Pros Of Reverse Mortgages

The benefits of a reverse mortgage include:

- There are no debt-to-income ratio or income requirements

- You can use it to pay off your first mortgage

- You can use it to purchase a home

- You dont have to make monthly payments unless you move out

- It prevents your heirs from inheriting an underwater mortgage

- The IRS does not tax income your receive from your reverse mortgage payouts

What Can I Use A Family Loan For

This type of loan is suitable for you if your family relationships are strong. Credit is a very complex thing. This can jeopardize your relationship with the lender and their finances. Success requires clear communication and perhaps even a written agreement with detailed loan terms.

Having a notarized and signed agreement with a family member can seem impersonal. But having such a document can prevent misunderstanding and disappointment. Be sure to include both parties in the decision-making process.

It may contain the amount of the credit and how it will be used, all repayment terms, frequency and terms, as well as the interest rate and the ability to repay it ahead of schedule without penalties. As well as conditions for lending in emergency situations.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: What Is The Lowest Auto Loan Interest Rate

Top 10 Different Types Of Mortgage Loans

Are you thinking about purchasing a home? If so, its important to know about all of the different types of mortgage loans that are available to you. Well share the top 10 different types of mortgage loans, and discuss the pros and cons of each one so you can make the best decision for your family and your future. With so many choices, it can be difficult to know which one is the best fit for your needs. Does one provide better value than the others? What about loan terms, interest rates, and other points of comparison? In todays post, were going to break down all the details you need to know.

Government Insured Vs Conventional Loans

As explained above, you will have decided between a fixed rate and an adjustable rate mortgage type. Once you have made that decision, there are additional options to consider. You will need to determine whether you prefer a government insured home loan or conventional type of loan.

A conventional loan is not insured or guaranteed by the government at all. This is how it is distinguished between the different types of home loans that are backed by the government. You do not have to have perfect credit to become eligible for a conventional loan. Conventional loans offer 3% down to compete with FHA for primary residences. The three types of government insured loans are as follows

Also Check: How To Cancel My Student Loan Debt

What Is A Family Loan

A family loan can be an inexpensive and safer option than other forms of loans. The money can be spent on a down payment on a house, to start a business, or to pay off high-interest debts. Nevertheless, this is not just a gift that you make to your relative.

It is a serious procedure that requires the signature of documents and responsibility. You cannot decide what interest rate the loan will have. Everything is controlled by law.

Moreover, if the credit amount exceeds $10,000 or the lending recipient uses the money to generate income , you must report interest income on your tax return.

Buying A Home Is A Big Decision One That Will Affect The Rest Of Your Life This Leaves Many First

What are the different types of home loans available and what are the pros and cons to each? As you prepare to become a home owner, working closely with a trusted lending company can help make the home loan process stress-free. Consider your options and look at the fine details to ensure you are making the right home loan choice.

Recommended Reading: Can You Get An Auto Loan After Bankruptcy

What Else Should I Think About Before I Take Out A Mortgage

Youll need to consider more than just your loan type when youre shopping for a mortgage.

Your loan term is an important factor as well. Loans typically range from 15- to 20- and 30-year terms but other lengths may be available depending on your lender.

Keep in mind that shorter-term loans tend to have higher monthly payments , but you can save thousands in interest over the life of the loan. Another consideration is that interest rates on shorter-term loans may be lower.

Depending on your situation, you may also consider a specialty loan like a construction loan or home renovation loan. Construction loansare generally short-term loans used to finance the building of a new house, or renovating an existing one, then convert to a traditional mortgage once the build phase is complete. A home renovation loan, like Fannie Maes HomeStyle® Renovation Mortgage, allows you to borrow enough money to buy a home and fix it up before you move in.

Different Types Of Home Loans: Which One Is Right For You

If youre a first-time home buyer shopping for a home, odds are you should be shopping for mortgage loans as welland these days, its by no means a one-mortgage-fits-all model. Youll want to get and understanding of all the basics, with mortgage 101.

Where you live, how long you plan to stay put, and other variables can make certain mortgage loans better suited to a home buyers circumstances and loan amount. Choosing wisely between them could save you a bundle on your down payment, fees, and interest.

Many types of house loans exist: conventional loans, FHA loans, VA loans, fixed-rate loans, adjustable-rate mortgages, jumbo loans, and more. Each mortgage loan may require certain down payments or specify standards for loan amount, mortgage insurance, and interest.

