Why You Should Report A Change In Income

Reporting a change of income, even if it’s the loss of a part-time job or side gig that you work in addition to your full-time career, could make a difference in reducing your loan payments. If your budget is stretched thin and you’re worried about missing payments, lowering payments through income recertification could help you avoid default.

You enter default status when you’re at least 270 days late on making payments. Once you enter default, you arent eligible for income-driven repayment plans.

Defaulting can be harmful to your credit score, and it can also result in other negative consequences, such as wage garnishment and an offset of your tax refund.

Whether it makes sense to change your income-driven repayment plan depends on how long you expect your income to be lower than it was, how much of a financial strain your current payment presents, and what your new student loan payment may end up being.

Something Borrowed: How Marriage Impacts Your Student Loans

Recently married? Getting married soon? Congratulations! Weddings can require a lot of planning, and you probably already have a ton on your plate, but there is one item you may not have on your to-do list that I recommend you addfiguring out how getting married can impact your student loans.

Now that youve read the title, Im sure youre thinking, Wait. Getting married impacts my student loans? If youre enrolled or interested in enrolling in an income-driven repayment plan, it sure can.

- Filing taxes jointly with your spouse always means well use your joint income when calculating payments under an income-driven repayment plan.

- Filing taxes separately from your spouse usually means well use just your income when calculating payments under an income-driven repayment plan.

- If we are using a joint income to calculate your payment and your spouse has federal student loans, your payments will be reduced to account for your spouses loan debt.

- Filing taxes separately can make some income-driven repayment plans more affordable, but you might take a tax hit.

Lets dive in.

Income-Driven Repayment

How you file your taxes affects how your income-driven payment amount is calculated

As a general rule:

- If you file a joint federal income tax return with your spouse, were going to base your student loan payment on your joint income.

- If you file a separate federal income tax return from your spouse, were going to base your student loan payment on your individual income.

Potential Pitfalls Of Forgiveness

The IRS likes to tax things, and forgiven debt is no exception. Public service loan forgiveness is not taxable. But any balance wiped out through an income-driven repayment plan can be counted as income and taxed. It’s important to prepare for this eventual tax bill. Consider setting aside money in a dedicated savings account.

Note that the American Rescue Plan , passed by Congress and signed by President Biden in March 2021, includes a provision that student loan forgiveness issued between Jan. 1, 2021, and Dec. 31, 2025, will not be taxable to the recipient.

You May Like: Car Refinance Rates Usaa

Option : Switch To Another Payment Plan

IDR plans arent the only option available if you want to reduce your monthly payments. The federal government also offers extended and graduated repayment plans.

The extended plan stretches payments to 25 years, while terms under the graduated plan are either 10 or 30 years, depending on the type of loan you have. Neither the extended nor the graduated plan offers loan forgivenessa notable downside compared to an IDR plan. If you want a low payment, IDR is often the best choice. But a different IDR plan could be better for you now than before the forbearance period began, depending on your circumstances.

Use the governments loan simulator to see which repayment plan would result in the lowest monthly payment for you.

Student Loan Forgiveness: Which Loans Are Eligible

Only direct loans made by the federal government are eligible for forgiveness. Stafford loans, which were replaced by direct loans in 2010, are also eligible. If you have other federal loans, you may be able to consolidate them into one direct consolidation loan that would make you eligible. Non-federal loans do not qualify for forgiveness.

In addition, borrowers with federal student loans who attended for-profit colleges and seek loan forgiveness because their school defrauded them or broke specific laws were recently dealt with a setback. On May 29, 2020, former President Trump vetoed a bipartisan resolution that overturned new regulations that make it much more difficult to access loan forgiveness. The new, more onerous regulations went into effect on July 1, 2020.

Don’t Miss: How Long Does Sba Loan Take To Get Approved

How Do I Change My Student Loan Repayment Plan For Federal Loans

First off, federal student loans are more flexible when it comes to modifying your payments. There are a few different ways you can go about it, from changing the number of years you have to repay to changing your monthly payment. You can even pause payments or consolidate your loans.

Therefore, choosing the right student loan repayment plan for you depends on the goal you have in mind. Do you want to pay off your loans faster? Or do you need to have lower monthly payments? Maybe you prefer to have all of your loans in one?

The answers to these questions will lead to different types of student loan repayment options. You need to understand your biggest pain point first and then go from there. Consider which of the following four scenarios applies directly to your situation:

Income Contingent Repayment Plan

Under the ICR plan, your payment is the lesser of:

- 20% of your discretionary income or

- what you would pay on a repayment plan with a fixed payment over 12 years, adjusted according to your income.

Like with all of the income-driven repayment plans, you’ll have to reapply every year, and the payment amount will likely be adjusted. If you haven’t paid off your loan after 25 years, the government will forgive the remaining balance.

Also Check: Can You Refinance Your Car With The Same Lender

I Can’t Keep Track Of My Payments And Due Datesconsolidation

If you have multiple federal student loans with different monthly payments and due dates you can consolidate your loans. Consolidation combines multiple federal loans into a single loan with a fixed interest rate and a single monthly payment, and provides a longer repayment period, which can reduce your monthly payment. Learn more about consolidation.

