Finding Your Loan Information

If you are unsure which agency is servicing your defaulted student loan, you may retrieve your loan information from the National Student Loan Data System . This system contains financial aid information collected from schools, agencies, and other educational institutions. You will need your Federal Student Aid ID information to access your account. Or, you may contact the Federal Student Aid Information Center .

Fixed Vs Floating Interest Rates

You can request to have a fixed interest rate. You can only make this change once. Contact the NSLSC or the Alberta Student Aid Service Centre for more information.

|

CIBC prime rate plus 2% |

Prime rate of Canadian banks plus 2% |

To compare the cost of choosing floating and fixed rates, use the Government of Canadas loan repayment estimator.

Federal Student Loan Fees

When you are approved for a direct federal loan, you may be surprised to learn that you won’t receive the full amount. The reason is that you must pay a loan fee of (1.057% for Direct Subsidized and Direct Unsubsidized, and 4.228% for Direct PLUS loans issued between Oct. 1, 2020, and Oct. 1, 2022, which is taken out of your loan principal. However, you still have to pay interest on the full principal even though you don’t actually get that amount.

For example, someone with a $7,500 loan and a 1.057% loan origination fee would receive $7,420.73. But they are still responsible to pay the full $7,500 when it comes time for repayment.

Be aware that, in response to the COVID-19 pandemic, there is 0% interest and a suspension of payments from March 13, 2020, through Jan. 31, 2022.

