct unsubsidized, or direct parent PLUS loans varies depending on your situation as you complete your FAFSA . You can figure out the limit to what you can borrow at a particular time by answering these three questions:

Should You Get Parent Plus Loans

Parent PLUS loans can help some families pay for college, but they wont be right for everyone. First, consider whether you should borrow for your childs education at all.

Consider how adding new student loan payments will affect your finances. If theyd stretch your budget too thin or detract from other important financial goals like retirement, that might be a sign that its wise to reconsider.

If you can afford this new debt, also investigate alternatives to parent PLUS loans. Max out other , such as scholarships, savings, and lower-cost undergraduate federal loans, first.

Private student loans might be a better fit for some borrowers, too. Parents who dont want to shoulder this debt alone, for example, could co-sign a private student loan with their childmaking both family members legally responsible for this debt.

Parent Plus Loans: A Quick Review

We have shown two of the major problems with Parent PLUS Loans, and really its a Catch 22. When parents dont meet Parent PLUS Loan eligibility requirements and are denied, their children suffer by taking on more debt, usually with bad terms.

Parents who do meet Parent PLUS Loan eligibility need to be very careful about taking on too much debt. While the PLUS loan has no limit, parents should not abuse this perk.

Luckily, if parents are struggling to pay back PLUS Loans, a student loan counselor can help explain their repayment options. Sign up for today for more assistance.

Thomas Bright is a longstanding Clearpoint blogger and student loan repayment aficionado who hopes that his writing can simplify complex subjects. When hes not writing, youll find him hiking, running or reading philosophy. You can follow him on .

Don’t Miss: What Is The Commitment Fee On Mortgage Loan

What Are The Eligibility Requirements For A Plus Loan

Plus loan applicants and the student must meet general eligibility requirements for federal student aid.

To qualify, the parent’s child/student must be enrolled full or at least half-time at an eligible school and the parent must meet the credit criteria. The Direct Parent/Plus loan is a loan that a parent takes out on behalf of their child/dependent student. The loan is in a parent’s name and usually requires the applicant to be credit-worthy. A cosigner may be required.

Services are also available online at Direct Lending. They can also be reached by phone at 1-800-557-7394.

Important: If for whatever reason a Direct Parent/Plus loan is denied, the student should contact his/her college financial aid office for additional information and instructions.

Can You Increase A Parent Plus Loan

Parent Plus Loan request can only be requested from the parent who was approved on the Plus Loan application. If you have an approved endorser on your application then the increase request would have to be done at www.studentloans.gov. Increase amount request will be approved by the financial aid office.

Don’t Miss: Usaa Used Auto Loan Rates

What Occurs During Parent Plus Processing

- Once the loan application has been completed, the servicer performs a .

- The servicer notifies the parent of acceptance or rejection of the loan.

- If the loan is approved, funds are sent directly to MSU and applied against the student’s bill.

- Any PLUS funds that exceed MSU charges are given as a refund by the Student Accounts division of the Controller’s Office.

Two Versions Of The Federal Plus Loan

There are two versions of the Federal PLUS Loan: the Federal Parent PLUS Loan and the Federal Grad PLUS Loan.

Other than the differences in the borrower, the purpose of the loan and some discharge provisions, the Parent PLUS and Grad PLUS loans are nearly identical. The Federal Grad PLUS Loan first became available on July 1, 2006, through an amendment to the Federal Parent PLUS Loan.

You May Like: Can You Refinance An Fha Loan

Newsa Catastrophe Is Looming For Us Colleges This Analysis Shows Just How Bad It Is

I don’t think these loans should be presented with the financial aid offer at all, said Amy Laitinen, director for higher education at New America. I think it speaks more to the schools desire to bring in the students than to whats best for the family. To present it as if its really a way for paying for college when theres no way for those parents to pay it back is shameful and harmful.

In 2011, the Obama administration set restrictions on who could borrow through the Plus program, imposing credit and income requirements. But an outcry from colleges caused the administration to reverse course the following year, making it even easier for parents to borrow.

Related: Universities that boost the poorest students to wealth are becoming harder to afford

Critics compare the governments loans to those given out by banks to people who couldnt afford to repay in the lead-up to the 2008 financial crisis. Unlike student loans, parent loans offer no easy option for an income-based repayment plan. If a parent defaults, the federal government can garnish wages and Social Security checks to force repayment.

