Use The Auto Refinance Calculator To Find Potential Savings

Bankrates auto refinance calculator can help you determine how much money a new rate would save you on interest, monthly payments, or even both. To use it, input the details of your current loan: your monthly payment, remaining balance, interest rate, and the remaining loan term.

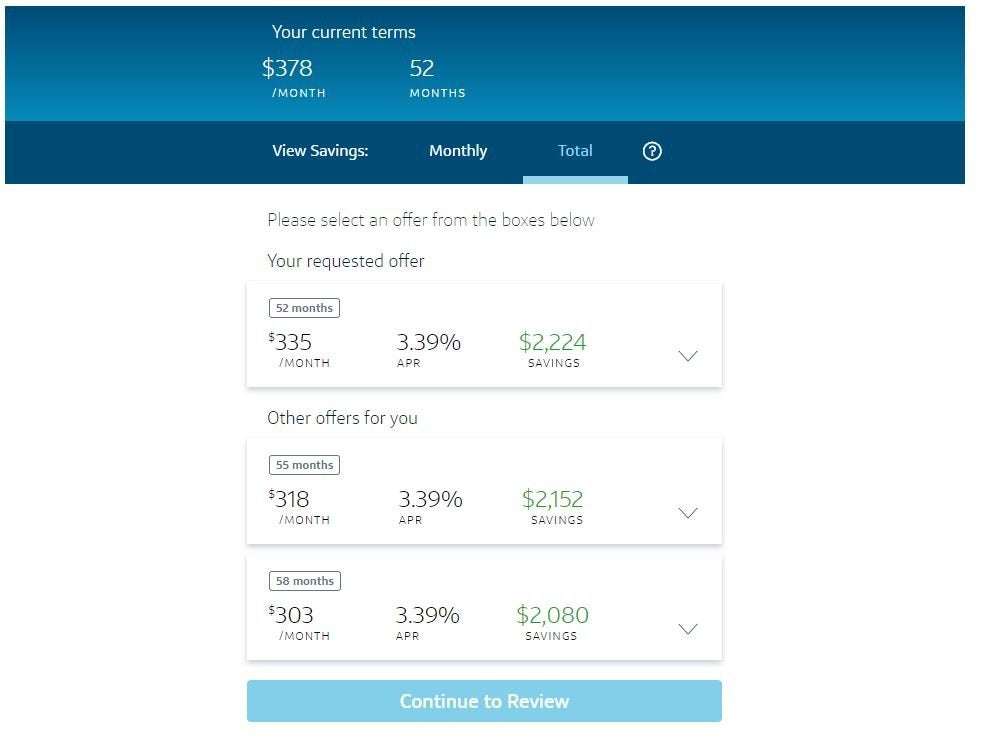

Next, play around with the interest rate and term for your new loan until the estimated savings or monthly payment are in your favor. Once you have an idea of what term and interest rate will make refinancing worth your while, its time to get prequalified. See current offers from Bankrate lending partners to compare different rates and terms on auto loans.

Applying To Refinance Your Vehicle Loan

When it comes to refinancing an auto loan, the application process is relatively quick and painless. In fact, you’ll likely find it much easier than when you applied for your original loan. Many lenders, banks and credit unions among them, allow customers to apply for refinancing online, often with same day approval. You may even be able to finalize the loan online with an e-signature, or by printing out the loan documents and returning them by mail. Having said all that, it is always helpful to speak with a loan officer in person to ensure that you fully understand the terms of the agreement, and in order to negotiate the best deal possible.

Whether you decide to apply online or in person, you will need to have some specific information at your fingertips in order to complete your application. The following checklist should help ensure that you have all of the necessary documents at hand when it comes time to contact a lender.

Keep in mind that while you are researching lenders, and applying for a refinance loan, you must maintain your current repayment schedule. Should you miss any payments, you will not qualify for refinancing. Your responsibilities to your original lender will remain in force until the refinance agreement is finalized and your new lender has resolved the original debt.

Where To Apply For Refinancing

Banks and credit unions are usually the best options when it comes to refinancing your vehicle. Online lending companies are also a viable alternative, and some even specialize in auto refinancing. However, online lenders rarely offer the competitive interest rates that are available from traditional banking institutions. Moreover, dealing one on one with a bank or credit union in your community typically makes the entire loan process easier. You can speak with a loan officer directly, and go over all aspects of your refi agreement before you sign the contract. You will also have direct access to customer support throughout the life of your loan.

As with any car loan, you will want to investigate a few different lenders in order to find the best deal that is available. Compare and contrast three to four different refinancing offers, and pick the one the best suits your financial needs at the time. Remember, refinancing a vehicle is simply paying off one loan with another, and you do not want to rush into any agreement that you don’t fully understand, or that you are not completely comfortable signing.

Don’t Miss: What Is The Largest Student Loan I Can Get

You Already Have The Best Rate

If you purchased your car new, you likely got an attractive new car rate, especially if you took advantage of a special interest offer, which can feature rates as low as 0%. The refinancing rates for some lenders, among them Bank of America, are higher than even their used-car rates, even if your vehicle isnt even a year old. Also, interest rates have been fairly low in recent years, and while a rate drop may be on the horizon, that alone may not be enough to justify a refinancing if your goal is to save a significant amount of money.

Fees Fees And More Fees

One thing to consider is that the cost of refinancing can really add up when you factor in attorney fees , title insurance, title exam fees, appraisals, loan origination fees, etc. If you recently refinanced, you will have just paid all of these fees and thinking about having to do it again usually doesnt sit well with most.

Keep in mind that even if you use the same loan originator, most likely, the fees will have to be paid again. However, some fees may not, such as the appraisal fee or you may be able to negotiate a discounted origination fee.

The fees may also be worth it if you can save more money over the life of the loan. Dont completely rule out a refinance until youve had the opportunity to really crunch the numbers.

You May Like: Does Refinancing Car Loan Hurt Credit

When Your Credit Health Has Improved

Your credit scores are a factor in determining your auto loan rate. If your scores have gone up since you bought the car, and youve made on-time car payments, you might get a better rate, which could save you money in interest over the life of the loan.

Lenders may use your FICO® Auto Scores;or base credit scores to help determine your creditworthiness. But no matter which they use, better credit scores can indicate to lenders that youre more likely to pay off your loan, so they may give you a lower rate.

Not sure if your scores have improved? On Credit Karma, you can get your free VantageScore 3.0 credit scores from TransUnion and Equifax.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Don’t Miss: Can You Refinance Your Car Loan With The Same Company

How And Where To Refinance An Auto Loan

When you are looking to refinance, youll want to shop around for the best rates, flexible terms, and lowest fees. Your local credit union is a great place to start. Check out Spirit Financials auto loan rates.;The more you research out your loan options, the better the chances of you getting the best deal. You can run the numbers to see how the deal stacks up and what your overall savings will be. When you find the lender you feel will offer you the best deal on an auto refi loan, youll find the process similar to when you got your previous auto loan.

Once you complete a car loan application, the lender will run a credit check and request information about your income and the vehicle you are refinancing. Theyll evaluate how much you owe on your existing loan and how much the car is worth to be sure youre not upside down on your vehicle. Once the car refi loan is approved, they will pay off your original loan, transfer the title and you will begin making your new loan payments.

Your decision to refinance an auto loan may depend on your individual financial situation. We hope that our blog helped you to better understand if refinancing is right for you. Interested in learning more about shopping for a new vehicle? Read;our Ten Steps to Getting the Best Deal when Purchasing a Vehicle and Buying a Car vs. Leasing. We also invite you to learn more about CarShop365, our online car shopping tool!;

When Should I Avoid A Refinance For My Auto Loan

With any auto loan, the amount of interest paid decreases each month during the length of the loan and the amount of principal paid increases each month. A good way to think about it is the interest is paid on the front end of the loan and the principal is paid on the back end.

With that said, if you are towards the end of your loan, it may not make sense to refinance your auto loan since you have paid most of the interest up front. Sure, it may lower your monthly payment, but overall, the refinance could cost you more in the long run.

Don’t Miss: Which Bank Is Best For Construction Loan

Which Is The Best Lender To Refinance With

The higher your credit scores and the stronger your finances, the more choices youll have. Apply to multiple lenders to see what new interest rate you can qualify for. Comparing several offers gives you the best chance of finding the lowest rate.

Keep in mind that rate shopping can also lead to being contacted by multiple lenders, especially if you use a service that compares offers for you. Consider opening a new email account and getting a free Google Voice phone number that you can check separately.

Most lenders use what is known as a soft credit check that gives you a rate estimate but does not hurt your credit score. If you apply to more than one lender that requires a full application and hard credit check, credit scoring formulas tend to treat multiple inquiries in a short time period as a single event. For most FICO formulas, for example, that period is 45 days.

Understand How Your Credit Will Be Impacted

Virtually every time you apply for credit, the hard inquiry will reduce your credit score by a few points. If you then open a new loan account, itll lower the average age of your accounts, which can also lower your credit score.

That said, both of these factors are much less important in calculating your credit score than your payment history and making timely payments on your new loan will increase your score over time. So unless youve applied for a lot of other credit accounts recently or you dont have a long credit history, refinancing is unlikely to make much of a difference.

Also Check: How To Apply For Direct Loan

Where Can I Refinance My Current Auto Loan

You can refinance your auto loan by visiting your local OneAZ Credit Union branch. If you do not have time to visit a branch, you can request an appointment with a banker on your computer, phone or tablet, or call the OneAZ Virtual Team at to apply. Or to apply online in five minutes or less.

In addition, you do not have to be a current member at OneAZ Credit Union to apply for a loan. to learn what it means to be a OneAZ member.

When Can You Refinance

You do not need to wait any minimum amount of time before refinancing your car loan. You just have to meet all the requirements for the new loan to refinance. Refinancing is possible immediately after buyingeven before you make your first monthly payment. Just be sure that you actually end up with a better deal, and that refinancing doesnt cause you to pay more for your vehicle.

In some cases, you may be unable to refinance until you have documentation from your states Division of Motor Vehicles . Gathering registration details may slow you down somewhat.

Also Check: What Is Refinance Home Loan

Benefits Of Refinancing After A Bankruptcy

Refinancing after a bankruptcy can have a number of advantages. Lets take a look at some of them now.

- More manageable payments: You can lower your monthly payment when you take a longer term when you refinance your loan. This can help save you from falling back into debt.

- Cash to cover debts: Most types of bankruptcy allow you to keep some form of equity in your home. Do you qualify for a cash-out refinance? You can take on a higher principal balance and get the difference in cash from your lender. You can put this cash toward debt payments and help improve your credit faster.

- Lower interest rates: Are interest rates lower now than when you initially got your loan? This may help you save thousands of dollars over the course of your loan. However, keep in mind that you may not have access to the best interest rates unless your previous bankruptcy expired from your credit profile.

Apply For A Refinance

The first step in any refinance is to apply with your lender of choice. You dont need to apply with the same lender you already have a loan with.

Define your goals for your refinance, then begin comparing lenders. Some of the things you should consider include:

- Minimum loan standards: Make sure you meet the lenders minimum credit score standards before you apply. Its also a good idea to meet debt or equity standards as well.

- Availability: Choose a lender with availability and customer service hours that mesh well with your career or other obligations.

- Rates and fees: Rates and fees can vary from lender to lender. Dont be afraid to take some time and choose one with reasonable refinance interest rates and fees.

Once you choose a lender, you can speed up the refinancing process by having all of your documentation in order before you apply for your new loan. Some documents you should have handy include your:

- Two most recent W-2s

You May Like: What Do You Need For Student Loan

Difference Between Chapter 7 And Chapter 13 Bankruptcies

The process youll go through to refinance after bankruptcy depends on the type of bankruptcy youve filed. Lets go over the differences between the main types of bankruptcy: Chapter 7 and Chapter 13.

- Chapter 7: Chapter 7, sometimes called a traditional bankruptcy, discharges your debts. A Chapter 7 bankruptcy might allow you to release certain types of debt, but you wont be able to wipe away things like student loans, child support and court-ordered judgments. It may also require you to liquidate some of your property. Chapter 7 bankruptcies stay on your credit report for 10 years.

- Chapter 13: A Chapter 13 bankruptcy doesnt get rid of all of your debt. However, it does allow you to restructure your debt and hang onto your property. This procedure may allow you to spread your payments over a longer period of time or only pay back part of your loan. Chapter 13 bankruptcies leave your credit report after 7 years.

You might have a much more difficult time getting a refinance if you have a Chapter 7 bankruptcy on your credit report. This procedure indicates to lenders that you havent been able to reach an agreement to pay back your debt with past creditors.

This makes you a much riskier borrower. Chapter 7 bankruptcies also stick around on your credit report for a longer period of time, which can negatively impact your .

Its Better To Refinance Sooner Rather Than Later

Its never too early to think about refinancing your home loan.

There is no minimum time wait. A mortgage is a contract. As soon as you can get a better deal, you should terminate the contract and take that better deal, says Realtor and real estate attorney;Bruce Ailion.

Closing attorney;Chuck Biskobing;says there are no major risks to refinancing within a year or so of purchasing.

Ive seen people refinance three times in a year to follow falling interest rates, says Biskobing.;

Say you want to apply the money saved each month back to the loan in the form of accelerated payments toward the principal, he says.;If so, you will almost certainly pay off the new loan faster than the old loan. And youre not adding enough time on the loan to really matter.

In other words, youre not resetting your loan term by much if youre just six or eight months into the mortgage.

But if youre much further into your loan say five to 10 years resetting to a new 30-year mortgage may not pay off.

To find out if a refi is worth it based on your remaining term,;try this refinance calculator.

Read Also: What Do Mortgage Loan Officers Do

Example: Cut Your Interest Payments By $29000 With A Refi

Your previous home buying or refinance process wasnt easy. There was a lot of red tape involved, and the;closing costs;were expensive. So why would you want to repeat all those steps again?;

There are plenty of good reasons.

First, you may be able to save a lot of money. In 2020 and 2021, mortgage rates reached their;lowest levels in history; meaning thousands of dollars in savings for many.;Current rates are still at historic lows.

Say you recently closed on a $250,000 mortgage for 30 years at a 4.5% fixed rate.;

Assume you now have the opportunity to refinance at 3.75%, resetting the 30 years.;

Youll save close to $100 a month on your monthly mortgage payments. Add that up over 30 years, and you will have paid almost $29,000 less in interest. And the lower rates go, the bigger savings you could see.;

If you count on staying put for a while, this strategy is usually worth it.

It makes sense to refinance if the interest payment savings make up for all the related costs and fees associated with closing a new mortgage, says Cororaton.

Other Considerations Before You Refinance

Think that a refinance might be right for you? Here are a few things to think about before you apply.;;

- Bankruptcies hurt your credit score. No matter which type of loan you choose, youll need to meet minimum credit standards before you qualify to refinance. Bankruptcy puts a massive hit on your credit rating, so you may need to focus on raising it prior to your refinance. To avoid disappointment, know your credit score and your loans minimum credit requirements before you apply.

- Youll still need to pay closing costs. Chances are, you dont have much in savings post-bankruptcy. Keep in mind that youll still need to pay closing costs with most refinances. These costs can equal 2% 3% of your total loan value. You may be able to roll your closing costs into the principal of your loan if you have enough equity.;

- Your old bankruptcy might still be on your credit report. Credit reporting bureaus must remove your bankruptcy from your credit report after 7 10 years, depending on which type you filed. However, credit reporting errors are common, and your old bankruptcy might still appear on your report. Make note of the date that your bankruptcy should no longer appear on your credit report, and make sure to follow up.

You May Like: Can I Transfer My Mortgage Loan To Another Bank