Recommended Reading: Refinance Car Usaa

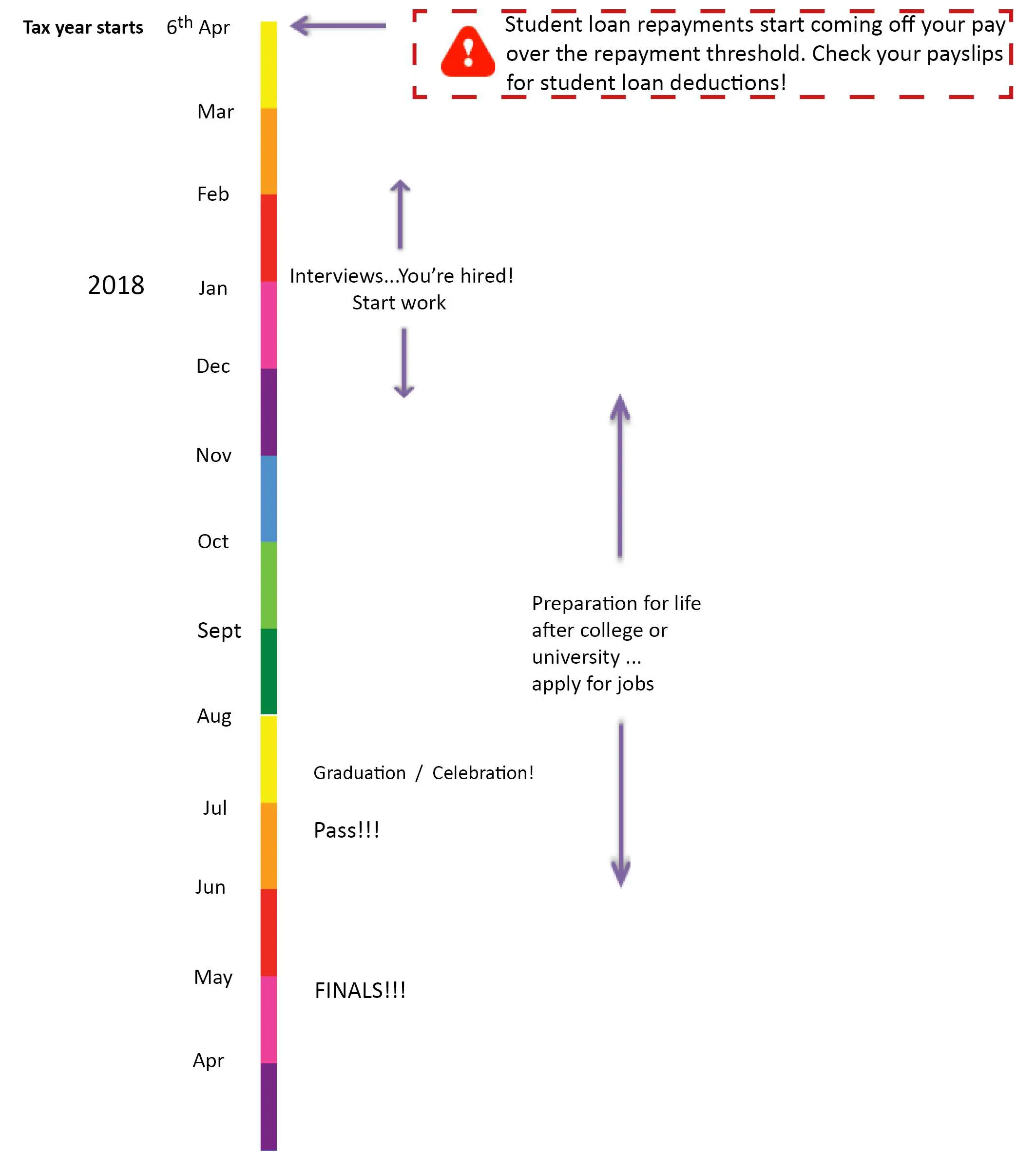

How And When Do I Repay

- Full-time courses youll be due to start repaying the April after you finish or leave your course, but only if you’re earning over the repayment threshold. For example, if you graduate in June 2021, youll be due to start repaying in April 2022, if you’re earning enough.

- Part-time courses youll be due to start repaying the April four years after the start of your course, or the April after you finish or leave your course, whichever comes first, but only if you’re earning over the repayment threshold.

How you’ll repay depends on what you choose to do after your course:

- If you start work, your employer will automatically take 9% of your income above the threshold from your salary, along with tax and National Insurance.

- If you’re self-employed, youll make repayments at the same time as you pay tax through self-assessment.

- If you move overseas, youll repay directly to the Student Loans Company, instead of having it taken automatically from your pay. The repayment threshold could be different from the UK, which means the amount you repay could be different. Find out more about repaying from overseas.

Can I Start Paying On A College Loan Before Graduation

Question: I was wondering if I can start paying off a student loan before graduation? My daughter is currently a college junior and has a student loan. Id like to begin paying on the loan before she graduates. Any information would be helpful.

Paying on student loans before college graduation is a great idea. This will help to eliminate her student loan debt total and lighten the financial impact of paying for student loans after graduation.

Unfortunately, many students do not take these payments into account when planning their post-grad, new-career professional budget. Some students are shocked at the monthly payment totals of their repayment plans.

If she has any federal student loans via the Direct Loan Program, she will have a grace period before shell be required to begin paying back her loan balance. According to StudentAid.Gov, this grace period is generally six months. For a Perkins loan, the grace period is nine months.

Why Paying Back Your Federal Student Loans Before Graduation Is a Good Idea

The sooner you can begin to pay back these loans the better. While the Federal Direct Loans have a fixed rate , you can begin to tackle repayment earlier. This will cut your overall loan cost, and help you pay off your loan faster.

There are many reasons why beginning to pay back your student loans before graduation is a good idea.

There is no penalty for pre-paying these loans. You wont face any extra charges for starting your repayment before you graduate college.

You May Like: Drb Vs Sofi

Commonbond Private Student Loan

CommonBond student loans seek to make the private student loan process easy and affordable. The lender offers undergraduate, graduate, MBA, dental and medical loans. Applicants and their cosigner can apply on any device, and the application process takes a few minutes to complete. There are no application, origination, or prepayment fees associated with the loan. CommonBond offers flexible repayment options and terms, and also has a six-month grace period with a 12-month payment postponement option, making this one of the best private loans for students. Borrowers can apply to release their cosigner after two years of on-time payments.

The minimum credit score for applicants is 660. The interest rate for loans with a fixed APR range from 3.99% to 12.78% and the APR for variable rate loans is 4.13% to 9.64%.

Look Into Other Deferment Or Forbearance Options

If an income-driven repayment plan is not affordable, you can potentially request a different type of forbearance or deferment after this forbearance period, says Ferastoaru. Additional deferment and forbearance outside of COVID-19 relief can give you more time to get back on your feet, but should be a last resort.

For example, theres unemployment deferment, which temporarily suspends payments on your student loans. It covers your interest for subsidized student loans, but not unsubsidized loans, and is limited to three years.

