How Long Do Usda Loans Take

While the process to secure a USDA loan is a lot like other loan programs, the actual timeline can vary based on your financial situation, credit score and selected property.

The initial USDA appraisal can take up to a week to complete. If repairs are necessary then a secondary appraisal may also be required, which can delay your loan from progressing.

Further, if you do not qualify for GUS, the USDA will have to manually underwrite the loan application, which could in turn require additional time to gather needed verification.

Borrowers can typically expect the USDA loan process to take anywhere from 30 to 60 days, depending on the qualifying conditions.

Usda Rural Development502 Direct Loan Program

RUPCO is an approved packager of the USDA Rural Development Section 502 Direct Loan Program. This loan product helps eligible low- and very-low-income applicants obtain decent, safe, and sanitary housing in eligible rural areas through interest rate subsidies allowing higher loan amounts or better affordability. This loan provides 100% financing and can include closing costs and home repair costs worked into the loan if the applicant is eligible. Interest subsidy assistance and eligible loan amount vary based on income, debt, and other factors. Ask a counselor about this loan product or learn more below.

Eligible Properties

- Generally, homes with 2,000 square feet or less

- Does not have market value above the applicable area loan limit

- Does not have in-ground swimming pools

- Property size below 5 acres and not sub-dividable

- Not designed for income-producing activities

Eligible Applicants

Applicants interested in obtaining a direct loan must have an adjusted income that is at or below the applicable low-income limit for the area where they wish to buy a house. Loan applicants must demonstrate a willingness and ability to repay debt. Credit history and additional requirements apply.

Singles, family households, and unrelated partners may apply.

Applicants must

Be unable to obtain a loan from other resources on terms and conditions that can reasonably be met

Agree to occupy the property as primary residence

Have the legal capacity to incur a loan obligation

Beginning Farmers And Ranchers

USDA, through the Farm Service Agency, provides direct and guaranteed loans to beginning farmers and ranchers who are unable to obtain financing from commercial credit sources. Each fiscal year, the Agency targets a portion of its direct and guaranteed farm ownership and operating loan funds to beginning farmers and ranchers.

Don’t Miss: Co Applicant For Home Loan

What Is A Usda Loan And How Do I Qualify For One

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

USDA loans can help you with buying or improving a home in a rural area with no down payment. The U.S. Department of Agriculture offers several programs to help low- to moderate-income borrowers, but there are strict income and geographic eligibility requirements to qualify.

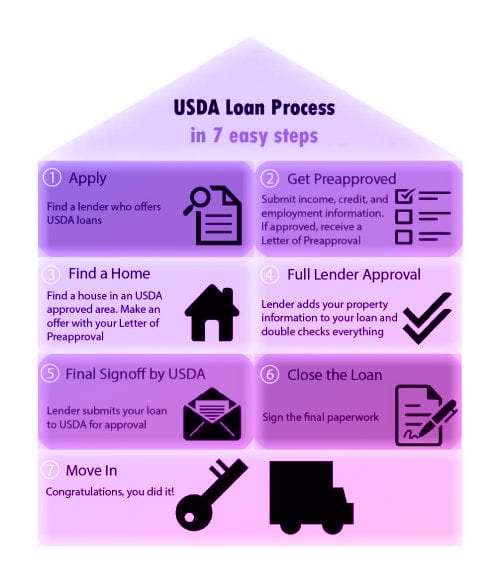

Find A Lender And Prequalify For A Usda Loan

The first step to getting a USDA loan is finding a USDA-approved lender. Hundreds of lenders make USDA loans, but some might only make a few of them every year. Working with a lender that specializes in this rural home program can make a big difference for homebuyers.

Once you’ve chosen a lender, it’s time to get prequalified. Prequalifying for a USDA loan is a relatively simple task that provides a general estimate of what you can afford, and if you are even eligible for the program.

This vital step can save you significant time and effort by narrowing down what homes you may be able to purchase. During this step, your lender will discuss how much you can afford and alert you to any red flags that may hold you back from qualifying for a USDA loan.

Be prepared to answer some initial questions about your financial situation. Most lenders will focus on:

- How much you wish to borrow,

- Your gross monthly income and other assets, and

- Your total monthly debts.

Many lenders will also ask your permission to do a hard credit inquiry at this time. Prequalifying for a USDA loan will help to identify common income, debt or credit issues that could make closing on a USDA loan difficult.

For example, the USDA considers four different income calculations when determining a borrower’s USDA income eligibility. Prequalification is an opportunity to review your qualifying income sources.

Depending on the lender, you may be able to obtain USDA prequalification and preapproval online.

Recommended Reading: How To Get A Car Loan When Self Employed

Usda Direct Loan Approval Process

As its name suggests, USDA Direct Loans are underwritten directly by the USDA, rather than a mortgage lender.

Direct loans are guaranteed loans that are designed to help low-income families and very-low-income families realize their goals of becoming homeowners by offering payment assistance to increase a households repayment ability.