Read Also: How Much Is My Car Loan

Research The Different Types Of Mortgage Loans

As you can see, there are many different types of mortgage loans available! To figure out which one is right for you, speak to your financial advisor or a trusted real estate agent. There are many factors to consider, including your budget, goals, and plans for the future.

As you browse available options, were here to help you find the Triangle home of your dreams. Take a look at our available properties today and contact us to connect!

Additional Resources:

/3 And 3/1 Hybrid Arms

Mortgages where the monthly payment and interest rate remains the same for 3 years are called 3/3 and 3/1 ARMs. At the beginning of the 4th year, the interest rate is changed every three years. That is 3 years for the 3/3 ARM and each year for the 3/1 ARM. This is the type of mortgage that is good for those considering an adjustable rate at the three-year mark.

Also Check: How To Cancel Your Student Loan

The 7 Most Popular Types Of Mortgage Loans For Home Buyers

We look at the most popular loan options for home buyers and their respective pros and cons

There are several types of mortgage loans that appeal to a wide range of borrowers with unique housing needs and financial situations.

This list provides an overview of interest rates, qualified borrowers, advantages, and potential drawbacks for each loan type.

Why Homebuyers Use This Type Of Loan

- Interest rates are usually lower than for fixed-rate loansat least at the start of the loan.

- Some homebuyers use ARMs to keep their payments lower near the beginning of the loan. This can work in their favor if they plan to resell or refinance the home, especially before the ARM’s first-rate adjustment.

You May Like: How Long Has Loan Depot Been In Business

The Bottom Line: The Best Type Of Home Loan For You Is The One You Can Afford

As you can see, there are many different varieties of home loans to pick from. Different mortgage types work best for different types of home buyers. Understanding which makes the most sense for your or your family will largely be a function of your individual financial situation, working scenario, and personal real estate goals.

Interested in shopping for a new home? Youll want to apply now with Rocket Mortgage® and start exploring your options today! Home mortgage specialists are standing by to help you determine the best choice of home loan option for your needs.

Get approved to buy a home.

Fixed Rate Mortgage Fees

Along with the risk that a mortgagor would still have to pay the higher rate of repayments if interest rates were to fall, there are additional costs associated with a fixed rate mortgage.

These include a loan establishment fee or application fee, which is a one-off upfront cost to establish your loan and cover valuations or a banks legal fees a rate lock fee, which is a fee to lock in the rate from the start of your application to your first repayment and break fees or exit fees when choosing to refinance.

Read Also: How To Take Out Equity Loan

Fixed Vs Variable Home Loan

A fixed-rate loan is one that allows you to lock-in the current interest rate at the time of settlement. This means that the lender can not make any adjustments to the interest rate, whether it be up or down. Depending on your situation and needs, you may want to fix a rate for up to 5 years, although the lifetime of the loan itself may be 25 or 30 years.

Though some people might like the security of knowing exactly how much their repayments will be, they might lose out on falling interest rates as the market changes.

