Variable Car Loan Interest Rates Why Theyre Hard To Budget For

Repayment tables and amortisation calculation is easy when theyre for fixed rate car loans. You divide the principal and the interest up over sixty months and pay off the loan in the allotted time. In a variable rate loan, these repayments can vary due to the nature of variable rates. Variable rates can climb up or down depending on the market. If the market for loans get tighter, your interest rate can go up and so do your repayments. If the market eases, your interest rate can go down along with your repayments.

In many cases, a variable rate is a gamble do you go along with the market and hope it drops? Or do you make the most of record low interest rates now and hope they dont shoot up? Either way, your monthly repayments may change from one month to the next, which makes budgeting all the more harder.

Car Loan Fees And Charges For Top 3 Banks

Given below is a comparison of a few fees and charges levied by three selective banks:

| Name of the bank | Axis Bank | |

|---|---|---|

| Processing fee | 1% of the loan amount. The maximum and minimum amount that can be charged are Rs.5,000 and Rs.10,000, respectively. | Rs.3,500 to Rs.5,500 |

| 3% – 6% depending on amount of time completed* | 5% of the principal outstanding | |

| Loan cancellation | As mentioned by the bank | Rs.2,500 per instance |

| 2% per month |

Note: GST rates will be applicable over and above the rates charges mentioned above.

*HDFC Bank does not allow foreclosure within 6 months from the day the car loan was availed.

How To Determine The Total Interest Paid On A Car Loan

Joyce Morse

An important aspect of any vehicle loan is the amount of interest you pay. If you want to compare loans to see which one is the better deal or just figure out how much interest youve paid in for the life of your car loan, you can calculate the total amount of interest paid. Follow these steps to know the true price of the vehicle you purchased.

Don’t Miss: Bayview Loan Servicing Tucson

Find Out How Much Is Being Financed And For How Long

The first step of the loan process is determining which loan you want to pursue. This requires you to figure out how much you can expect to pay in principal, annual percentage rate , and other fees.

Step 1: Find out the principal. Discover the amount you are financing in your loan, which is called the principal.

It will be the purchase price minus any cash rebates and your down payment and trade-in. When you subtract these amounts from the total purchase price, which will also include charges and the sales tax, it gives you the principal.

For example, if your cars sticker price was $20,000 and you traded in your old car for $5,000 and gave $2,000 as a down payment, your principal is $13,000.

Step 2: Find out the length of the loan term. Many car loans for new or slightly used vehicles carry a term up to five or even six years. Some may go as long as seven years, but keep in mind that you pay more interest for longer-term loans.

Divide Total Interest By Time

Once you have the total amount of interest you will pay off over the life of the loan, divide this number by the number of years you will be paying on the loan to determine the yearly interest payments. You can then divide this number by twelve to determine the amount of your monthly payment that will be applied to interest. An auto loan calculator available on the Internet can aid in this process, which can help you customize your payment options to fit your budget and financial schedule.

Before you take out a loan for a new or used car, you should calculate the auto loan interest that youll end up paying on the loan. Auto loan terms can be hard to understand sometimes, if not misleading.

Also Check: Capitol One Car Loans

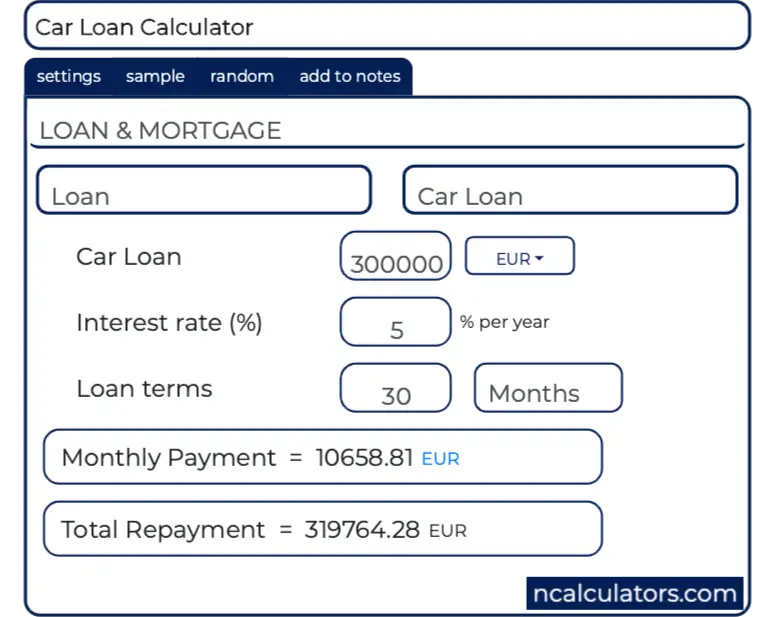

Try Our Calculator For Yourself

If youve learned anything today, we hope its that its important to weigh all factors when buying a vehicle, either new or used. Our car financing calculator will be a great tool to help you plan your next vehicle purchase.

It can help determine how much money you want to put down . Based on how much your trade-in value is, it can be a great help when deciding what kind of term you want to choose. Note: some interest rates are term-specific, so even if your credit history says you can get 1.99% interest, for example, you may have to choose a certain term length in order to qualify for that interest rate.

Calculate The Total Interest Payment

In order to calculate your interest payments over time, it is necessary to know the total amount of interest due on your loan. Begin by multiplying your loan’s interest rate by the number of years you will be paying the loan off. For example, if you have a 6 percent interest rate on a five-year term, you would multiply 0.06 by 5 to get 0.30. Multiply it by the total amount of money you are borrowing on the loan to get the total amount of interest you will pay over the course of paying off the loan.

If you get a $20,000 loan at 6.0%, you will pay $6,764.51 in interest for the five-year duration, making that a total of $26,764.51. That’s considerably more than you will take out.

Using a monthly payment calculator brings is similar in that it simplifies loan calculations. Enter in the amount borrowed, the interest rate and the time period. Using the same example, your monthly payment would be $386.65.

Both types of calculators give an approximate total, whether its interest or a monthly payment. Fees may alter the numbers given but offer a good estimate.

Don’t Miss: Capital One Auto Loans Rates

Toyota Rav4 Suv Seen In India Ahead Of Launch

The model of the Toyota RAV4 SUV that has been spotted in India looks similar to the one that is sold globally. According to the rules, around 2,500 units can be imported by the manufacturer in a year. The car is expected to launch in India and is very popular around the world. In case the vehicle is launched in India, it will be powered by a 2.5-litre petrol engine. The SUV is expected to be priced around Rs.60 lakh and will be available in limited numbers. The car is expected to compete against the likes of the Jeep Compass and the Hyundai Tucson.

25 February 2021

Buying A Car With Cash Instead

Although most car purchases are made with auto loans in the U.S., there are benefits to buying a car outright with cash.

There are a lot of benefits to paying with cash for a car purchase, but that doesn’t mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. For example, if a very low interest rate auto loan is offered on a car purchase and there exist other opportunities to make greater investments with the funds, it might be more worthwhile to invest the money instead to receive a higher return. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. It is up to each individual to determine which the right decision is.

Recommended Reading: Co-applicant In Home Loan

Calculation Of Car Loan Emi

The table below provides you the car loan repayment schedule for a loan amount of Rs.5 lakh, EMI of 10,624, tenure of 5 years, interest rate of 10% p.a. and processing fee of 1%.

| Year |

|---|

| Rs.6,37,411 |

In the above example, if you make a prepayment of Rs.50,000 after paying 4 EMIs:

You will Save Rs.32,505 in total loan amount Loan tenure will be reduced by 7 months

Without Pre-payment

Interest: Rs.1,09,906 EMI tenure: 4 years 5 months

You can make use of the Car Loan EMI calculator to estimate the amount you have to pay each month towards your car loan. The online EMI Calculator offered by BankBazaar will calculate the monthly instalments as well as provide you with a detailed loan repayment table presenting you with details such as the principal amount and interest amount being paid and the outstanding balance after payment of the instalment.

How Do Lenders Decide My Auto Loan Interest Rate

Answered by Jim Manelis is a car enthusiast and Chase Auto Executive.

Buying and financing a vehicle can seem like a daunting transaction, but you can accelerate the process by being prepared with the right information. One of the most common questions people ask is how lenders decide on what their auto loan interest rate will be.

Also Check: Capital One Car Pre Approval

Advantages Of Using The Car Loan Emi Calculator

- Break-Up of the Due Amount is Provided: The car loan EMI calculator helps you calculate the processing fees, interest that is paid, the total amount that must be paid, and the principal amount.

- Your Budget can be Planned: Once you know the EMI that must be paid, you can plan your budget accordingly. In case the loan amount that is being availed is large, you may think of opting for a longer tenure. These details can be determined by using the car loan EMI calculator.

- Accuracy: For the details that are being provided on the calculator, the results that are displayed are accurate. Manual calculations may not provide accurate results.

- Saves Time: The main aim of the Car Loan EMI calculator is to save time. Once the relevant details are entered, the results are displayed almost immediately.

- No Limit: There is no limit to the number of times the calculator can be used. Therefore, you use the calculator with different variants. This can help you choose the best lender and the down payment that must be paid.

- Compare: As there is no limit to the number of times that the calculator can be used, you can compare the EMIs for different values.

Controllable Factors That Determine Interest Rate

While many factors that affect the interest rate are uncontrollable, individuals can, to some degree, affect the interest rates they receive.

Individual Credit Standing

In the U.S., credit scores and credit reports exist to provide information about each borrower so that lenders can assess risk. A credit score is a number between 300 and 850 that represents a borrower’s creditworthiness the higher, the better. Good credit scores are built over time through timely payments, low credit utilization, and many other factors. Credit scores drop when payments are missed or late, credit utilization is high, total debt is high, and bankruptcies are involved. The average credit score in the U.S. is around 700.

The higher a borrower’s credit score, the more favorable the interest rate they may receive. Anything higher than 750 is considered excellent and will receive the best interest rates. From the perspective of a lender, they are more hesitant to lend to borrowers with low credit scores and/or a history of bankruptcy and missed credit card payments than they would be to borrowers with clean histories of timely mortgage and auto payments. As a result, they will either reject the lending application or charge higher rates to protect themselves from the likelihood that higher-risk borrowers default. For example, a credit card issuer can raise the interest rate on an individual’s credit card if they start missing many payments.

How to Receive Better Interest Rates

You May Like: Specialized Loan Servicing Lawsuit

How To Calculate Total Interest Paid On A Car Loan

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin. This article has been viewed 345,921 times.

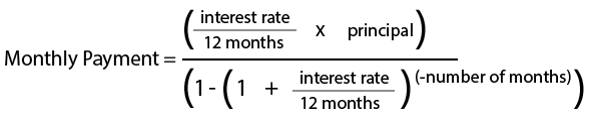

There are several components that are used to compute interest on your car loan. You need to know the principal amount owed, the term of the loan, and the interest rate. Most car loans use an amortization schedule to calculate interest. The formula to compute amortization is complicated, even with a calculator. Car buyers can find amortization calculators on the web. If your car loan uses simple interest, you can use the calculator to determine your monthly payment amount.

The Hyundai Genesis S80 Spotted In Mumbai

The Hyundai Genesis S80 has been spotted testing in Mumbai. The sedan will compete with the likes of the BMW 5 Series and the Mercedes-Benz E-Class. The car made its debut in the global markets in March 2020. However, there is still no confirmation that the car will launch in India. The Genesis line-up was launched in the international markets in 2015. Currently, there are two SUVs and three sedans under the Genesis brand. The car comes with a 4-door coupe design. Some of the main interior features of the car include a 12.3-inch digital instrument cluster, a two-spoke steering wheel, and a 14-inch infotainment unit.

19 February 2021

Recommended Reading: How Long Before Sba Loan Is Approved

Significance Of Effective Annual Rate

The effective annual interest rate is a significant term that permits the assessment of the genuine profit from speculation or genuine financing cost on an advance.

The stated annual interest rate and the effective interest rate can be altogether different, because of compounding. The effective interest rate is significant in sorting out the best loan or figuring out which venture offers the most elevated place of return.

On account of accumulating, the EAR is consistently higher than the expressed yearly loan cost.

Calculate Interest Paid By Hand

You can also calculate the total interest you can expect to pay by hand using a simple formula. Before doing so, make sure you have the information you need, including how much you pay per month, the principal loan amount, and the total number of payments you have to make.

Materials Needed

- Calculator

- Paper and pencil

Step 1: Find the monthly interest. Divide the APR by 12 to determine the amount of monthly interest.

For our example we will assume that you have an APR of 6%. Divided by 12, this gives you a monthly interest rate of .5%. Convert this further into its decimal point equivalent, which is 0.005. As part of the equation, you have to add 1 to your monthly APR, giving you 1.005.

- Tip: You could opt to make a higher down payment to qualify for a lower APR. This reduces the total amount of interest you have to pay over the life of the loan.

Step 2: Factor in your other numbers. Further information you need for this equation includes the principal, or the amount you are borrowing, and the length of the loan, or the amount of time in months, that you plan on paying the loan back.

For this example, we will use $15,000 as the amount of the principal, paid off over the course of five years, or 60 months.

Step 4: Multiply with the APR. Multiply the amount gained from the above step by the amount of the original APR, which in this case is 0.005. This gives you the sum of 0.00674.

Don’t Miss: Usaa Auto Loan Approval Odds

Computing Your Total Interest Using An Online Calculator

How To Calculate Interest On A Car Loan

Calculating interest on a car loan can prove difficult as some car loans do not advertise the full cost of taking out a loan. You can only know how much a loan will cost when a lender or bank shows you the comparison rate, which includes most fees and charges youll pay over the length of a loan term account keeping fees for example shown as a percentage.

Once you know this figure, you can use a car loan calculator to figure out how much interest youll be paying over the term of a loan. You can also use a calculator called an amortisation table to show you how much interest youll be paying per repayment, provided your car loan has a fixed interest rate.

You May Like: Auto Calculator Usaa