According to the USDA, in order to qualify for a direct loan, buyers need to:

- Be without safe and sanitary housing

- Be ineligible for a loan from other providers on terms and conditions that can be reasonably met

- Agree to occupy the home as their primary residence

- Meet citizenship or eligible noncitizen requirements.

Furthermore, direct loans also carry property eligibility requirements, including:

- Home must be modest in size for area

- Home value must not exceed the market value of the applicable area loan limit

- Home may not have in-ground swimming pools

- Home may not be designed for income-producing activities

Even though USDA Direct Loans are underwritten by the USDA, home buyers can still expect a 30-60 day timeline for loan approval.

Requirements For Homes Purchased With Usda Direct Loans

Those who purchase a home with the help of a USDA Direct Loan must be buying homes no larger than two thousand square feet, and that do not have a market value higher than the applicable loan limit for that market. Homes purchased with USDA loans cannot have in-ground swimming pools. They also cannot be used for income producing activities.

These loan funds may be used to build, renovate or relocate a home. USDA loan rules add that loan funds can be used to purchase and prepare sites, including providing water and sewage facilities.

USDA Direct Loans require the borrower to repay all or a portion of the payment subsidy received over the life of the loan when the borrower no longer lives in the home or transfers ownership.

Other Property Eligibility Requirements

In general, housing markets defined by the USDA as rural areas that have populations less than 35,000 may qualify for USDA Direct Loan assistance. The USDA Income and Property Eligibility official site provides a wealth of information.

Terms Of The USDA DIrect Loan

USDA Direct Loans feature a fixed interest rate, plus the following:

- Interest rates based on current market rates

- Interest rates when modified by payment assistance may be offered as low as 1%

- 33-year payback or 38-year payback period

- Zero down unless the applicant has assets higher than the asset limit

Potential borrowers should contact their State USDA office to learn more about applying and qualifying.

| Related Articles |

Don’t Miss: Mortgage Loan Originator License California

Is A Usda Loan Or An Fha Loan Better

USDA loans and FHA loans each have pros and cons. Which one is better for you depends on your circumstances.

A USDA loan may be less costly than an FHA loan, so its worth considering a USDA loan first if you meet the eligibility requirements. USDA loans typically dont require down payments, making them attractive to homebuyers who dont have much money saved up. FHA loans, on the other hand, require down payments starting at 3.5%.

Direct loans from the USDA dont require you to pay for mortgage insurance, while FHA loans require monthly mortgage insurance as well as a one-time mortgage insurance premium upfront.

But FHA loans dont have income-eligibility caps like USDA loans do, so theyre available to people with a wider range of incomes. And you can use an FHA loan to buy an eligible home anywhere in the U.S., unlike USDA loans, which are restricted specifically to rural areas that meet population thresholds.

You arent excluded from any geographic location with an FHA loan, though the maximum amount you can borrow varies by county.

What Are The Usda Loan Requirements

There are three main factors the USDA considers when determining your eligibility. First, you’ll need to buy a home in a designated area. Next, your household income cannot exceed USDA income thresholds for your place of residence — 15% above the local median income. Finally, you’ll also need a credit score of at least 640, though contributing some cash toward a down payment can negate this requirement. If you meet the first two specifications but have a low credit score, you might still qualify for a USDA direct loan or FHA loan.

Otherwise, the requirements are pretty pedestrian. You’ll need to be a US citizen, green-card holder or noncitizen national. Your mortgage payment cannot exceed 29% of your monthly income, and your debt-to-income ratio must be no more than 41% of your monthly salary. You’ll also need to use the home as your primary residence, not have a record of breaking mortgages or commitments to other federal programs and meet any other lender-specific requirements.

Recommended Reading: 84 Month Auto Loan Usaa

How To Research And Apply

To apply for a USDA Rural Development loan, start by contacting a participating lender, preferably a USDA Multi-State Lender. After discussing your project scope, your goals and financing needs, you and the lender will determine the best loan option. If a loan under the USDA OneRD program is best suited for you, the lender will submit a pre-application to the agency to confirm eligibility.

If youre eligible, you and your lender will submit a full application to the USDA. Typically, the USDA will approve or deny the application within 30 days. The USDA requires financial statements, credit reports and other documents to complete the application, which may include but not limited to:

- A business plan

- Profit and loss statement not more than 90 days old

- Pro forma balance sheet projected for loan closing

- Balance sheet and cash flow projections for next two years

- Number of jobs created or saved and average wages

- Current personal or corporate financial statements for guarantors

- Real estate and/or environmental appraisal

- Feasibility study by independent consultant

The USDA B& I loan program carries restrictions on certain types of projects and borrowers. The program does not cover lines of credit, agricultural productions, lease payments and federal tax-exempt obligations. Certain types of borrowers are ineligible: charitable institutions, churches, fraternal organizations, lending and investment institutions, insurance companies, golf courses and racetracks or gambling facilities.

Benefits Of The Usda Single

There isnt much to pick at with the USDA rural development section 502 loan. These awesome mortgage products come with an absurdly low interest rate, sometimes as low as 1%. Even if that were the only benefit, it would still be more affordable than a good number of similar loans.

