What Are Unsubsidized Loans

Unsubsidized loans are student loans that are offered by the federal government.

You can qualify for an unsubsidized loan if you are starting your undergraduate or graduate education.

Different from a subsidized loan, you do not need to demonstrate financial need to qualify for an unsubsidized loan. You also need to pay interest on your loan as soon as you take it out.

The upside of a subsidized loan is you dont need to pay the loan back until after you graduate. There are also no credit checks when you apply.

What Are The Similarities Between Direct Subsidized Loans And Direct Unsubsidized Loans

Both direct subsidized loans and direct unsubsidized loans are for students to help cover the cost of higher education. While there are important differences between each offering, there are key similarities.

Eligibility: To apply for either, students will need to fill out FASFA forms each year. After that, your school decides what federal aid you qualify for and then sends a financial aid package letter to you.

Loan Fees: Both loan offerings come with the same fees. 1.069% for loans disbursed on or after Oct. 1, 2016, and before Oct. 1, 2017. 1.066% for loans disbursed on or after Oct. 1, 2017, and before Oct. 1, 2018.

Interest Rates: According to the Federal Student Aid website, both options have a 4.45% interest rate .

Financial Aid Eligibility Period: Both direct subsidized and direct unsubsidized loans have the same eligibility period. The longest is 150% of the length of the degree track you are enrolled in. For example, you could qualify for six years of funding for a four-year undergraduate program.

Subsidized Loan Vs An Unsubsidized Loan: Which To Repay First

When prioritizing loan repayments, its a good idea to repay your direct unsubsidized loans first before paying back your direct subsidized loans. Because an unsubsidized loan continues accruing interest while in school, the balance of your unsubsidized loans will be larger unless you paid the interest while in school.

Not only could you save on interest by paying the loan with the higher balance first, but repaying your direct unsubsidized loans first means that if you go back to school or otherwise qualify for deferment or forbearance, you wont have as much unsubsidized debt for interest to grow.

Read Also: Usaa Auto Loan Credit Score

Interest On Subsidized Vs Unsubsidized Loans

Interest rates on federal Direct Subsidized Loans and Direct Unsubsidized Loans are set by the government and change every year. For a given type of loan, the rate is the same for every borrower, regardless of the borrowers credit score, income, or other financial information. You can see the current rates for different types of federal student loans, as well as rates for previous years, on the Federal Student Aid website.

Although the interest rate is the same on subsidized and unsubsidized loans for undergraduate students, how interest accrues is quite different.

When To Choose An Unsubsidized Loan

In some cases, youll need to take out unsubsidized loans instead of subsidized loans, even though subsidized loans can cost you more over time. Here are a few common situations where you might choose unsubsidized loans:

- Youre a graduate or professional degree student: Subsidized loans are only for undergraduate students. If youre pursuing a graduate a professional degree, youre ineligible for subsidized loans. Instead, you can take out unsubsidized loans or Direct PLUS Loans.

- You dont have financial need: Only students with financial need can take out subsidized loans. But unsubsidized loans are for any borrower, regardless of their financial situation.

- Youve reached the annual limit: The annual limits for subsidized loans are relatively low. For example, independent first-year undergraduate students can only take out $3,500 in subsidized loans. If you need more money than that to pay for school, youll need to take out unsubsidized loans, which have higher limits.

Recommended Reading: Loan Processor License California

Interest Rates On Subsidized And Unsubsidized Loans

The federal government sets federal student loan interest rates, and the rates may change each school year. For the 2021-22 academic year, the interest rates are:

- 3.73 percent for undergraduate students who take out Direct Unsubsidized or Direct Subsidized Loans.

- 5.28 percent for graduate and professional-degree students who take out Direct Unsubsidized Loans.

Subsidized Vs Unsubsidized Loans

The rising cost of a college degree has more students than ever borrowing to cover their expenses. While some students opt for loans from private lenders, an estimated 42.8 million borrowers have Federal Direct Loans, as of Q3 2021.

Federal Direct Loans may be subsidized or unsubsidized. Both types of loans offer numerous benefits, including flexible repayment options, low-interest rates, the option to consolidate loans, and forbearance and deferment programs. But how do subsidized and unsubsidized loans compare? We focus on the key aspects of each type of loan so you can decide what’s right for you.

