How To Make Sba Disaster Loan Payments

Borrowers can make SBA disaster loan payments online, by mail or by phone.

| Make payments to the SBA | |

| Online | Make recurring or one-time payments at Pay.gov, the online portal for paying federal government agencies |

Your SBA disaster loan will be designated for a specific purpose, such as repairing property damage. As you begin to spend your funds, make sure you save all receipts and maintain your spending records for at least three years. If you misuse an SBA disaster loan, you would likely face penalties, which could include an immediate payment thats one and a half times your original loan amount.

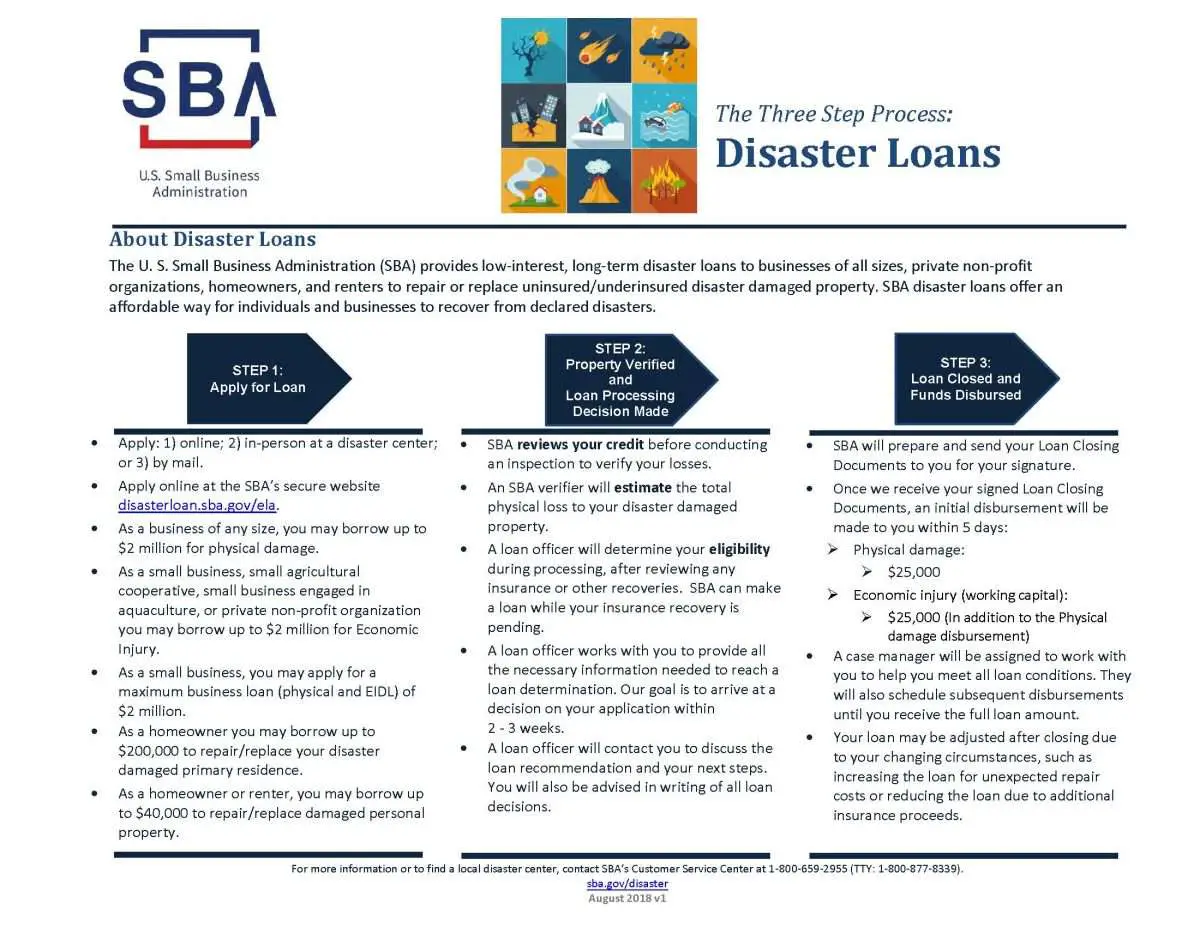

Who Qualifies For Sba Disaster Loans

That depends on which disaster loan youre applying for! The SBA offers a great deal of different disaster loans for a variety of different events and circumstances.At the moment, any business in a US state or territory where a disaster has occurred is able to apply, though that doesnt mean that youll get accepted.According to the official SBA website, reasons for eligibility for an Economic Injury Disaster Loan include:

- Substantial economic injury means the business is unable to meet its obligations and pay its ordinary and necessary operating expenses

- EIDL provides the necessary working capital to help small businesses impacted by a disaster survive until normal operations resume.