As if that alone werent impressive enough, these mortgages do not require a down payment to be made, and also do not require mortgage insurance. The upfront affordability is limited only to what a borrower must pay in closing costs, which the USDA estimates to be between $1,000 and $1,200. Still, this is a drop in the bucket when compared to other loan offerings.

Another absolutely awesome benefit of the USDA Single-family Direct Homeownership Loan is the flexibility a borrower has with how they can utilize the funds. Borrowers are able to fund a home purchase, refinance, renovation, rehabilitation, even the construction of a new dwelling. The possibilities are seemingly endless.

The USDA Single-family Direct Homeownership Loan is a one of a kind loan, designed to give families who would not be able to qualify for conventional financing a real path to home ownership. The best part is that if you are a family that needs the USDA Single-family Direct Homeownership Loan, there is a good chance that you qualify. The USDA doesnt put a heavy focus on credit scores for eligibility, rather it sets the requirements to ensure that the people who need the loan most are able to obtain one.

Recommended Reading: Refinance Car Usaa

Home Improvement Loans And Grants

The USDA loan program also includes loans and grants that help homeowners modernize, improve or repair their homes and grants that help older homeowners pay to remove safety and health hazards from their homes. Eligible homeowners need to earn less than 50% of the median income for their area.

As of 2021, the maximum loan amount is $20,000 and the maximum grant amount is $7,500. Homeowners who qualify for both a grant and a loan can combine them, receiving a maximum of $27,500. People who receive a USDA home improvement loan have 20 years to repay it. While the grants usually dont need to be repaid, if a homeowner sells their property within three years of getting the grant, they will have to pay it back.

Both grants and home improvement loans come directly from the USDA, and availability can vary based on area and time of year. Eligible individuals can apply for a loan, grant or both at their local Rural Development office.

Section 502 Direct Loans

Through its Single Family Housing Direct Home Loans program , the USDA lends money directly to homebuyers. Some people who take out direct loans from the USDA also qualify for payment assistance, which temporarily lowers the monthly payment they owe.

If eligible, you can use these loans to buy an existing home, and even repair it, if needed. You can also use the money to build a new home.

You dont have to make a down payment, unless your assets are above a certain threshold. Another plus: You dont have to pay for mortgage insurance.

The loans have a fixed interest rate thats determined by market rates. If you qualify for payment assistance, the effective rate can be as low as 1%. Loan terms are typically 33 years, though borrowers with very low income may have up to 38 years to repay the loan.

The loan amount is determined by your income, assets, debt-to-income ratio and other financial details, but it cant be higher than the USDAs loan limit for the area. And this type of loan cant be used to buy or build a home thats unusually large or valuable for its location, that has an in-ground swimming pool, or thats constructed to serve as the site of a business or to generate income.

Also Check: How Does Someone Take Over A Car Loan

What Is A Usda Loan And How Can I Qualify

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

If you’re buying a home in a rural area, it could pay to apply for a USDA loan instead of a conventional loan. Here, we’ll explain how USDA loans work, highlight the differences between USDA and other types of mortgages, and help you discover whether a USDA loan is right for you.

The Bottom Line: Dont Sleep On These Rural Housing Loans

Now that you know a little bit more about the differences between USDA guaranteed vs. direct loans, you should have a better understanding of where you fit in.

Although Rocket Mortgage® doesnt offer USDA loans, it can help you find the best loan option for your situation with its useful resources. Take some time to review your options and move forward with your homeownership dreams today.

Get approved to refinance.

You May Like: Calculate School Loan Payment

Find A Home In A Usda

Youve been preapproved for a USDA home loan. Now its time to find a home in a USDA-eligible area and make an offer. Your preapproval letter shows sellers and agents youre a lender-verified USDA buyer who can close. Keep it close at hand.

USDAs property eligibility lies in primarily rural areas. But you can also find USDA-eligible homes just outside of major metropolitan areas. In fact, huge swaths of the country are eligible for USDA financing.

Usda Loans: What They Are And Who’s Eligible

Whether you’re moving to the suburbs or the country, this federal mortgage program could save you thousands.

Have you stumbled upon USDA loans during your mortgage search? USDA loans are backed by the US Department of Agriculture — yes, you read that right — as part of its Rural Development program, which promotes homeownership in smaller communities across the country. If you don’t have enough money saved for a down payment or if you’ve been denied a conventional loan, you have a good chance of qualifying for a USDA loan.

Contrary to popular belief, these loans are not just designed for homebuyers in completely rural areas — in fact, 97% of the land in the US is eligible for a USDA loan. This means even if you’re moving just outside of a city, chances are pretty high that you’re moving to a USDA-designated area. That’s great news for the increasing number of buyers looking to jump ship from crowded urban apartments to homes with more square footage and land, following the pandemic.

Let’s find out if this rural development home-buying program is right for you.

Don’t Miss: Fha Refinance Fees