Recommended Reading: Capital One Preapproved Auto Financing

What Is The Difference Between A Subsidized And Unsubsidized Loan

Blog> Financing Your Education> What is the Difference Between a Subsidized and Unsubsidized Loan?

The culinary college search process is exciting! With so many different opportunities out there, youll be sure to find a program that lines up with your passions and career goals.

Financial planning for school on the other hand can be a bit overwhelming. It may be hard to know where to start. But dont be discouragedthere are many resources available to you.

And, financial aid is not just for 4-year colleges! There are many options available for 2-year programs such as culinary school, too.

What Is The Difference Between Subsidized And Unsubsidized

What is the difference between subsidized and unsubsidized housing? In subsidized housing, the cost of owning and operating the housing is not fully borne by the occupant. This makes the housing affordable for a low income occupant. In unsubsidized housing, the occupant pays the full cost of the housing. Click to see full answer.

Also Check: Fha Title 1 Loan Requirements

How Much Can You Borrow In Subsidized And Unsubsidized Loans

The amount you can borrow depends on two factors: your year in school and whether youre financially independent from your parents. Thats determined by a set of questions on the FAFSA.

Both direct subsidized and unsubsidized loans have relatively low annual loan limits. PLUS loans and many private student loans, on the other hand, let you borrow up to the schools total costwhich includes tuition, fees, room, board, books, transportation and other expensesminus other financial aid youve gotten.

If youre an independent student or a dependent undergraduate student whose parents didnt pass the credit check required to get PLUS loans, you can take out a higher amount of unsubsidized loans.

You or your parent wont pass the PLUS loan credit check if you have more than about $2,000 in debt thats at least 90 days delinquent, or if you had a bankruptcy, foreclosure or certain other negative marks on your credit report in the past five years. You may still be able to get a PLUS loan, though, by using a qualified co-signer, or by explaining the reasons for the negative marks on your credit to the satisfaction of the U.S. Department of Education.

Heres how the subsidized and unsubsidized borrowing maximums break down:

| Year in school |

|---|

Amount You Can Borrow

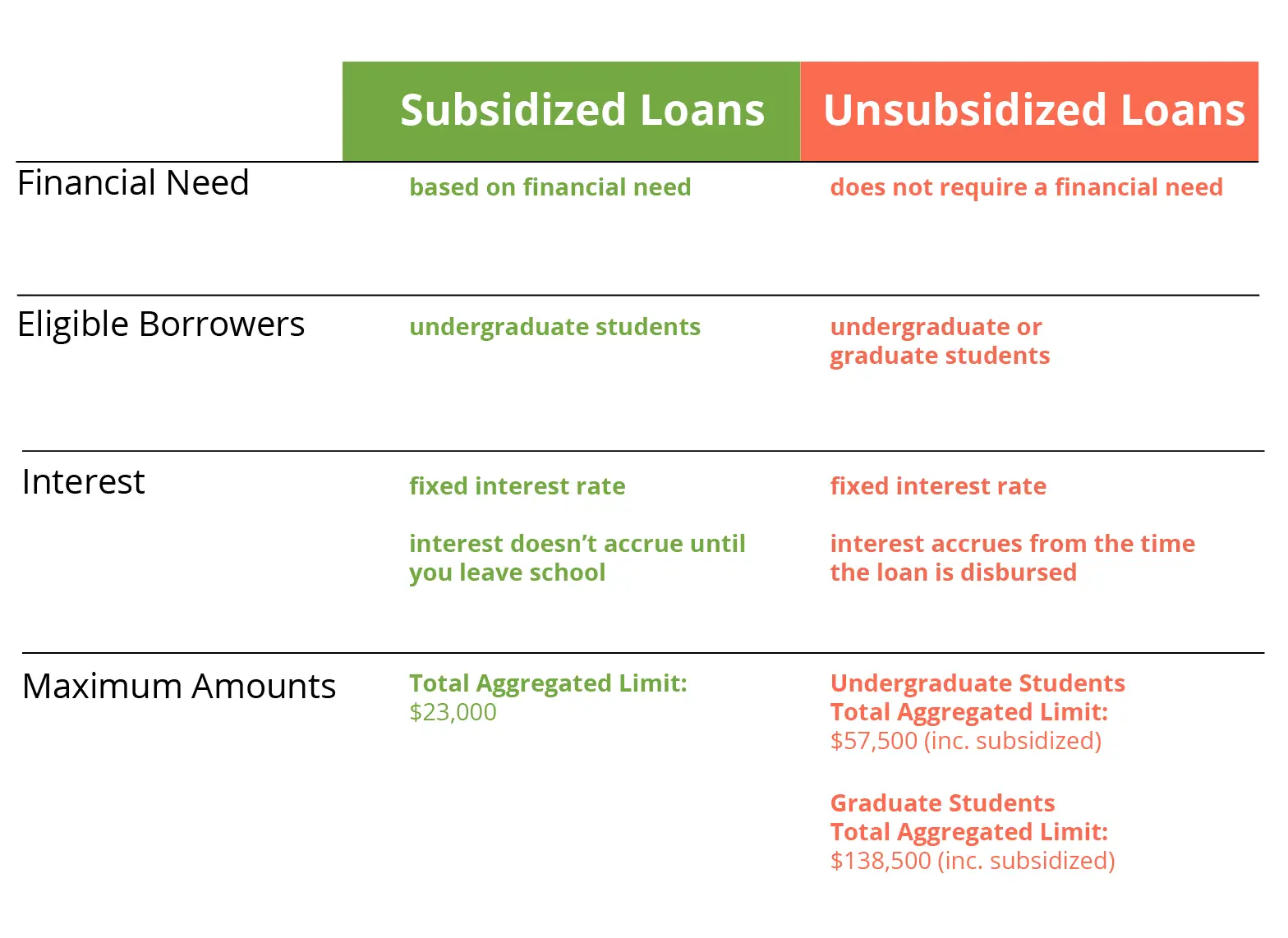

The U.S. Department of Education limits the dollar amount of subsidized and unsubsidized loans you can get each academic year . They also limit the total amount you can borrow over your graduate or undergraduate career . The limits vary based on your class statusthat is, whether you’re a freshman, junior and so onwhether your parents claim you as a dependent on their tax return, and whether or not your parents are eligible for a direct PLUS loan.

Currently, dependent students whose parents aren’t eligible for direct PLUS loans are limited to borrowing an aggregate of $31,000 in subsidized and unsubsidized student loans over four years of college only $23,000 of that amount can be in subsidized loans. Check out the U.S. Department of Education website to get the complete details on annual and aggregate loan limits and see what you may be qualified to borrow.

Recommended Reading: Usaa Car Loan Application

Your Subsidized Loan Usage Is Calculated By Your Enrollment Status

Full-time

Half-time Student

- A full-time student taking out a subsidized loan for a full academic year has used one year of eligibility.

- A half-time student taking out a subsidized loan for a full academic year has used half a year of eligibility.

Only periods for which you receive subsidized loans count against this limit. If you’re enrolled full time for four years but only take out subsidized loans for three years, you have only used three years of your eligibility.