For the most recent Covid-19 EIDL loan, there are specific rules, and the following businesses qualify to apply:

- Small businesses

- Non-profit organizations of any size

- US agricultural businesses with 500 or less employees that have suffered substantial economic injury as a result of the COVID-19 pandemic

When it comes to all other disasters that the SBA offers loans for, things are a little different. Those who are eligible to apply for them include:

- Businesses of any size that are located in the

- Private non-profit organizations

- Homeowners or renters affected by a declared disaster

What Do I Need To Do Before Applying

First, you need to determine if you are in a declared disaster area. The federal government, the SBA, and the Secretary of Agriculture can declare an area as a designated disaster area. Check the list of current designated disaster areas to see if your area is included.

Next, you may need to submit a claim to your insurance company and get started with the process of determining what they will pay you.

Most business income or business interruption policies don’t cover epidemics or pandemics.

The SBA will only pay for damage that is not covered by insurance, but you can begin the loan process before you know the amount repaid by insurance. You may be able to apply for the SBA loan and agree to use insurance proceeds to repay or reduce it.

Don’t Miss: Will Loan Companies Settle For Less

How To Use Your Sba Coronavirus Loan

The COVID-19 pandemic was the first time many small business owners ever thought about SBA loans. When Congress passed the CARES Acta $2.2 trillion stimulus package for individuals and businessesone of the main focuses was on expanding the resources and relief available to small businesses affected by COVID-19.

The CARES Act includes provisions to aid small businesses through existing financial programs like SBA Debt Relief and SBA Express Bridge Loans. It also includes funding for Economic Injury and Disaster Loans and established a completely new SBA loanthe Paycheck Protection Program .

PPP loans and EIDLs are the main SBA disaster loans that businesses are seeking under the CARES Act, and they can provide a necessary influx of cash for companies that have been shut down or limited by the coronavirus. These 2 SBA coronavirus loans are exceptionally flexible, but they do come with limits.

Learn how you can use these 2 different loans to support your business and maximize their impact during our current crisis.

What Can Business Physical Disaster Loans Be Used For

Business Physical Disaster Loans provide up to $2 million to repair or replace damaged physical property including machinery, equipment, fixtures, inventory, and leasehold improvements that are not covered by insurance.18Damaged vehicles normally used for recreational purposes may be repaired or replaced with SBA loan proceeds if the borrower can submit evidence that the vehicles were used for business purposes.

Also Check: What Is The Fha Loan Limit In Arizona

Everything You Need To Know About Sba Disaster Assistance Loans

In times of crisis, the U.S. Small Business Administration provides low-interest disaster assistance loans to struggling small businesses.

By: Nicole Fallon, Contributor

Many small businesses and nonprofit organizations in a declared disaster area are eligible for an SBA loan to mitigate any uninsured losses and damages.

What Happened To The Applications That Were Dropped Into The Drop Box

If EIDL applications were completed BEFORE Monday, March 30, they should be resubmitted using the online link. EIDL applications submitted March 30 or later received a verification number upon submission of the application. This verification indicates the application was received. No confirmation email will be sent as a follow-up confirmation of receipt of application.

Don’t Miss: How Can I Apply For Fha Loan

Active Disasters And How To Apply

For information related to the Small Business Administrations Economic Injury Disaster Loan program for COVID-19 , please see COVID-19 Resources and Guidance for Businesses.

To learn more about SBA disaster loans, including historical disaster declarations, visit the Small Business Administration Disaster Loans website.

For questions or additional information, contact MEMA’s Recovery Unit Staff.

Is The Sba Disaster Loan Real

Yes! The Small Business Association provides a great many loans during what is known as a declared or official disaster. Servicing the whole of America, if something goes horribly wrong in your area, the SBA is there to help.Most recently, they have been offering what is called a Covid-19 Economic Injury Disaster Loan , which is helping businesses to recover and reopen following the coronavirus pandemic.They also cover a variety of other disasters with their loans, for instance:

- Physical damage loans – as the name suggests, these cover the costs of repairing and replacing anything physically damaged during a declared disaster

- Mitigation assistance – this allows funding for small businesses to cover the expenses of opening and operating following a declared disaster

- Economic injury disaster loans – providing relief to both non-profit organizations and small businesses who have suffered either damage to their business, home, or personal property in the event of a declared disaster