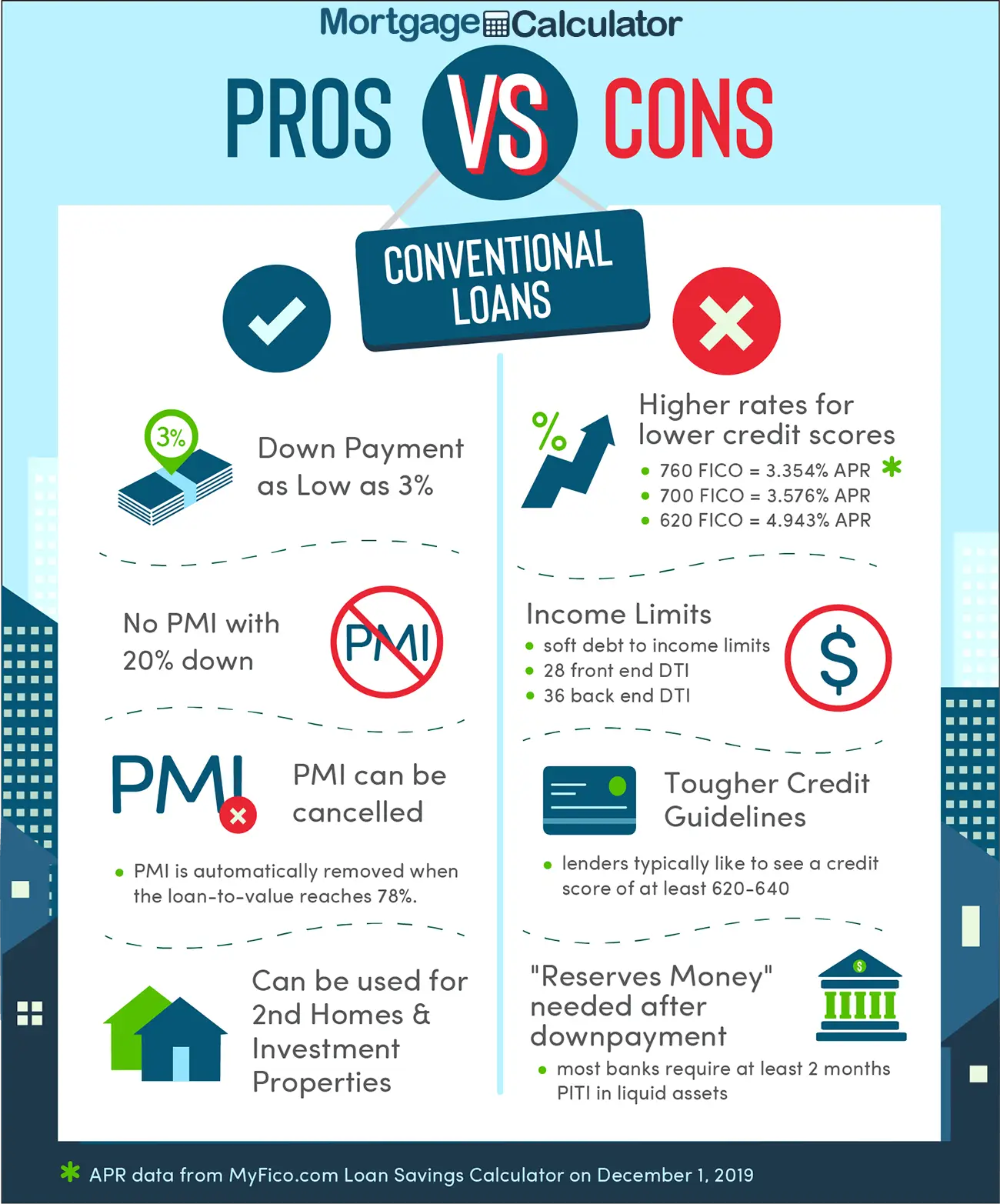

# : Conventional Mortgage Loan

Conventional loans are the most popular home loan because they are less restrictive, there are a fewer number of required fees, and fewer terms to qualify. Conventional home loans are not backed by the federal government like the other loan types we will cover. Instead, conventional loans follow guidelines set by two private agencies, Freddie Mac and Fannie Mae.

Benefits of a Conventional Loan: Home buyers will typically receive a lower interest rate due to the credit score and down payment minimums. Unlike an FHA loan and USDA loan, you do not pay any upfront funding fees. If your down payment is 20% or more, you will not pay Private Mortgage Insurance .

Disadvantages of a Conventional Loan: Generally requires a credit score of 620 or higher. A conventional loan typically requires a minimum 10% down payment. Some lenders will require a minimum of 20% down payment to qualify.*

*Some conventional loans are available with a down payment of only 3%

Also to keep in mind, conventional loans typically come with 30-year or 15-year duration term. There are also two main types of conventional loans: adjustable-rate mortgage and a fixed-rate mortgage.

Adjustable-Rate Mortgage

After the fixed-rate period ends your interest rate will adjust based on the current market interest rate. This means your interest rate could increase, or go down, based on the overall financial market. Either way, the rate will continue to adjust based on a schedule predetermined in your loan agreement.

Recommended Reading: What Credit Score Do You Need For Avant Loan

How To Apply For A Fixed Rate Home Loan

What Types Of Mortgage Loans Are There

If youre a first-time home buyer shopping for a home, odds are you should be shopping for mortgage loans as well. In these days, its by no means a one-mortgage-fits-all model. Youll want to get and understanding of all the basics, and compare all types of mortgage loans with our mortgage 101.