Who Is Eligible For Subsidized And Unsubsidized Student Loans

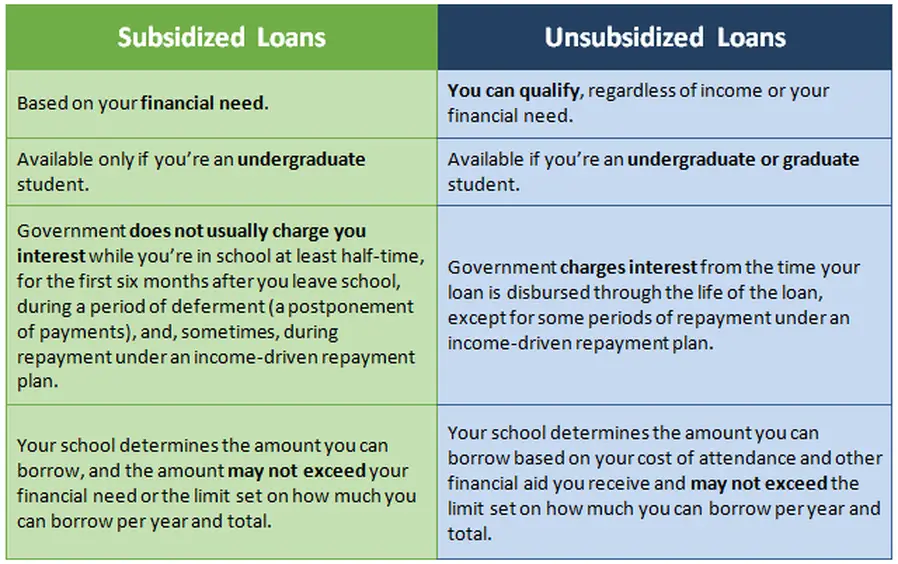

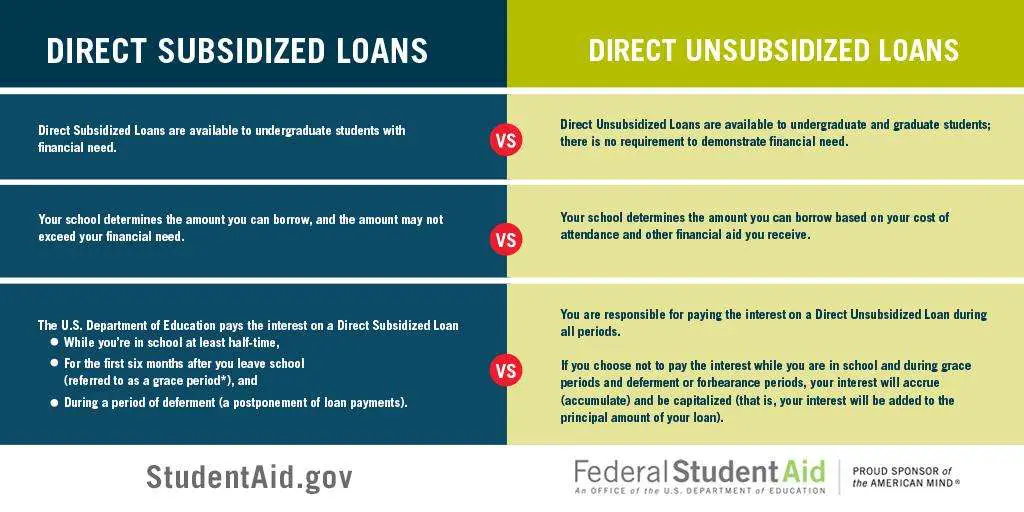

Subsidized loans are awarded based on financial need. Unsubsidized loans are available to all students, regardless of need.

Subsidized loans are available only to undergraduate students. Graduate and professional school students have not been eligible for the subsidized Federal Direct Stafford loan since 2012.

The amount of a subsidized student loan is determined by the college financial aid office, based on the students financial need, up to certain annual and aggregate loan limits.

Loan-specific eligibility requirements include:

- The student must be enrolled on at least a half-time basis.

- The student must complete entrance student loan counseling, which is often provided through StudentLoans.gov.

- The student must sign a Master Promissory Note .

Borrowers must also satisfy the general eligibility requirements for federal student aid, which include:

Also Check: My Car Loan Is Not On My Credit Report

Are Subsidized Or Unsubsidized Loans Better

When it comes to subsidized and unsubsidized loans, subsidized loans are the clear winner. If you can qualify for them, youll pay less money in interest charges with a subsidized loan, and youll save money over the life of your loan.

But not everyone will qualify for a subsidized loan. Students are often eligible for unsubsidized loans only, or they must use a combination of the two to meet the full cost of college. Unsubsidized loans could be a better choice than other financing options like private student loans because theyre eligible for federal benefits like:

- Income-Driven Repayment : Once your loans are in repayment, you can enroll in an IDR plan. These plans base your payments on a longer term and a percentage of your discretionary income, so you could significantly lower your payment amount.

How Do You Pay Back Subsidized Loans

You can pay back your subsidized loan at any time. Most students begin paying their loans back after they graduate, and the loan payment is required six months after graduation, known as the “grace period” when the government continues to pay the interest due on the loans.

When your loan enters the repayment phase, your loan servicer will place you on the Standard Repayment Plan, but you can request a different payment plan at any time. Borrowers can make their loan payments online via their loan servicer’s website in most cases.