Also Check: What Is An Fda Loan

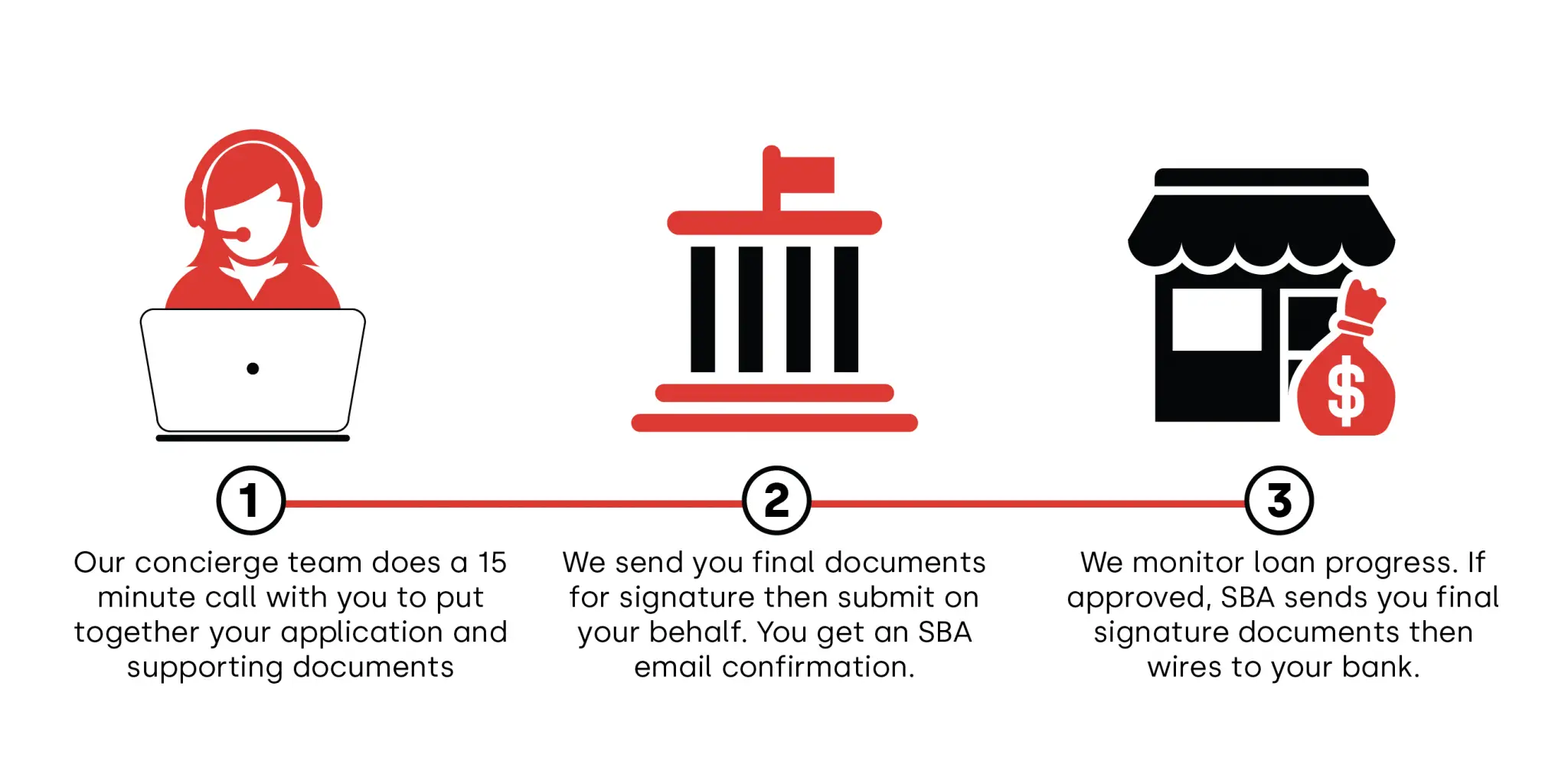

How Do I Get An Sba Disaster Loan

The fastest way to apply for an SBA disaster loan is through their online portal. You will be required to complete the disaster loan application as well as submit IRS Form 4506-T .

However, you ought to consider all of your before applying to the SBA, as disaster loans may only apply to businesses without any other options.

Consolidated Appropriations Act 2021 & American Rescue Plan Act 2021

Neither the Consolidated Appropriations Act of 2021 nor the American Rescue Plan Act, 2021 are government loan programs per se. They are laws, passed by Congress, that provide additional funding and rule changes for several government programs, including the Paycheck Protection Program , Economic Injury Disaster Loan program, and EIDL advances. Also included is funding for a new Shuttered Venue Operator Grant program.