Theres also economic hardship deferment, which is similar to unemployment deferment, except you have to receive federal or state public assistance, earn below 150% of the federal poverty line, and work at least 30 hours per week to qualify. The last option is applying for federal forbearance, which can last up to three years. But unlike a deferment, the government wont cover any of the interest on your loan.

You May Like: Usaa Auto Refinance

Know How To Make Student Loan Payments

Your lender will likely work through a student loan servicer that youll pay directly. You can manually pay your loans online or with a check, like any other bill. But autopay is especially beneficial for student loans because youll usually receive an interest rate discount of one-quarter of a percentage point for signing up.

Autopay lets your servicer debit the monthly payment from your checking account automatically. By enrolling in autopay, you wont forget to make a payment and fall behind by accident. Just make sure theres enough money in your checking account each month to avoid overdraft fees.

You have to repay your loans even if you dont receive a bill. Because you likely moved after finishing school, check that your servicer has up-to-date address and contact information.

The federal government employs several student loan servicers, including FedLoan, Navient and Nelnet. If youre not sure who services your loans, you can find out by using the governments central student loan database, the National Student Loan Data System.

» MORE:How to switch student loan servicers

Why Take A Semester Off

Students take a semester off for a variety of reasons.

“Many students take an academic term off to work full-time for a short period to earn money to pay for the next phase of their education,” said Anita Thomas, senior vice president of Edvisors, a website that provides information and advice on financial aid for students and their parents.

Other reasons might include extreme stress or illness, taking time off to travel or helping care for a sick family member. Whatever the reason, it’s important to consider the effect taking a semester off will have on your student loans.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Talk To Your Loan Servicer

You dont have to contact your student loan servicer or take any specific action to temporarily suspend your payments, but its important to check in with your servicer, as well as check your mail or email for up-to-date information about your loans and the forbearance period. Make sure your address and email is up-to-date in your online portal. Your loan servicer should always be your go-to resource for any specific concerns or questions.

Start Paying Student Loans Early To Save Money

You pay more interest at the beginning of your repayment term than you do later on. If you want to limit the amount you repay, committing to certain strategies when you start paying student loans can maximize your savings.

-

Make extra payments. You can pay student loans off faster by making larger automatic payments or biweekly payments. By paying half the amount you owe every two weeks, youll make 13 full payments by the end of the year, rather than 12. Or you can make a full extra payment every two weeks and conquer your loans in half the time.

-

Refinance at a lower interest rate. Once you have a solid income, refinancing can save you money. To get the best interest rate, you or a co-signer will need solid income and a credit score in at least the high 600s. Theres little downside to refinancing private student loans. You can also refinance federal student loans, but it will cost you benefits such as income-driven repayment and loan forgiveness. Youll want to be comfortable giving these up.

» MORE:When to refinance student loans

Read Also: Va Loan Requirements For Mobile Homes

Talk To Your Servicer Or Lender

Thomas from Edvisors recommends that students communicate with their servicer or lender, notifying them when they drop below half-time status and when they anticipate returning to school at least half-time.

Borrowers with federal student loans who “are planning to re-enroll need to do so before the grace period expires,” Thomas said, “and they will need to communicate with the servicer to confirm their attendance to preserve their grace period for the future.”

If your grace period is coming to an end but you need more time, call your servicer or lender right away to ask about your options. You may be eligible to postpone your student loan payments, but keep in mind this will add to the overall cost of your loan. It’s important that you discuss your options sooner rather than later to avoid missing a payment.

What Kind Of Student Loan Do You Have

When you will need to start paying back your student loans depends on what type of loan you have.

There are two main types of student loans that you can take out:

- private student loans, and

- businesses, and

- the school youre attending.

The terms of the loan are set by the lender themselves, and there can be lots of variation between different loan providers.

Private loans can have either variable or fixed interest rates, so your interest rate can be dependent on your, your parents, or any other co-signers credit score. This also determines what kind of interest rate you will have over the long term.

- If you go with a fixed rate, the rate will not change over the course of the loan. Whatever rate you started with is the rate youll finish with.

- If you choose a variable rate, it can change over the course of your loan. You could start your loan with a 3% rate and be paying 13% a few years later.

They usually have a set repayment term, anywhere from 5-20 years. Private loans are not eligible for student loan forgiveness programs, and are also not eligible for any government-backed repayment programs that are designed to lower your monthly costs. They also accrue interest while youre in school, and some even require payment while youre still in school.