Recommended Reading: Can I Buy Land With A Va Loan

Which To Borrow: Subsidized Vs Unsubsidized Student Loans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Read more on federal student loans

-

Government loan rates:Current student loan interest rates

When choosing a federal student loan to pay for college, the type of loan you take out either subsidized or unsubsidized will affect how much you owe after graduation. If you qualify, youll save more money in interest with subsidized loans.

|

What you need to qualify |

Must demonstrate financial need |

Don’t have to demonstrate financial need |

|

How much you can borrow |

Lower loan limits compared with unsubsidized loans |

Higher loan limits compared with subsidized loans |

|

How interest works while you’re enrolled in college |

Education Department pays interest |

|

|

Undergraduate and graduate or professional degree students |

Subsidized And Unsubsidized Loan Limits

The amount you can borrow through the Federal Direct Loan Program is determined by your dependency status and classification in college. The annual and aggregate loan limits are listed in the charts below.

| Undergraduate Annual Loan Limits |

|---|

| Health Professions* Aggregate Loan Limits | $224,000 |

* Some professional students may be eligible for increased unsubsidized loan limits. Contact your adviser to determine if you are eligible.

You May Like: Pre Approved Capital One Auto Loan

Differences Between Subsidized Vs Unsubsidized Student

The main difference between subsidized and unsubsidized loans is when interest starts accruing and who is responsible for paying it. For Direct Subsidized Loans, the U.S. Department of Education pays the interest that accrues during college, during the six month grace period after a student graduates, and during any other deferments.

Should I Take Out Federal Or Private Student Loans

As you consider how to pay for college, its wise to take advantage of any grant or scholarship opportunities available to you before you start to look at financing options. If you do have to borrow money, its almost always best to start with federal loans. These loans come with many benefits unique to the federal government, like income-driven repayment plans, long forbearance and deferment periods and loan forgiveness options.

If grants, scholarships and federal loans dont cover your costs, you may need to stack on private student loans to finance the remaining balance. While these should typically be a last resort, you may qualify for low interest rates if you have good credit.

You May Like: Average Interest Rate For Commercial Real Estate Loan

Topic: Direct Unsubsidized Loan Interest Rate Usa 2022

If youre a university student that isnt eligible to receive federal direct subsidized loans and you must get Direct Unsubsidized Loans to pay for your tuition and fees then this article will prove quite instructive. This article provides information on the Direct Unsubsidized Loan Interest Rate, which is a kind of interest rate for student loans.

The aim of this piece is to encourage you to think about the possibility of saving cash by taking out a loan at a less rate of interest than that currently offered in all Direct unsubsidized loans.

For instance, if youre thinking of borrowing $5,000 with the rate of 4.5 percent. But you can borrow $5000 with an interest of 2.8 percent, would you be able to borrow the same amount?

What is an Unsubsidized Direct Loan?

Direct Unsubsidized loan interest rate accrues even when youre at school and during the grace period. Even though youre not legally required to pay during your time at school.

The interest is capitalized, which means it is added to the principal amount of the loan. The loan then accumulates interest and you will be left with more debt at the time you graduate than what you initially borrowed.

Of course, its possible to pay the interest on your loan thats not subsidized when youre in school, to help you save money in the end. But, you arent required to pay back the loans for a period of six months following youve graduated from college.

What is Direct Unsubsidized Loans operate?

What Is The Difference Between Stafford Perkins And Plus

If an individual receives an unsubsidized Stafford loan, the interest on the loaned funds will begin to accrue prior to the students graduation. Alternatively, if one receives a subsidized Stafford loan, the interest will not begin accruing until after the student graduates from college. Perkins Loan

Don’t Miss: Usaa Car Loans Bad Credit

To Receive Your Subsidized Or Unsubsidized Loan:

Strategy For Subsidized Vs Unsubsidized Student Loans

Subsidized student loans are less expensive than unsubsidized student loans, so borrowers should prefer subsidized student loans to save money.

However, borrowers might not be able to cover all college costs with just subsidized loans, especially at higher-cost colleges. Also, graduate students are no longer eligible for subsidized loans.

If a borrower has both subsidized and unsubsidized student loans, it is best to make extra payments on the unsubsidized loans, since this will save the money if the borrower ever needs a deferment.

You May Like: Fha Loan Limits Harris County

How To Get Subsidized And Unsubsidized Loans

To get a federal loan, first submit the FAFSA. Youll get a report detailing how much federal aid youre entitled to. Be sure to first take all the grants and scholarships youre offered in the report, since its free money. Youll also want to accept any work-study youre offered before you take on loans. Each year youre enrolled, your school will determine the amount you can borrow as well as the loan types you qualify for: subsidized or unsubsidized.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: How Long Does Sba Loan Take To Get Approved