Rep. Marcia Fudge, D-Ohio, introduced a bill last year that would cap Parent Plus interest rates, allow for income-based repayment plans and mandate counseling for all borrowers, but it has been stuck in committee. Biden has not announced any plans regarding the program.

Sign up for The Hechinger Report’s higher education newsletter.

Problem #: Strict Parent Plus Loan Eligibility Requirements

Parent PLUS loan eligibility requirements are strict, and students may be forced to seek private loans when their parents are denied.

To meet Parent PLUS loan eligibility requirements, a borrower must be the parent of a dependent undergraduate student who is enrolled at least half-time at a qualifying school, and the borrower must pass a credit check without being deemed to have adverse credit. Read here for the full definition of adverse credit along with more information about Parent PLUS Loan eligibility.

Recommended Reading: What Type Of Loan Do I Need To Buy Land

Have Your Student Record His/her Eaward Decision

Have your student access hi/her financial aid information from myCU.

- Select the aid year that you wish to review at the ‘Select an Award Year’ field.

- NOTE: All the steps on the checklist prior to this must be completed first.

- Review the direct loans that are part of your financial aid package and record your decision.

- NOTE: For the Parent PLUS loan, be sure to have the borrowing parent complete step #5 in order for the Parent PLUS loan to reflect the desired amount and term on your Self-Service Financial Aid account.

- After you Accept or Decline the loan, you will be able to see the immediate changes in your eAward.

- NOTE: If, at a later date, you change your mind regarding an Accepted or Declined loan, you CANNOT change it in your Self-Service account. To change the loan status OR amount, please review our FAQ on Loans page for further instructions.

General Eligibility & Citizenship Status Requirements For A Direct Plus Loan

All PLUS applicants, including the dependent student in the case of a Parent PLUS Loan, must be a U.S. citizen or eligible noncitizen, must not be in default on any federal education loans or owe a repayment on a federal education grant, and must meet other general eligibility requirements for Federal Student Aid programs. You can find more information about these requirements including a list of eligible noncitizen statuses Federal Student Aid.

Recommended Reading: How To Get Loan Officer License In California

Youre Helping Your Child Pay For Grad School

Maybe your student is headed for graduate school, med school, law school or another professional program. If you want to help them pay for graduate school, private student loans will be your only option to do so.

The federal parent PLUS loan is available only to parents of undergraduate students. If you want to borrow to help pay for your childs advanced degree, private student loans are the way to go.

Like undergraduate students, however, graduate students might have access to federal aid and student loans that are a better deal. Talk through all the borrowing options with your graduate student to find the best and most affordable way to finance their degree.

Apply For A Parent Plus Loan For The Current School Year

- Go to studentaid.gov Click on the Log In button.

- Sign in using your FSA ID

- Select APPLY FOR AID then select Apply for a Parent PLUS Loan

- Please note if more than one parent wishes to borrow PLUS loan funds, each parent must apply for their own FSA ID, complete their own PLUS application and MPN.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

How Does Repayment Work

When applying for a Parent PLUS Loan, you can request a deferment while your child is in school. In this case, you won’t have to start making loan payments until they leave school, graduate, or drop below half-time enrollment.

However, it’s important to mention that you need to request a deferment if this is what you want. Otherwise, you’ll be responsible for making payments as soon as the loan is fully disbursed.

Parent PLUS Loan borrowers can choose from the standard repayment plan, the graduated repayment plan , or the extended repayment plan . Generally speaking, Parent PLUS Loans aren’t eligible for income-driven repayment plans, but the exception is that if you consolidate the loans into a Direct Consolidation Loan, they could be eligible for the Income-Contingent Repayment plan, which limits the monthly payment to a certain percentage of your discretionary income.

If you’re having trouble repaying a Parent PLUS Loan, you may be able to request a deferment or forbearance to temporarily reduce or stop your loan payments.

Parent Plus Loan Repayment Options

Borrowers who are part of the Parent PLUS program are expected to begin repaying the loan as soon as the loan is fully disbursed, unless they request a deferment, which most parents do.

The deferment means you will not have to make payments while your child is enrolled at least half-time. When the child graduates, leaves school or drops below half-time, the deferment gives you a six-month grace period, after which you must begin making payments on the PLUS loan.

You should be aware that interest will accrue on the loan during the time you are not required to make payments. You can choose to pay the accrued interest or have it added to your loan principle balance when you start making payments.

Parent PLUS borrowers can choose from four repayment options.

Read Also: How To Transfer Car Loan To Another Person

Time Limits For Loans

Since 2013, Direct Loan statutory requirements have limited a first-time borrowers eligibility for Direct Subsidized Loans to a period not to exceed 150% of the length of the borrowers educational program. In addition, under certain conditions, the requirements have caused first-time borrowers who have met or exceeded the 150% limit to lose the interest subsidy on their Direct Subsidized Loans. The FAFSA Simplification Act, part of the Consolidated Appropriations Act, 2021 provides for a repeal of the 150% Subsidized Usage Limit Applies requirements.

Federal loan servicers will retroactively apply subsidy benefits to any period of time, such as an in-school deferment, during which a borrower would have been entitled to subsidy benefits. This may include removing accrued interest and reapplying payments, where appropriate.

Contact yourFederal Loan Servicerwith questions regarding your subsidized loan eligibility.

To Receive Your Parent Plus Loan:

Recommended Reading: Chfa Loan Colorado

What Happens To My Parent Plus Loan When I Retire

(Technically the Parent PLUS loan is eligible for public service loan forgiveness. However, Parent PLUS loans are not eligible for income-based repayment or income-contingent repayment. That leaves just standard ten-year repayment or the equivalent available for use with public service loan forgiveness.

Can I Claim My Parent Plus Loan On My Taxes

Yes you can claim the interest. This deduction lets you claim up to $2,500 of interest you paid on qualifying student loans. If you are a parent and the loan is in your childs name, then you cant deduct the interest on your tax return even if your child is your dependent on your tax return.

You May Like: Does Va Loan Work For Manufactured Homes

Parent Plus Loan Denied

Parent PLUS loans are easy to get if you have had a good credit history, but if there are a few bumps in your financial road, your request can be denied.

Then what? Try using one of the detours.

The easiest way out of trouble is to find someone with good credit who will co-sign the loan. Its also the hardest thing to ask because that person has to assume responsibility for paying back the money if you stumble financially.

To include a co-signer, the applicant needs to complete the Electronic Endorsement Addendum section of the loan application. In addition, the parent must complete PLUS credit counseling and sign a PLUS master promissory note.

You also can appeal the rejection, a step that involves providing documentation of an extenuating circumstances that led to the denial. In addition to filing the appeal, the parent or parents need to complete PLUS credit counseling.

Its possible only one parent has a bad credit rating, in which case, the other parent could apply solo for the loan.

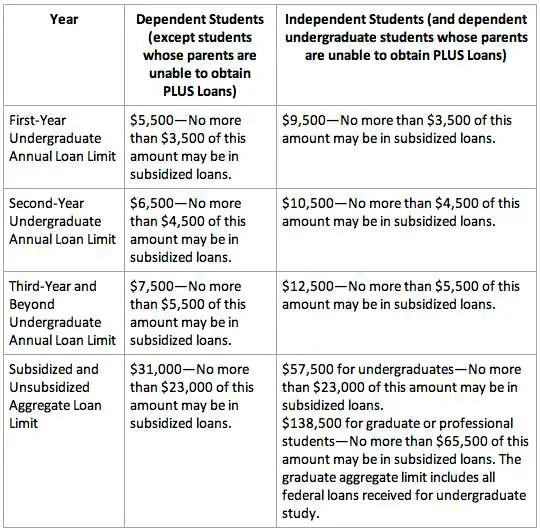

Finally, the student whose parents were rejected can apply for a Federal Direct Unsubsidized Stafford Loan. Under that plan, the student can borrow $4,000 to $5,000 annually, and up to $26,500 in pursuit of a degree. These are the same limits available to independent students.

7 Minute Read

If Your Plus Loan Request Is Denied

There are three possible courses of action:

Note: the maximum amount of additional unsubsidized loans is up to $4,000 per year for students with fewer than 90 earned credit hours, and up to $5,000 per year for students with 90 or more earned credit hours.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Parent Plus Loan Application

You, as the parent, will not need to complete the Direct PLUS loan application. You will need to log into Student.Aid.gov with your FSA ID.

Complete the Direct PLUS loan application. You will need to identify how much you would like to borrow, and authorize a credit check. The U.S. Department of Education will then conduct a credit check to determine if you have adverse credit. If you are determined to have adverse credit, you can then:

- file an extenuating circumstances appeal, or

- apply with a cosigner.

Taking Out A Parent Plus Loan Read These 6 Pros And Cons First

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

OUR PROMISE TO YOU: Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

You May Like: What Credit Score Is Needed For Usaa Auto Loan