Where you live, how long you plan to stay put, and other variables can make certain mortgage loans better suited to a home buyers circumstances and loan amount. Choosing wisely between them could save you a bundle on your down payment, fees, and interest.

Many types of house loans exist: conventional loans, FHA loans, VA loans, fixed-rate loans, adjustable-rate mortgages, jumbo loans, and more. Each mortgage loan may require certain down payments or specify standards for loan amount, mortgage insurance, and interest.

Recommended Reading: What Does Unsubsidized Student Loan Mean

Different Types Of Home Loans Explained

If youve found the process of choosing the right type of home loan that fits your personal needs and budget to be difficult, knowing the difference between each type can help. Visiting with a Galaxy Lending Group lender about the different options available to new home buyers, as well as becoming informed about the types of home loans available can help make your home-buying dream a reality.

Fannie Mae Homestyle Loan

For fixer-upper fans, an alternative is the Fannie Mae HomeStyle Loan, which requires only 3% to 5% down but a minimum credit score of 620.

Pros: No upfront MIP is required, and you may cancel mortgage insurance after 12 years or once you reach 20% home equity. The rate is often lower than that of an FHA 203.

Con: You must meet credit score thresholds.

Don’t Miss: Can I Refinance My Sofi Personal Loan

Your Guide To The Different Mortgage Loan Products Available To Borrowers

When shopping for a home loan, its easy to get overwhelmed by the lingo and types of mortgage products available to you. Learn more about the most common mortgages and see if you are eligible for any of the specialty mortgage types listed below.

Other Considerations: Variable Vs Fixed Rate Loans

This is a key question youll need to consider regardless of the loan type you pick. Most of the loan options above are available either as fixed-rate or variable-rate loans.

If you choose a fixed-rate mortgage, your interest rate is set when you take out the loan and wont change when interest rates go up or down. This means your monthly payments will stay steady for the life of the loan.

With a variable-rate loan, also known as an adjustable-rate mortgage, your interest rate may go up or down depending on market conditions. Adjustable-rate mortgages typically start with a lower interest rate than a fixed-rate loan but will change after a certain number of years. If interest rates go up, so will your monthly payment.

How to choose? Fixed-rate loans are lower risk over the term of the loan and offer more certainty, even though the initial interest rate tends to be higher. Variable-rate loans can be a good option for people who know theyll be moving before the introductory period of their loan ends. Historically, about 75% of home buyers choose a fixed-rate loan, according to the Consumer Financial Protection Bureau.

Read Also: How To Get Approved For Home Loan With Low Income

What Can I Use A Small Business Loan For

A small business loan gives you access to money that you can invest in your business. Funds can be used for a variety of purposes, for example, in working capital or improving business processes, repair of equipment, technology and personnel, acquisition of a business, purchase of real estate, and much more.

When a bank evaluates whether you qualify for a loan and how much debt your business can afford, they look at different factors such as the state of your business, available collateral, your cash flow, and your character.

Depending on which type of borrowing product you are applying for, requirements and conditions may vary. So make sure you understand your lenders terms and conditions in order to meet his requirements.

The Benefits Of A Fixed Rate Home Loan

Along with the certainty of the price of repayments, fixed rate home loans protect the mortgagor from any sudden increases in interest rates by the RBA. These interest rate increases have been especially prevalent as of late, as the central bank looks to curb inflation.

While those with fixed rates are not feeling the pressure from the recent increases, those with a different type of home loan would be. And this could mean they end up entering mortgage stress territory.

However, the opposite is also true. If the RBA were to lower interest rates, those with a fixed rate home loan would still be required to pay their fixed rate of monthly repayments until the loan period concluded. Those with variable rates would benefit, as their rates would change alongside the RBAs movement of the cash rate.

Also Check: Does Student Loan Interest Accrue Monthly

What Types Of Home Loans Are There

Written by Elise Loan Tucson on April 24, 2020. Posted in Home Loan.

Buying a new home can be the most exciting purchase you will ever make. Whether its your first home as a newlywed couple or the long-awaited dream home where you intend to enjoy retirement, understanding what types of home loans are available, will save you stress in the long run!

Oftentimes factors such as credit score and income play a large part in what you can afford. Rest assured there is a loan out there for you, regardless of your circumstances! Lets look at a few of the main types of home loans to help you better understand your options. Know what loans are available to you, and how they work. This will set you up for success in choosing which home loan you can afford.