Descriptions of the programs below reflect changes made by the CAA and the American Rescue Plan. Additional guidance from the Treasury Department and the SBA may require further updates.

Also Check: How To Apply For Usda Direct Loan

What Can Real Property Loans Be Used For

Only uninsured or otherwise uncompensated disaster losses are eligible for loan assistance. The loans may not be used to upgrade a home or build additions to the home, unless the upgrade or addition is required by city or county building codes. Secondary homes or vacation properties are not eligible for Real Property Loans.13 Repair or replacement of landscaping and/or recreational facilities cannot exceed $5,000. A homeowner may borrow funds to cover the cost of improvements to protect their property against future damage . In some cases, SBA loans can be used to refinance all or part of a previous mortgage when the applicant does not have credit available elsewhere, has suffered substantial disaster damage not covered by insurance, and intends to repair the damage. SBA considers refinancing when processing each application. In addition, loan recipients can use loan money to pay their insurance deductible.14

What Are The Requirements For An Sba Disaster Loan

The Small Business Administration is a United States government agency created to support small businesses. While the SBA offers loans year round, they provide additional financial support in response to disasters.

While the SBA aims to be generous and helpful with loan assistance, in the case of disasters like the coronavirus pandemic there are strict requirements for qualifying businesses .

Read Also: How Do You Get An Equity Loan

Types Of Sba Disaster Loans

- Home Disaster Loans Loans to homeowners or renters to repair or replace disaster-damaged real estate and personal property, including automobiles. SBA disaster loans also may be used to pay insurance deductibles, if needed.

- Business Physical Disaster Loans Loans to businesses to repair or replace disaster-damaged property owned by the business, including real estate, inventories, supplies, machinery and equipment. Businesses of any size are eligible. Private, non-profit organizations such as charities, churches, private universities, etc., also are eligible.

- Economic Injury Disaster Loans Working capital loans to help small businesses, small agricultural cooperatives, small businesses engaged in aquaculture, and most private, non-profit organizations of all sizes meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. These loans are intended to assist through the disaster recovery period.

Through SBA, homeowners may be eligible for a disaster loan up to $200,000 for primary residence structural repairs or rebuilding. SBA may also be able to help homeowners and renters with up to $40,000 to replace important personal property, including automobiles damaged or destroyed in the disaster.

The application filing deadline for physical damage loans is .

The application filing deadline for economic injury loans is .

Targeted Eidl Program With The Coronavirus Relief Bill

A new sub-section of the SBA Disaster Loans program was created by the Coronavirus Relief Bill, which was signed by President Trump on December 27, 2020. The bill targets small businesses in areas that have been particularly hard-hit by the pandemic, aiming to get funds to those who need them most.

|

Coronavirus Relief Bill Programs |

|

|

|

| Funding |

|

| Tax-free and does not reduce PPP loan forgiveness eligibility | Tax-free and does not reduce PPP loan forgiveness eligibility |

Also Check: What Is The Maximum Sba Loan

How You Can Use An Eidl Loan

Fortunately for small businesses that were directly affected by the COVID-19 economic disaster, the EIDL program is another option to receive funding. The type of businesses that may be eligible for EIDL funding include most small businesses and private non-profits with fewer than 500 employees. Some of the most heavily impacted businesses that will most likely qualify include retailers, hotels, wholesalers, manufacturers, rental property owners, restaurants, and many more. An eligible business may borrow up to two million dollars at a 3.75% rate for small businesses and a 2.75% rate for most private non-profit organizations. The term of the loan can be up to 30 years and there are certain criteria that a business must meet including: acceptable credit history, ability to repay the EIDL loan, and various eligibility requirements. The funds from an EIDL loan may be used for the following purposes:

Sba Economic Injury Disaster Loans

Non-COVID EIDLs are essentially working capital loans for small for-profit and nonprofit businesses that have suffered a loss in revenue due to a natural disaster.

- Loan amounts: Up to $2 million

- Interest rates: Up to 4%

- Terms: Up to 30 years, depending on your ability to repay

- Collateral: Required on loans over $25,000 preferably real estate

Non-COVID EIDLs are meant to help small businesses stay up and running while the disaster area recovers. Like other SBA loans, EIDLs are only available to small businesses that can’t qualify for a loan elsewhere. Requirements may vary depending on the circumstances of the disaster.

Read Also: How Much Student Loan Should I Borrow

Where To Apply For An Expansion Loan

As previously noted, the SBA doesnt lend money directly to help you grow your business, as it does when providing disaster relief. Instead, it sets stipulations for loans made by its partners . You can apply for an expansion loan at any SBA-approved lender or use the SBAs Lender Match.