A private student loan can also be refinanced later. So you could try to get a lower interest rate, depending on your credit score, salary, and other factors.

Also Check: What Car Loan Can I Afford Calculator

College Ave Private Student Loan

College Avenue private student loans make the loan process easy with a simple, 3-minute application process with an instant decision. Borrowers can pick how long they want to take to repay the loan with choices that range from five to 15 years. Students can take out a loan that covers all of their attendance costs including fees, tuition, housing, books, and other related costs. Loan products include

- Undergraduate

- Health professions

- Refinancing

There are no application, origination, or disbursement fees associated with the loan. Interest rates for fixed APR loans range from 2.99% to 12.99% and 0.99% to 11.98% for variable APR loans. The minimum credit score for applicants is in the mid-600s.

History Of The Student Loan Payment Pause And Interest Waiver

Senator Chuck Schumer sent a letter to President Trump on March 11, 2020, urging the President to declare a national emergency under the Robert T. Stafford Disaster Relief and Emergency Assistance Act and to provide a six-month forbearance for federal student loans.

The President responded by declaring a national emergency on March 13, 2020. He also said that he would suspend repayment and waive the interest on all student loans held by federal government agencies for at least 60 days. On March 20, 2020, Secretary DeVos issued a press release announcing implementation of this policy.

After President Trump announced the payment pause and interest waiver on March 13, 2020, Congress enacted a six-month payment pause and interest waiver as part of the CARES Act on March 27, 2020. The payment pause and interest waiver was set to expire on September 30, 2020.

On August 8, 2020, President Trump signed a memorandum ordering Secretary DeVos to extend the payment pause and interest waiver through December 31, 2020. Secretary DeVos implemented the extension on August 21, 2020.

On December 4, 2020, Secretary DeVos announced an extension the payment pause and interest waiver through January 31, 2021.

On January 20, 2021, his first day as president, President Biden further extended the payment pause and interest waiver through September 30, 2021.

Also Check: Patelco Refinance Auto Loan

Your Renewable Help Balance And Re

Your HELP balance is renewable. Starting from the 2019-20 income year, any compulsory or voluntary HELP or VSL repayments made will top up a person’s HELP balance. These repayments will be applied to a person’s HELP balance after they have completed their 2019-20 tax return and been issued with a notice of assessment from the ATO. Repayments can be re-borrowed in the future, up to the current HELP loan limit. For more information on the new combined HELP loan limit and renewable HELP balance visit the combined HELP loan limit page.

When Do I Have To Start Repaying My Student Loan

Most loans dont require any payments until at least six months after you graduate or drop below half-time enrollment, but from there youll need to make regular monthly payments. With federal student loans, you might be automatically enrolled in the standard repayment plan set to complete repayment in 10 years.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

Avoiding Delinquency And Default

If you don’t make payments on your student loans, your loan is delinquent. Your loan is considered delinquent from the day after you miss a payment until you make up that missed payment or it enters default. When a loan is delinquent, late fees may be charged to your account, and missed payments are reported to the four nationwide credit bureaus. If you haven’t made a payment for more than 270 days, your loan enters default. In default, the full balance of your loan is due immediately, and there may be other financial and legal consequences. Fortunately, there are options for turning things around.

Default Dangers

- Negative impact on your credit score and your ability to borrow money in the future

- Withholding of federal tax refunds

- Wage garnishment

- Loss of future federal aid eligibility

Fix-It Options

Repaying Your Student Loans

Once youre ready to move on to repayment, youll want to consider all the options available to you. Overall, everyone will be getting into a consistent payment plan with their loans, hopefully paying more than the minimum to chip away at the principle amount as well as the interest, all while balancing other financial goals and responsibilities.

Repaying your student loans is definitely a big undertaking, fortunately there are lots of options for you depending on your situation.

Also Check: Rv Loan With 670 Credit Score

How Can I Stop Worrying About Student Loans

If youre feeling overwhelmed, these eight strategies can help.

Student Lines Of Credit

If you have a student line of credit through your financial institution, you’ll have to pay the interest on the amount of money you borrow while youre still in school.

After you graduate, many financial institutions give you a 4 to 12-month grace period. During this time, you only have to pay the interest on your line of credit. After this period, youll pay back your debt through a repayment schedule agreed upon with your financial institution.

Contact your financial institution to get information about paying back your student line of credit.

Also Check: What Happens If You Default On Sba Loan