Olivia’s story: I can’t keep track of my payments and due dates

Olivia got a good job out of college. She has the budget to make her student loan payments, but she has a hard time keeping track of the different due dates and amounts on top of her other monthly expenses. Consolidation will make things easier to manage.

In a number of small scenarios you may be eligible for loan forgiveness. It’s a special program that cancels part or all of a federal student loan. Learn more if you think you might be eligible.

Don’t see your story here? Find an option that matches your story in the Repayment Planner.

Get Credit For Student Loan Forgiveness If You Used Wrong Student Loan Repayment Plan

Some borrowers dont realize that only certain student loan repayment plans are eligible for public service loan forgiveness. For example, income-driven repayment plans such as IBR or REPAYE are two example of eligible student loan repayment plans. A new rule change would give payment credit to any student loan borrowers who made student loan payments through an ineligible student loan repayment plan.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Can I Change My Student Loan Repayment Plan

It depends on what types of student loans you have and your lender. If you have federal loans, youre eligible to change your repayment plan as needed. But most private loans dont come with the option to change your repayment plan or at least not officially. If youre at risk of defaulting and need to lower your monthly repayments, some private servicers might be willing to budge.

What This Announcement Means For You

Depending on your loan situation, you might need to take action to get credit for your student loan payments.

- If you have FFEL or Perkins loans: You must apply for Direct loan consolidation by Oct. 31, 2022, to fold these loans into the Direct loan program. After you consolidate, you must submit a PSLF form to your loan servicer.

- If you havent submitted a PSLF form or Employment Certification Form yet: You need to submit a PSLF form by Oct. 31, 2022, to get credit for all your student loan payments. While the PSLF and Employment Certification forms used to be separate, theyve now been combined into a single form that you can access here.

- If you have Direct loans but havent been assigned to FedLoan Servicing: This would most likely happen if you hadnt submitted a PSLF form yet. In this situation, you also need to submit a PSLF form.

- If you have Direct loans and have already submitted your forms: You shouldnt have to do anything to get credit for your payments, even if they werent on income-driven repayment, as long as your employer was approved. However, its still worth checking with your loan servicer to make sure youre on track to getting PSLF. Its often a good idea to submit the form every year so that the Education Department has a paper trail of your years of qualifying employment.

Also Check: Usaa Certified Dealers List

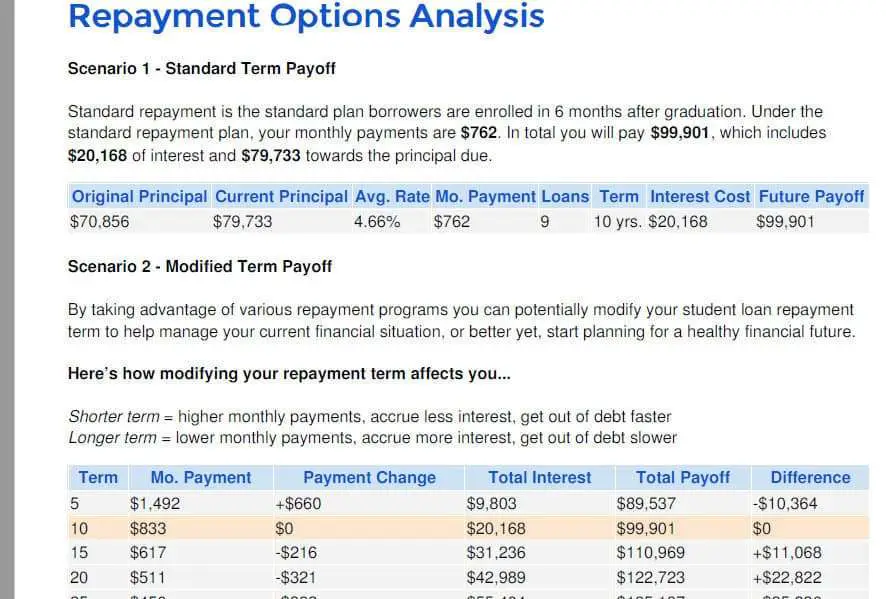

Understand Your Repayment Options

After you know who and how much you owe, and have a sense of your personal budget, it’s time to learn about your repayment options. Your repayment plan determines how much you pay each month, including what you may pay in interest, over the life of your loan.

This means that choosing a repayment plan is usually about paying as much as you can afford each month , but not more than you can afford (to avoid missing payments.

Im Hoping To Be Able To Repay My Loans

If paying off your debts is your primary objective, youll be relieved to know that its possible using the income-driven repayment alternatives we described earlier.

To begin, we must present a list of Federal loan forgiveness options:

The bulk of these programs are entirely arbitrary. However, there are several that you can deliberately seek out and learn how to use.