Sba Assistance For Small Businesses

Mayor Muriel Bowser announced on March 17, 2020 that the U.S. Small Business Administration accepted the District of Columbias declaration for assistance in the form of economic injury disaster loans following the advent of the novel coronavirus . DC businesses can apply for this assistance now. While the SBA directly administers this loan program, the Department of Small and Local Business Development , led by Director Kristi Whitfield, will liaise with the SBA on behalf of the District of Columbia.

The SBAs Office of Disaster Assistance will provide targeted, low-interest loans to Washington, DC small businesses that have been severely impacted by COVID-19. The SBAs Economic Injury Disaster Loan program provides working capital loans of up to $2 million that can provide vital economic support to help qualified small businesses and private nonprofit organizations overcome the temporary loss of revenue as a result of the COVID-19 virus outbreak. These loans may be used to pay fixed debts, payroll, accounts payable, and other bills that cannot be paid because of the disasters impact. Terms are determined on a case-by-case basis, based upon each borrowers ability to repay.

Apply Online

You May Like: How Long To Close Home Equity Loan

Is My Business Eligible

As long as your business has been affected by the coronavirus, you can apply for an SBA disaster loan. This includes freelancers and sole proprietors with no employees.

Key requirements:

- Business must be > 1 year old

- Business must have < 500 employees

The key here is that there must be a direct impact to the business. Although you can still apply even if you arent in hot water today, youll need to show you have existing obligations that may create issues later.

Who Can Use An Sba Disaster Loan And How

Low-interest SBA disaster loans are available to business owners, homeowners and renters in regions where a federally declared disaster has occurred. SBA disaster loans can be used for many purposes, including repairing real estate or personal property, recovering from economic injury or purchasing machinery, equipment or inventory.

The SBA offers four types of long-term disaster loans:

| Long-Term Disaster Loan | ||

| Military reservists economic injury disaster loans | Up to $2,000,000, with exceptions | 4.00% |

| Home and personal property loans | Up to $200,000 to repair a primary residence up to $40,000 to replace or repair personal property | Up to 8.00% |

Short-term solution: Small businesses in disaster areas could secure interim financing for disaster-related needs while waiting for long-term funding. The Express Bridge maximum loan amount is $25,000, with a maximum term of 84 months. The maximum rate would be based on the prime rate plus 6.5%. The Express Bridge loan is part of a pilot program from the SBA that expires in March 13, 2021.

Its important to note the SBA is not a lender. Instead, it guarantees loans issued through partner lenders. The guarantee reduces risk for the lender, giving small business owners a better chance of qualifying for financing.

You May Like: Is An Auto Loan Secured Or Unsecured

What Is An Sba Disaster Loan Disbursement

In situations that are serious enough to be declared disasters by the Office of Disaster Assistance, the Small Business Administration will step in to provide low-interest loans to all those affected by the crisis in question.

These parties could be businesses, homeowners, renters, or nonprofits. Generally, a disaster might only affect one or two of these groups or limited subsets of each.

This would be the case in the event of a natural disaster, like a hurricane or tornado. However, the COVID-19 pandemic has affected all of these groups. This has created an unprecedented demand for SBA disaster loans.

What Are The Ramifications If I Use Sba Funds For Personal Use

The ramifications will cause a great deal of potential legal and financial problems. The loan could be declared in default and called immediately. You could face legal issues for fraud as well as tax issues with the IRS for failing to report income. The business loan is for the business and you should always keep that in mind.

Recommended Reading: Should I Refinance My Va Home Loan

How Eidl Funds May Be Used

EIDL loans werent created just for the coronavirus economic crisis. In fact, theyve been part of the SBAs Disaster Loan program for many years. They often make national headlines when a natural disaster hits an area, like when Hurricane Harvey caused flooding and business disruption for many parts of Texas. So before we dive into specific questions, lets look at how these loans were designed to be used. According to the Standard Operating Procedures for Disaster Loans :

Economic Injury is a change in the financial condition of a small business concern, small agricultural cooperative, small aquaculture enterprise, or PNP of any size attributable to the effect of a specific disaster, resulting in the inability of the concern to meet its obligations as they mature, or to pay ordinary and necessary operating expenses.

Economic injury may be reduced working capital, increased expenses, cash shortage due to frozen inventory or receivables, accelerated debt, etc. Economic injury loan proceeds can only be used for working capital necessary to carry the concern until resumption of normal operations and for expenditures necessary to alleviate the specific economic injury .

While there is no comprehensive list of how EIDL funds may be used, if youre trying to err on the side of caution, there are clues in the section of the SOP that describes how to calculate economic injury. The following examples come from the section of the SOP that relates to calculating economic injury: