How Do I Reduce My Closing Costs

Closing costs are an important cost in the process of buying a home and getting a mortgage. There are a few costs that are fixed, but a majority of them are variable where shopping around can get you a better deal. One of the largest closing costs is lender fees, especially origination charges, which can be close to 1% of the loan amount. This is where you can really try to save money. By shopping around for different lenders and with proper negotiations, these fees can be brought down significantly. There are a host of other variable fees where proper research and negotiation can save you a lot of money.

Selecting The Right Location

Borrowers can only choose a home within an approved USDA rural location. The USDA characterizes rural areas as communities, towns, and even small cities with a population below 20,000 inhabitants. These places are usually in need of financing options that cater to low and average income households. In some cases, the USDA may make exceptions by approving areas with up to 35,000 people. On the other hand, urban places are defined as areas inhabited by 50,000 residents or more.

Before 2015, more than 90% of land in the U.S. qualified for USDA home financing. Over the years, increasing populations have made it more difficult for people to find eligible USDA rural areas for residential properties. But depending on the location, some USDA approved areas can be suburbs. Others may be extended sections of small cities thats a ways away from metro areas. The area restriction may be discouraging. But if youre determined to move away from the city, especially if youve found work that allows you to telecommute, taking a USDA loan is worth it.

Verify Your Area

To check if your preferred location is eligible, visit the USDA property eligibility map. Its also a useful tool to search for feasible locations outside of busy metropolitan areas. Just enter the address or pin the location on the map. Areas in gray and green indicate eligible areas, while regions highlighted in yellow are cities that do not qualify as USDA rural locations.

Home Improvement Loans And Grants

Additionally, the USDA offers loans or grants for homeowners to make necessary repairs or upgrade their homes. Eligible homeowners can apply for a grant of up to $7,500, or a loan of up to $20,000. They can also apply for a combination of the two that may total as much as $27,500. Loans are repaid over 20 years with a fixed interest rate of 1%.

Recommended Reading: Usaa Conventional 97

Complete Consumer Guide To Closing Costs

In the United States average closing costs for homeowners are about $3,700, though that depends heavily on home price and location.

ClosingCorp averaged statewide data for 1.6 million single family homes in 2019. The following table shows average statewide closing costs with and without property taxes included.

| State |

|---|

| $50 | Local Government | Recording a property sale has an associated documentation fee, but some locations also charge sales tax and/or transfer tax. |

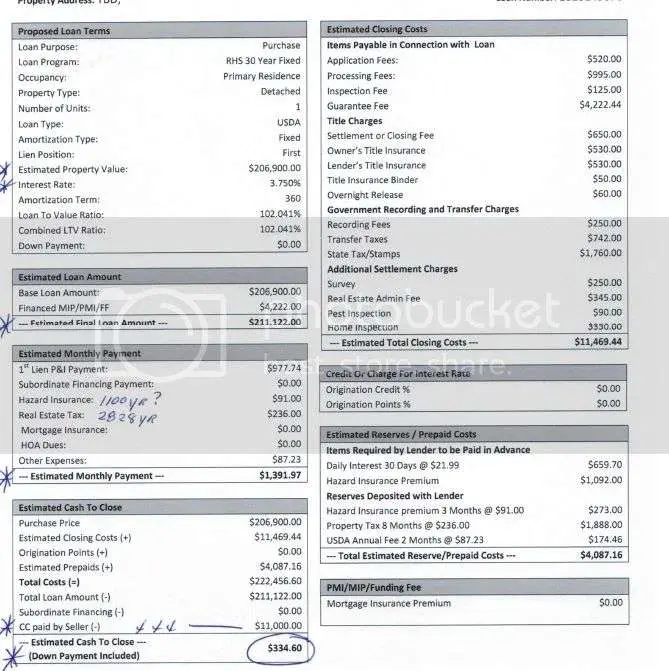

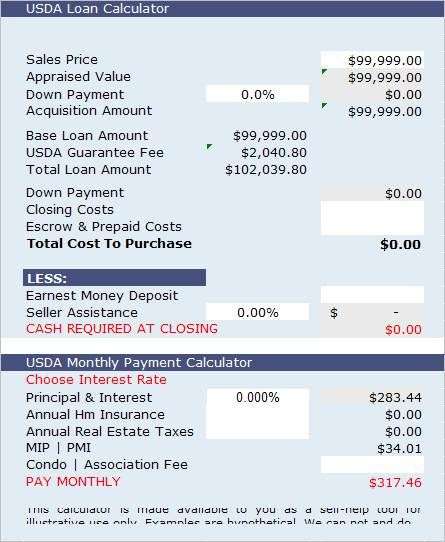

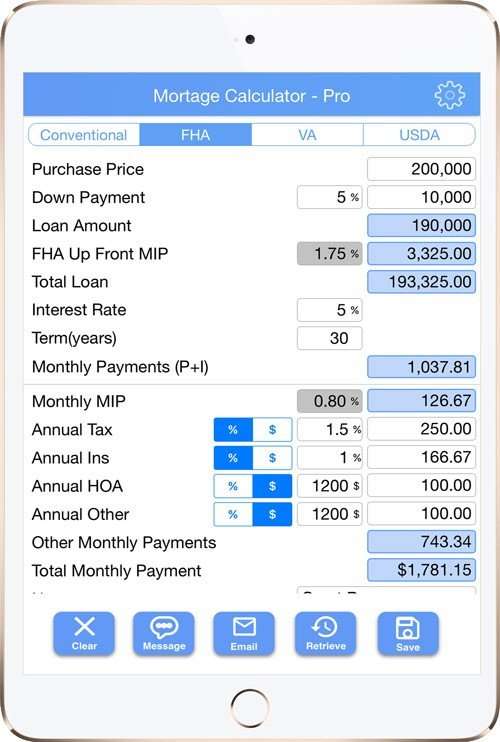

Calculate Your Mortgage Payment

Mortgages and mortgage lenders are often a necessary part of purchasing a home, but it can be difficult to understand what youre paying forand what you can actually afford.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

Heres what youll need in order to calculate your monthly mortgage payment:

- Interest rate

- Insurance

- HOA fees

What you can afford depends on a number of factors, including your income, debt, debt-to-income ratio, down payment and credit score.

You also want to consider closing costs, property taxes, insurance costs and ongoing maintenance expenses.

The type of loan you choose can also affect how much house you can afford. When shopping for a loan, think about whether a conventional mortgage, FHA loan, VA loan or USDA loan is best for your particular situation.

Recommended Reading: Usaa Refinance Auto Loan Rates

Use Our Mortgage Calculator To Estimate Your Monthly Payment

Do you know how much house you can afford? Use our mortgage calculator to see your estimated monthly payments with different mortgage amounts, interest rates, and down payment amount.

Apply online now with our easy QuickStart App or talk to a licensed Mortgage Loan Officer to review which loan is the best option for you.

Examples Of Closing Costs

Closing costs include many smaller fees. Here are some common examples:

Read Also: Refinancing Car Loan Usaa

Can You Roll Closing Costs Into A Usda Loan

USDA loans allow financing up to 100% of the appraised value of the property, plus the guarantee fee. So, if youre buying a home with a USDA loan and the home appraises at $250,000, you can get a loan for that amount plus your $2,500 guarantee fee . Youd be getting a mortgage for a total of $252,500.

Typically, you cant pay for your closing costs using your loan . However, USDA loans allow borrowers to roll some or all of their closing costs into their mortgages if the home appraises for more than the sales price. In this situation, youd use the extra loan amount to cover the closing costs.

For example, say youre buying a home for $250,000, but the appraisal reveals that the fair market value of the home is actually $275,000. Thats a $25,000 difference. If your closing costs are $12,000, you can get a loan amount that also pays for your closing costs. To do this, youd take out a $262,000 loan , which is less than the appraised value of the home.

Youre also allowed to roll your closing costs into your loan when you get a USDA streamline refinance.

What Are The Pros And Cons Ofrolling Closing Costs Into Your Mortgage

When you roll closing costs into your mortgage, you have less outofpocket funds and more cash on hand.

However, you are also paying interest on those costs over the life of the loan.

For example, lets assume:

- The closing costs on your new mortgage total $5,000

- You have an interest rate of 4.5% on a 30year term

If you roll the closing costs into your loan balance:

- Your monthly mortgage payment would increase by $25 per month

- And you would pay an extra $9,000 over the 30year term

In addition, by adding the closing costs to your new mortgage balance you are increasing the loantovalue. By increasing the LTV, you are reducing the amount of equity in your home.

Less equity means less profit when you go to sell your home. You would also have less equity if you wanted to take out any type of home equity loan.

Recommended Reading: Va Business Loan For Rental Property

What Is A Usda Guarantee Fee

4-minute readAugust 13, 2021

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

With housing prices on the rise across the United States, saving 20% for a down payment might seem impossible. Luckily, there are government programs available that can make homeownership a reality at a much lower upfront cost.

If living outside the city limits is ideal for you, a USDA loan might be the perfect fit. USDA loans are issued through the United States Department of Agriculture and offer rural home buyers access to low interest rates and no down payment.

Before we go over the costs involved with a USDA loan, lets look at how the loan program actually works.

Apply Online with Rocket Mortgage®

Usda Mortgage Eligible Geographic Areas

The property must be located in a USDA-eligible area. Borrowers can search USDAs maps to browse certain areas or pinpoint a specific address. If you are unsure if a property is eligible, check with a USDA loan officer here

Think your area is not eligible? Well, about 97% of United States land mass is USDA-eligible, representing 109 million people. Many properties in suburban areas may be eligible for USDA financing. Its worth checking, even if you think your area is too developed to be considered rural. The USDA eligibility maps are still based on population statistics from the census in the year 2000. This is a unique opportunity to finance a suburban home with this zero-down mortgage program before the USDA updates their maps.

Don’t Miss: Upstart Second Loan

What Form Of Payment Can You Use

The payment method you can use for your cost to close may depend on where you live and the title company you use. Often the only payment methods allowed are certified checks and wire transfers. In other cases, you may also be able to use cash, debit card, a cashiers check, or even a personal check.

Wire transfers are one of the safer options when it comes to paying your mortgage, Auerswald said. Its transferred electronically from one bank to another or from one account to another. Wire transfers also dont require your presence, so you can be at work while the transaction takes place. Be careful to make sure you know exactly where youre sending your money, however, since wire transfers are non-reversible.

While certified checks and cashiers checks have previously been the most common payment methods for cash to close, more title companies are now requiring wire transfers.

Closing Costs: What You Need To Know

When it comes to saving money to buy or refinance a home, youve probably been pretty focused on the down payment. But youll also need to plan for closing costs, which are due on closing day.

Understanding what closing costs are, how much they cost on average and whats included can help eliminate any unexpected last-minute financial obstacles when you close on your new home.

You May Like: Avant Refinance Application

How To Pay For Closing Costs

There are multiple ways to handle closing costs for a USDA loan. Prospective buyers may be able to have sellers cover these costs for them or even finance them into the loan.

A seller who is eager to sell their house quickly or reach a certain purchase price may agree to pay the closing costs in the form of a seller credit. This is something youll negotiate when its time to get under contract.

On a USDA Loan, sellers can contribute up to 6 percent of the purchase price toward your closing costs and concessions.

In some cases, its also possible to finance these costs into your loan. That involves the home appraising for more than the purchase price. Talk with a USDA loan specialist for more details.

But what if the seller wont cover these costs and you cant finance them? The lender may be able to pay them for you, although its important to understand that this route typically means youll wind up with a higher interest rate.

Lenders get whats essentially a rebate on that higher interest rate and use some of the proceeds to pay your closing costs.

If all else fails, buyers will be on the hook for paying these costs at closing.

Close At The End Of The Month

One of the simplest ways to reduce closing costs is to schedule your closing at the end of the month. This way you will be saving up on a lot on the prepaid interest which otherwise will be charged.

For instance, if you choose to close on the beginning of the month, say June 3rd, you will be paying prepaid interest for the rest of the month at closing. However, if you schedule it on June 29th instead, you will only have to pay one day of interest.

Also Check: Does Collateral Have To Equal Loan Amount

G Initial Escrow Payment At Closing

- Escrow homeowners insurance: Lenders may also require you to place some amount in an escrow account to cover homeowners insurance in case you fail to make a payment further down the line. This ensures that the home will be covered for some number of months even if you run into financial trouble. This, along with the property tax escrow described below, are most common when your down payment is less than 20%. Your Loan Estimate should show you the amount youll be required to put in escrow to cover two months of homeowners insurance.

- Escrow property taxes: Since the government, in some cases, can place a lien on a house that has unpaid property taxes, or even foreclose on that house, lenders try to make sure that borrowers stay current on their taxes. Tax liens have priority over mortgage liens, so the government would have claim on the house before the lender. An escrow account for taxes gives the lender a backup if you do miss some tax payments and makes a property tax lien less likely to occur

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Nslds Ed Gov Legit

How Much House Can I Afford With A Usda Loan

One of the main benefits of a USDA loan is that it doesn’t require a down payment, making it easier for manyto become a homeowner. However, USDA loans have strict criteria you’ll need to meet to qualify — including living in a USDA-designated area and not exceeding the income threshold for that area. You’ll also need to have a DTI under 41% and a monthly mortgage payment that doesn’t exceed 29% of your monthly income.

Submit A Mortgage Application And Documentation

Most conventional refinances will require you to complete a new application and provide documentation. Streamline refinances often have less paperwork and an easier application process compared to conventional refinances. If you are a current Freedom Mortgage customer, you may be able to start your streamline application on the telephone or using an online form.

You May Like: Mountain America Credit Union Refinance Rates

Can Closing Costs Be Included In The Loan

If you dont have the cash to pay closing costs upfront, you might be able to include them in your loan balance.

This is often allowed on refinance loans, though unfortunately its not an option for home buyers.

This strategy will cost more in the long run since you end up paying interest on your closing costs. It will also raise your interest rate. But it might be a good option if you dont have the upfront cash needed to refinance.

At todays low rates, many homeowners can include their closing costs in the loan and still walk away with a good deal.

Prepaid Taxes And Insurance

Two big upfront costs are your prepaid property taxes and homeowners insurance. These arent closing costs, but you will need to pay them before you take possession of the home, so youll need to account for them in your homebuying budget.

Youll pay the first year of taxes and insurance upfront . Thats one reason closing costs are so variable. If the local property taxes are high, they can add substantially to the amount of money needed upfrtong to close.

Same goes for homeowners insurance. Fortunately, you can and should shop around for the best rate. You may be able to save money by bundling your homeowners insurance with other policies, such as your car insurance.

If calling around to multiple companies for quotes sounds overwhelming on top of all the other to dos associated with buying a house, you can go through an insurance agency. Theyll shop around for rates for you and can help you get set up with a new policy.

Recommended Reading: Refinance Usaa Car Loan

B Services You Cannot Shop For

Theres a lot of administrative and legal work needed to finalize a home sale. The bank needs to make sure the loan it is making is backed by a valuable asset the government needs to make a record of the deal, and collect whatever fees and taxes are allowed by law and someone needs to deal with all of the paperwork involved. All that work can add up to a significant amount of money.

- Appraisal fee: Before the deal is finalized, your bank will likely want to hire someone to confirm the value of the house. Appraisers look at the size of the property, the features, the condition the house is in and the price of comparable properties recently sold in the area. Appraisers typically charge around $300 to $500 for their services.

- This is the cost to the bank of purchasing your credit report from one of the credit reporting agencies. Not all banks pass this fee along, but dont be surprised if they do. It should be no more than $30.

- Flood certification: If your house is situated on or near a flood plain, your bank may want documentation confirming its status. This involves paying for a certification from the Federal Emergency Management Agency , and should be around $15 to $20.