Read Also: How Do I Find Out My Auto Loan Account Number

When You Should Report A Change Of Income

The best time to report a change of income to your loan servicer is before you reach a point where you’re struggling with how to pay off student loans. In other words, as soon as you experience an income drop that looks to be more than just temporary, you may want to reach out to see what options you have.

Remember that when you’re on an income-driven repayment plan such as income-based repayment or Revised Pay As You Earn, you need to recertify your income annually so your loan servicer can ensure that you’re still income-eligible.

Count Prior Student Loan Payments Made For Ffelp Loans

This is one of the biggest issues with student loan forgiveness. If the Education Department changes this rule, there could be student loan relief for these borrowers who have struggled for years. . Prior to 2010, FFELP student loans were issued by financial institutions as federal student loans. Historically, borrowers who hold these student loans have struggled to get them included in student loan forgiveness because the Public Service Loan Forgiveness program only applies to Direct Loans such as Stafford Loans. While student loan borrowers with FFELP Loans can consolidate FFELP Loans into a Direct Consolidation Loan, their prior payments for FFELP Loans didnt count toward the required 120 monthly payments. In effect, these student loan borrowers had to start over after they consolidated into a Direct Loan, even if they made 100 monthly payments, for example. Now, the Education Department may scrap this rule and count prior student loan payments, even for FFELP Loans. If the Education Department implements this rule change, it could be a game changer for student loan forgiveness.

You May Like: Rv Loan Calculator Usaa

Federal Student Loans: What To Expect And How To Prepare For Payment Resumption

Federal student loan payments will resume at the end of January 2022. The U.S. Department of Education has made it clear that this is the last COVID relief extension. This means borrowers should be ready to make their first payment in February.

Here are some things you can expect:

-

Your student loan servicer will contact you about payments resuming.

-

You will receive an invoice at least 21 days before your first payment is due.

-

Your monthly payment due date should be the same you had prior to the COVID administrative forbearance.

-

Your payment amount should be the same if you were enrolled in an Income Driven Repayment plan unless you renewed or changed your payment plan during the suspended period. If you were enrolled in a Standard, Graduated or Extended Repayment plan, your payment amount may be different. Contact your servicer for more information.

-

Auto-debit payments should resume automatically.

-

Your loans will start accumulating interest starting February 2022 and any accumulated interest should not be capitalizedi.e., added to your principalunless you were in a traditional deferment or forbearance prior to the COVID relief .

-

If your loans were in default, collection activities may resume.

-

For more information on what to expect, click here.

Between now and February, here are some things you can do to prepare for student loan payment resumption:

Switching Student Loan Repayment Plans: Should You Do It

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

* * *

Don’t Miss: How To Transfer A Car Loan To Someone Else

Revised Pay As You Earn Repayment Plan

With REPAYE, your monthly loan installments are 10% of your discretionary income, which means they could be as little as $0 or as high as youd pay under the Standard Repayment Plan.

Under REPAYE, youre allowed 20 years to pay off loans for undergraduate studies and 25 years to pay off loans that include graduate work. Any amount not paid within the set time is typically forgiven.

The following federal student loans are eligible for REPAYE:

- Direct Subsidized Loans

- Direct PLUS Loans made to students

- Direct Consolidation Loans that do not include PLUS loans made to parents.

With REPAYE, student loans can cost more than the 10-year Standard Repayment Plan, but the plan provides breathing room if your income fluctuates or your loan amount is high.

Pay As You Earn works similarly, but youll never be required to pay as much monthly as you would under the Standard Repayment Plan. Additionally, you must be a new borrower on or after Oct. 1, 2007, and must have received a disbursement of a Direct Loan on or after Oct. 1, 2011.

PAYE works like other income-driven federal student loan repayment options in that you must report income and family size annually, and any unpaid balance will be forgiven in this case after 20 years.

Federal student loans eligible for PAYE are the same as those eligible for REPAYE .

Option : Resubmit Your Income

If you lost your job or were furloughed during the forbearance period, you can apply for a new IDR monthly payment. Youll have to provide evidence that you were laid off, like a termination letter from your previous employer or proof of unemployment benefits. Ask the loan servicer what documents will qualify.

You may also resubmit your information if youve had a child since the administrative forbearance period began. Adding a dependent will also reduce your monthly payment. If you have children and got divorced during forbearance, you may also qualify for a lower payment.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Teacher Loan Forgiveness Program

Student loan forgiveness for teachers is neither generous nor easy to qualify for. Teachers can have up to $17,500 of their federal direct and Stafford student loans forgiven by teaching for five complete and consecutive academic years at a qualifying low-income school or educational service agency. Loans that were issued before October 1, 1998, are not eligible.

You must be classified as a highly qualified teacher, which means having at least a bachelor’s degree and having full state certification. Only science and math teachers at the secondary level, and special education teachers at the elementary or secondary level, are eligible for $17,500 in forgiveness. Forgiveness is capped at $5,000 for other teachers.

You can qualify for both teacher and public service loan forgiveness , but you can’t use the same years of service to be eligible for both programs. So you’d need 15 years of teaching service to qualify for both programs, along with meeting all the specific requirements to earn each type of forgiveness.